Answered step by step

Verified Expert Solution

Question

1 Approved Answer

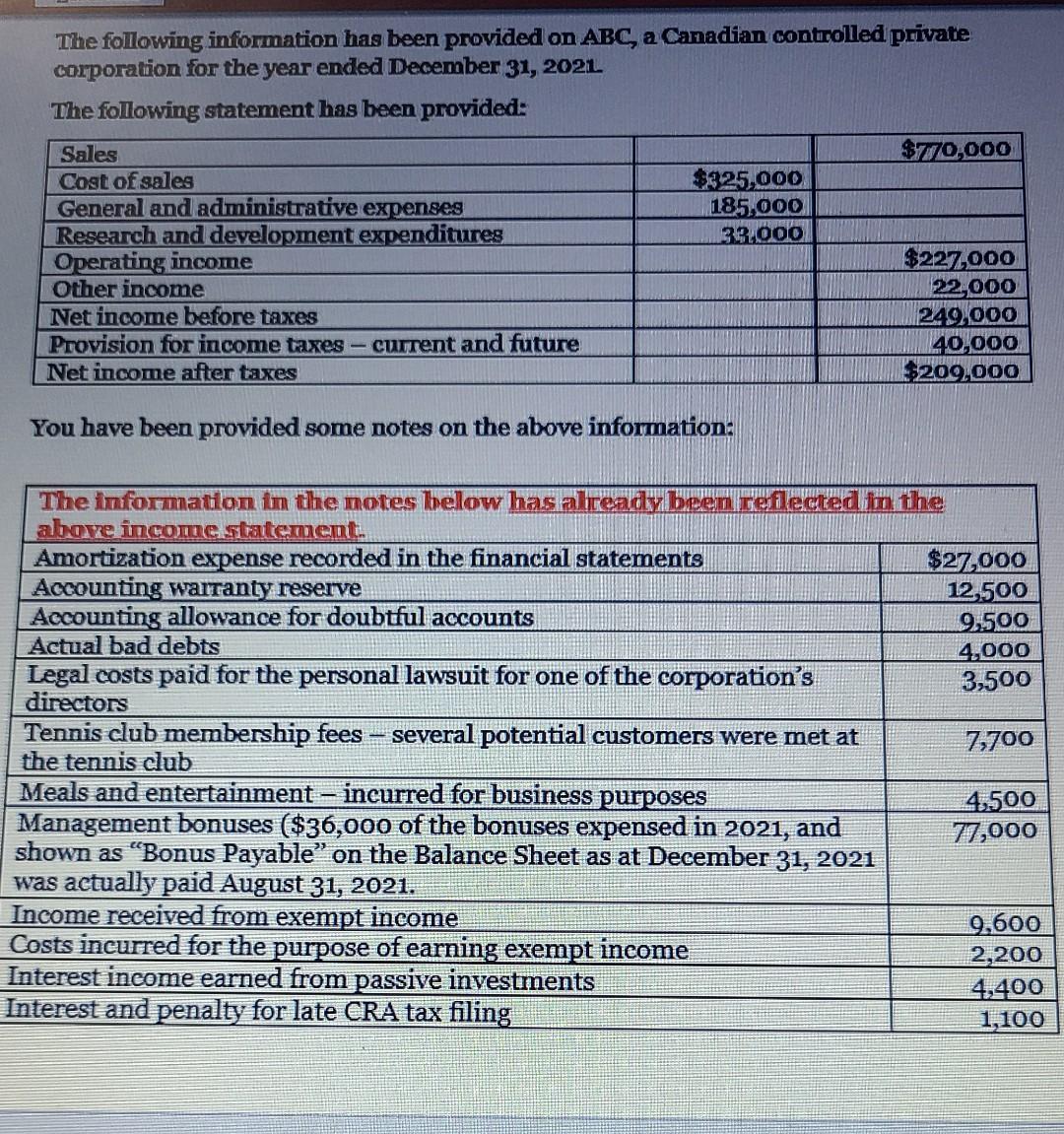

tax ques, pls answer asap The following information has been provided on ABC, a Canadian controlled private corporation for the year ended December 31, 202L

tax ques, pls answer asap

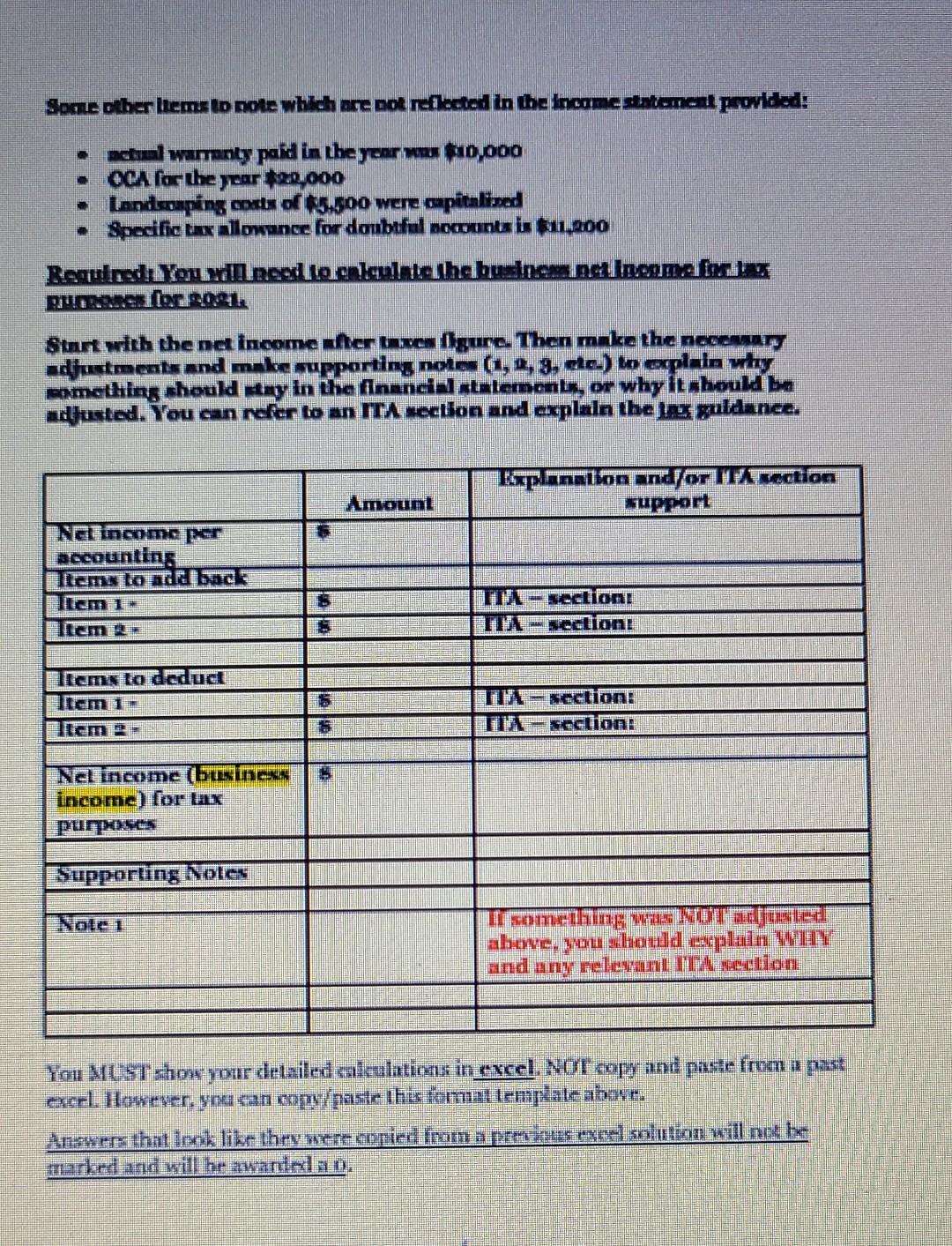

The following information has been provided on ABC, a Canadian controlled private corporation for the year ended December 31, 202L The following statement has been provided: Sales $770,000 Cost of sales $325,000 General and administrative expenses 185.000 Research and development expenditures 331000 Operating income $227,000 Other income 22,000 Net income before taxes 249,000 Provision for income taxes - current and future 40,000 Net income after taxes $209,000 You have been provided some notes on the above information: The information in the motes below has already been reflected in the above income statement. Amortization expense recorded in the financial statements $27,000 Accounting warranty reserve 12.500 Accounting allowance for doubtful accounts 9.500 Actual bad debts 4,000 Legal costs paid for the personal lawsuit for one of the corporation's 3,500 directors Tennis club membership fees - several potential customers were met at 7,700 the tennis club Meals and entertainment incurred for business purposes 4,500 Management bonuses ($36,000 of the bonuses expensed in 2021, and 77,000 shown as Bonus Payable" on the Balance Sheet as at December 31, 2021 was actually paid August 31, 2021. Income received from exempt income 9,600 Costs incurred for the purpose of earning exempt income 2,200 Interest income earned from passive investments 4,400 Interest and penalty for late CRA tax filing 1,100 Soate other liems to nole which are not reflected in the income statement provided: meelwamanly paid in the year mu $10,000 OCA for the year 2000 Landonping mubol 15.500 were capitalized Specific taxallowance for doubtful nomounts is $11.200 Rsuund You will needle anleulate the benennenme muertorro Start with the na Income her mengure. Then make the ncbear adjustments and make supporting nolo (1, 2, 3, co.) lo aplain why something should any in the financial stalemonls, or why itahould be adjusted. You can refer to an ITA section and explaln the lp guldance. Kplannion and/or IT motion support Amount No Income per accounting ems to a baca Ticm 1. item 2 - RE 3 15 Medion TMErection cms lo deduct em 1- Trection, Trection, 3 NeTiname (bu income) for tax pumas Supporting Note Nole i Tr something wax WOT adjusted aboc. pou should explain WHY and any relevant ITA section You MUST show your detailed calculations in excel. NOT copy and paste from a past excel. However, you can copy paste this fomuat template above. Answer that look like they were copied Imm a presence solution will nok br mared and will be awantalanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started