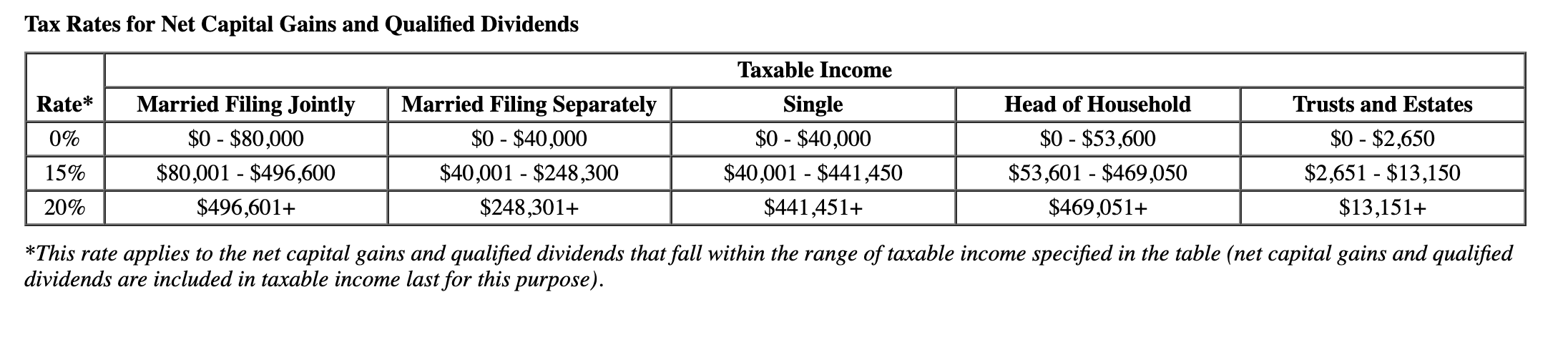

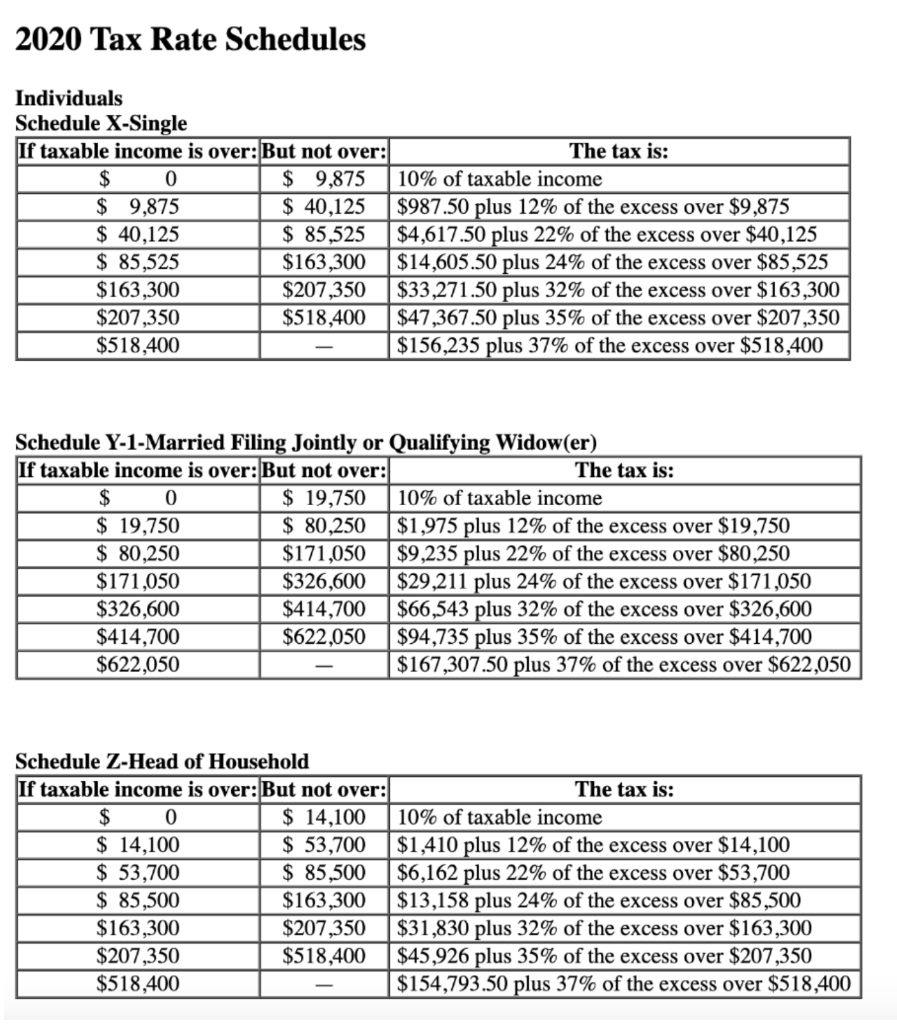

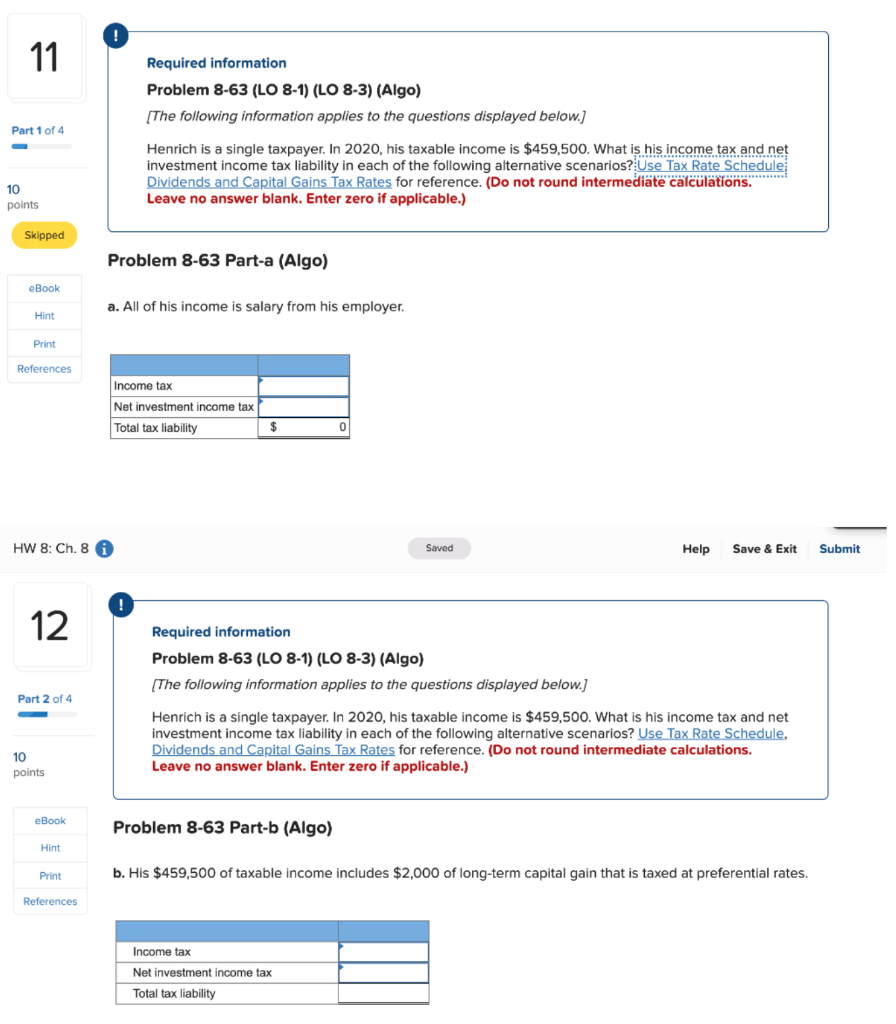

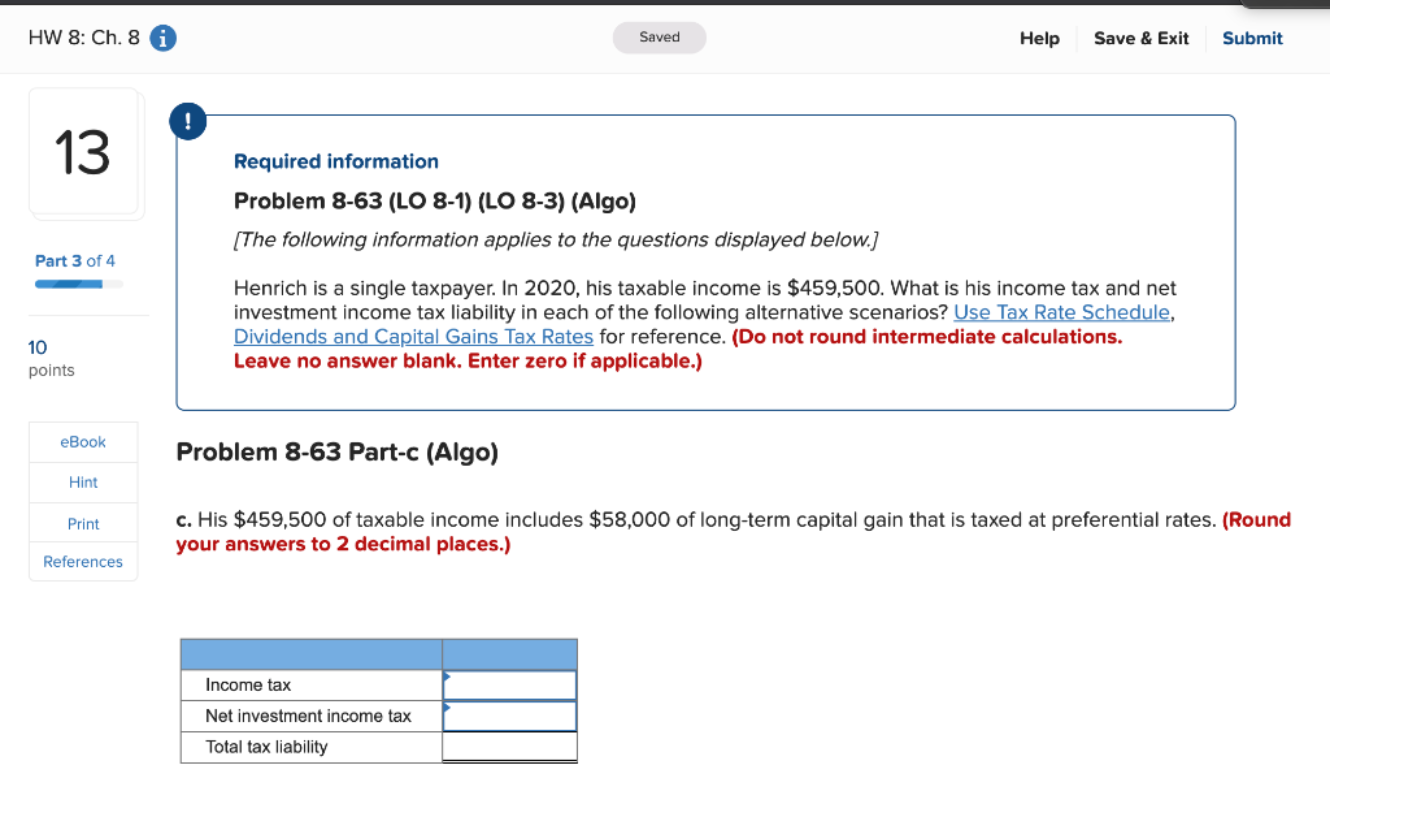

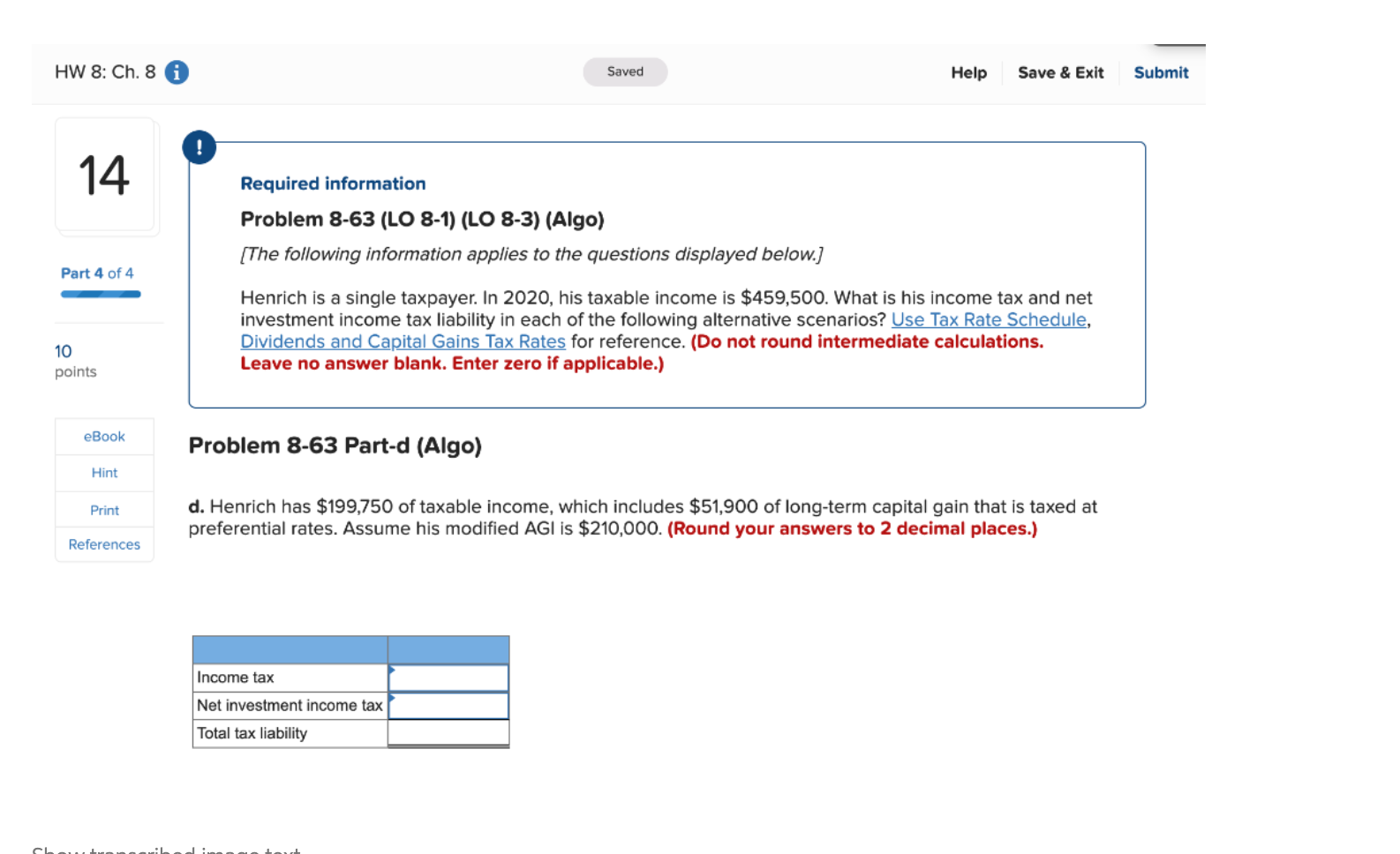

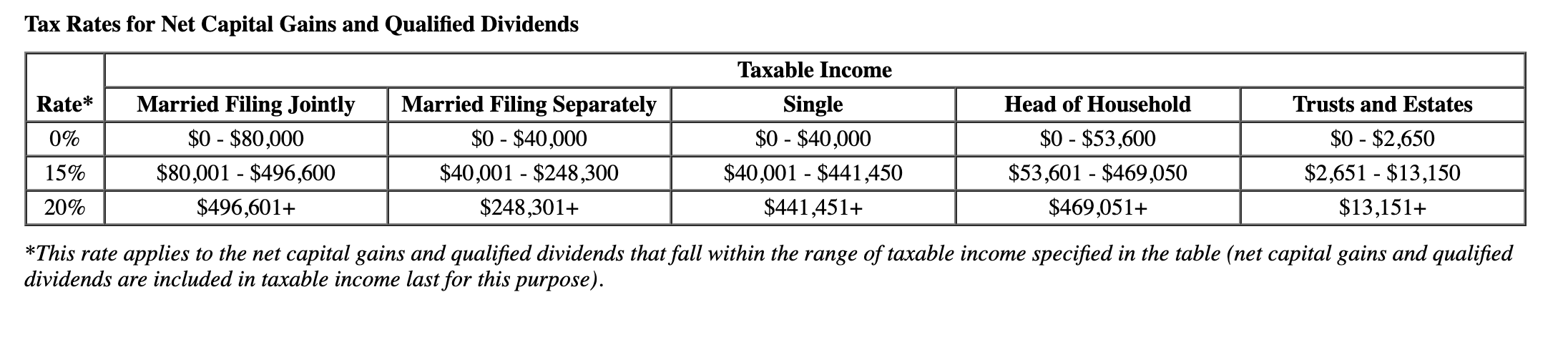

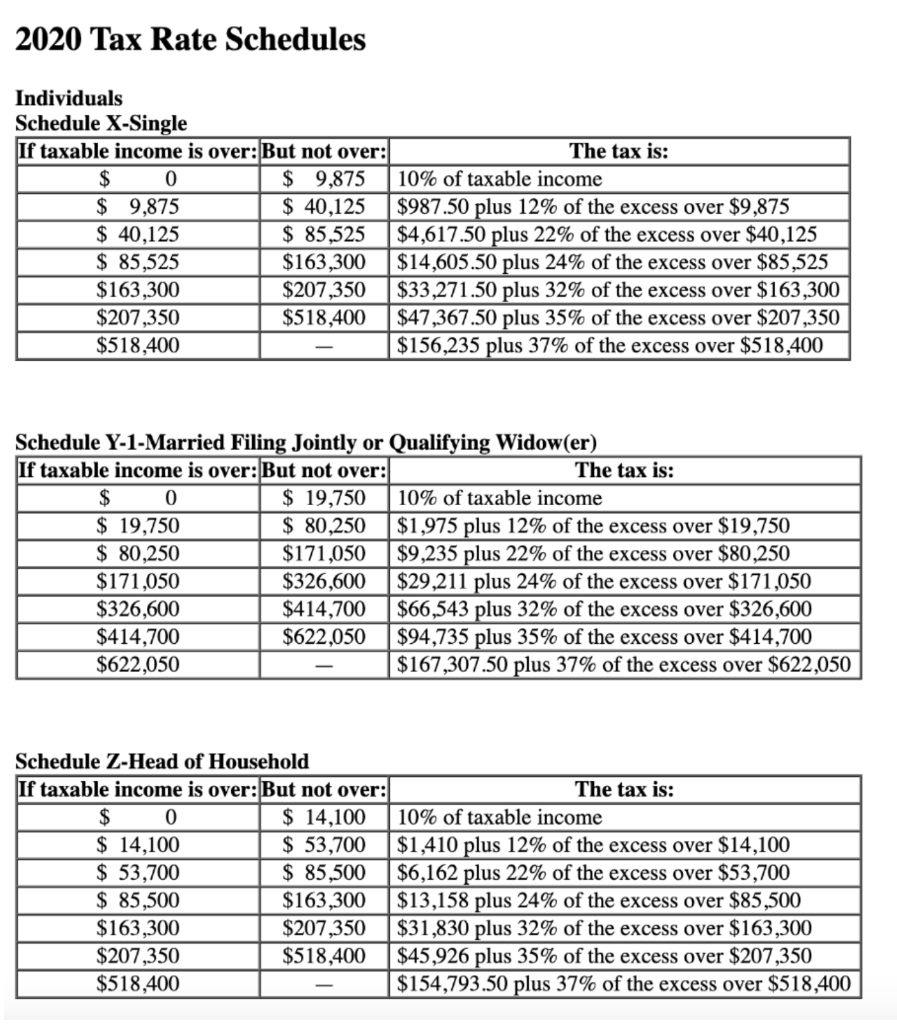

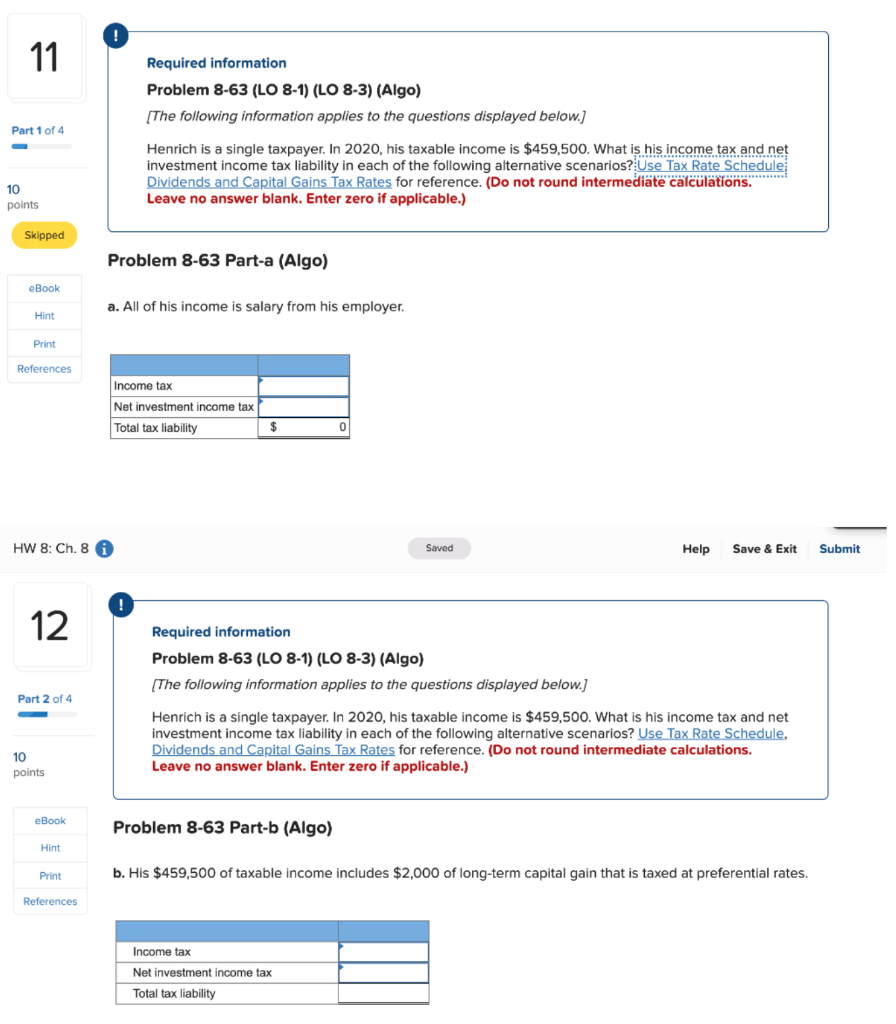

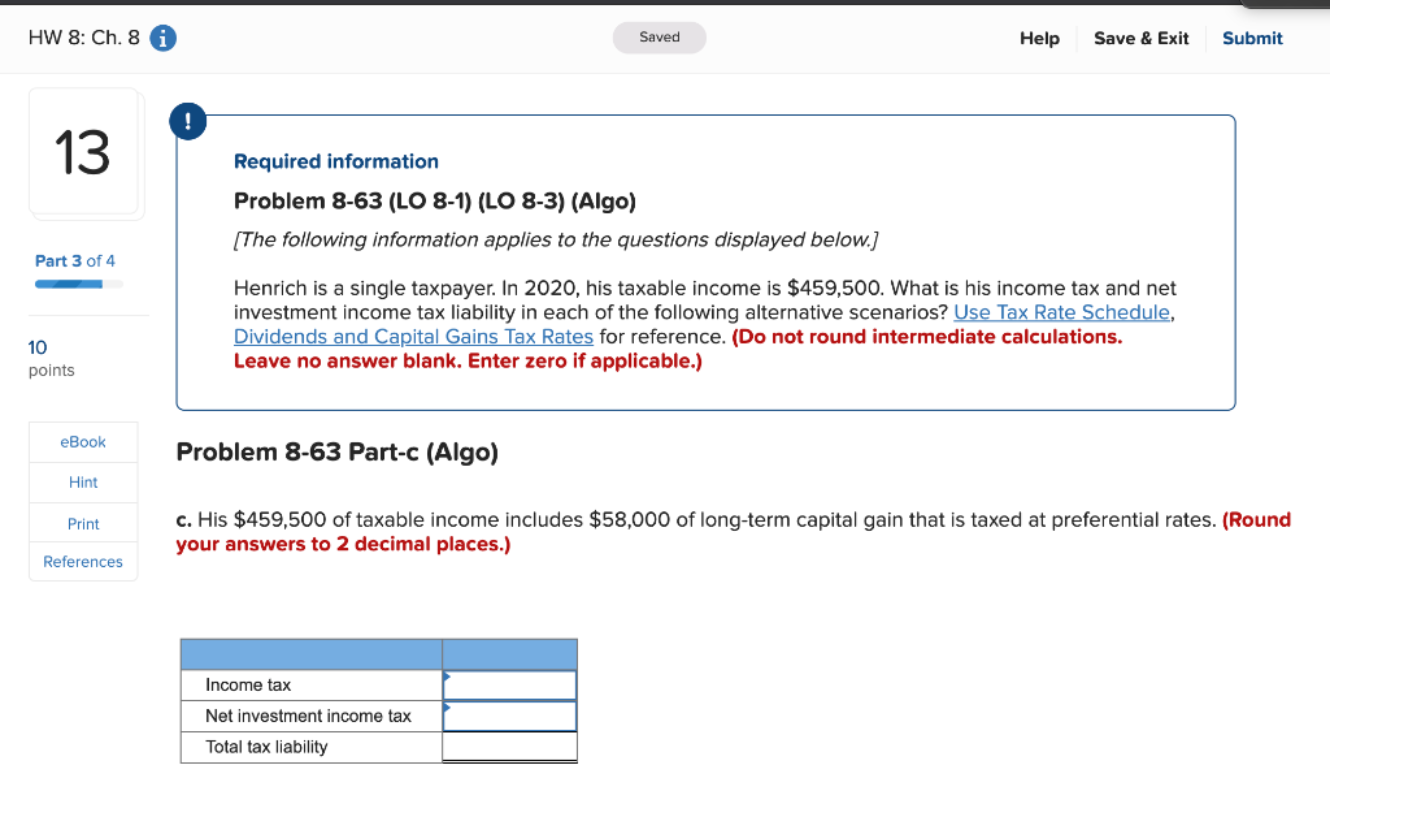

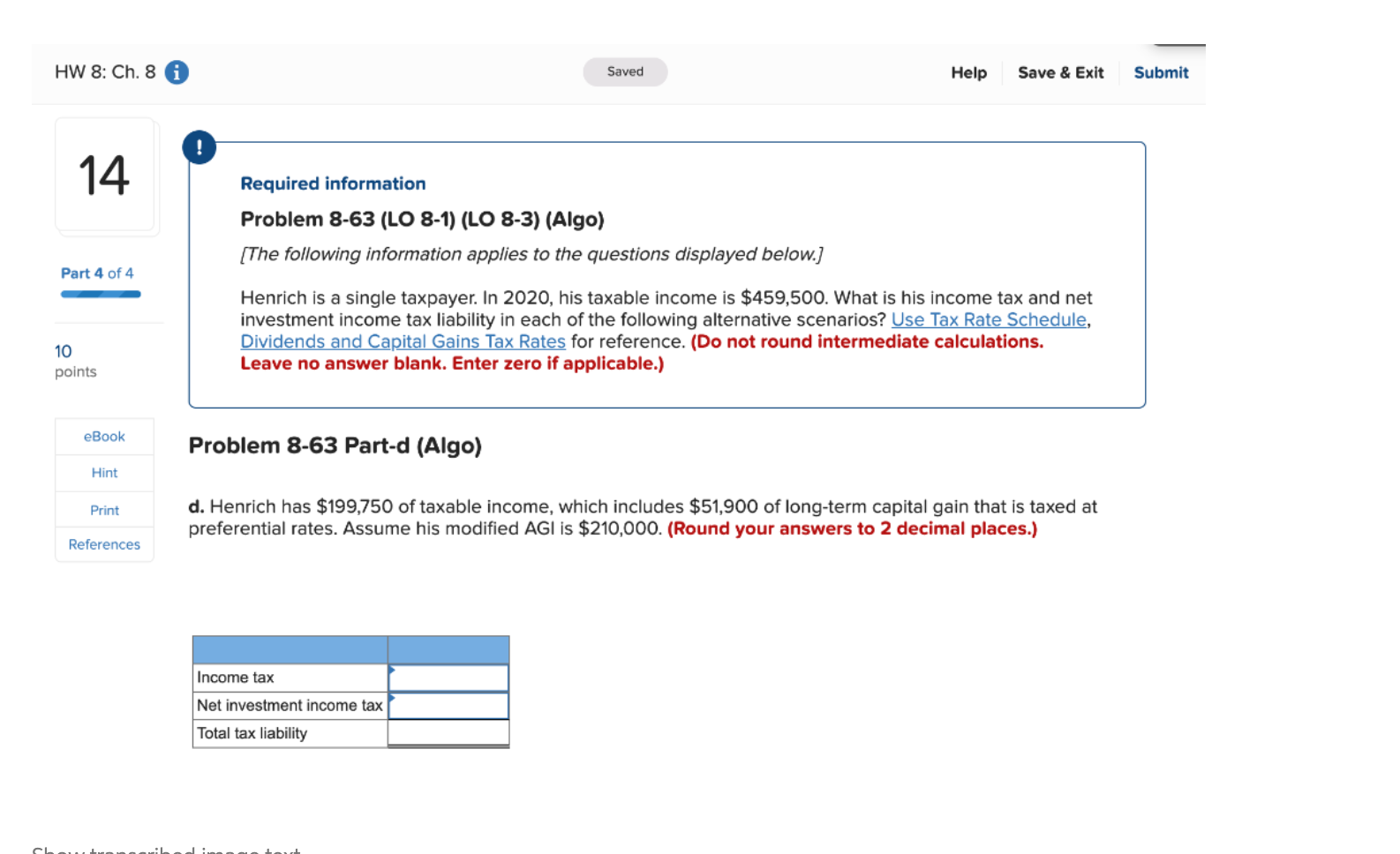

Tax Rates for Net Capital Gains and Qualified Dividends Rate* 0% Married Filing Jointly $0 - $80,000 $80,001 - $496,600 $496,601+ Married Filing Separately $0 - $40,000 $40,001 - $248,300 $248,301+ Taxable Income Single $0 - $40,000 $40,001 - $441,450 $441,451+ Head of Household $0 - $53,600 $53,601 - $469,050 $469,051+ Trusts and Estates $0 - $2,650 $2,651 - $13,150 $13,151+ 15% 20% *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: $ 0 $ 9,875 $ 9,875 $ 40,125 $ 40,125 $ 85,525 $ 85,525 $163,300 $163,300 $207,350 $207,350 $518,400 $518,400 The tax is: 10% of taxable income $987.50 plus 12% of the excess over $9,875 $4,617.50 plus 22% of the excess over $40,125 $14,605.50 plus 24% of the excess over $85,525 $33,271.50 plus 32% of the excess over $163,300 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: $ 0 $ 14,100 $ 14,100 $ 53,700 $ 53,700 $ 85,500 $ 85,500 $163,300 $163,300 $207,350 $207,350 $518,400 $518,400 The tax is: 10% of taxable income $1,410 plus 12% of the excess over $14,100 $6,162 plus 22% of the excess ov $53,700 $13,158 plus 24% of the excess over $85,500 $31,830 plus 32% of the excess over $163,300 $45,926 plus 35% of the excess over $207,350 $154,793.50 plus 37% of the excess over $518,400 ! 11 Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below.] Part 1 of 4 Henrich is a single taxpayer. In 2020, his taxable income is $459,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable.) 10 points Skipped Problem 8-63 Part-a (Algo) eBook a. All of his income is salary from his employer. Hint Print References Income tax Net investment income tax Total tax liability $ 0 Submit HW 8: Ch.8 Saved Help Save & Exit Submit 12 Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below. Part 2 of 4 Henrich is a single taxpayer. In 2020, his taxable income is $459,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable.) 10 points eBook Problem 8-63 Part-b (Algo) Hint Print b. His $459,500 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. References Income tax Net investment income tax Total tax liability HW 8: Ch. 8 i Saved Help Save & Exit Submit 13 Part 3 of 4 Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below.) Henrich is a single taxpayer. In 2020, his taxable income is $459,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable.) 10 points eBook Problem 8-63 Part-c (Algo) Hint Print c. His $459,500 of taxable income includes $58,000 of long-term capital gain that is taxed at preferential rates. (Round your answers to 2 decimal places.) References Income tax Net investment income tax Total tax liability HW 8: Ch. 8 Saved Help Save & Exit Submit 14 Part 4 of 4 Required information Problem 8-63 (LO 8-1) (LO 8-3) (Algo) [The following information applies to the questions displayed below.) Henrich is a single taxpayer. In 2020, his taxable income is $459,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable.) 10 points eBook Problem 8-63 Part-d (Algo) Hint Print d. Henrich has $199,750 of taxable income, which includes $51,900 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $210,000. (Round your answers to 2 decimal places.) References Income tax Net investment income tax Total tax liability