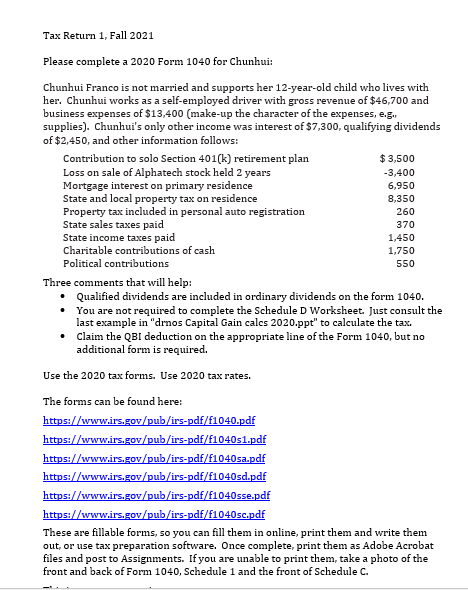

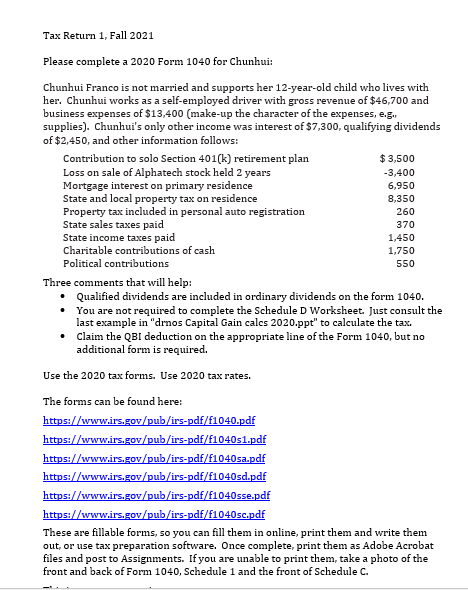

Tax Return 1, Fall 2021 Please complete a 2020 Form 1040 for Chunhui: 8,350 1,450 550 Chunhui Franco is not married and supports her 12-year-old child who lives with her. Chunhui works as a self-employed driver with gross revenue of $46,700 and business expenses of $13,400 (make-up the character of the expenses, e.g., supplies). Chunhui's only other income was interest of $7,300, qualifying dividends of $2,450, and other information follows: Contribution to solo Section 401(k) retirement plan $ 3,500 Loss on sale of Alphatech stock held 2 years -3,400 Mortgage interest on primary residence 6,950 State and local property tax on residence Property tax included in personal auto registration 260 State sales taxes paid 370 State income taxes paid Charitable contributions of cash 1,750 Political contributions Three comments that will help: Qualified dividends are included in ordinary dividends on the form 1040. You are not required to complete the Schedule D Worksheet. Just consult the last example in "drnos Capital Gain calcs 2020.ppt" to calculate the tax. Claim the QBI deduction on the appropriate line of the Form 1040, but no additional form is required. Use the 2020 tax forms. Use 2020 tax rates. The forms can be found here: https://www.irs.gov/pub/irs-pdf/f1040.pdf https://www.irs.gov/pub/irs-pdf/f1040s1.pdf https://www.irs.gov/pub/irs-pdf/f1040sa.pdf https://www.irs.gov/pub/irs-pdf/f1040sd.pdf https://www.irs.gov/pub/irs-pdf/f1040sse.pdf https://www.irs.gov/pub/irs-pdf/f1040sc.pdf These are fillable forms, so you can fill them in online, print them and write them out, or use tax preparation software. Once complete, print them as Adobe Acrobat files and post to Assignments. If you are unable to print them, take a photo of the front and back of Form 1040, Schedule 1 and the front of Schedule C. Tax Return 1, Fall 2021 Please complete a 2020 Form 1040 for Chunhui: 8,350 1,450 550 Chunhui Franco is not married and supports her 12-year-old child who lives with her. Chunhui works as a self-employed driver with gross revenue of $46,700 and business expenses of $13,400 (make-up the character of the expenses, e.g., supplies). Chunhui's only other income was interest of $7,300, qualifying dividends of $2,450, and other information follows: Contribution to solo Section 401(k) retirement plan $ 3,500 Loss on sale of Alphatech stock held 2 years -3,400 Mortgage interest on primary residence 6,950 State and local property tax on residence Property tax included in personal auto registration 260 State sales taxes paid 370 State income taxes paid Charitable contributions of cash 1,750 Political contributions Three comments that will help: Qualified dividends are included in ordinary dividends on the form 1040. You are not required to complete the Schedule D Worksheet. Just consult the last example in "drnos Capital Gain calcs 2020.ppt" to calculate the tax. Claim the QBI deduction on the appropriate line of the Form 1040, but no additional form is required. Use the 2020 tax forms. Use 2020 tax rates. The forms can be found here: https://www.irs.gov/pub/irs-pdf/f1040.pdf https://www.irs.gov/pub/irs-pdf/f1040s1.pdf https://www.irs.gov/pub/irs-pdf/f1040sa.pdf https://www.irs.gov/pub/irs-pdf/f1040sd.pdf https://www.irs.gov/pub/irs-pdf/f1040sse.pdf https://www.irs.gov/pub/irs-pdf/f1040sc.pdf These are fillable forms, so you can fill them in online, print them and write them out, or use tax preparation software. Once complete, print them as Adobe Acrobat files and post to Assignments. If you are unable to print them, take a photo of the front and back of Form 1040, Schedule 1 and the front of Schedule C