Tax on Domestic Corporation

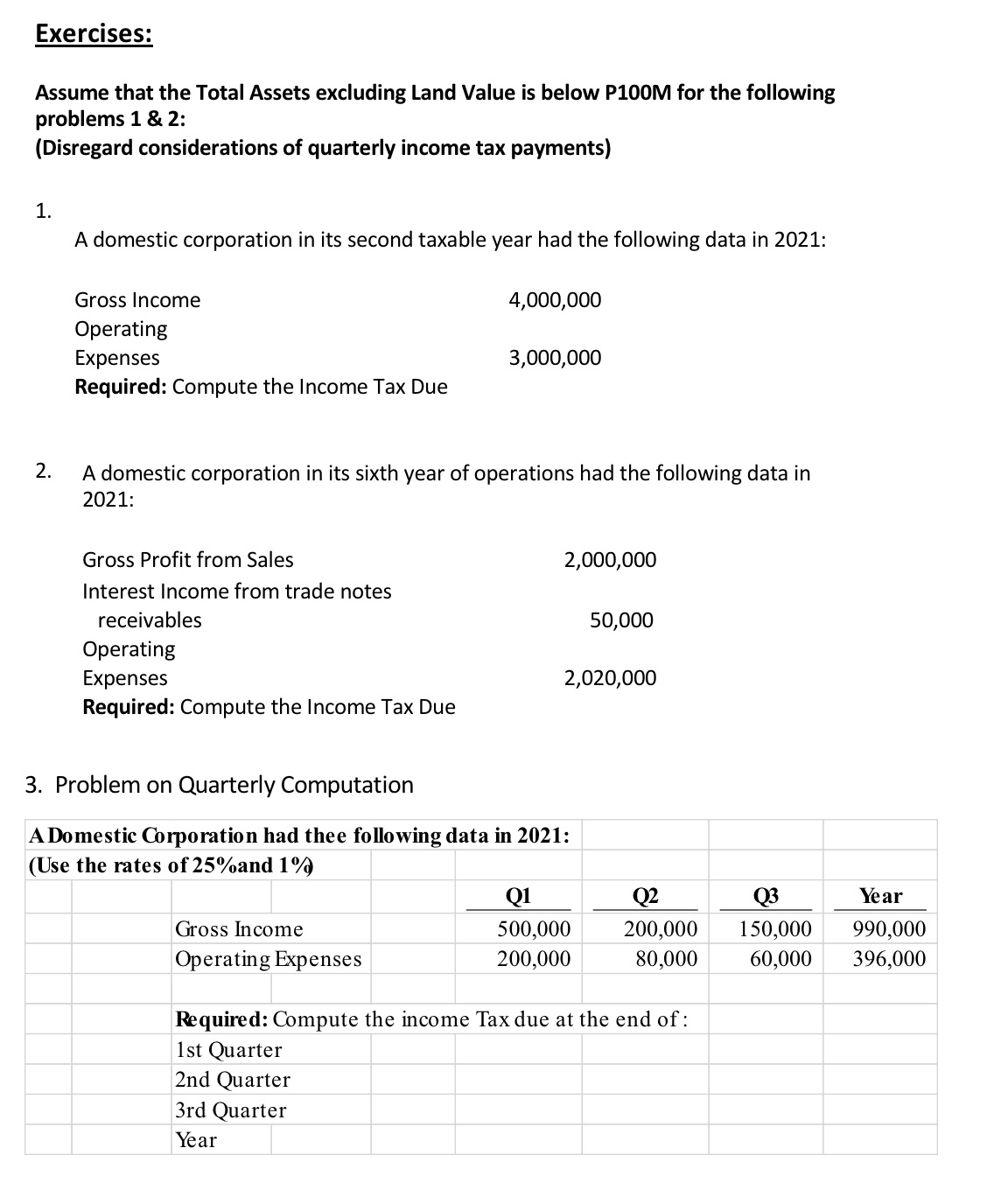

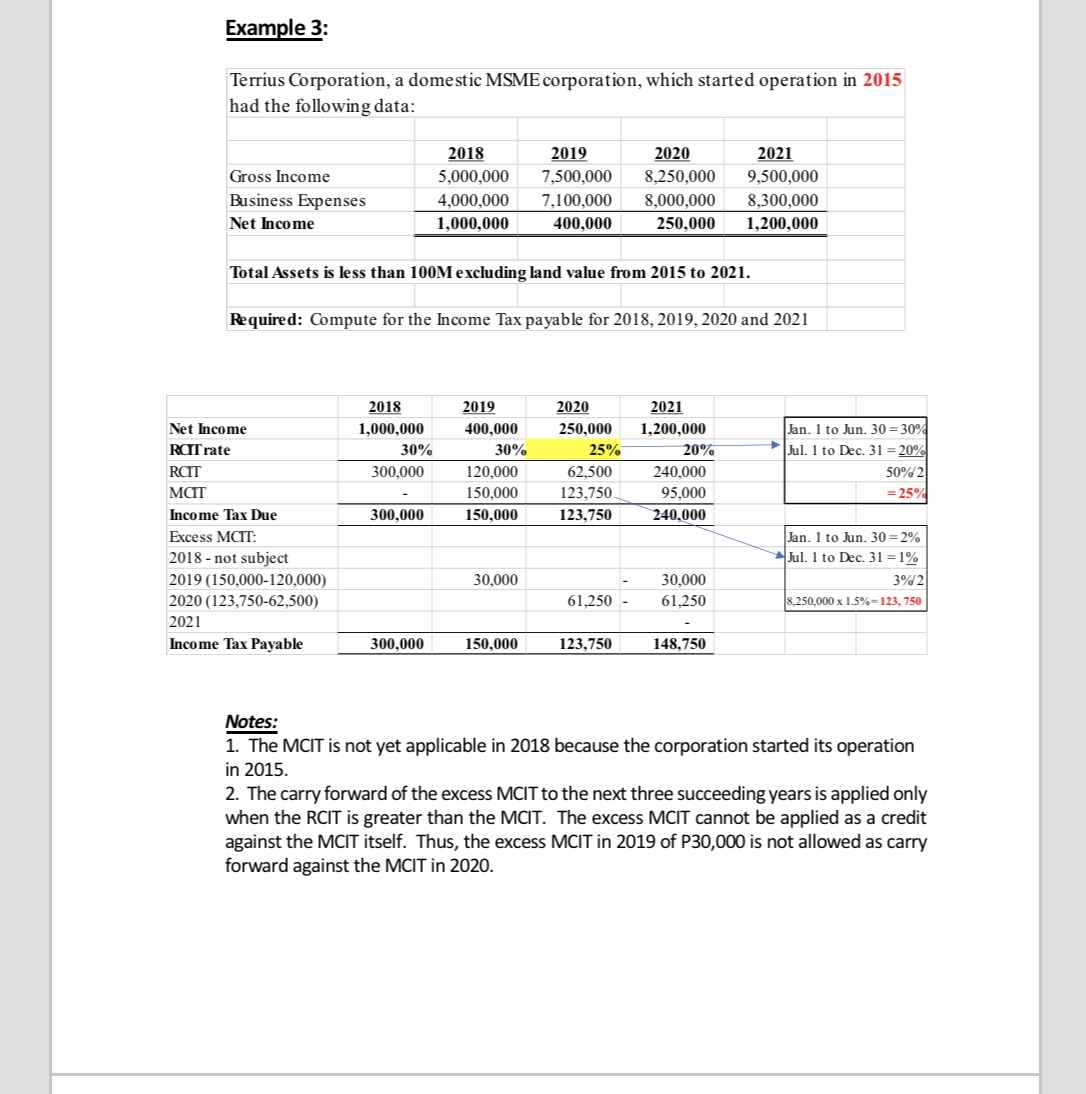

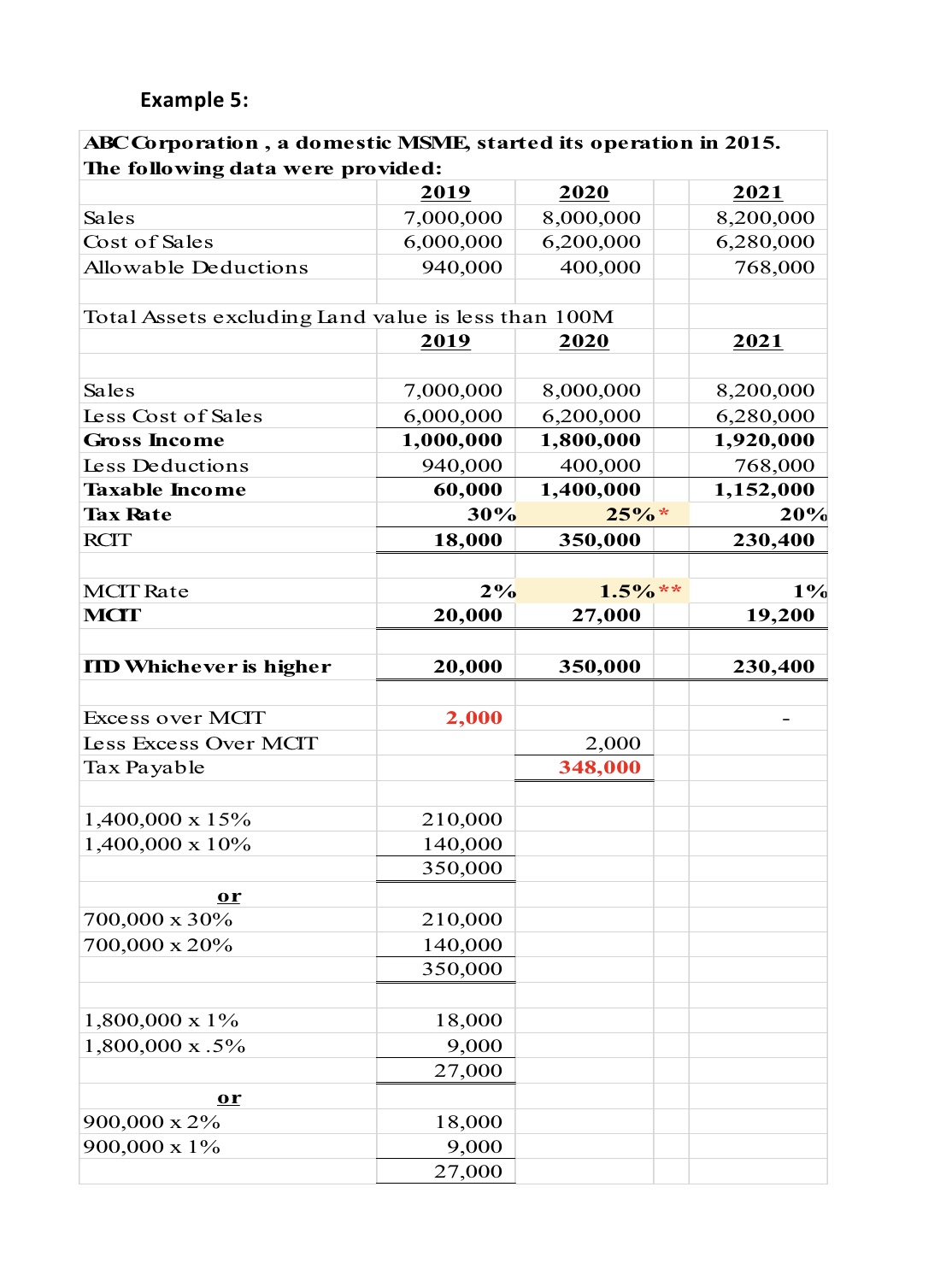

Exercises: Assume that the Total Assets excluding Land Value is below PIDOM for the following problems 1 8: 2: (Disregard considerations of quarterly income tax payments) A domestic corporation in its second taxable year had the following data in 2021: Gross Income 4,000,000 Operating Expenses 3,000,000 Required: Compute the Income Tax Due 2. A domestic corporation in its sixth year of operations had the following data in 2021: Gross Profit from Sales 2,000,000 Interest Income from trade notes receivables 50,000 Operating Expenses 2,020,000 Required: Compute the Income Tax Due 3. Problem on Quarterly Computation ADomestic Corporation had thee following data in 2021: (Use the rates of 25%and 10/.) Q1 Q2 Q3 Year Gross Income 500,000 200,000 150,000 990,000 Operating Expenses 200,000 80,000 60,000 396,000 Required: Compute the income Tax due at the end of : lst Quarter 2nd Quarter 3rd Quarter Yea]~ Example 3: Terrius Corporation, a domestic MSME corporation, which started operation in 2015 had the following data: 2018 2019 2020 2021 Gross Income 5,000,000 7,500,000 8,250,000 9,500,000 Business Expenses 4,000,000 7,100,000 8,000,000 8,300,000 Net Income 1,000,000 400.000 250,000 1,200,000 Total Assets is less than 100M excluding land value from 2015 to 2021. Required: Compute for the Income Tax payable for 2018, 2019, 2020 and 2021 2018 2019 2020 2021 Net Income 1,000,000 400,000 250,000 1,200,000 Jan. 1 to Jun. 30 = 30% RCIT rate 30% 30% 25% 20% Jul. 1 to Dec. 31 = 20% RCIT 300,000 120,000 62,500 240,000 50%2 MCIT 150,000 123,750 95,000 =259 Income Tax Due 300,000 150,000 123,750 240,000 Excess MCIT: Jan. 1 to Jun. 30 =2% 2018 - not subject Jul. 1 to Dec. 31 = 1% 2019 (150,000-120,000) 30,000 30,000 3%2 2020 (123,750-62,500) 61,250 - 61,250 8,250,000 x 1.5%=123, 750 2021 Income Tax Payable 300,000 150,000 123,750 148,750 Notes: 1. The MCIT is not yet applicable in 2018 because the corporation started its operation in 2015. 2. The carry forward of the excess MCIT to the next three succeeding years is applied only when the RCIT is greater than the MCIT. The excess MCIT cannot be applied as a credit against the MCIT itself. Thus, the excess MCIT in 2019 of P30,000 is not allowed as carry forward against the MCIT in 2020.Example 5: ABC Corporation , a domestic MSME, started its operation in 2015. The following data were provided: 2019 2020 2021 Sales 7,000,000 8,000,000 8,200,000 Cost of Sales 6,000,000 6,200,000 6,280,000 Allowable Deductions 940,000 400,000 768,000 Total Assets excluding Land value is less than 100M 2019 2020 2021 Sales 7,000,000 8,000,000 8,200,000 Less Cost of Sales 6,000,000 6,200,000 6,280,000 Gross Income 1,000,000 1,800,000 1,920,000 Less Deductions 940,000 400,000 768,000 Taxable Income 60,000 1,400,000 1,152,000 Tax Rate 30% 25% * 20% RCIT 18,000 350,000 230,400 MCIT Rate 2% 1.5% * * 1% MCT 20,000 27,000 19,200 ITD Whichever is higher 20,000 350,000 230,400 Excess over MCIT 2,000 Less Excess Over MCIT 2,000 Tax Payable 348,000 1,400,000 x 15% 210,000 1,400,000 x 10% 140,000 350,000 or 700,000 x 30% 210,000 700,000 x 20% 140,000 350,000 1,800,000 x 1% 18,000 1,800,000 x .5% 9,000 27,000 or 900,000 x 2% 18,000 900,000 x 1% 9,000 27,000