Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tax is 28% Smaug Ltd is listed on the JSE. The following information relates to the financial year ended 30 September 20.20: 1. For the

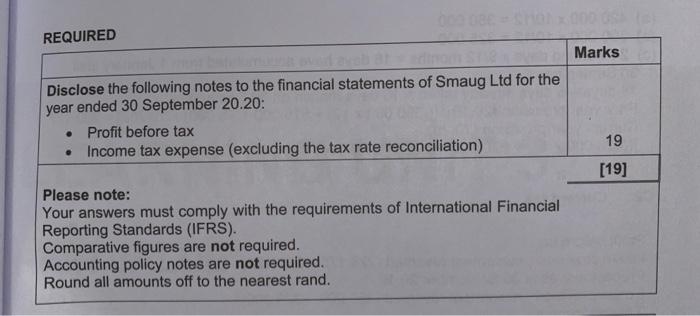

tax is 28%

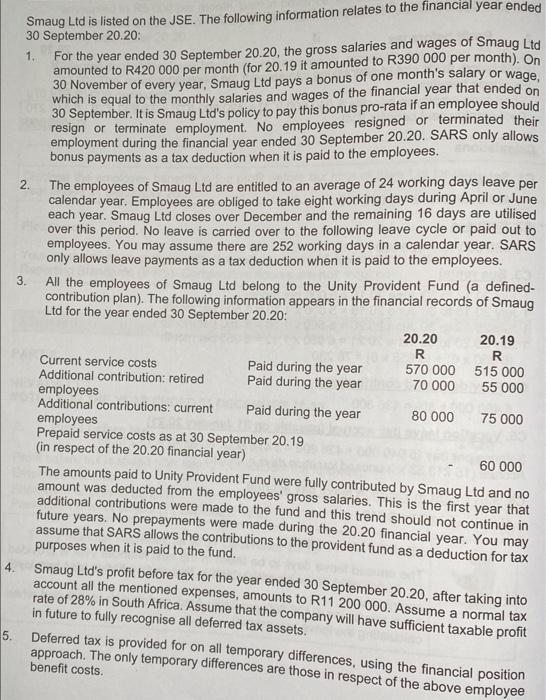

Smaug Ltd is listed on the JSE. The following information relates to the financial year ended 30 September 20.20: 1. For the year ended 30 September 20.20, the gross salaries and wages of Smaug Ltd amounted to R420 000 per month (for 20.19 it amounted to R390 000 per month). On 30 November of every year, Smaug Ltd pays a bonus of one month's salary or wage, which is equal to the monthly salaries and wages of the financial year that ended on 30 September. It is Smaug Ltd's policy to pay this bonus pro-rata if an employee should resign or terminate employment. No employees resigned or terminated their employment during the financial year ended 30 September 20.20. SARS only allows bonus payments as a tax deduction when it is paid to the employees. 2. The employees of Smaug Ltd are entitled to an average of 24 working days leave per calendar year. Employees are obliged to take eight working days during April or June each year. Smaug Ltd closes over December and the remaining 16 days are utilised over this period. No leave is carried over to the following leave cycle or paid out to employees. You may assume there are 252 working days in a calendar year. SARS only allows leave payments as a tax deduction when it is paid to the employees. 3. All the employees of Smaug Ltd belong to the Unity Provident Fund (a defined- contribution plan). The following information appears in the financial records of Smaug Ltd for the year ended 30 September 20.20: 20.20 20.19 R R Current service costs Paid during the year 570 000 515 000 Additional contribution: retired Paid during the year 70 000 55 000 employees Additional contributions: current Paid during the year 80 000 employees 75 000 Prepaid service costs as at 30 September 20.19 (in respect of the 20.20 financial year) 60 000 The amounts paid to Unity Provident Fund were fully contributed by Smaug Ltd and no amount was deducted from the employees' gross salaries. This is the first year that additional contributions were made to the fund and this trend should not continue in future years. No prepayments were made during the 20.20 financial year. You may assume that SARS allows the contributions to the provident fund as a deduction for tax purposes when it is paid to the fund. 4. Smaug Ltd's profit before tax for the year ended 30 September 20.20, after taking into account all the mentioned expenses, amounts to R11 200 000. Assume a normal tax rate of 28% in South Africa. Assume that the company will have sufficient taxable profit in future to fully recognise all deferred tax assets. Deferred tax is provided for on all temporary differences, using the financial position approach. The only temporary differences are those in respect of the above employee benefit costs. 5. REQUIRED Marks Disclose the following notes to the financial statements of Smaug Ltd for the year ended 30 September 20.20 Profit before tax Income tax expense (excluding the tax rate reconciliation) . 19 . [19] Please note: Your answers must comply with the requirements of International Financial Reporting Standards (IFRS). Comparative figures are not required. Accounting policy notes are not required. Round all amounts off to the nearest rand Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started