Tax rate is 5% it is mintioned in the question!

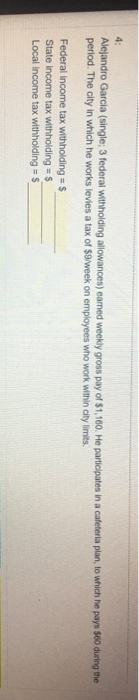

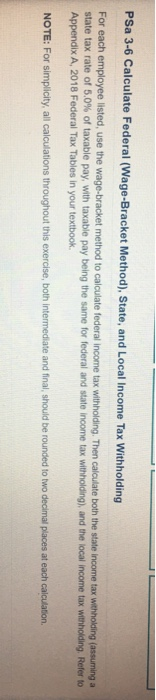

PSa 3-6 Calculate Federal (Wage-Bracket Method), State, and Local Income Tax Withholding For each employee listed, use the wage-bracket method to calculate federal Income tax withholding. Then calculate both the state income tax withholding assuming a tate tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax witholding Refer to appendix A, 2018 Federal Tax Tables in your textbook. IOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation Alejandro Garcia (single; 3 federal withholding allowances) eamed weekly gross pay of $1,160. He participates in a cafeteria plan, to which he pays $60 during the period. The city in which he works levies a tax of $9/week on employees who work within city limits. Federal income tax withholding = $ State income tax withholding = $ Local income tax withholding - S PSa 3-6 Calculate Federal (Wage-Bracket Method), State, and Local Income Tax Withholding For each employee listed, use the wage-bracket method to calculate federal income tax withholding. Then calculate both the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. Refer to Appendix A, 2018 Federal Tax Tables in your textbook. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation Alejandro Garcia (single: 3 federal withholding allowances) earned weekly gross pay of $1,160. He participates in a cafeteria plan, to which he pays $60 during the period. The city in which he works levies a tax of $8/week on employees who work within city limits Federal income tax withholding = $ State income tax withholding = $ Local income tax withholding = $ PSa 3-6 Calculate Federal (Wage-Bracket Method), State, and Local Income Tax Withholding For each employee listed, use the wage-bracket method to calculate federal Income tax withholding. Then calculate both the state income tax withholding assuming a tate tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax witholding Refer to appendix A, 2018 Federal Tax Tables in your textbook. IOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation Alejandro Garcia (single; 3 federal withholding allowances) eamed weekly gross pay of $1,160. He participates in a cafeteria plan, to which he pays $60 during the period. The city in which he works levies a tax of $9/week on employees who work within city limits. Federal income tax withholding = $ State income tax withholding = $ Local income tax withholding - S PSa 3-6 Calculate Federal (Wage-Bracket Method), State, and Local Income Tax Withholding For each employee listed, use the wage-bracket method to calculate federal income tax withholding. Then calculate both the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. Refer to Appendix A, 2018 Federal Tax Tables in your textbook. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation Alejandro Garcia (single: 3 federal withholding allowances) earned weekly gross pay of $1,160. He participates in a cafeteria plan, to which he pays $60 during the period. The city in which he works levies a tax of $8/week on employees who work within city limits Federal income tax withholding = $ State income tax withholding = $ Local income tax withholding = $