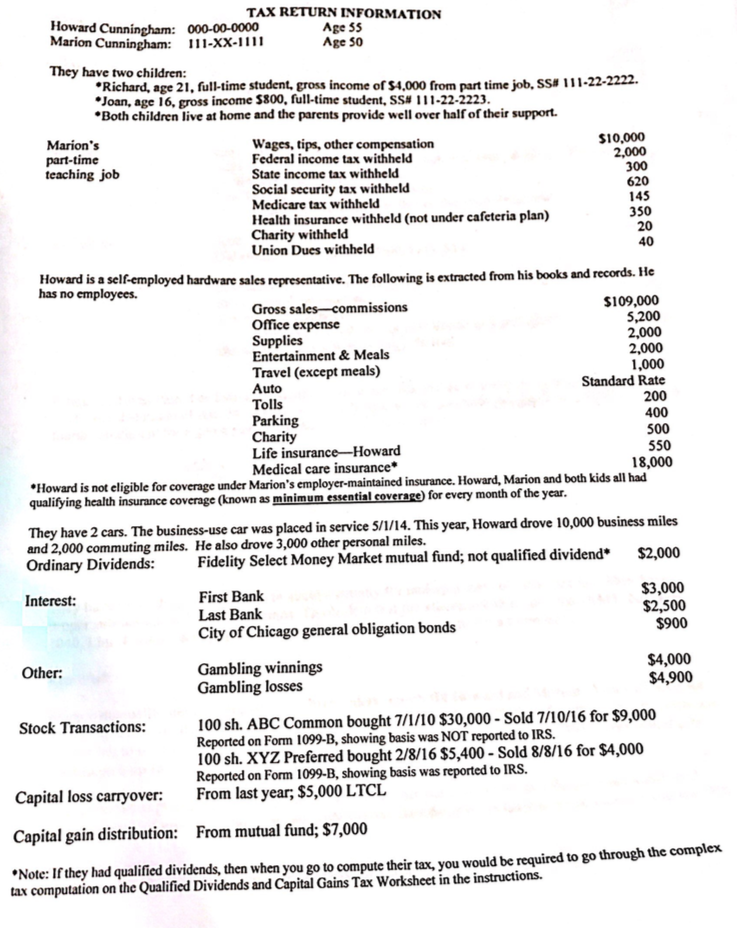

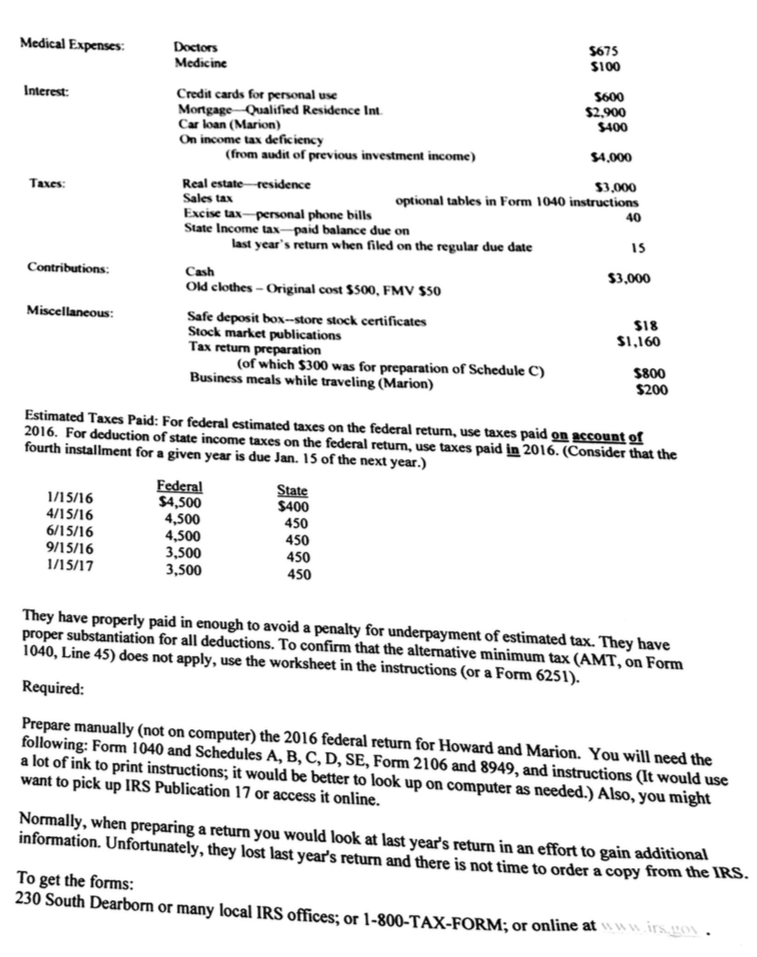

TAX RETURN INFORMATION Howard cunningham: 000.00-0000 Age 55 Marion Cunningham 111-XX-1111 Age 50 They have two children: ssa 111-22-2222. .Richard, 21. fulltime student, gross income ofs4.000 from part time job. "Joan, age 16, gross income S800, full-time student, SSa 111-22-2223. "Both children live at home and the parents provide well over half of their support. $10,000 wages, tips, other compensation Marion's Federal income tax withheld part-time 300 State income tax withheld teaching job 6200 Social security tax withheld 145 Medicare tax withheld Health insurance withheld (not under cafeteria plan) 350 20 Charity withheld 40 Union Dues withheld Howard is a self employed hardware sales representative. The following is extracted from his books and records. H has no employees. $109,000 Gross sales-commissions 5,200 Office expense 2.000 Supplies 2,000 Entertainment & Meals 1.000 Travel (except meals) Standard Rate Auto 200 Tolls 400 Parking 500 Charity 550 Life insurance-Howard Medical care insurance 18,000 .Howard is not eligible for coverage under Marion's employer-maintained insurance. Howard, Marion and both kidsall had qualifying health insurance coverage (known as minimum essentialsoverage for every month of the year They have 2 cars. The business-use car was placed in service SII/i4. This year, Howard drove 10,000 business miles 2,000 commuting miles. 3,000 other personal miles. qualified dividend $2,000 Ordinary Dividends: Fidelity Select Money Market mutual fund, not $3,000 First Bank Interest: $2,500 Last Bank. $900 City of Chicago general obligation bonds $4,000 Gambling winnings Other: $4900 Gambling losses 100 sh. ABC common bought 7II/10 $30,000 Sold 7/10/16 for s9,000 Stock Transactions: Reported on Form 1099-B, showing basis wasNOT reported to IRS. Preferred bought 8/8/16 for SA,000 Reported on Form basis was reported to IRS. Capital loss carryover: From last years $5,000 LTCL Capital gain distribution: From mutual fund, $7,000 .Note: If they had qualined dividends, then when you go to compute their tax, you would be required to go through the complex tax computation on the Qualified Dividends and Capital Gains Tax Worksheet in the instructions