Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax Return Problem 2. Dave (SSN: 412-34-5670) and Alexis (SSN: 412-34-5671) Stanley are married and retired at age 51. The couple's income consists of

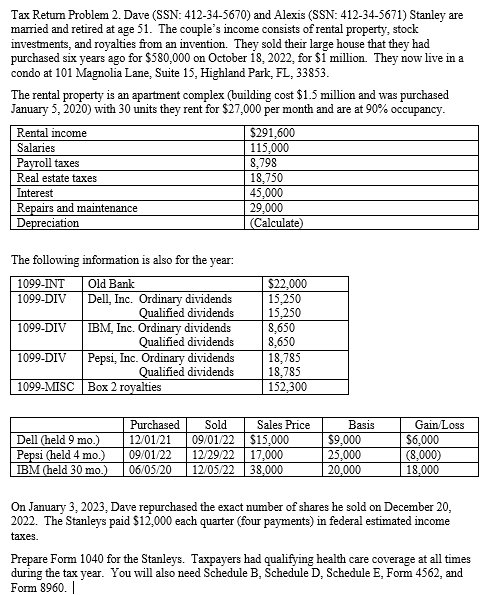

Tax Return Problem 2. Dave (SSN: 412-34-5670) and Alexis (SSN: 412-34-5671) Stanley are married and retired at age 51. The couple's income consists of rental property, stock investments, and royalties from an invention. They sold their large house that they had purchased six years ago for $580,000 on October 18, 2022, for $1 million. They now live in a condo at 101 Magnolia Lane, Suite 15, Highland Park, FL, 33853. The rental property is an apartment complex (building cost $1.5 million and was purchased January 5, 2020) with 30 units they rent for $27,000 per month and are at 90% occupancy. Rental income Salaries Payroll taxes Real estate taxes Interest Repairs and maintenance Depreciation The following information is also for the year: $291,600 115,000 8,798 18,750 45,000 29,000 (Calculate) 1099-INT Old Bank $22,000 1099-DIV Dell, Inc. Ordinary dividends 15,250 Qualified dividends 15,250 1099-DIV IBM, Inc. Ordinary dividends 8,650 Qualified dividends 8,650 1099-DIV Pepsi, Inc. Ordinary dividends 18,785 Qualified dividends 18,785 1099-MISC Box 2 royalties 152,300 Dell (held 9 mo.) Purchased 12/01/21 09/01/22 Sold Sales Price Basis Gain/Loss $15,000 $9,000 $6,000 Pepsi (held 4 mo.) 09/01/22 12/29/22 17,000 25,000 (8,000) IBM (held 30 mo.) 06/05/20 12/05/22 38,000 20,000 18,000 On January 3, 2023, Dave repurchased the exact number of shares he sold on December 20, 2022. The Stanleys paid $12,000 each quarter (four payments) in federal estimated income taxes. Prepare Form 1040 for the Stanleys. Taxpayers had qualifying health care coverage at all times during the tax year. You will also need Schedule B, Schedule D, Schedule E, Form 4562, and Form 8960. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started