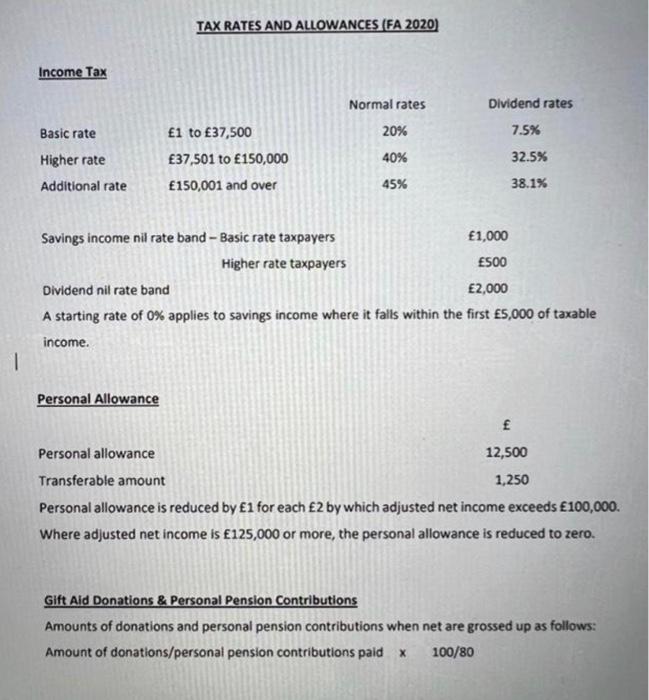

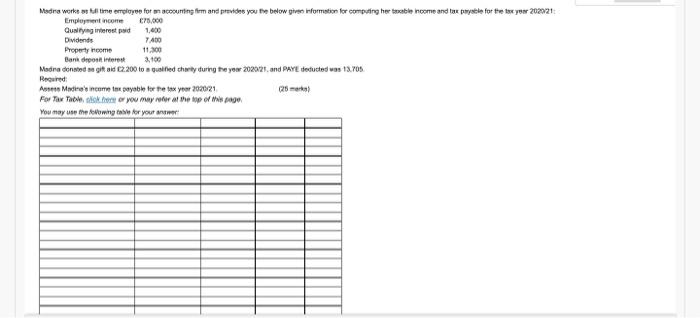

TAX RATES AND ALLOWANCES (FA 2020) Income Tax Dividend rates Normal rates 20% Basic rate 7.5% 1 to 37,500 37,501 to 150,000 40% 32.5% Higher rate Additional rate 150,001 and over 45% 38.1% Savings income nil rate band - Basic rate taxpayers 1,000 Higher rate taxpayers 500 Dividend nit rate band 2,000 A starting rate of 0% applies to savings income where it falls within the first 5,000 of taxable income. 1 Personal Allowance Personal allowance 12,500 Transferable amount 1,250 Personal allowance is reduced by 1 for each 2 by which adjusted net income exceeds 100,000. Where adjusted net income is 125,000 or more, the personal allowance is reduced to zero. Gift Aid Donations & Personal Pension Contributions Amounts of donations and personal pension contributions when net are grossed up as follows: Amount of donations/personal pension contributions paid X 100/80 Madra work of me employee for a counting firm and provides you the below information for coming her table home and tax payable for the test year 202021 Employment income 6.000 Qually great pod 1,400 Dividends 7400 Property room 11.00 Bandrost interest 100 Madina donated segit ad 2.200 to qualified charty during the year 202021. and PAYE deducted was 13.709 Roured Arsen Mediea's income tax payable for the tax ytor 2020/21 (25) For Tar Taoinikot or you may refer the top of page You may use the foowing table for your TAX RATES AND ALLOWANCES (FA 2020) Income Tax Dividend rates Normal rates 20% Basic rate 7.5% 1 to 37,500 37,501 to 150,000 40% 32.5% Higher rate Additional rate 150,001 and over 45% 38.1% Savings income nil rate band - Basic rate taxpayers 1,000 Higher rate taxpayers 500 Dividend nit rate band 2,000 A starting rate of 0% applies to savings income where it falls within the first 5,000 of taxable income. 1 Personal Allowance Personal allowance 12,500 Transferable amount 1,250 Personal allowance is reduced by 1 for each 2 by which adjusted net income exceeds 100,000. Where adjusted net income is 125,000 or more, the personal allowance is reduced to zero. Gift Aid Donations & Personal Pension Contributions Amounts of donations and personal pension contributions when net are grossed up as follows: Amount of donations/personal pension contributions paid X 100/80 Madra work of me employee for a counting firm and provides you the below information for coming her table home and tax payable for the test year 202021 Employment income 6.000 Qually great pod 1,400 Dividends 7400 Property room 11.00 Bandrost interest 100 Madina donated segit ad 2.200 to qualified charty during the year 202021. and PAYE deducted was 13.709 Roured Arsen Mediea's income tax payable for the tax ytor 2020/21 (25) For Tar Taoinikot or you may refer the top of page You may use the foowing table for your