Question

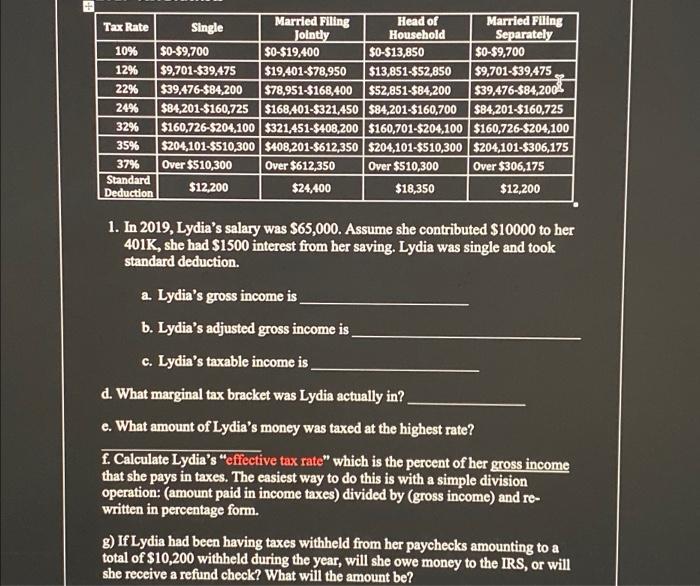

Tax Rate Single Married Filing Jointly Head of Household Married Filing Separately 10% $0-$9,700 $0-$19,400 $0-$13,850 $0-$9,700 12% $9,701-$39,475 $19,401-$78,950 $13,851-$52,850 $9,701-$39,475 22% 32%

Tax Rate Single Married Filing Jointly Head of Household Married Filing Separately 10% $0-$9,700 $0-$19,400 $0-$13,850 $0-$9,700 12% $9,701-$39,475 $19,401-$78,950 $13,851-$52,850 $9,701-$39,475 22% 32% $39,476-$84,200 $78,951-$168,400 $52,851-$84,200 $39,476-$84,200 24% $84,201-$160,725 $168,401-$321,450 $84,201-$160,700 $84,201-$160,725 $160,726-$204,100 $321,451-$408,200 $160,701-$204,100 $160,726-$204,100 $204,101-$510,300 $408,201-$612,350 $204,101-$510,300 $204,101-$306,175 Over $510,300 Over $612,350 Over $510,300 Over $306,175 $12,200 35% 37% Standard Deduction $12,200 $24,400 $18,350 1. In 2019, Lydia's salary was $65,000. Assume she contributed $10000 to her 401K, she had $1500 interest from her saving. Lydia was single and took standard deduction. a. Lydia's gross income is b. Lydia's adjusted gross income is c. Lydia's taxable income is d. What marginal tax bracket was Lydia actually in? e. What amount of Lydia's money was taxed at the highest rate? f. Calculate Lydia's "effective tax rate" which is the percent of her gross income that she pays in taxes. The easiest way to do this is with a simple division operation: (amount paid in income taxes) divided by (gross income) and re- written in percentage form. g) If Lydia had been having taxes withheld from her paychecks amounting to a total of $10,200 withheld during the year, will she owe money to the IRS, or will she receive a refund check? What will the amount be?

Step by Step Solution

3.50 Ratings (10 Votes)

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started