Tax Return for Individual

Compute Marias net federal tax payable or refund due for 2018. If she incurs a penalty, she wants to pay it with her tax return. If she is to receive a tax refund, she wants to receive a check. Turn in Schedule A, Schedule B, Schedule C, Schedule D, and Schedule SE.

Maria Gonzalez is divorced. She was born on May 22, 1970, and lives at 1502 Elm Terrace, Baton Rouge, LA 70465. Her Social Security Number is 385-22-7844.

Maria has a child, Juan Gomez, who resides with Maria. Juans social security number is 285-33-8999. Juan was born on June 3, 2010. Maria receives alimony of $3,000 per year and child support of $4,000 per year from her ex-husband, Rigoberto Gomez. Marias home phone number is 605-833-2222. She does not want to contribute $3 to the Presidential Election Campaign Fund.

Marias mother, Juanita Hernandez, lived with Maria until her death on January 2, 2018. Juanitas only income was $4,000 from Social Security. Maria paid more than 50% of Juanitas support. Juantias Social Security number was 123-55-5555. Juanitas birthday is May 15, 1945. Juanita had minimum essential health insurance coverage because she had Medicare coverage. Maria received Form 1095-B for her mother which indicated that her mother had coverage for 12 months.

Maria is employed by the Highway Department of the State of Louisiana in an executive position. The employers federal identification number is 33-6666666. The employers address is 800 First Street, Baton Rouge, LA 70464. The following information is shown on her Wage and Tax Statement (Form W-2) for 2018,

| Line | Description | Maria |

| 1 | Wages, tips, other compensation | $70,000 |

| 2 | Federal income tax withheld | 8,000 |

| 3 | Social Security wages | 70,000 |

| 4 | Social Security tax withheld | 4,340 |

| 5 | Medicare wages and tips | 70,000 |

| 6 | Medicare tax withheld | 1,015 |

| 12a | DD | 8,500 |

| 16 | State wages, tips, etc. | 70,000 |

| 17 | State income tax withheld | 3,000 |

In addition to her salary, Marias employer provides her with the following fringe benefits:

a. Group term life insurance with a face value of $30,000. The cost of the premiums for the employer was $600. The Highway Department provides term life insurance policies for all full-time employees.

b. Group health insurance plan. Marias employer paid premiums of $8,500 for her and her sons medical insurance coverage. The plan paid $7,000 in medical expenses for her and her son during the year. The coverage on her employers medical insurance plan meets the minimum essential coverage requirement under the Affordable Care Act for her and her son. She received Form 1095-B from her employer that shows that she and her son had coverage for 12 months.

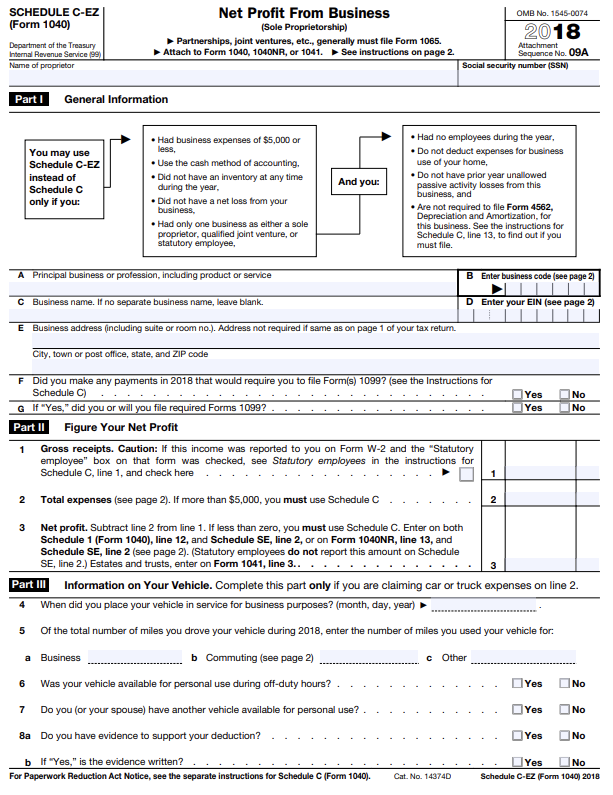

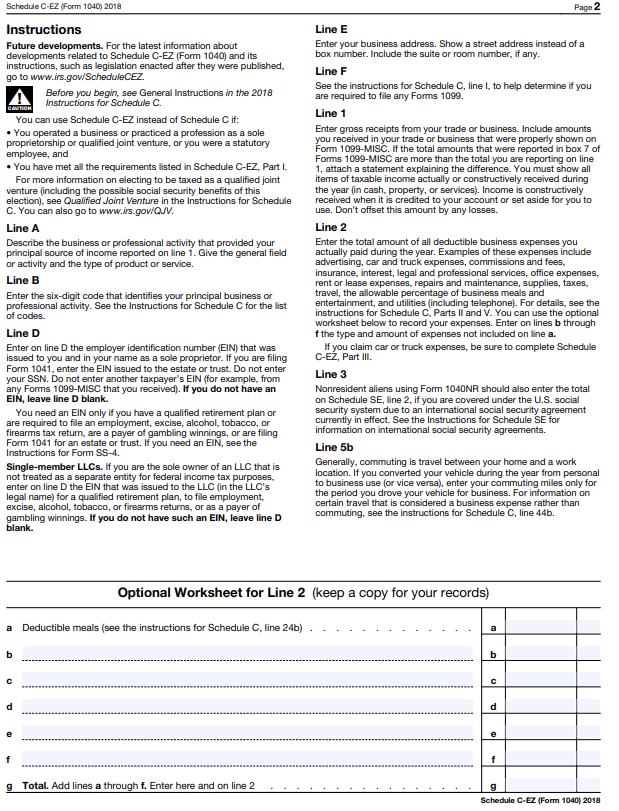

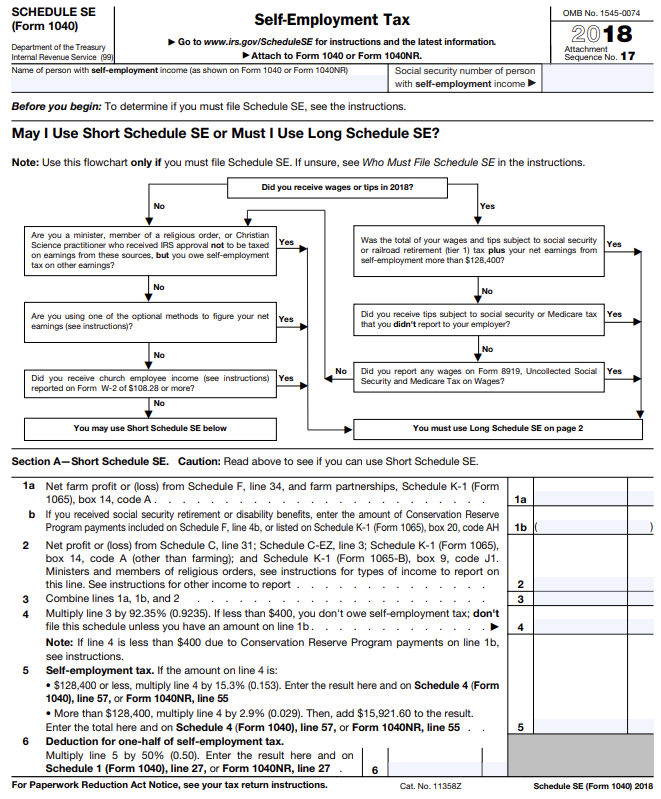

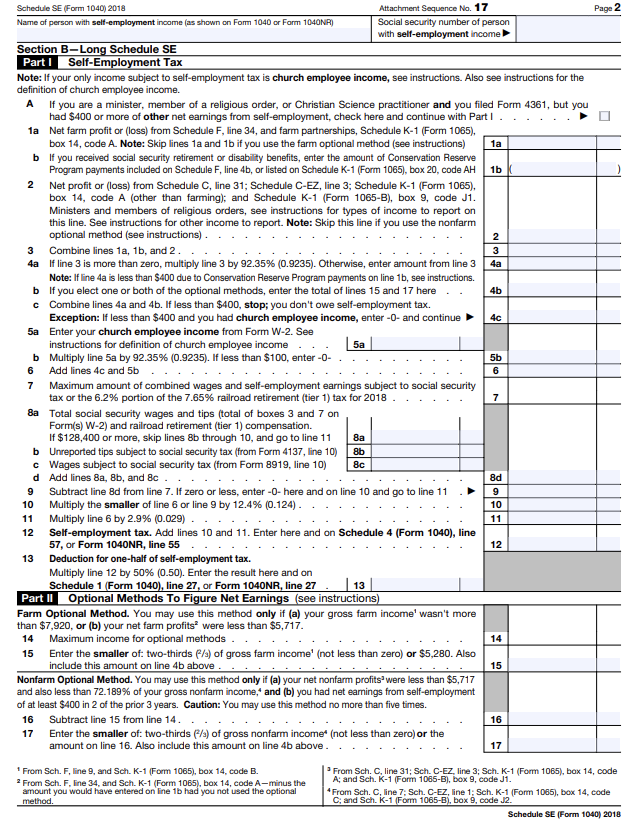

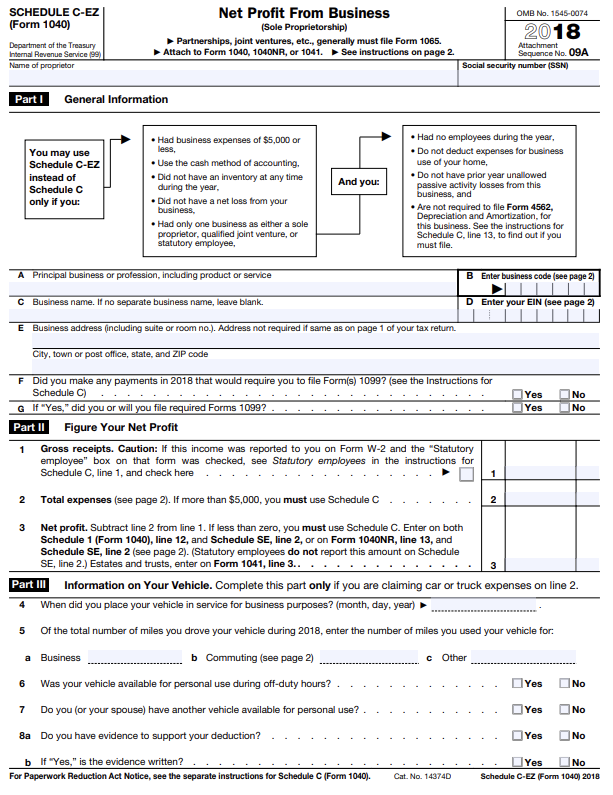

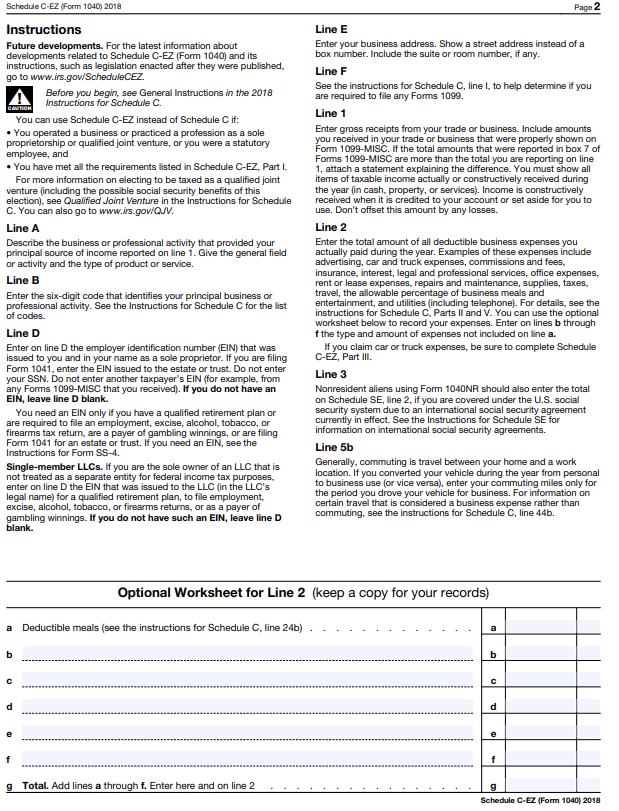

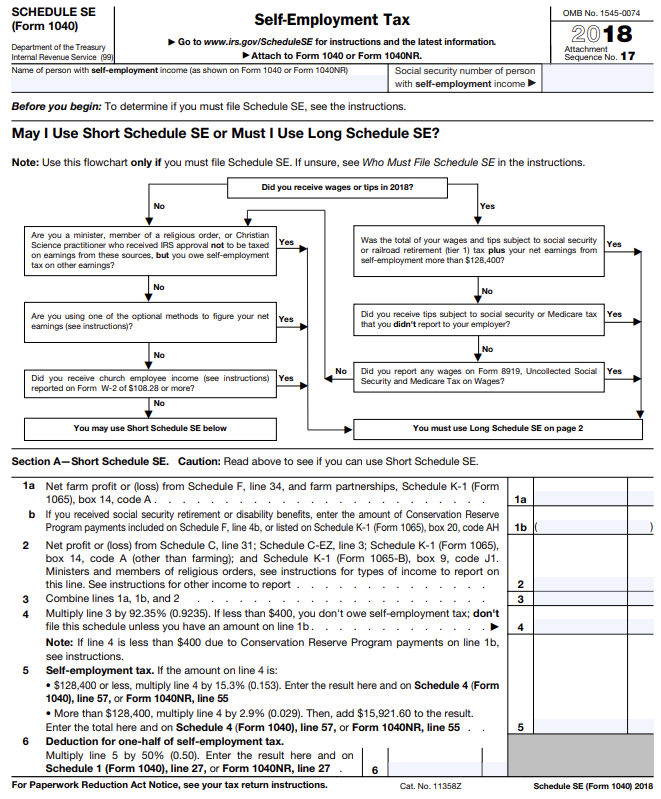

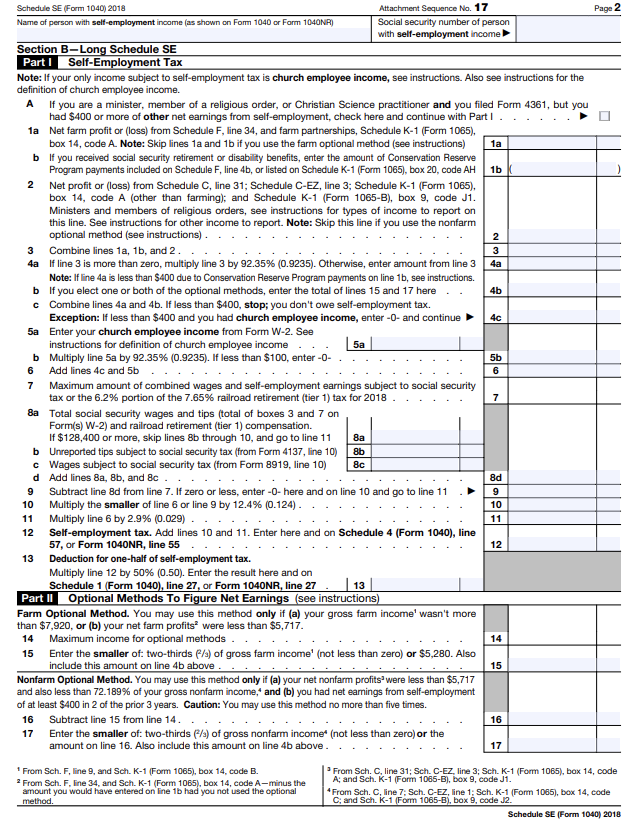

Besides her normal job, Maria runs a sole proprietor business in computer systems design service. Maria earned $5,000 from a consulting assignment in this year. The amount was reported to her on a 1099-MISC form in Box 7. The principal business code is 541510. Her basis for accounting is cash. The payer was ABC Corporation whose payors federal identification number is 22-8888888. It is located at 333 Main Street, Baton Rouge, LA 70465. When required to file form(s) 1099, you will.

In order to for Maria to maintain her full-time job, she sends her son Juan to a day care program after school five days a week. During the year, Magdalena paid the day care operator $4,250 for child care. The day care details are as follows:

Horizon Day Care

452 Patriot Road

Baton Rouge, LA 70465

EIN: 43-6598324

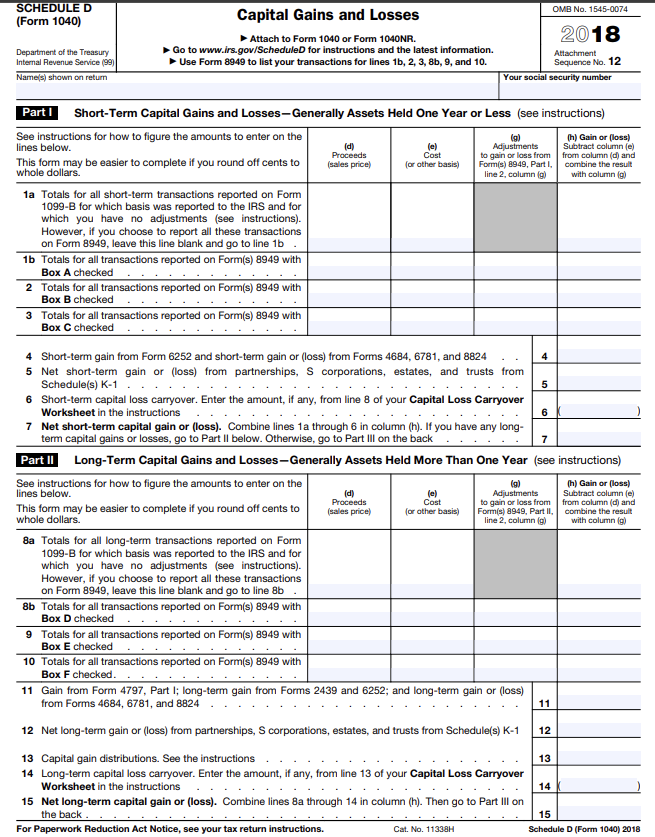

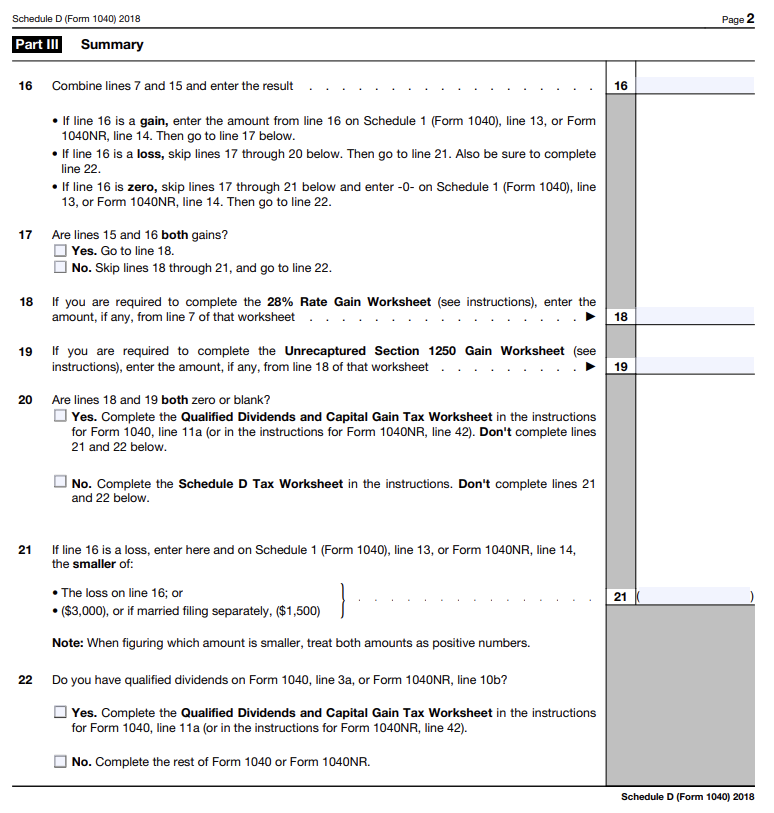

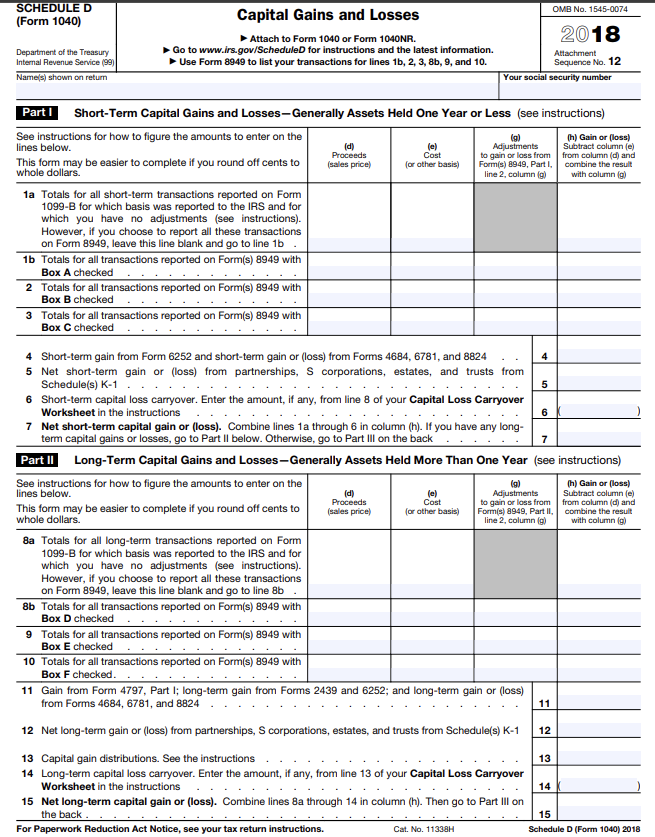

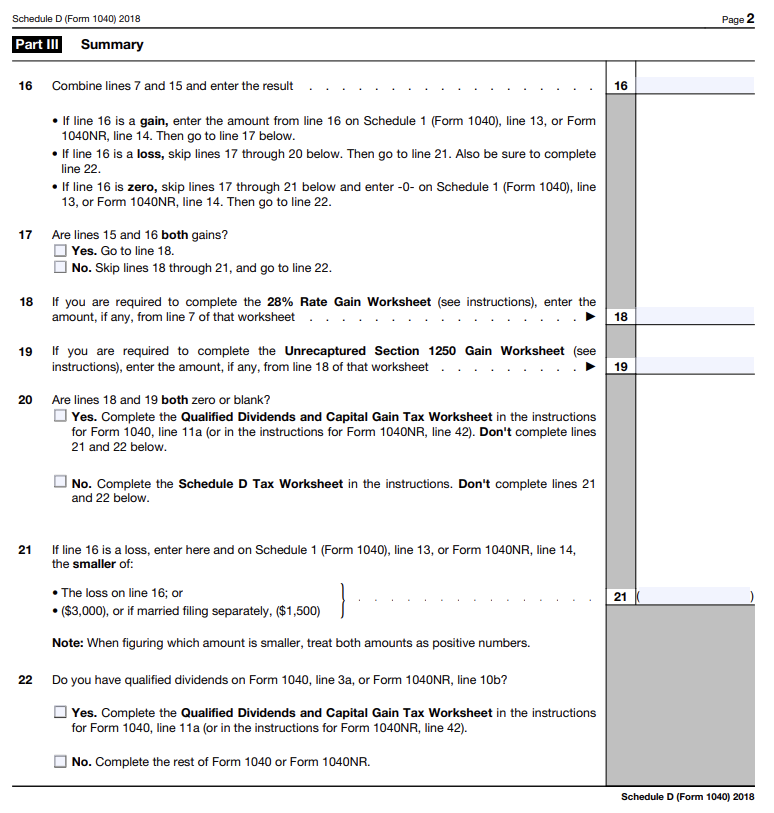

On June 15, 2018, Maria sold 200 shares of XYZ common stock for its market value of $56,000. Maria had purchased the shares for $50,000 on December 2, 2016. Her brokerage firm provided her with IRS Form 1099-B that properly reported the nature of her gain and its correct basis.

On July 20, 2014, Maria purchased a stamp collection for $2,400 as an investment. On December 8, 2018, Maria sold the stamp collection for $4,800. She did not receive a Form 1099-B for this transaction.

Maria has a long-term carryforward capital loss of $2,000 from the sale of common stock in 2016.

Other sources of income for Maria were as follows:

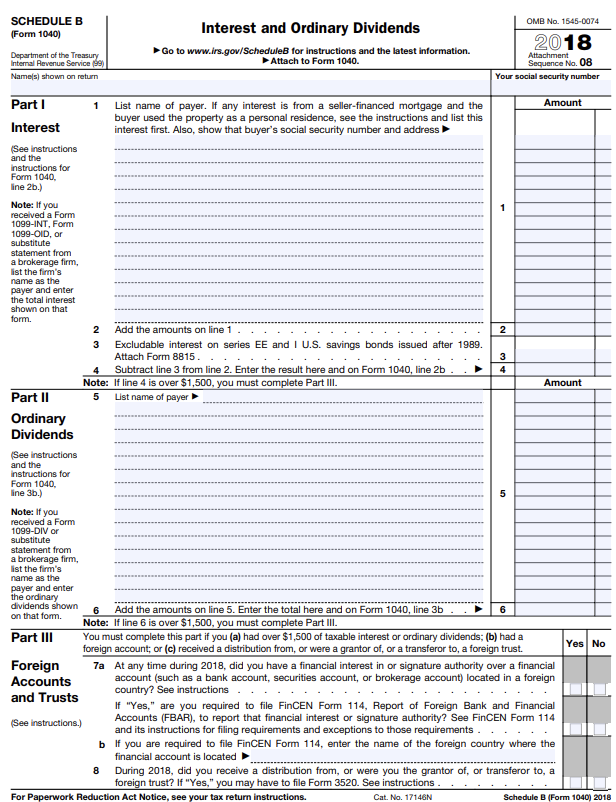

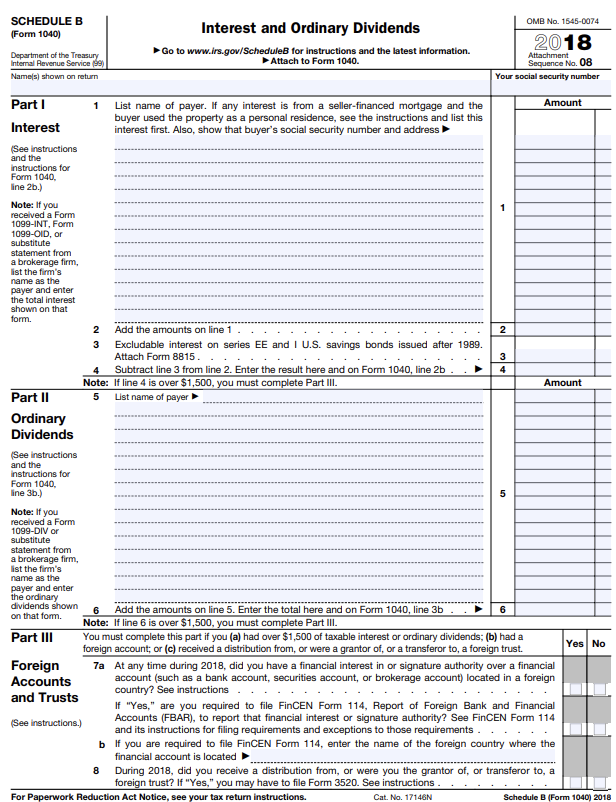

Ordinary Dividend income XYZ Corporation $9,000

(only $8,000 qualified dividends out of the $9,000 total dividends)

Interest income

Forest Bank 4,000

City of Lafayette, LA water bonds 1,000

Forest Bank reported the interest income on a Form 1099-INT in Box 1. The interest from the City of Lafayette water bonds is only reported in Box 8 on Form 1099-INT since it is from municipal bond interest. This interest is also exempt from State of Louisiana income taxes, so Maria reports it as in-state municipal bond interest. Maria also received a Form 1099-DIV from XYZ Corporation. The ordinary dividends of $9,000 are reported in Box 1a, and the qualified dividends of $8,000 are reported in Box 1b. Maria has no foreign bank accounts or trusts.

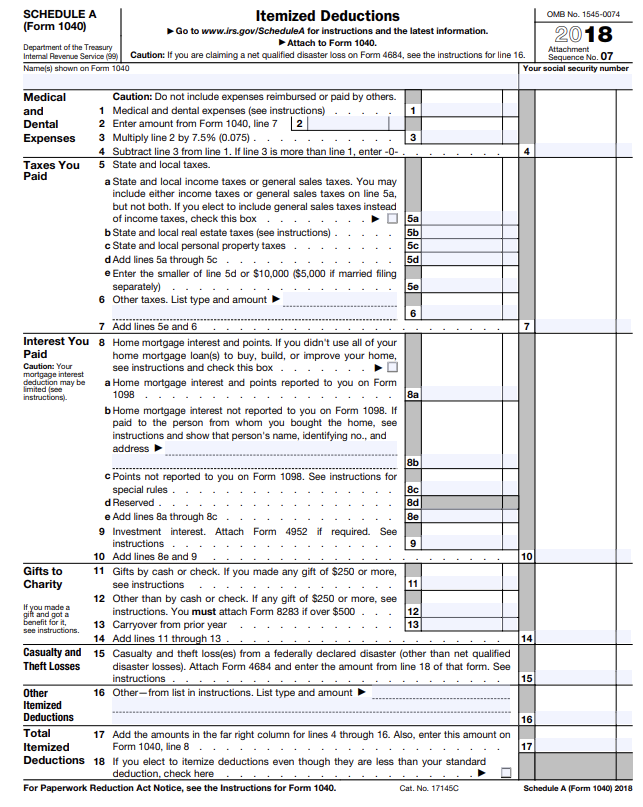

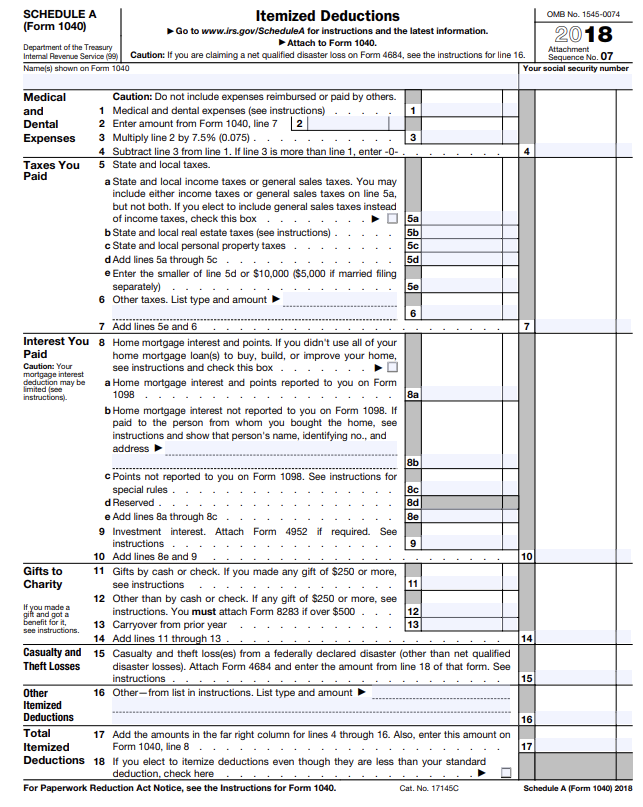

Potential itemized deductions for Maria, in addition to items already mentioned, were as follows:

Property taxes paid on her residence - Short Mortgage Co. - Form 1098 $4,000

Charitable contributions - cash to United Church 2,000

Mortgage interest on her residence - Short Mortgage Co. - Form 1098 3,500

State income tax payment sent with 2017 state return in April 2018 800

Doctor expenses for Maria and her son (not covered by insurance) 4,500

Doctor expenses for Juanita 8,000

Interest paid on personal use automobile loan 1,000

Maria put $4,000 in a traditional IRA in 2018. Her employer does not provide a pension to its employees. (Chapter 19)

Maria made four estimated federal income tax payments of $500 each on April 15, 2018; June 15, 2018; September 15, 2018; and January 15, 2019.

SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/Schedule for instructions and the latest information. 2018 Department of the Treasury Attach to Form 1040. Internal Revenue Service (9) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the Instructions for line 16. Sequence No. 07 Name(s) shown on Form 1040 Your social security number Attachment 1 Medical and Dental Expenses 3 Taxes You Paid Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions) 2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075) 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -O- 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) 5b c State and local personal property taxes d Add lines 5a through 5c. 5d e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) 5e 6 Other taxes. List type and amount 5a 5c 6 9 7 Add lines 5e and 6 Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid home mortgage loan(s) to buy, build, or improve your home, Caution: Your see instructions and check this box. mortgage interest deduction may be a Home mortgage interest and points reported to you on Form limited see instructions 1098 8a b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 8b C Points not reported to you on Form 1098. See instructions for special rules 8c d Reserved 8d e Add lines Ba through 8c 8e 9 Investment interest. Attach Form 4952 if required. See instructions 10 Add lines 8e and 9 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions 11 12 Other than by cash or check. If any gift of $250 or more, see If you made a 12 gift and got a instructions. You must attach Form 8283 if over $500 benefit for it, 13 Carryover from prior year 13 14 Add lines 11 through 13 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions Other 16 Other from list in instructions. List type and amount Itemized Deductions Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040, line 8 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check here For Paperwork Reduction Act Notice, see the Instructions for Form 1040. 10 see instructions 14 15 16 17 Cat. No. 17145C Schedule A (Form 1040 2018 OMB No. 1545-0074 SCHEDULE B (Form 1040) Interest and Ordinary Dividends Go to www.irs.gov/Schedule for instructions and the latest information. 2018 Department of the Treasury Internal Revenue Service) Name(s) shown on return Attach to Form 1040. Attachment Sequence No. 08 Your social security number 1 3 4 Part 1 1 List name of payer. If any interest is from a seller-financed mortgage and the Amount buyer used the property as a personal residence, see the instructions and list this Interest interest first. Also, show that buyer's social security number and address (See Instructions and the instructions for Form 1040 line 2b.) Note: If you received a Form 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, list the firm's name as the payer and enter the total interest shown on that form. 2 Add the amounts on line 1 2 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815 4 Subtract line 3 from line 2. Enter the result here and on Form 1040, line 2b Note: If line 4 is over $1,500, you must complete Part III. Amount Part II 5 List name of payer Ordinary Dividends (See instructions and the instructions for Form 1040, line 3b.) 5 Note: If you received a Form 1099-DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown 6 Add the amounts on line 5. Enter the total here and on Form 1040, line 3b on that form. Note: If line 6 is over $1,500, you must complete Part III. Part III You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a es No foreign account; or (c) received a distribution from, or were a grantor of, or a transferorto, a foreign trust. Foreign 7a At any time during 2018, did you have a financial interest in or signature authority over a financial Accounts account (such as a bank account, securities account, or brokerage account) located in a foreign and Trusts country? See instructions ... If "Yes," are you required to file FinCEN Form 114, Report of Foreign Bank and Financial (See instructions.) Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its instructions for filing requirements and exceptions to those requirements b If you are required to file FinCEN Form 114, enter the name of the foreign country where the financial account is located 8 During 2018, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If "Yes," you may have to file Form 3520. See instructions. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 17146N Schedule B (Form 1040) 2018 6 OMB No. 1545-0074 SCHEDULE C-EZ (Form 1040) Department of the Treasury Internal Revenue Service) Name of proprietor Net Profit From Business (Sole Proprietorship) Partnerships, joint ventures, etc., generally must file Form 1065. Attach to Form 1040, 1040NR, or 1041. See instructions on page 2. 2018 Attachment Sequence No. 09A Social security number (SSN) Part 1 General Information You may use Schedule C-EZ instead of Schedule C only if you: And you: . Had business expenses of $5,000 or less, Use the cash method of accounting, Did not have an inventory at any time during the year. Did not have a net loss from your business, Had only one business as either a sole proprietor, qualified joint venture, or statutory employee, .Had no employees during the year, Do not deduct expenses for business use of your home, Do not have prior year unallowed passive activity losses from this business, and Are not required to file Form 4562 Depreciation and Amortization, for this business. See the instructions for Schedule C, line 13, to find out if you must file. A Principal business or profession, including product or service B Enter business code (see page 2) C Business name. If no separate business name, leave blank. D Enter your EIN (see page 2) E Business address (including suite or room no.). Address not required if same as on page 1 of your tax return City, town or post office, state, and ZIP code Yes Yes No No F Did you make any payments in 2018 that would require you to file Form(s) 1099? (see the Instructions for Schedule C) G If "Yes," did you or will you file required Forms 1099?. Part II Figure Your Net Profit 1 Gross receipts. Caution: If this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked, see Statutory employees in the instructions for Schedule C, line 1, and check here 1 2 2 3 4 5 Total expenses (see page 2). If more than $5,000, you must use Schedule C Net profit. Subtract line 2 from line 1. If less than zero, you must use Schedule C. Enter on both Schedule 1 (Form 1040), line 12, and Schedule SE, line 2, or on Form 1040NR, line 13, and Schedule SE, line 2 (see page 2). (Statutory employees do not report this amount on Schedule SE, line 2.) Estates and trusts, enter on Form 1041, line 3... Part III Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 2. When did you place your vehicle in service for business purposes? (month, day, year) Of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for a Business b Commuting (see page 2) Was your vehicle available for personal use during off-duty hours? Yes Do you (or your spouse) have another vehicle available for personal use? 8a Do you have evidence to support your deduction? b If "Yes," is the evidence written? Yes No For Paperwork Reduction Act Notice, see the separate instructions for Schedule C (Form 1040). Schedule C-EZ (Form 1040) 2018 c Other 6 No 7 Yes No Yes No Cat. No. 14374D Schedule C-EZ (Form 1040) 2018 Page 2 Instructions Future developments. For the latest information about developments related to Schedule C-EZ (Form 1040) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/ScheduleCEZ Before you begin, see General Instructions in the 2018 Instructions for Schedule C. CAUTION You can use Schedule C-EZ instead of Schedule Cif: You operated a business or practiced a profession as a sole proprietorship or qualified joint venture, or you were a statutory employee, and . You have met all the requirements listed in Schedule C-EZ, Part I. For more information on electing to be taxed as a qualified joint venture (including the possible social security benefits of this election), see Qualified Joint Venture in the Instructions for Schedule C. You can also go to www.irs.gov/QJV. Line A Describe the business or professional activity that provided your principal source of income reported on line 1. Give the general field or activity and the type of product or service. Line B Enter the six-digit code that identifies your principal business or professional activity. See the Instructions for Schedule C for the list of codes Line D Enter on line D the employer identification number (EIN) that was issued to you and in your name as a sole proprietor. If you are filing Form 1041, enter the EIN issued to the estate or trust. Do not enter your SSN. Do not enter another taxpayer's EIN (for example, from any Forms 1099-MISC that you received). If you do not have an EIN, leave line D blank. You need an EIN only if you have a qualified retirement plan or are required to file an employment, excise, alcohol, tobacco, or firearms tax return, are a payer of gambling winnings, or are filing Form 1041 for an estate or trust. If you need an EIN, see the Instructions for Form SS-4. Single-member LLCs. If you are the sole owner of an LLC that is not treated as a separate entity for federal income tax purposes, enter on line D the EIN that was issued to the LLC (in the LLC's legal name) for a qualified retirement plan, to file employment, excise, alcohol, tobacco, or firearms returns, or as a payer of gambling winnings. If you do not have such an EIN, leave line D blank. Line E Enter your business address. Show a street address instead of a box number. Include the suite or room number, if any. Line F See the instructions for Schedule C, line I, to help determine if you are required to file any Forms 1099. Line 1 Enter gross receipts from your trade or business. Include amounts you received in your trade or business that were properly shown on Form 1099-MISC. If the total amounts that were reported in box 7 of Forms 1099-MISC are more than the total you are reporting on line 1, attach a statement explaining the difference. You must show all items of taxable income actually or constructively received during the year (in cash, property, or services). Income is constructively received when it is credited to your account or set aside for you to use. Don't offset this amount by any losses. Line 2 Enter the total amount of all deductible business expenses you actually paid during the year. Examples of these expenses include advertising, car and truck expenses, commissions and fees, insurance, interest, legal and professional services, office expenses, rent or lease expenses, repairs and maintenance, supplies, taxes, travel, the allowable percentage of business meals and entertainment, and utilities (including telephone). For details, see the instructions for Schedule C, Parts II and V. You can use the optional worksheet below to record your expenses. Enter on lines b through f the type and amount of expenses not included on line a. If you claim car or truck expenses, be sure to complete Schedule C-E, Part III. Line 3 Nonresident aliens using Form 1040NR should also enter the total on Schedule SE, line 2, if you are covered under the U.S. social security system due to an international social security agreement currently in effect. See the Instructions for Schedule SE for information on international social security agreements. Line 5b Generally, commuting is travel between your home and a work location. If you converted your vehicle during the year from personal to business use (or vice versa), enter your commuting miles only for the period you drove your vehicle for business. For information on certain travel that is considered a business expense rather than commuting, see the instructions for Schedule C, line 44b. Optional Worksheet for Line 2 (keep a copy for your records) a Deductible meals (see the instructions for Schedule C, line 24b) a b b d d e f f g Total. Add lines a through f. Enter here and on line 2 g Schedule C-EZ (Form 1040) 2018 OMB No. 1545-0074 SCHEDULED (Form 1040) Capital Gains and Losses Attach to Form 1040 or Form 1040NR. Go to www.irs.gov/Scheduled for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. 2018 Department of the Treasury Internal Revenue Service (99) Names) shown on return Attachment Sequence No. 12 Your social security number Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the la) (h) Gain or loss) lines below. (d) Adjustments Subtract column (e) Proceeds Cost to gain or loss from from column (d) and This form may be easier to complete if you round off cents to (sales price) (or other basis) Formis) 8949, Part 1, combine the result whole dollars. line 2 column (g) with columna 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 16 Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked on Cost 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part Il below. Otherwise, go to Part III on the back 7 Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the (g) (h) Gain or loss) lines below. (d) Adjustments Subtract column (e) Proceeds This form may be easier to complete if you round off cents to to gain or loss from from column (d) and (sales price) (or other basis) Formis) 8949, Part II, combine the result whole dollars. line 2 columni) with column(a) 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked.. 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 12 Net long-term gain or loss) from partnerships, Scorporations, estates, and trusts from Schedule(s) K-1 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or loss). Combine lines 8a through 14 in column (h). Then go to Part Ill on the back. 15 For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040) 2018 11 12 Cat. No. 11338H Page 2 Schedule D (Form 1040) 2018 Part III Summary 16 Combine lines 7 and 15 and enter the result 16 If line 16 is a gain, enter the amount from line 16 on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter - - on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet 19 20 Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). Don't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14, the smaller of: The loss on line 16; or ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. } 21 22 Do you have qualified dividends on Form 1040, line 3a, or Form 1040NR, line 10b? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). No. Complete the rest of Form 1040 or Form 1040NR. Schedule D (Form 1040) 2018 Internal Revenue Service (99 SCHEDULE SE OMB No. 1545-0074 (Form 1040) Self-Employment Tax 2018 Department of the Treasury Go to www.irs.gov/ScheduleSE for instructions and the latest information Attachment Attach to Form 1040 or Form 1040NR. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040 or Form 104ONR) Social security number of person with self-employment income Before you begin: To determine if you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2018? No Yes Yes Are you a minister, member of a religious order, or Christian Science practitioner who received IRS approval not to be taxed Yes on earnings from these sources, but you owe self-employment tax on other earnings? Was the total of your wages and tips subject to social security or railroad retirement tier 1) tax plus your net earnings from self-employment more than $128.400? No No Are you using one of the optional methods to figure your net Yes earnings (see instructions)? Did you receive tips subject to social security or Medicare tax Yes that you didn't report to your employer? No No No Did you report any wages on Form 8919. Uncollected Social Yes Security and Medicare Tax on Wages? Did you receive church employee income (see instructions) Yes reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedule SE on page 2 1a 1b 2 3 4 Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 2 Net profit or loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code 31. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. 3 Combine lines 1a, 1b, and 2 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax, don't file this schedule unless you have an amount on line 1b. Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. If the amount on line 4 is: $128,400 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921.60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z 4 5 6 lol 6 Schedule SE (Form 1040) 2018 Page 2 1a 2 4a 4c 5a 5b 7 Schedule SE (Form 1040) 2018 Attachment Sequence No. 17 Name of person with self-employment income (as shown on Form 1040 or Form 1040NR) Social security number of person with self-employment income Section B-Long Schedule SE Parti Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions. Also see instructions for the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. Note: Skip lines 1a and 1b if you use the farm optional method (see instructions) b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code 31. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. Note: Skip this line if you use the nonfarm optional method (see instructions). 3 Combine lines 1a, 1b, and 2. 3 4a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b c Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -O- and continue 5a Enter your church employee income from Form W-2. See instructions for definition of church employee income b Multiply line 5a by 92.35% (0.9235). If less than $100, enter-O- 6 Add lines 4c and 5b 6 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2018 7 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $128,400 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax (from Form 4137, line 10) 8b c Wages subject to social security tax (from Form 8919, line 10) 8c d Add lines 8a, 8b, and 8c.. Subtract line 8d from line 7. If zero or less, enter-O- here and on line 10 and go to line 11 9 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124) 10 Multiply line 6 by 2.9% (0.029). 11 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 12 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 | 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income' wasn't more than $7,920, or (b) your net farm profits were less than $5,717. 14 Maximum income for optional methods. 14 15 Enter the smaller of two-thirds (/) of gross farm income' (not less than zero) or $5,280. Also include this amount on line 4b above. Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $5,717 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14. 17 Enter the smaller of: two-thirds (/) of gross nonfarm income (not less than zero) or the amount on line 16. Also include this amount on line 4b above. From Sch. F, line 9, and Sch. K-1 Form 1065), box 14. code B. From Sch. C, line 31; Sch. C-EZ line 3; Sch. K-1 (Form 1065), bax 14, code 2 From Sch. F. line 34, and Sch. K-1 (Form 1065), box 14, code A-minus the A: and Sch. K-1 (Form 1065-B), box 9, code J1. amount you would have entered on line 1b had you not used the optional * From Sch. C, line 7: Sch. C-EZ, line 1: Sch. K-1 (Form 1065), box 14. code C: and Sch. K-1 (Form 1065-B), box 9, code J2. Schedule SE (Form 1040) 2018 8 8d 9 11 12 15 16 17 method SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/Schedule for instructions and the latest information. 2018 Department of the Treasury Attach to Form 1040. Internal Revenue Service (9) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the Instructions for line 16. Sequence No. 07 Name(s) shown on Form 1040 Your social security number Attachment 1 Medical and Dental Expenses 3 Taxes You Paid Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions) 2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075) 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -O- 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) 5b c State and local personal property taxes d Add lines 5a through 5c. 5d e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) 5e 6 Other taxes. List type and amount 5a 5c 6 9 7 Add lines 5e and 6 Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid home mortgage loan(s) to buy, build, or improve your home, Caution: Your see instructions and check this box. mortgage interest deduction may be a Home mortgage interest and points reported to you on Form limited see instructions 1098 8a b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 8b C Points not reported to you on Form 1098. See instructions for special rules 8c d Reserved 8d e Add lines Ba through 8c 8e 9 Investment interest. Attach Form 4952 if required. See instructions 10 Add lines 8e and 9 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions 11 12 Other than by cash or check. If any gift of $250 or more, see If you made a 12 gift and got a instructions. You must attach Form 8283 if over $500 benefit for it, 13 Carryover from prior year 13 14 Add lines 11 through 13 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions Other 16 Other from list in instructions. List type and amount Itemized Deductions Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040, line 8 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check here For Paperwork Reduction Act Notice, see the Instructions for Form 1040. 10 see instructions 14 15 16 17 Cat. No. 17145C Schedule A (Form 1040 2018 OMB No. 1545-0074 SCHEDULE B (Form 1040) Interest and Ordinary Dividends Go to www.irs.gov/Schedule for instructions and the latest information. 2018 Department of the Treasury Internal Revenue Service) Name(s) shown on return Attach to Form 1040. Attachment Sequence No. 08 Your social security number 1 3 4 Part 1 1 List name of payer. If any interest is from a seller-financed mortgage and the Amount buyer used the property as a personal residence, see the instructions and list this Interest interest first. Also, show that buyer's social security number and address (See Instructions and the instructions for Form 1040 line 2b.) Note: If you received a Form 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, list the firm's name as the payer and enter the total interest shown on that form. 2 Add the amounts on line 1 2 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815 4 Subtract line 3 from line 2. Enter the result here and on Form 1040, line 2b Note: If line 4 is over $1,500, you must complete Part III. Amount Part II 5 List name of payer Ordinary Dividends (See instructions and the instructions for Form 1040, line 3b.) 5 Note: If you received a Form 1099-DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown 6 Add the amounts on line 5. Enter the total here and on Form 1040, line 3b on that form. Note: If line 6 is over $1,500, you must complete Part III. Part III You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a es No foreign account; or (c) received a distribution from, or were a grantor of, or a transferorto, a foreign trust. Foreign 7a At any time during 2018, did you have a financial interest in or signature authority over a financial Accounts account (such as a bank account, securities account, or brokerage account) located in a foreign and Trusts country? See instructions ... If "Yes," are you required to file FinCEN Form 114, Report of Foreign Bank and Financial (See instructions.) Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its instructions for filing requirements and exceptions to those requirements b If you are required to file FinCEN Form 114, enter the name of the foreign country where the financial account is located 8 During 2018, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If "Yes," you may have to file Form 3520. See instructions. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 17146N Schedule B (Form 1040) 2018 6 OMB No. 1545-0074 SCHEDULE C-EZ (Form 1040) Department of the Treasury Internal Revenue Service) Name of proprietor Net Profit From Business (Sole Proprietorship) Partnerships, joint ventures, etc., generally must file Form 1065. Attach to Form 1040, 1040NR, or 1041. See instructions on page 2. 2018 Attachment Sequence No. 09A Social security number (SSN) Part 1 General Information You may use Schedule C-EZ instead of Schedule C only if you: And you: . Had business expenses of $5,000 or less, Use the cash method of accounting, Did not have an inventory at any time during the year. Did not have a net loss from your business, Had only one business as either a sole proprietor, qualified joint venture, or statutory employee, .Had no employees during the year, Do not deduct expenses for business use of your home, Do not have prior year unallowed passive activity losses from this business, and Are not required to file Form 4562 Depreciation and Amortization, for this business. See the instructions for Schedule C, line 13, to find out if you must file. A Principal business or profession, including product or service B Enter business code (see page 2) C Business name. If no separate business name, leave blank. D Enter your EIN (see page 2) E Business address (including suite or room no.). Address not required if same as on page 1 of your tax return City, town or post office, state, and ZIP code Yes Yes No No F Did you make any payments in 2018 that would require you to file Form(s) 1099? (see the Instructions for Schedule C) G If "Yes," did you or will you file required Forms 1099?. Part II Figure Your Net Profit 1 Gross receipts. Caution: If this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked, see Statutory employees in the instructions for Schedule C, line 1, and check here 1 2 2 3 4 5 Total expenses (see page 2). If more than $5,000, you must use Schedule C Net profit. Subtract line 2 from line 1. If less than zero, you must use Schedule C. Enter on both Schedule 1 (Form 1040), line 12, and Schedule SE, line 2, or on Form 1040NR, line 13, and Schedule SE, line 2 (see page 2). (Statutory employees do not report this amount on Schedule SE, line 2.) Estates and trusts, enter on Form 1041, line 3... Part III Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 2. When did you place your vehicle in service for business purposes? (month, day, year) Of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for a Business b Commuting (see page 2) Was your vehicle available for personal use during off-duty hours? Yes Do you (or your spouse) have another vehicle available for personal use? 8a Do you have evidence to support your deduction? b If "Yes," is the evidence written? Yes No For Paperwork Reduction Act Notice, see the separate instructions for Schedule C (Form 1040). Schedule C-EZ (Form 1040) 2018 c Other 6 No 7 Yes No Yes No Cat. No. 14374D Schedule C-EZ (Form 1040) 2018 Page 2 Instructions Future developments. For the latest information about developments related to Schedule C-EZ (Form 1040) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/ScheduleCEZ Before you begin, see General Instructions in the 2018 Instructions for Schedule C. CAUTION You can use Schedule C-EZ instead of Schedule Cif: You operated a business or practiced a profession as a sole proprietorship or qualified joint venture, or you were a statutory employee, and . You have met all the requirements listed in Schedule C-EZ, Part I. For more information on electing to be taxed as a qualified joint venture (including the possible social security benefits of this election), see Qualified Joint Venture in the Instructions for Schedule C. You can also go to www.irs.gov/QJV. Line A Describe the business or professional activity that provided your principal source of income reported on line 1. Give the general field or activity and the type of product or service. Line B Enter the six-digit code that identifies your principal business or professional activity. See the Instructions for Schedule C for the list of codes Line D Enter on line D the employer identification number (EIN) that was issued to you and in your name as a sole proprietor. If you are filing Form 1041, enter the EIN issued to the estate or trust. Do not enter your SSN. Do not enter another taxpayer's EIN (for example, from any Forms 1099-MISC that you received). If you do not have an EIN, leave line D blank. You need an EIN only if you have a qualified retirement plan or are required to file an employment, excise, alcohol, tobacco, or firearms tax return, are a payer of gambling winnings, or are filing Form 1041 for an estate or trust. If you need an EIN, see the Instructions for Form SS-4. Single-member LLCs. If you are the sole owner of an LLC that is not treated as a separate entity for federal income tax purposes, enter on line D the EIN that was issued to the LLC (in the LLC's legal name) for a qualified retirement plan, to file employment, excise, alcohol, tobacco, or firearms returns, or as a payer of gambling winnings. If you do not have such an EIN, leave line D blank. Line E Enter your business address. Show a street address instead of a box number. Include the suite or room number, if any. Line F See the instructions for Schedule C, line I, to help determine if you are required to file any Forms 1099. Line 1 Enter gross receipts from your trade or business. Include amounts you received in your trade or business that were properly shown on Form 1099-MISC. If the total amounts that were reported in box 7 of Forms 1099-MISC are more than the total you are reporting on line 1, attach a statement explaining the difference. You must show all items of taxable income actually or constructively received during the year (in cash, property, or services). Income is constructively received when it is credited to your account or set aside for you to use. Don't offset this amount by any losses. Line 2 Enter the total amount of all deductible business expenses you actually paid during the year. Examples of these expenses include advertising, car and truck expenses, commissions and fees, insurance, interest, legal and professional services, office expenses, rent or lease expenses, repairs and maintenance, supplies, taxes, travel, the allowable percentage of business meals and entertainment, and utilities (including telephone). For details, see the instructions for Schedule C, Parts II and V. You can use the optional worksheet below to record your expenses. Enter on lines b through f the type and amount of expenses not included on line a. If you claim car or truck expenses, be sure to complete Schedule C-E, Part III. Line 3 Nonresident aliens using Form 1040NR should also enter the total on Schedule SE, line 2, if you are covered under the U.S. social security system due to an international social security agreement currently in effect. See the Instructions for Schedule SE for information on international social security agreements. Line 5b Generally, commuting is travel between your home and a work location. If you converted your vehicle during the year from personal to business use (or vice versa), enter your commuting miles only for the period you drove your vehicle for business. For information on certain travel that is considered a business expense rather than commuting, see the instructions for Schedule C, line 44b. Optional Worksheet for Line 2 (keep a copy for your records) a Deductible meals (see the instructions for Schedule C, line 24b) a b b d d e f f g Total. Add lines a through f. Enter here and on line 2 g Schedule C-EZ (Form 1040) 2018 OMB No. 1545-0074 SCHEDULED (Form 1040) Capital Gains and Losses Attach to Form 1040 or Form 1040NR. Go to www.irs.gov/Scheduled for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. 2018 Department of the Treasury Internal Revenue Service (99) Names) shown on return Attachment Sequence No. 12 Your social security number Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the la) (h) Gain or loss) lines below. (d) Adjustments Subtract column (e) Proceeds Cost to gain or loss from from column (d) and This form may be easier to complete if you round off cents to (sales price) (or other basis) Formis) 8949, Part 1, combine the result whole dollars. line 2 column (g) with columna 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 16 Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked on Cost 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part Il below. Otherwise, go to Part III on the back 7 Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the (g) (h) Gain or loss) lines below. (d) Adjustments Subtract column (e) Proceeds This form may be easier to complete if you round off cents to to gain or loss from from column (d) and (sales price) (or other basis) Formis) 8949, Part II, combine the result whole dollars. line 2 columni) with column(a) 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked.. 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 12 Net long-term gain or loss) from partnerships, Scorporations, estates, and trusts from Schedule(s) K-1 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or loss). Combine lines 8a through 14 in column (h). Then go to Part Ill on the back. 15 For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040) 2018 11 12 Cat. No. 11338H Page 2 Schedule D (Form 1040) 2018 Part III Summary 16 Combine lines 7 and 15 and enter the result 16 If line 16 is a gain, enter the amount from line 16 on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter - - on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet 19 20 Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). Don't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14, the smaller of: The loss on line 16; or ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. } 21 22 Do you have qualified dividends on Form 1040, line 3a, or Form 1040NR, line 10b? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). No. Complete the rest of Form 1040 or Form 1040NR. Schedule D (Form 1040) 2018 Internal Revenue Service (99 SCHEDULE SE OMB No. 1545-0074 (Form 1040) Self-Employment Tax 2018 Department of the Treasury Go to www.irs.gov/ScheduleSE for instructions and the latest information Attachment Attach to Form 1040 or Form 1040NR. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040 or Form 104ONR) Social security number of person with self-employment income Before you begin: To determine if you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2018? No Yes Yes Are you a minister, member of a religious order, or Christian Science practitioner who received IRS approval not to be taxed Yes on earnings from these sources, but you owe self-employment tax on other earnings? Was the total of your wages and tips subject to social security or railroad retirement tier 1) tax plus your net earnings from self-employment more than $128.400? No No Are you using one of the optional methods to figure your net Yes earnings (see instructions)? Did you receive tips subject to social security or Medicare tax Yes that you didn't report to your employer? No No No Did you report any wages on Form 8919. Uncollected Social Yes Security and Medicare Tax on Wages? Did you receive church employee income (see instructions) Yes reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedule SE on page 2 1a 1b 2 3 4 Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 2 Net profit or loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code 31. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. 3 Combine lines 1a, 1b, and 2 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax, don't file this schedule unless you have an amount on line 1b. Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. If the amount on line 4 is: $128,400 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921.60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z 4 5 6 lol 6 Schedule SE (Form 1040) 2018 Page 2 1a 2 4a 4c 5a 5b 7 Schedule SE (Form 1040) 2018 Attachment Sequence No. 17 Name of person with self-employment income (as shown on Form 1040 or Form 1040NR) Social security number of person with self-employment income Section B-Long Schedule SE Parti Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions. Also see instructions for the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. Note: Skip lines 1a and 1b if you use the farm optional method (see instructions) b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code 31. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. Note: Skip this line if you use the nonfarm optional method (see instructions). 3 Combine lines 1a, 1b, and 2. 3 4a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b c Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -O- and continue 5a Enter your church employee income from Form W-2. See instructions for definition of church employee income b Multiply line 5a by 92.35% (0.9235). If less than $100, enter-O- 6 Add lines 4c and 5b 6 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2018 7 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $128,400 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax (from Form 4137, line 10) 8b c Wages subject to social security tax (from Form 8919, line 10) 8c d Add lines 8a, 8b, and 8c.. Subtract line 8d from line 7. If zero or less, enter-O- here and on line 10 and go to line 11 9 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124) 10 Multiply line 6 by 2.9% (0.029). 11 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 12 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 | 13 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income' wasn't more than $7,920, or (b) your net farm profits were less than $5,717. 14 Maximum income for optional methods. 14 15 Enter the smaller of two-thirds (/) of gross farm income' (not less than zero) or $5,280. Also include this amount on line 4b above. Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $5,717 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14. 17 Enter the smaller of: two-thirds (/) of gross nonfarm income (not less than zero) or the amount on line 16. Also include this amount on line 4b above. From Sch. F, line 9, and Sch. K-1 Form 1065), box 14. code B. From Sch. C, line 31; Sch. C-EZ line 3; Sch. K-1 (Form 1065), bax 14, code 2 From Sch. F. line 34, and Sch. K-1 (Form 1065), box 14, code A-minus the A: and Sch. K-1 (Form 1065-B), box 9, code J1. amount you would have entered on line 1b had you not used the optional * From Sch. C, line 7: Sch. C-EZ, line 1: Sch. K-1 (Form 1065), box 14. code C: and Sch. K-1 (Form 1065-B), box 9, code J2. Schedule SE (Form 1040) 2018 8 8d 9 11 12 15 16 17 method