Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax pls help asap tq ASSIGNMENT #1 Question #2 Michael and Rebecca Johnson are married and file a joint tax return. Michael and Rebecca, who

Tax

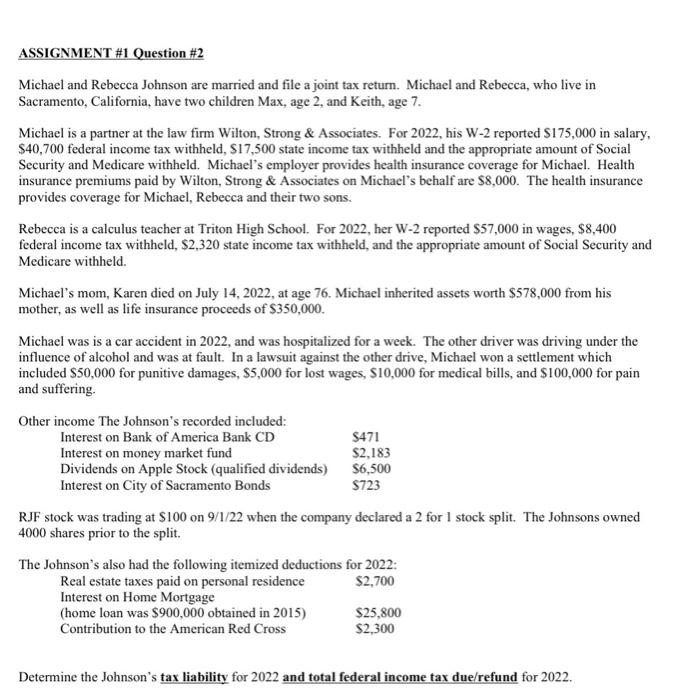

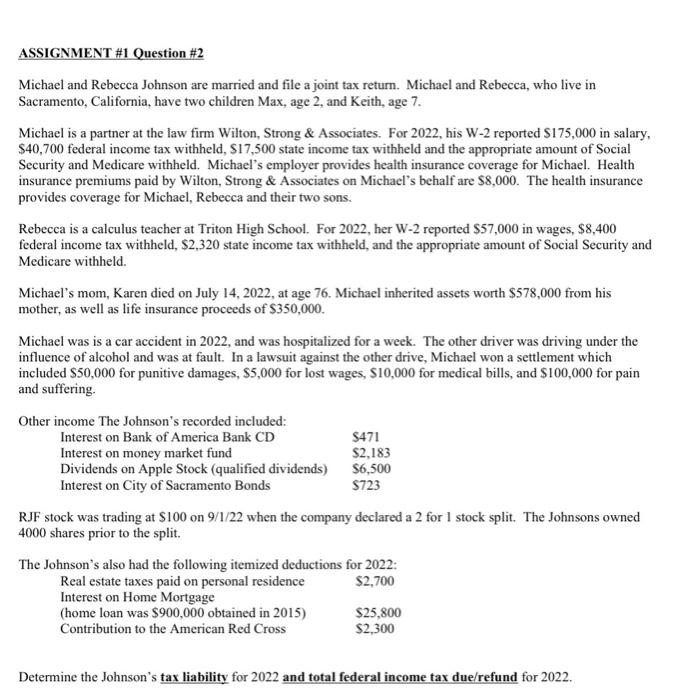

ASSIGNMENT \#1 Question \#2 Michael and Rebecca Johnson are married and file a joint tax return. Michael and Rebecca, who live in Sacramento, California, have two children Max, age 2, and Keith, age 7. Michael is a partner at the law firm Wilton, Strong \& Associates. For 2022, his W-2 reported \$175,000 in salary, $40,700 federal income tax withheld, $17,500 state income tax withheld and the appropriate amount of Social Security and Medicare withheld. Michael's employer provides health insurance coverage for Michael. Health insurance premiums paid by Wilton, Strong \& Associates on Michael's behalf are $8,000. The health insurance provides coverage for Michael, Rebecca and their two sons. Rebecca is a calculus teacher at Triton High School. For 2022, her W-2 reported $57,000 in wages, $8,400 federal income tax withheld, \$2,320 state income tax withheld, and the appropriate amount of Social Security and Medicare withheld. Michael's mom, Karen died on July 14, 2022, at age 76. Michael inherited assets worth $578,000 from his mother, as well as life insurance proceeds of $350,000. Michael was is a car accident in 2022, and was hospitalized for a week. The other driver was driving under the influence of alcohol and was at fault. In a lawsuit against the other drive, Michael won a settlement which included $50,000 for punitive damages, $5,000 for lost wages, $10,000 for medical bills, and $100,000 for pain and suffering. RJF stock was trading at $100 on 9/1/22 when the company declared a 2 for 1 stock split. The Johnsons owned 4000 shares prior to the split. The Johnson's also had the following itemized deductions for 2022: Determine the Johnson's tax liability for 2022 and total federal income tax due/refund for 2022 pls help asap tq

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started