Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tax rate = 25% discount rate = 12% (10 points) The new division will entail operating costs starting at $1,000,000 in the first year. You

tax rate = 25%

discount rate = 12%

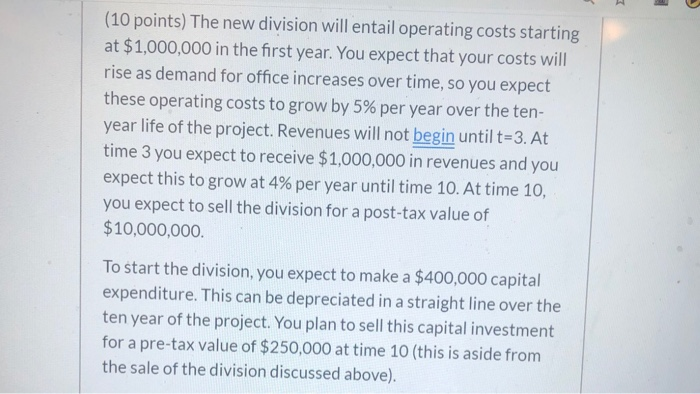

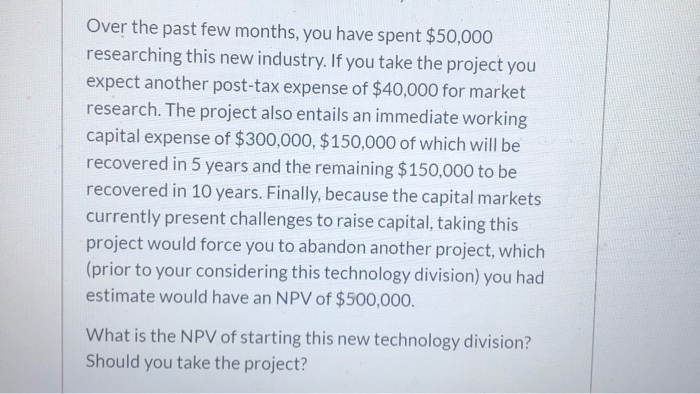

(10 points) The new division will entail operating costs starting at $1,000,000 in the first year. You expect that your costs will rise as demand for office increases over time, so you expect these operating costs to grow by 5% per year over the ten- year life of the project. Revenues will not begin untilt=3. At time 3 you expect to receive $1,000,000 in revenues and you expect this to grow at 4% per year until time 10. At time 10, you expect to sell the division for a post-tax value of $10,000,000. To start the division, you expect to make a $400,000 capital expenditure. This can be depreciated in a straight line over the ten year of the project. You plan to sell this capital investment for a pre-tax value of $250,000 at time 10 (this is aside from the sale of the division discussed above). Over the past few months, you have spent $50,000 researching this new industry. If you take the project you expect another post-tax expense of $40,000 for market research. The project also entails an immediate working capital expense of $300,000, $150,000 of which will be recovered in 5 years and the remaining $150,000 to be recovered in 10 years. Finally, because the capital markets currently present challenges to raise capital, taking this project would force you to abandon another project, which (prior to your considering this technology division) you had estimate would have an NPV of $500,000. What is the NPV of starting this new technology division? Should you take the project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started