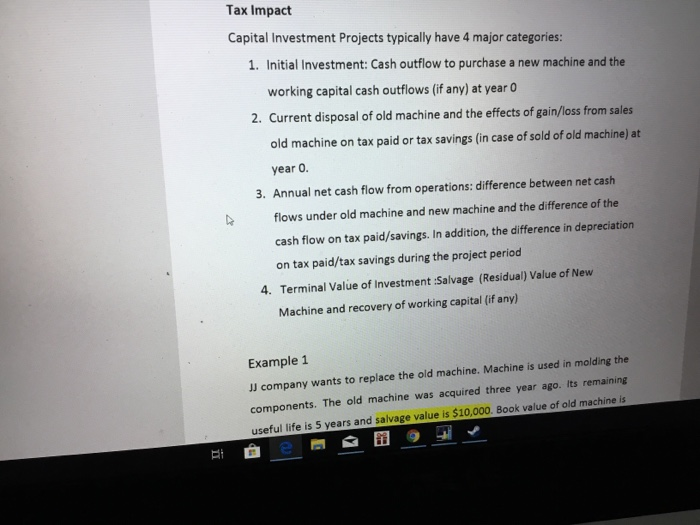

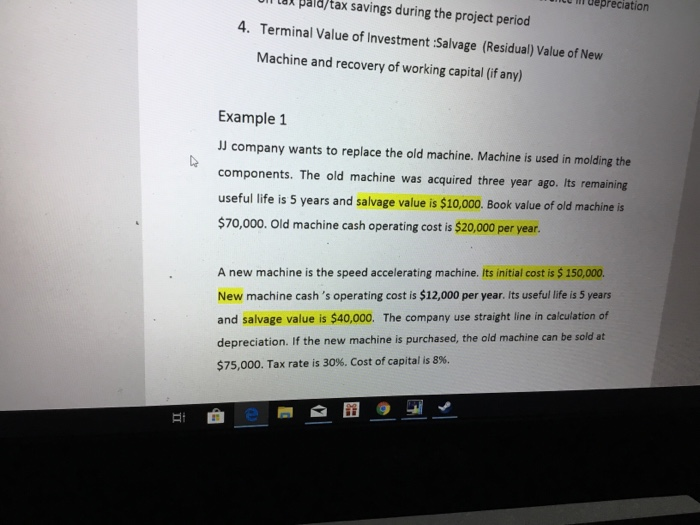

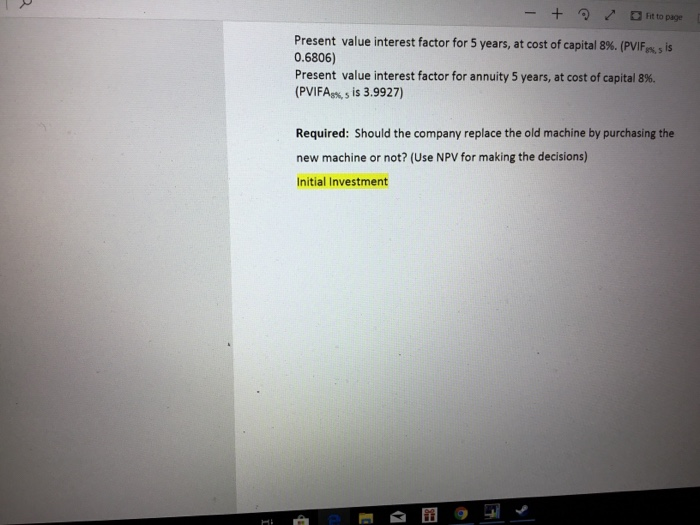

Tax Impact Capital Investment Projects typically have 4 major categories: 1. Initial Investment: Cash outflow to purchase a new machine and the working capital cash outflows (if any) at year o 2. Current disposal of old machine and the effects of gain/loss from sales old machine on tax paid or tax savings (in case of sold of old machine) at year 0. 3. Annual net cash flow from operations: difference between net cash flows under old machine and new machine and the difference of the cash flow on tax paid/savings. In addition, the difference in depreciation on tax paid/tax savings during the project period 4. Terminal Value of Investment :Salvage (Residual) Value of New Machine and recovery of working capital (if any) Example 1 JJ company wants to replace the old machine. Machine is used in molding the components. The old machine was acquired three year ago. Its remaining useful life is 5 years and salvage value is $10,000. Book value of old machine is IL I Depreciation Ulla pala/tax savings during the project period 4. Terminal Value of Investment :Salvage (Residual) Value of New Machine and recovery of working capital (if any) Example 1 JJ company wants to replace the old machine. Machine is used in molding the components. The old machine was acquired three year ago. Its remaining useful life is 5 years and salvage value is $10,000. Book value of old machine is $70,000. Old machine cash operating cost is $20,000 per year. A new machine is the speed accelerating machine. Its initial cost is $ 150,000, New machine cash's operating cost is $12,000 per year. Its useful life is 5 years and salvage value is $40,000. The company use straight line in calculation of depreciation. If the new machine is purchased, the old machine can be sold at $75,000. Tax rate is 30%. Cost of capital is 8%. - + fit to page Present value interest factor for 5 years, at cost of capital 8%. (PVIF.Si 0.6806) Present value interest factor for annuity 5 years, at cost of capital 8%. (PVIFAs,s is 3.9927) Required: Should the company replace the old machine by purchasing the new machine or not? (Use NPV for making the decisions) Initial Investment