Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax Planning Strategies for Individuals and Businesses: Tax planning involves the strategic management of financial affairs to minimize tax liabilities within the framework of applicable

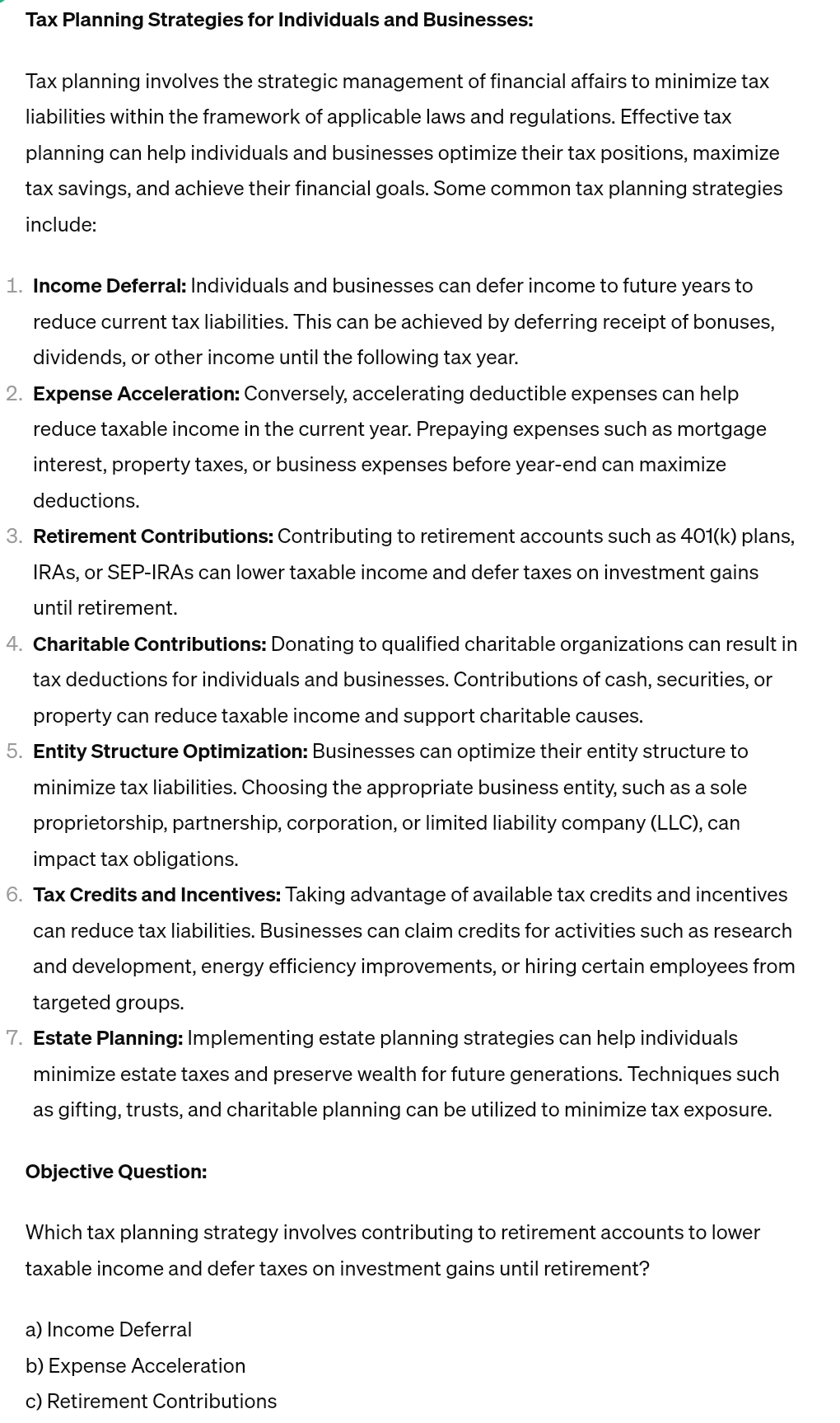

Tax Planning Strategies for Individuals and Businesses:

Tax planning involves the strategic management of financial affairs to minimize tax liabilities within the framework of applicable laws and regulations. Effective tax planning can help individuals and businesses optimize their tax positions, maximize tax savings, and achieve their financial goals. Some common tax planning strategies include:

Income Deferral: Individuals and businesses can defer income to future years to reduce current tax liabilities. This can be achieved by deferring receipt of bonuses, dividends, or other income until the following tax year.

Expense Acceleration: Conversely, accelerating deductible expenses can help reduce taxable income in the current year. Prepaying expenses such as mortgage interest, property taxes, or business expenses before yearend can maximize deductions.

Retirement Contributions: Contributing to retirement accounts such as k plans, IRAs, or SEPIRAs can lower taxable income and defer taxes on investment gains until retirement.

Charitable Contributions: Donating to qualified charitable organizations can result in tax deductions for individuals and businesses. Contributions of cash, securities or property can reduce taxable income and support charitable causes.

Entity Structure Optimization: Businesses can optimize their entity structure to minimize tax liabilities. Choosing the appropriate business entity, such as a sole proprietorship, partnership, corporation, or limited liability company LLC can impact tax obligations.

Tax Credits and Incentives: Taking advantage of available tax credits and incentives can reduce tax liabilities. Businesses can claim credits for activities such as research and development, energy efficiency improvements, or hiring certain employees from targeted groups.

Estate Planning: Implementing estate planning strategies can help individuals minimize estate taxes and preserve wealth for future generations. Techniques such as gifting, trusts, and charitable planning can be utilized to minimize tax exposure.

Objective Question:

Which tax planning strategy involves contributing to retirement accounts to lower taxable income and defer taxes on investment gains until retirement?

a Income Deferral

b Expense Acceleration

c Retirement Contributions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started