Tax project #1. please help with a-f. thank you!

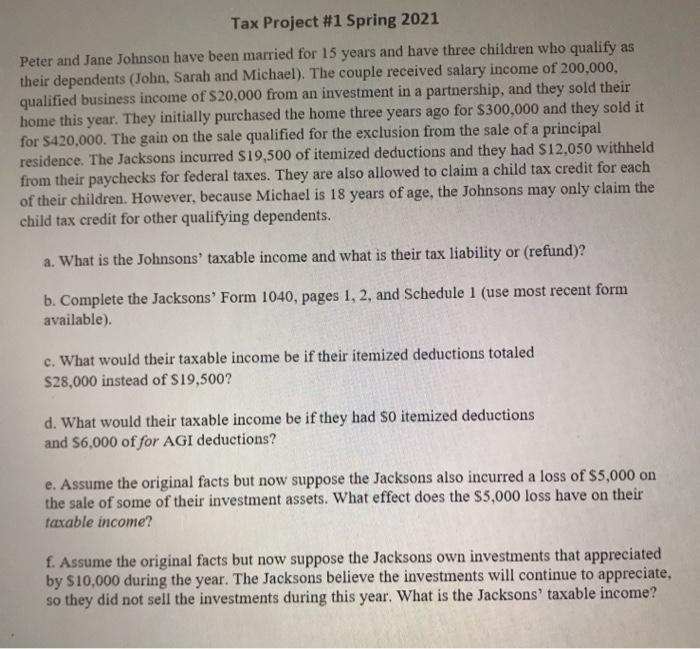

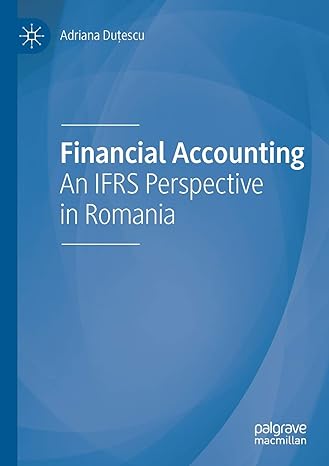

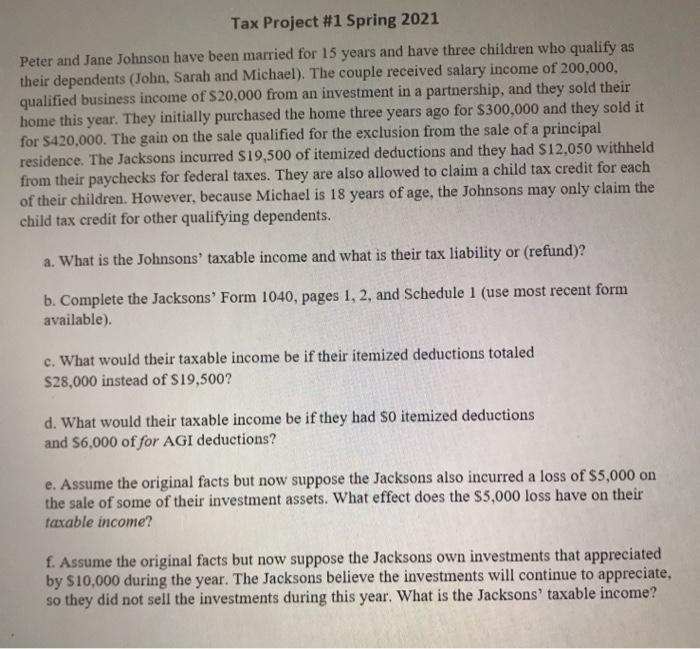

Tax Project #1 Spring 2021 Peter and Jane Johnson have been married for 15 years and have three children who qualify as their dependents (John, Sarah and Michael). The couple received salary income of 200.000, qualified business income of $20,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $300,000 and they sold it for $420,000. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred S19,500 of itemized deductions and they had $12,050 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Michael is 18 years of age, the Johnsons may only claim the child tax credit for other qualifying dependents. a. What is the Johnsons' taxable income and what is their tax liability or (refund)? b. Complete the Jacksons' Form 1040, pages 1, 2, and Schedule 1 (use most recent form available) c. What would their taxable income be if their itemized deductions totaled $28,000 instead of $19,500? d. What would their taxable income be if they had so itemized deductions and S6,000 of for AGI deductions? e. Assume the original facts but now suppose the Jacksons also incurred a loss of $5,000 on the sale of some of their investment assets. What effect does the $5,000 loss have on their taxable income? f. Assume the original facts but now suppose the Jacksons own investments that appreciated by $10,000 during the year. The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year. What is the Jacksons' taxable income? Tax Project #1 Spring 2021 Peter and Jane Johnson have been married for 15 years and have three children who qualify as their dependents (John, Sarah and Michael). The couple received salary income of 200.000, qualified business income of $20,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $300,000 and they sold it for $420,000. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred S19,500 of itemized deductions and they had $12,050 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Michael is 18 years of age, the Johnsons may only claim the child tax credit for other qualifying dependents. a. What is the Johnsons' taxable income and what is their tax liability or (refund)? b. Complete the Jacksons' Form 1040, pages 1, 2, and Schedule 1 (use most recent form available) c. What would their taxable income be if their itemized deductions totaled $28,000 instead of $19,500? d. What would their taxable income be if they had so itemized deductions and S6,000 of for AGI deductions? e. Assume the original facts but now suppose the Jacksons also incurred a loss of $5,000 on the sale of some of their investment assets. What effect does the $5,000 loss have on their taxable income? f. Assume the original facts but now suppose the Jacksons own investments that appreciated by $10,000 during the year. The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year. What is the Jacksons' taxable income