Answered step by step

Verified Expert Solution

Question

1 Approved Answer

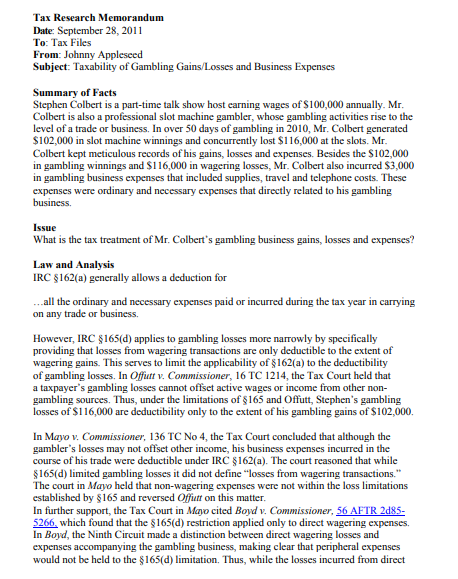

Tax Research Memorandum Date: September 28, 2011 To: Tax Files From: Johnny Appleseed Subject: Taxability of Gambling Gains/Losses and Business Expenses Summary of Facts

Tax Research Memorandum Date: September 28, 2011 To: Tax Files From: Johnny Appleseed Subject: Taxability of Gambling Gains/Losses and Business Expenses Summary of Facts Stephen Colbert is a part-time talk show host earning wages of $100,000 annually. Mr. Colbert is also a professional slot machine gambler, whose gambling activities rise to the level of a trade or business. In over 50 days of gambling in 2010, Mr. Colbert generated $102,000 in slot machine winnings and concurrently lost $116,000 at the slots. Mr. Colbert kept meticulous records of his gains, losses and expenses. Besides the $102,000 in gambling winnings and $116,000 in wagering losses, Mr. Colbert also incurred $3,000 in gambling business expenses that included supplies, travel and telephone costs. These expenses were ordinary and necessary expenses that directly related to his gambling business. Issue What is the tax treatment of Mr. Colbert's gambling business gains, losses and expenses? Law and Analysis IRC 162(a) generally allows a deduction for ...all the ordinary and necessary expenses paid or incurred during the tax year in carrying on any trade or business. However, IRC $165(d) applies to gambling losses more narrowly by specifically providing that losses from wagering transactions are only deductible to the extent of wagering gains. This serves to limit the applicability of $162(a) to the deductibility of gambling losses. In Offutt v. Commissioner, 16 TC 1214, the Tax Court held that a taxpayer's gambling losses cannot offset active wages or income from other non- gambling sources. Thus, under the limitations of $165 and Offutt, Stephen's gambling losses of $116,000 are deductibility only to the extent of his gambling gains of $102,000. In Mayo v. Commissioner, 136 TC No 4, the Tax Court concluded that although the gambler's losses may not offset other income, his business expenses incurred in the course of his trade were deductible under IRC $162(a). The court reasoned that while $165(d) limited gambling losses it did not define "losses from wagering transactions." The court in Mayo held that non-wagering expenses were not within the loss limitations established by $165 and reversed Offutt on this matter. In further support, the Tax Court in Mayo cited Boyd v. Commissioner, 56 AFTR 2d85- 5266, which found that the $165(d) restriction applied only to direct wagering expenses. In Boyd, the Ninth Circuit made a distinction between direct wagering losses and expenses accompanying the gambling business, making clear that peripheral expenses would not be held to the $165(d) limitation. Thus, while the losses incurred from direct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started