Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax Question for an individual. Calculate income from self employment INCOME FROM SELF-EMPLOYMENT: On June 1, 2020 Patty decided to start a small business as

Tax Question for an individual. Calculate income from self employment

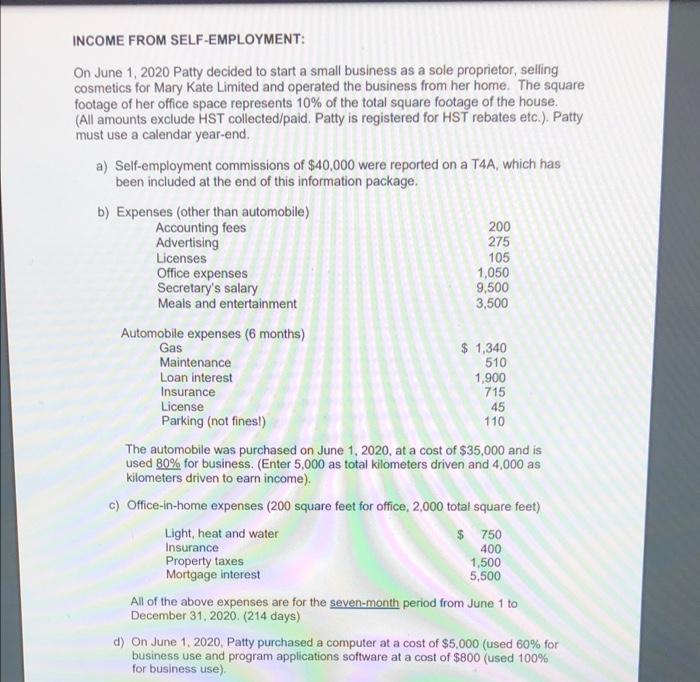

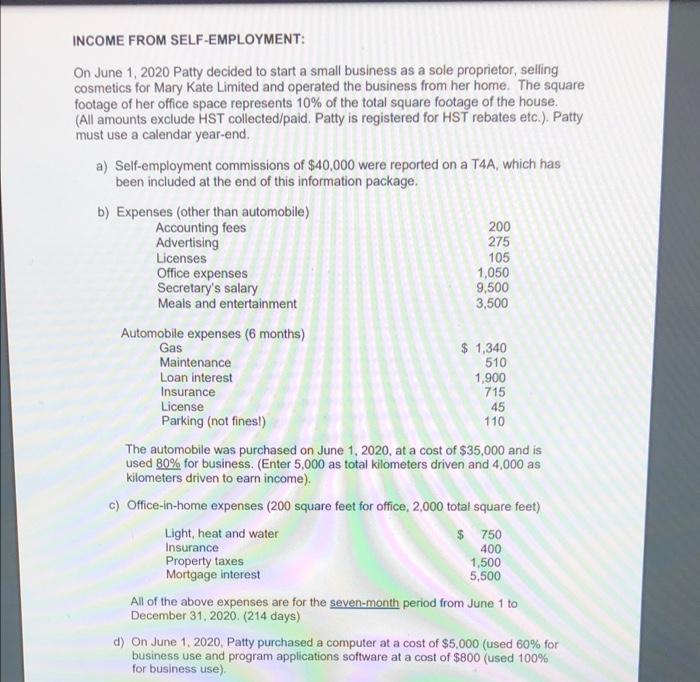

INCOME FROM SELF-EMPLOYMENT: On June 1, 2020 Patty decided to start a small business as a sole proprietor, selling cosmetics for Mary Kate Limited and operated the business from her home. The square footage of her office space represents 10% of the total square footage of the house. (All amounts exclude HST collected/paid. Patty is registered for HST rebates etc.). Patty must use a calendar year-end. a) Self-employment commissions of $40,000 were reported on a T4A, which has been included at the end of this information package. b) Expenses (other than automobile) Accounting fees 200 Advertising 275 Licenses 105 Office expenses 1,050 Secretary's salary 9,500 Meals and entertainment 3,500 Automobile expenses (6 months) Gas $ 1,340 Maintenance 510 Loan interest 1,900 Insurance 715 License Parking (not fines!) 110 The automobile was purchased on June 1, 2020, at a cost of $35,000 and is used 80% for business. (Enter 5,000 as total kilometers driven and 4,000 as kilometers driven to earn income). c) Office-in-home expenses (200 square feet for office, 2,000 total square feet) Light, heat and water $ 750 Insurance 400 Property taxes 1,500 Mortgage interest 5,500 All of the above expenses are for the seven-month period from June 1 to December 31, 2020. (214 days) d) On June 1, 2020. Patty purchased a computer at a cost of $5,000 (used 60% for business use and program applications software at a cost of $800 (used 100% for business use) 45 a INCOME FROM SELF-EMPLOYMENT: On June 1, 2020 Patty decided to start a small business as a sole proprietor, selling cosmetics for Mary Kate Limited and operated the business from her home. The square footage of her office space represents 10% of the total square footage of the house. (All amounts exclude HST collected/paid. Patty is registered for HST rebates etc.). Patty must use a calendar year-end. a) Self-employment commissions of $40,000 were reported on a T4A, which has been included at the end of this information package. b) Expenses (other than automobile) Accounting fees 200 Advertising 275 Licenses 105 Office expenses 1,050 Secretary's salary 9,500 Meals and entertainment 3,500 Automobile expenses (6 months) Gas $ 1,340 Maintenance 510 Loan interest 1,900 Insurance 715 License Parking (not fines!) 110 The automobile was purchased on June 1, 2020, at a cost of $35,000 and is used 80% for business. (Enter 5,000 as total kilometers driven and 4,000 as kilometers driven to earn income). c) Office-in-home expenses (200 square feet for office, 2,000 total square feet) Light, heat and water $ 750 Insurance 400 Property taxes 1,500 Mortgage interest 5,500 All of the above expenses are for the seven-month period from June 1 to December 31, 2020. (214 days) d) On June 1, 2020. Patty purchased a computer at a cost of $5,000 (used 60% for business use and program applications software at a cost of $800 (used 100% for business use) 45 a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started