Answered step by step

Verified Expert Solution

Question

1 Approved Answer

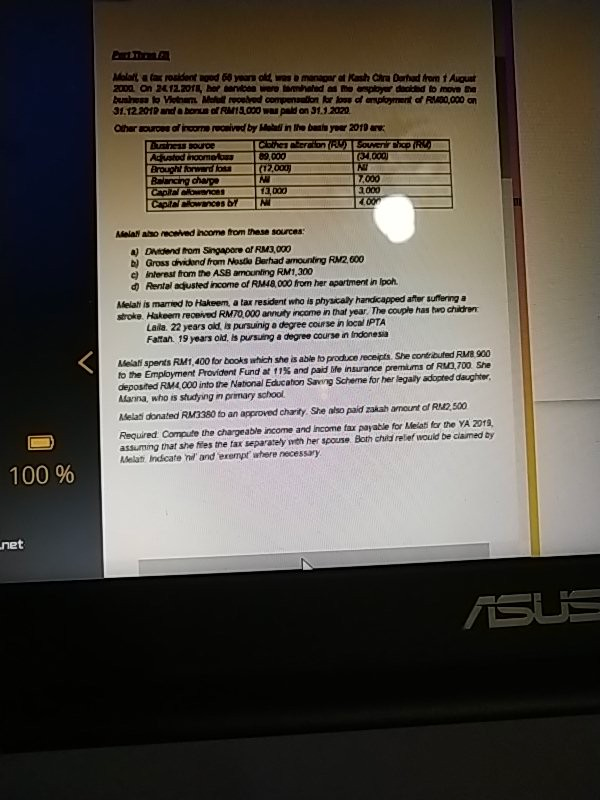

tax please do help me fast Molalla faxrosidont wood 60 years old, was mangaral Kash Cara Darhad from 1 August 2000 on 2612. Orl, her

tax please do help me fast

Molalla faxrosidont wood 60 years old, was mangaral Kash Cara Darhad from 1 August 2000 on 2612. Orl, her er de bedded to move the Behow to Vietnam Metal rooted compensation for bed oployment R10,000 on 31.12.2010 and a Bonus RM14.000 wapoleon 31.3.2020 Other Rudolirom raived by Malene ball your 2010 r. ITUDE CiT cron AS TIC Agatonomous 29,000 (34.000 Broup onardo (2.000) Balancing charpe N 1.000 Capitolo 12,000 37000 Capowances by N Kl007 Mia Aho ved home from these sources: .) Dividend from Singapore of RM3,000 N Gross chickend from Most Berhad amounting RM2.600 c) interest from the ASB amounting RM1,300 Revital adusled Income of RM48.000 from her Apartment in Ipoh, Melat' is married to Hakeem a tax resident who is physically handicapped after suffering a stroke. Hakeem received RM70,000 arvuty income in that year. The couple has two children Laila 22 years old, la pursuing a degree course in local IPTA Falah. 19 years old, is pursuing a degree course in Indonesia Melar spents RM1,400 for books which she is able to produce receipts. She contributed RM 900 to the Employment Provident Fund & 11% and paid Me Insurance premium of RNO.700 She deposted RM4.000 into the National Education Sawing Scherne for her legalyadated daughter, Alarma, who is studying in primary school Melari donated RM3380 to an approved charity. She also paid zakah amount of RM2,500 Aequired Computo the chargeable income and income tax payable for Meat for the YA 2019, assuming that she files the tax separately with her spouse. Both child rele would be claimed by Alat Indicated and prompt where necessary 100 % -net Molalla faxrosidont wood 60 years old, was mangaral Kash Cara Darhad from 1 August 2000 on 2612. Orl, her er de bedded to move the Behow to Vietnam Metal rooted compensation for bed oployment R10,000 on 31.12.2010 and a Bonus RM14.000 wapoleon 31.3.2020 Other Rudolirom raived by Malene ball your 2010 r. ITUDE CiT cron AS TIC Agatonomous 29,000 (34.000 Broup onardo (2.000) Balancing charpe N 1.000 Capitolo 12,000 37000 Capowances by N Kl007 Mia Aho ved home from these sources: .) Dividend from Singapore of RM3,000 N Gross chickend from Most Berhad amounting RM2.600 c) interest from the ASB amounting RM1,300 Revital adusled Income of RM48.000 from her Apartment in Ipoh, Melat' is married to Hakeem a tax resident who is physically handicapped after suffering a stroke. Hakeem received RM70,000 arvuty income in that year. The couple has two children Laila 22 years old, la pursuing a degree course in local IPTA Falah. 19 years old, is pursuing a degree course in Indonesia Melar spents RM1,400 for books which she is able to produce receipts. She contributed RM 900 to the Employment Provident Fund & 11% and paid Me Insurance premium of RNO.700 She deposted RM4.000 into the National Education Sawing Scherne for her legalyadated daughter, Alarma, who is studying in primary school Melari donated RM3380 to an approved charity. She also paid zakah amount of RM2,500 Aequired Computo the chargeable income and income tax payable for Meat for the YA 2019, assuming that she files the tax separately with her spouse. Both child rele would be claimed by Alat Indicated and prompt where necessary 100 % -netStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started