Tax Return Project Spring 2020

Instructions:

Please complete the 2018 federal income tax return for Carlos and Maria Gomez.Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040.If required information is missing, use reasonable assumptions to fill in the gaps.

Carlos and Maria Gomez live in Lubbock, Texas.The Gomezes have two children: Luis (age 14) and Amanda (age 12).Both children qualify as federal income tax dependents of Carlos and Maria.The Gomezes provided the following information:

Luis's social security number is 589-24-8432

Amanda's social security number is 599-74-8733

The Gomez's current mailing address is 543 West La Patera, Lubbock, Texas 79401

Carlos is a civil engineer.For the first two months of the year, he was employed by West Texas Engineering (WTE).However, he resigned his position with WTE to start his own engineering firm called Gomez Professional Engineers (GPE).GPE is conducted as a sole proprietorship with Carlos being the sole owner.GPE started business on January 1, 2018 and is located at 1515 West Industrial Road 5Lubbock, Texas 79401 (EIN 20-1616167). Maria is self-employed as a part-time bookkeeper.

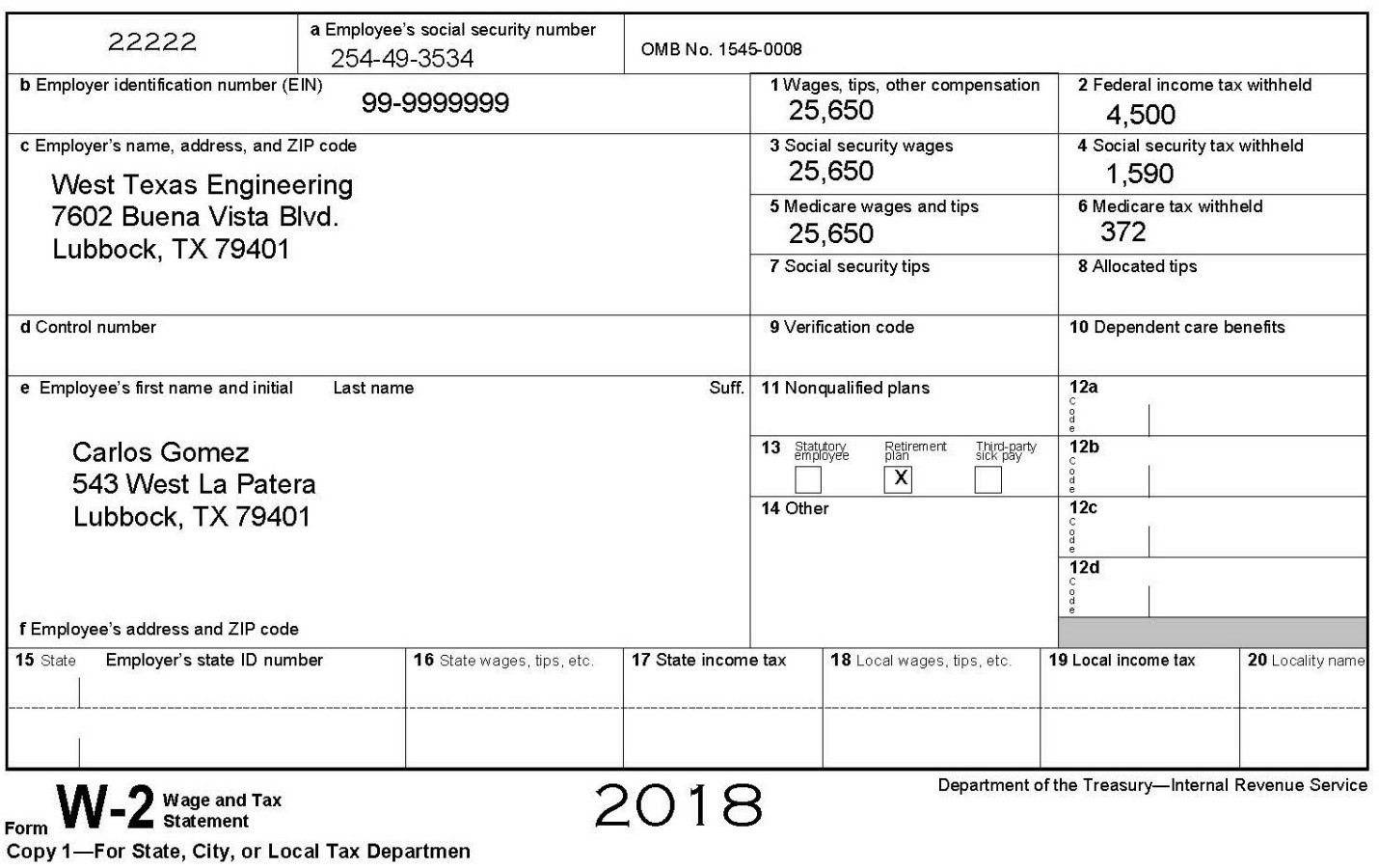

Carlos provided the following W-2 from WTE.

Carlos reported the following information for GPE's business activities (GPE uses the cash method of accounting):

Revenues:

Credit card receipts$352,000

Cash receipts 648,000

Total revenue $1,000,000

Expenses:

Advertising$5,450

Insurance-professional 15,750

Office building rent 62,000

Equipment leases 6,050

Travel14,200

Meals and entertainment 2,980

Wages498,725

Taxes and licenses44,875

Employee health insurance 42,000

Employee benefit programs 14,500

Utilities37,425

Office supplies 18,900

Legal and professional fees 15,550

Repairs and maintenance 10,000

Total Expenses$ 788,400

GPE purchased and placed in service the following fixed assets in 2018:

Item Date Purchased Amount

Laptop computers March 1 $20,500

Printers June 1 $6,500

Office furniture October 10 $19,000

GPE does not want to claim any Section 179 expensing on any of these assets, but would like to take bonus depreciation, if available, on all the assets.

Carlos worked part-time on GPE business activities until he finished his employment with WTE early in the year.Carlos worked full-time on GPE business activities for the rest of the year.

GPE filed Forms 1099 for payments made to contractors when required to do so. His business is not a specified service business for purposes of the Qualified Business Income Deduction.

Carlos and Maria paid $22,000 for health insurance for his family (for the time he was working at GPE).This amount is not included in the GPE expenses listed above.Neither Carlos nor Maria had access to employer-provided health insurance during the year while they were paying the premiums for this policy.The entire Gomez family was covered by minimum essential health insurance during each month in 2018.

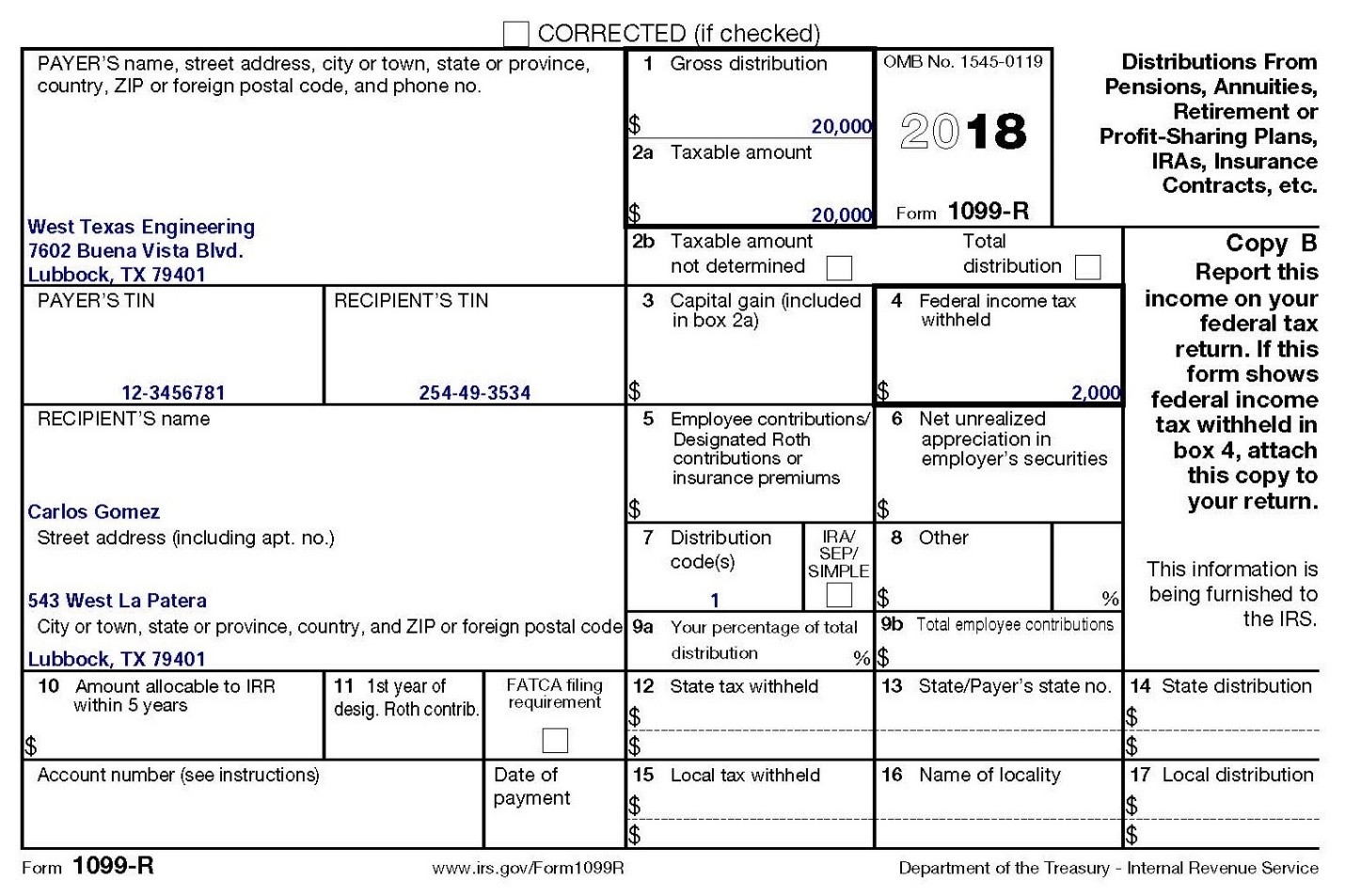

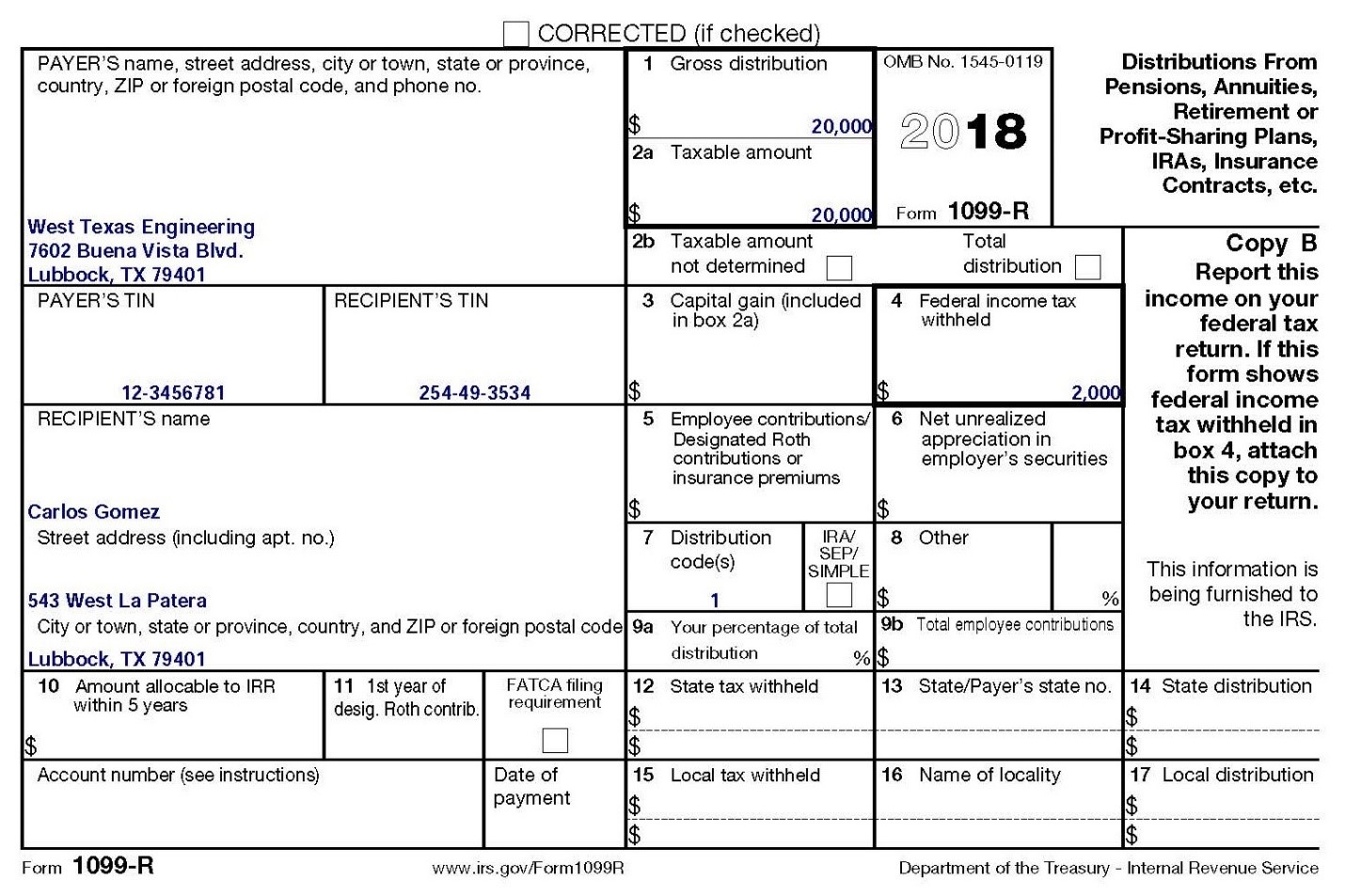

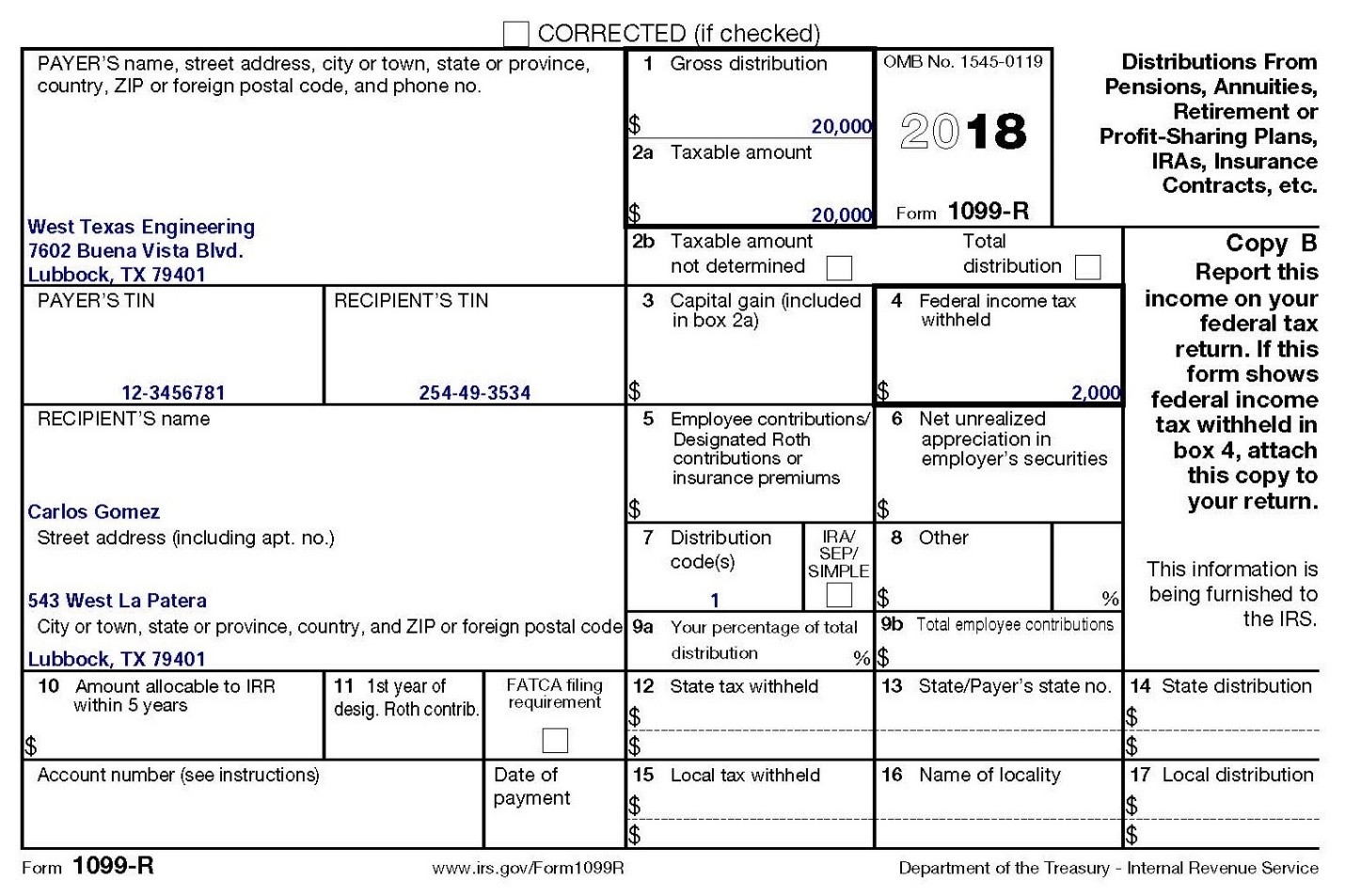

In need of cash, in February, Carlos withdrew $20,000 from his 401(k) account. He received the following Form 1099-R:

In addition, Carlos has established a SEP-IRA (self-employed retirement plan) using his business earnings from GPE.He would like to make the maximum deductible contributionto this plan for 2018.Assume that Carlos will file his tax return by April 15, 2019 and Carlos will contribute to his SEP IRA the full amount allowable by the date he files the return.

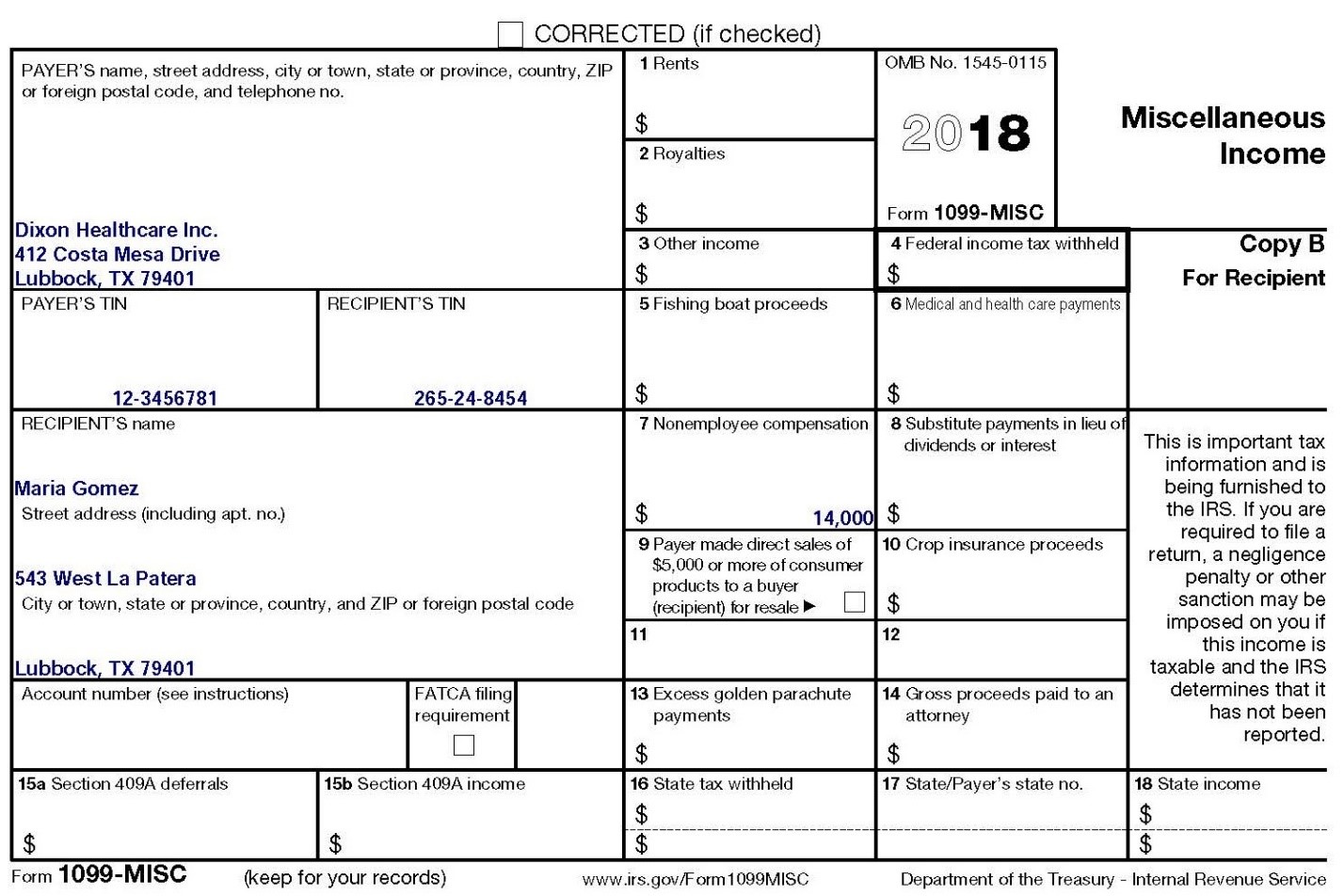

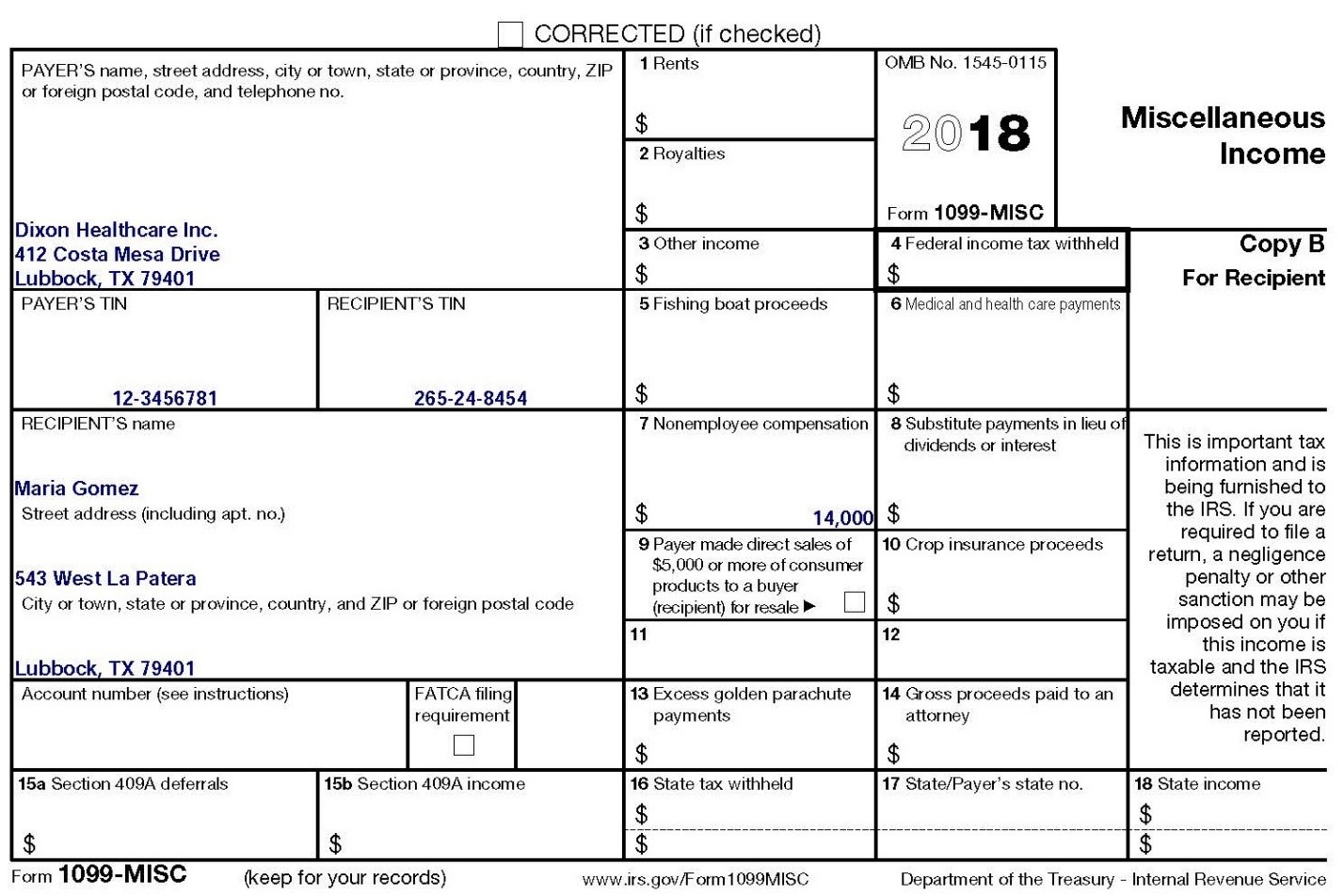

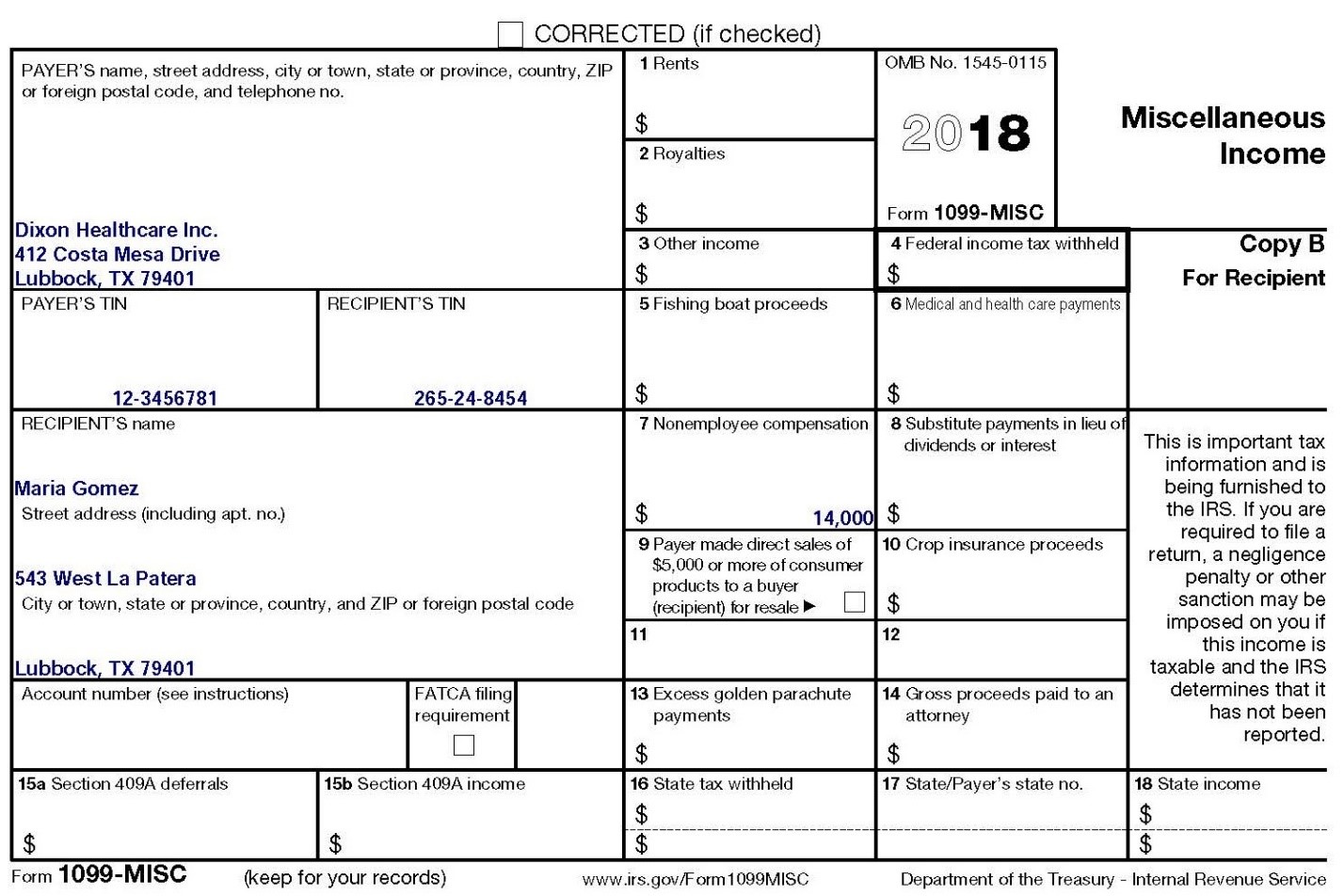

Maria received the following Form 1099-MISC from her bookkeeping activities for her largest client:

Maria received an additional $4,000 from clients who were not required to issue Maria a Form 1099-MISC.

During the year, Maria paid the following business-related expenses:

Paper$365

Toner$450

Meals$580

Maria purchased and placed in service the following fixed assets for her business in 2018:

Item Date Purchased Amount

New laptop computers March 1 $1,850

New laser printers March 1 $840

New computer software April 2 $400

Maria would like to recover the cost of these business assets as soon as possible through Section 179 expensing.

Maria owns a 2015 Acura.She started to use the Acura for her business on January 1, 2017.She drove 2,050 business miles during 2018 (she has documentation to verify).She drove the vehicle for a total of 10,000 miles during the year (7,950 personal miles). She also has access to another vehicle that she can use for personal purposes.

Maria started her bookkeeping service in 2015 and she uses the cash method of accounting.She is the only person performing services in the business.She did not make any payments that would have required her to file a Form 1099.

Maria's business is a specified service business for purposes of the Qualified Business Income Deduction.

On January 3, 2018, the Gomezes sold their prior principal residence.They purchased that residence on January 31, 2013 and had lived there full-time until they sold it this year.They originally purchased the home for $310,000.The Gomez family has never claimed any tax depreciation (nor were they allowed to) on the home.The sales price of the home was $405,000.The home is located at 45 East Entrada Trail, Lubbock Texas 79401.

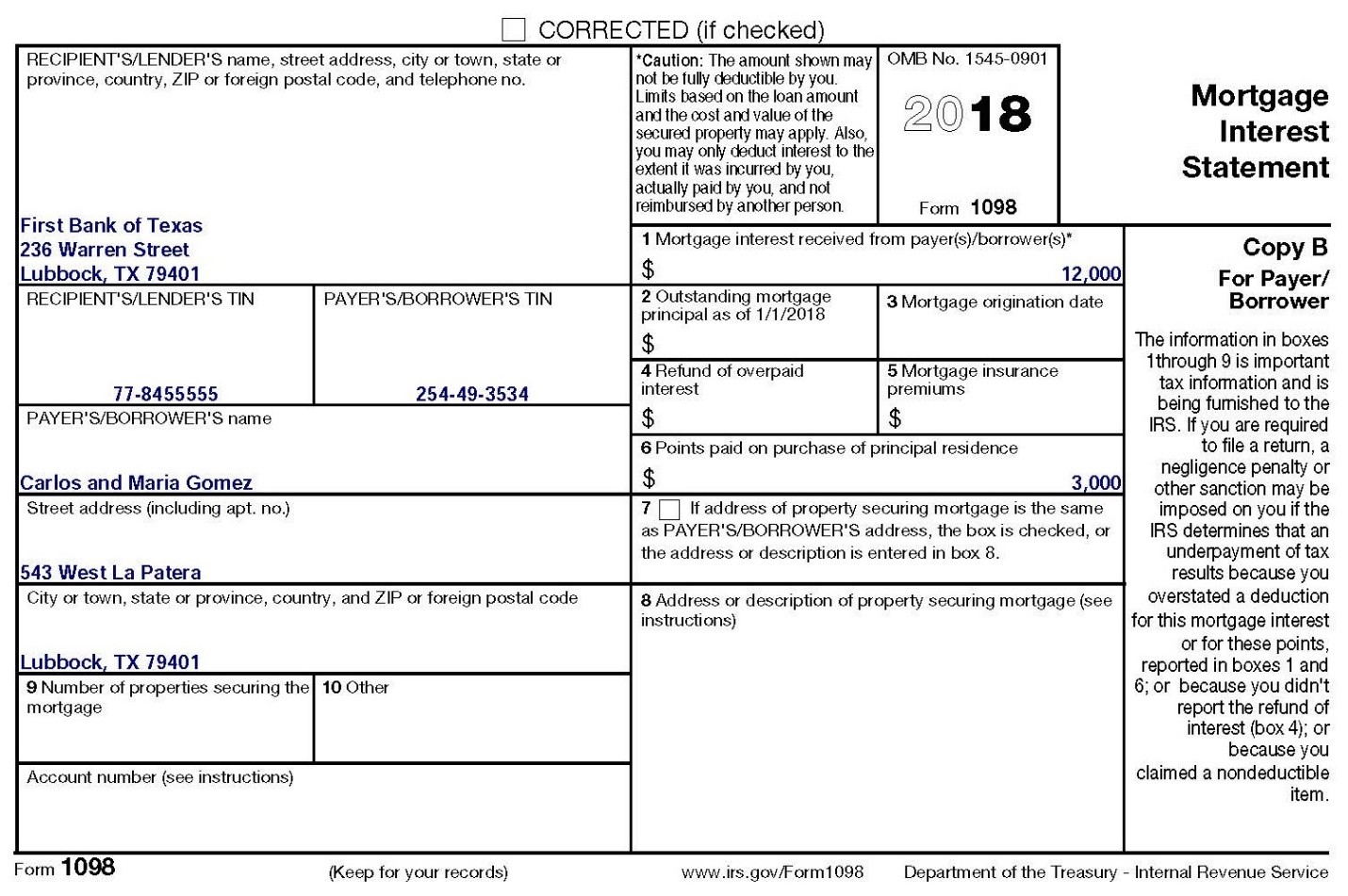

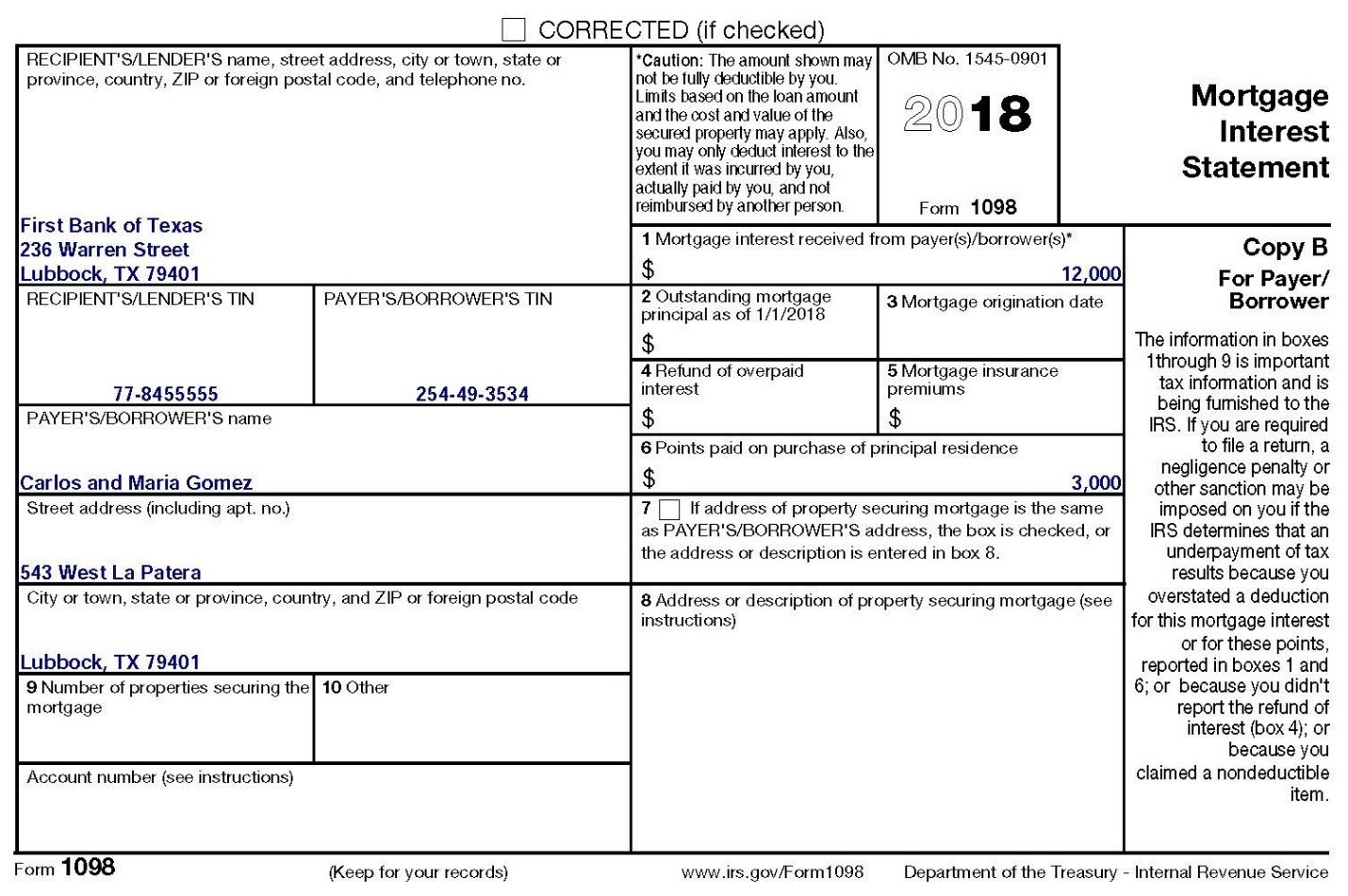

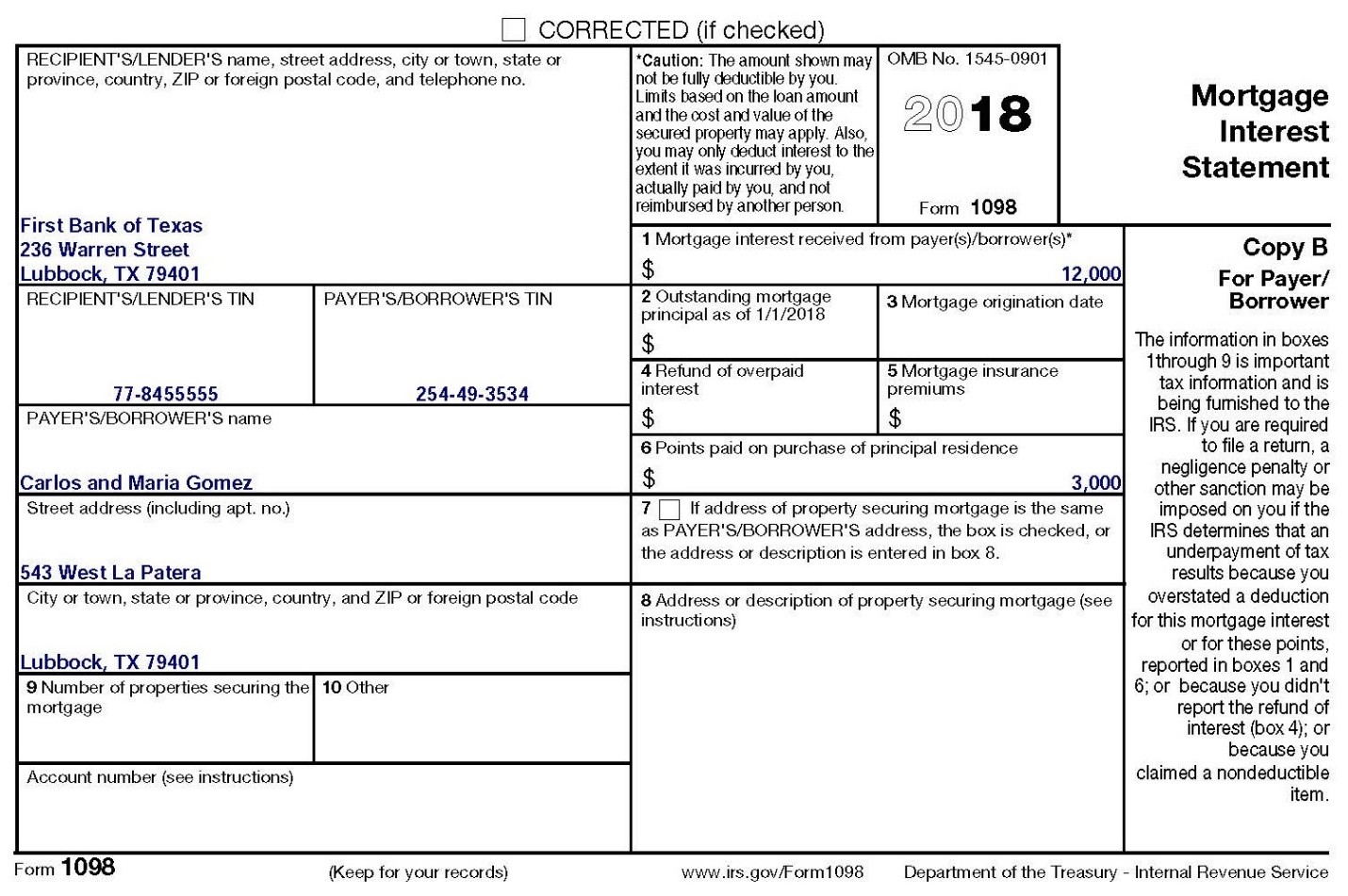

The Gomez family purchased (and moved into) their current residence at 543 West La Patera, Lubbock, Texas 79401 in late January of 2018.The La Patera residence is 2,000 square feet.The purchase price of the residence was $500,000 (building value was $350,000 and the lot value was $150,000).The mortgage on the purchase was $300,000.Expenses relating to the La Patera residence were as follows:

Property taxes $10,750

Utilities$3,000

Insurance$2,000

Maria utilized a room in the La Patera home for her bookkeeping business.The room was used exclusively on a regular basis as Maria's principal place of business.Maria wants to maximize her home office deduction related to this use.The room she uses is 200 square feet.

In the summer of 2018, the Gomez family rented out the La Patera residence to another family.The La Patera residence is situated along the ninth green of the famous Lubbock Country Club (LCC).The LCC hosted the U.S. Senior Open golf tournament this year.The Gomez family rented their residence to a golfer participating in the event for $1,200 per day for 10 days (the home office remained locked and off limits to the renters, however).During this time the Gomez family went on vacation touring the west coast of the United States.The Gomez family incurred $1,500 of cleaning and other expenses associated with the 10-day rental period.

Maria owns 20 acres of vacant ground within the city limits of Lubbock.Maria acquired the land as a gift from her parents on July 1, 2011.The land was valued at $4,000 per acre on the date of the gift.Her parents purchased the land in 1995 at a price of $500 per acre.Maria has held this land as an investment since she received it.On September 15, 2018 Maria exchanged this land with a development company that plans to develop the 20 acres (Maria and the development company are not related parties).In exchange for the 20 acres, Maria received a condominium in Lubbock that was valued at $160,000.The building was valued at $120,000 and the land was valued at $40,000.The condominium is located at 990 El Mar, Unit A, Lubbock Texas 79401. (Like-Kind Exchange)

Maria first rented out the El Mar unit on October 1, 2018.The revenue and expenses from the rental unit from October through December are as follows:

Rental revenue$3,600

HOA fee expense$300

Property taxes paid$225

Utilities expense$350

No Form(s) 1099 were required to be filed for this rental. Maria is not considered an active participant and the rental activity does not produce Qualified Business Income.

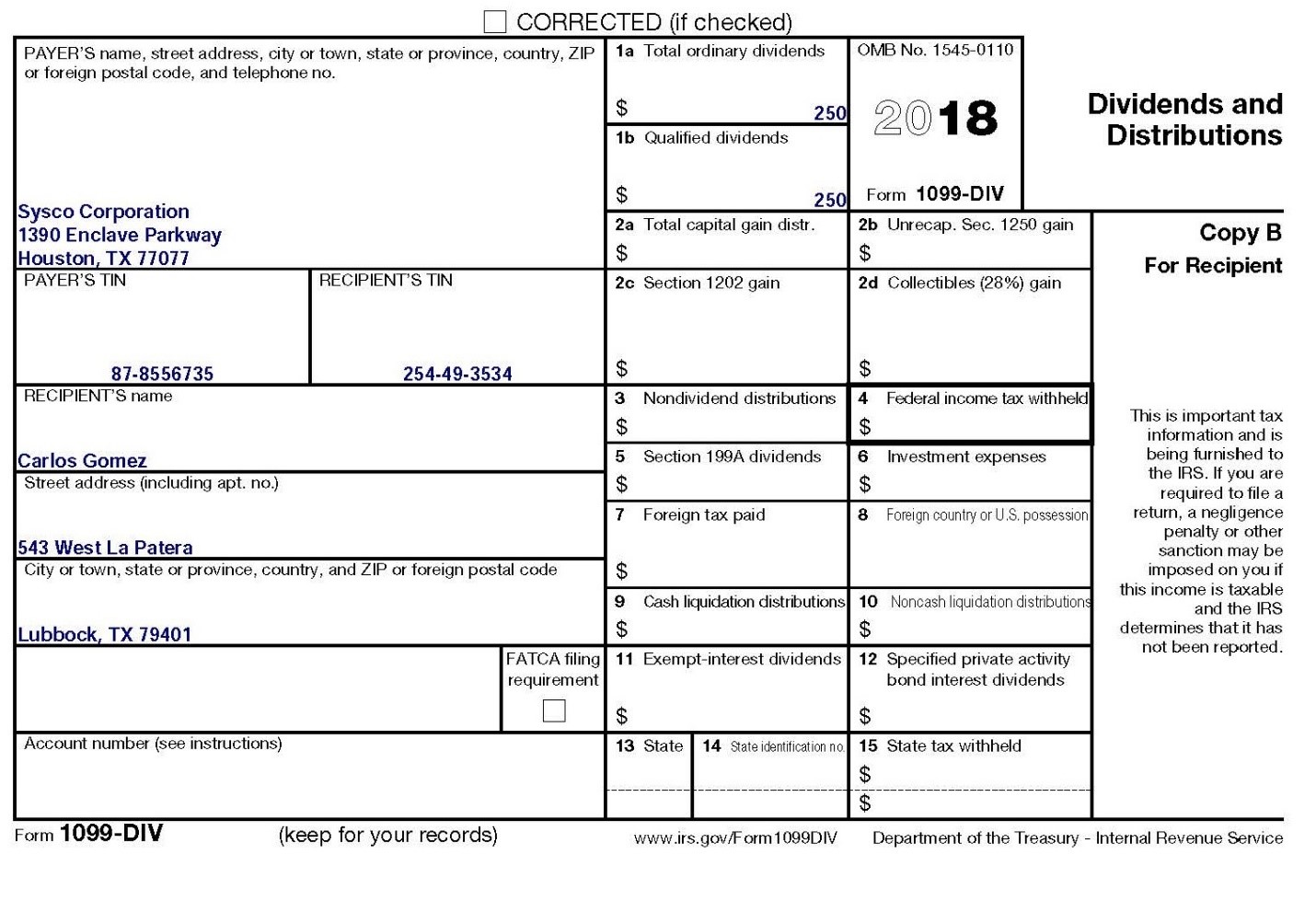

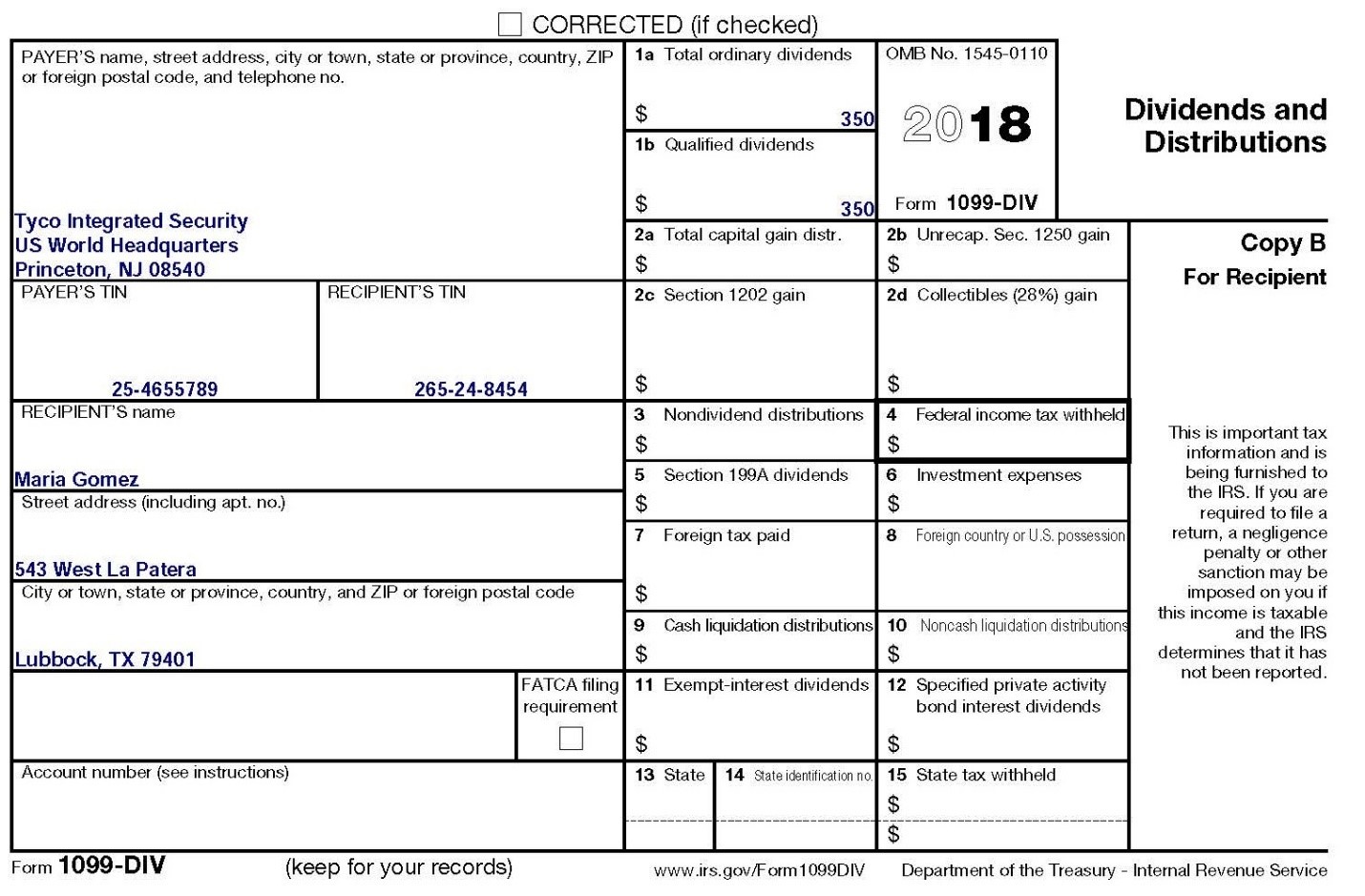

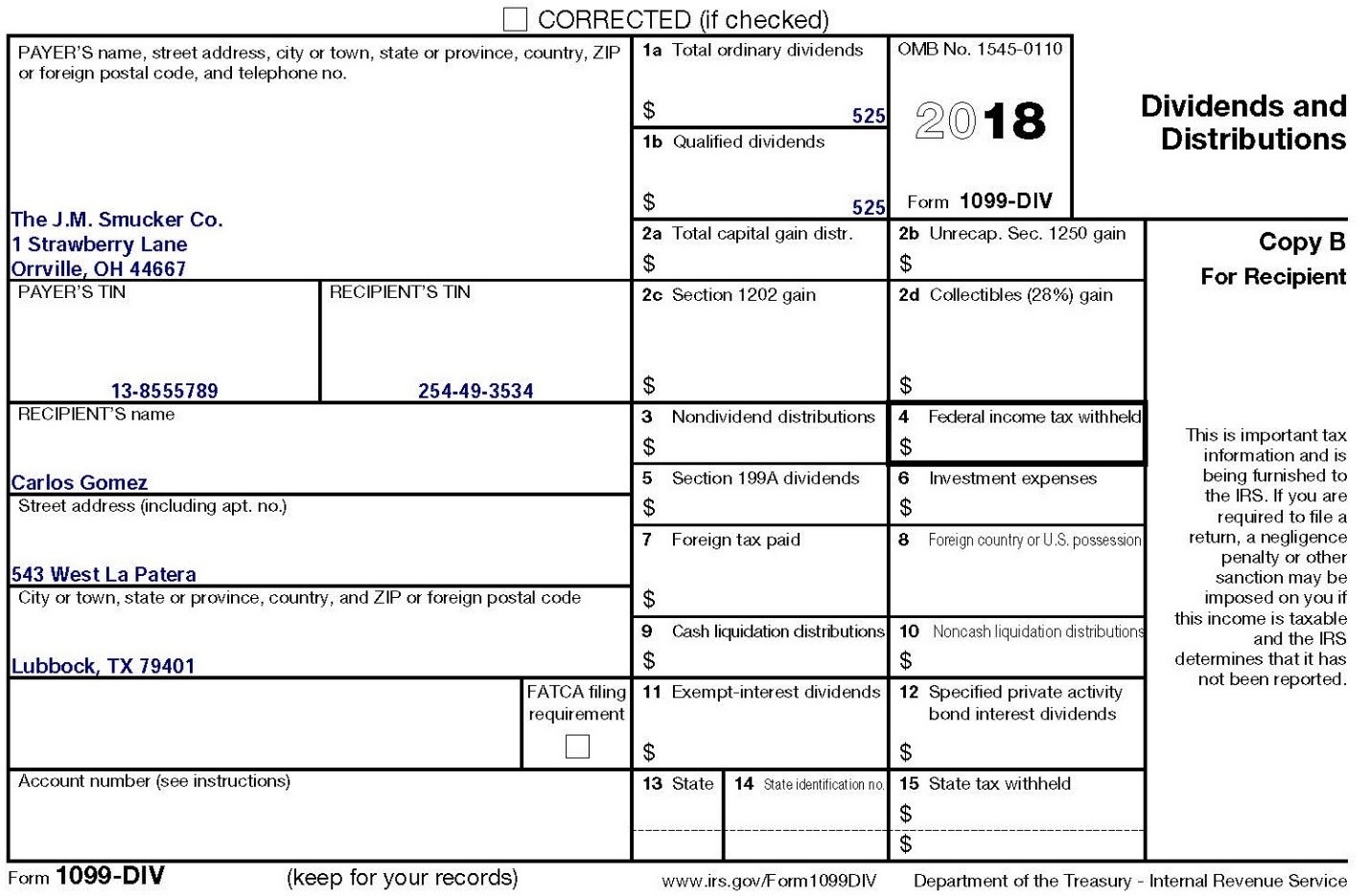

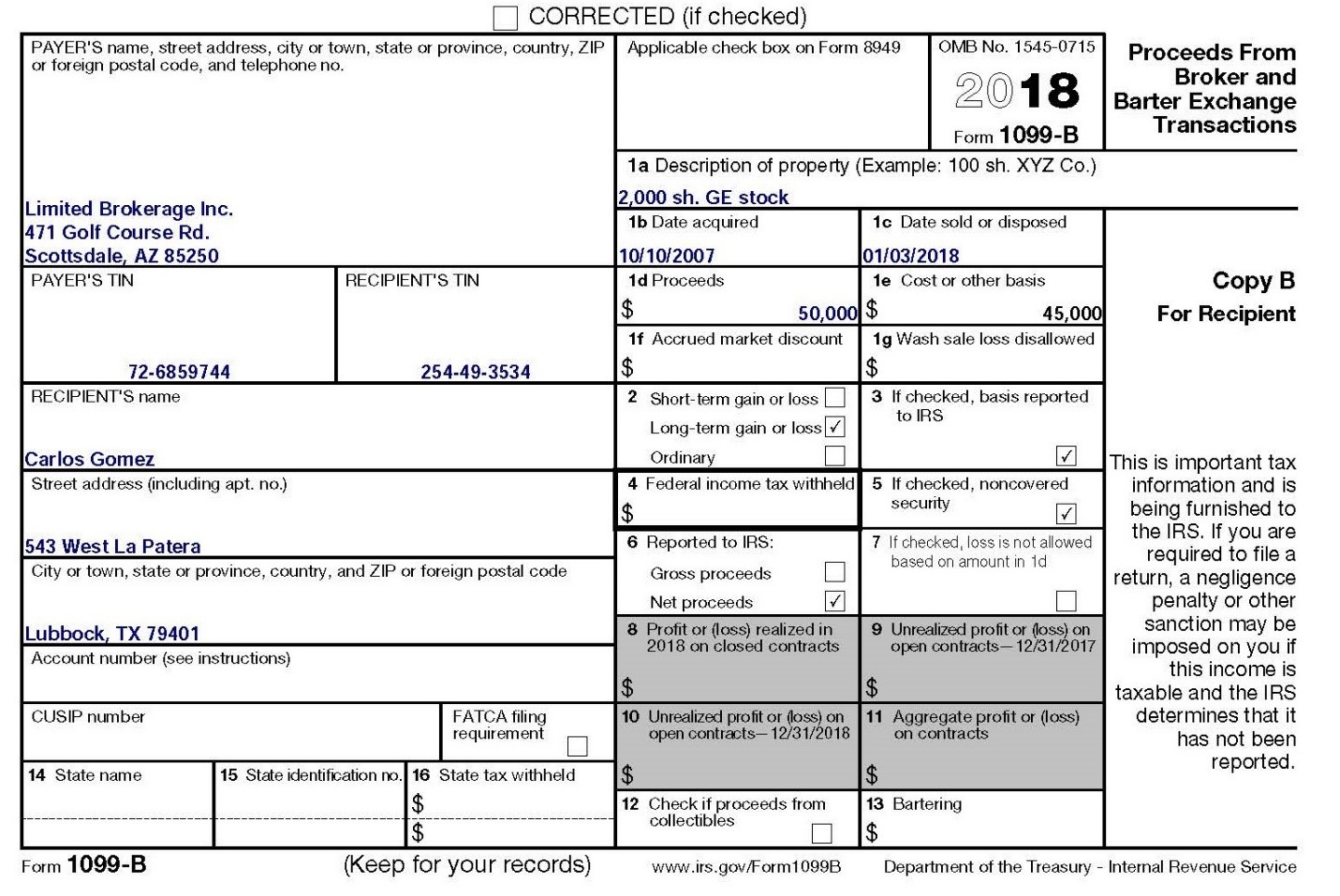

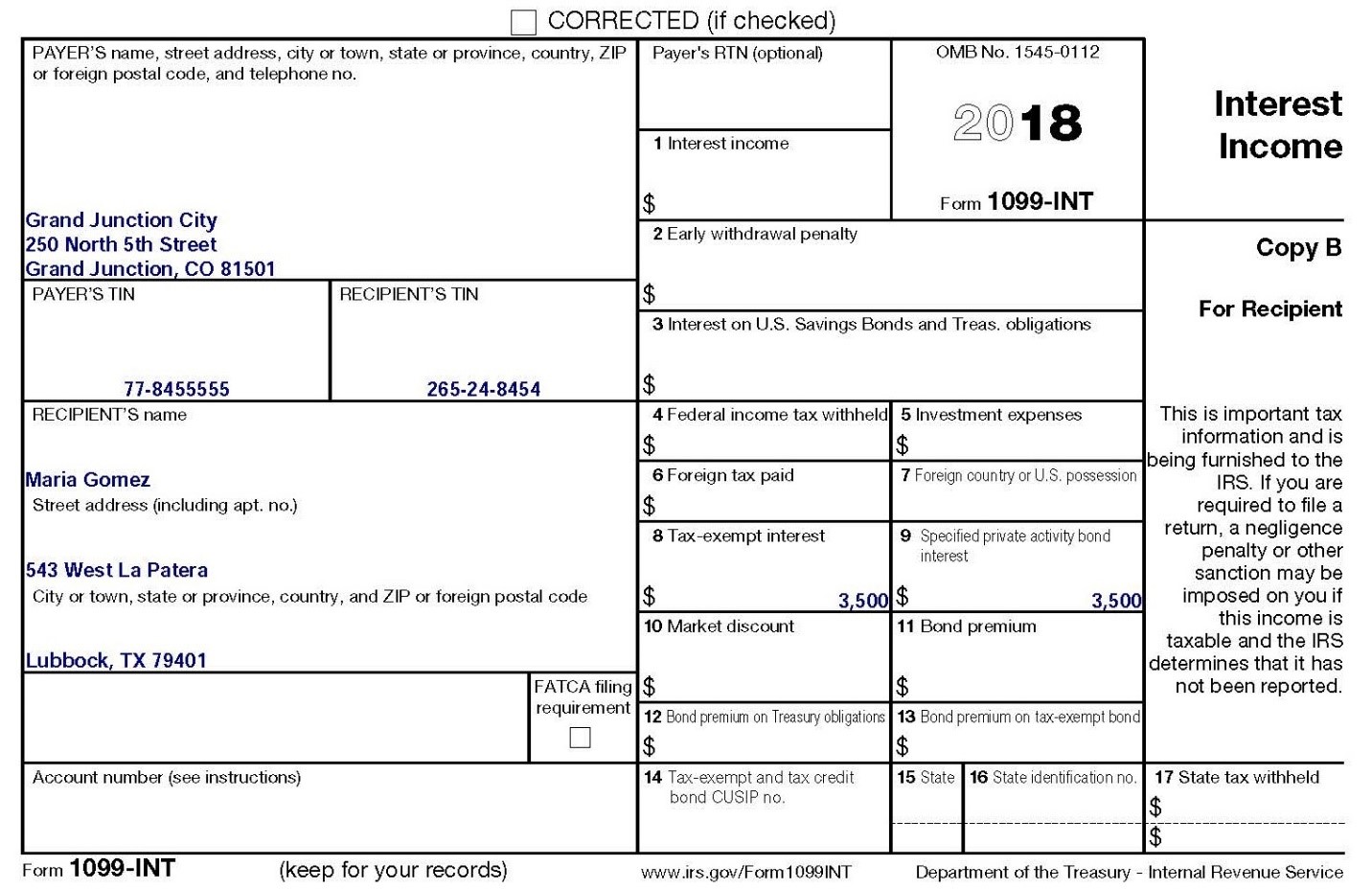

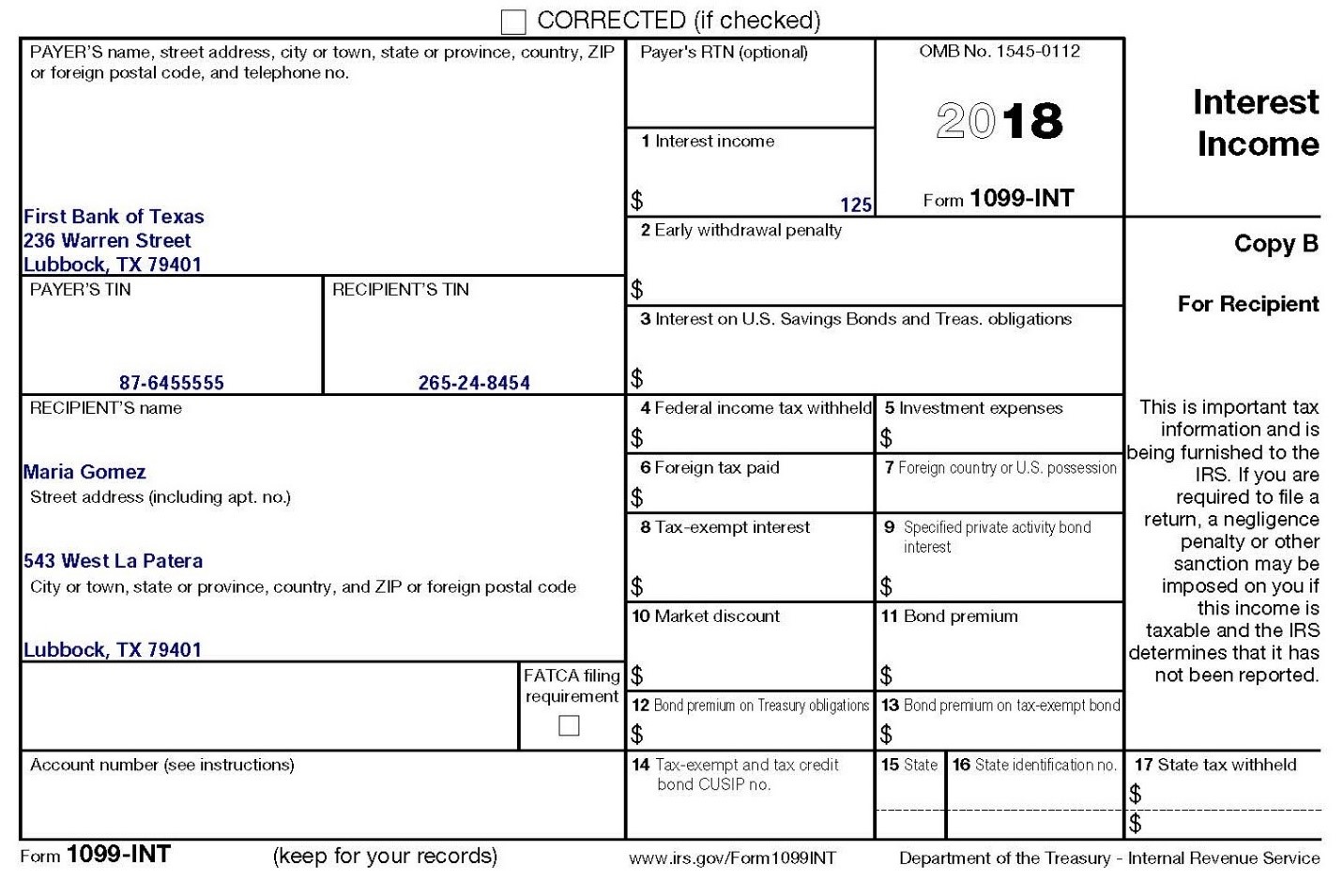

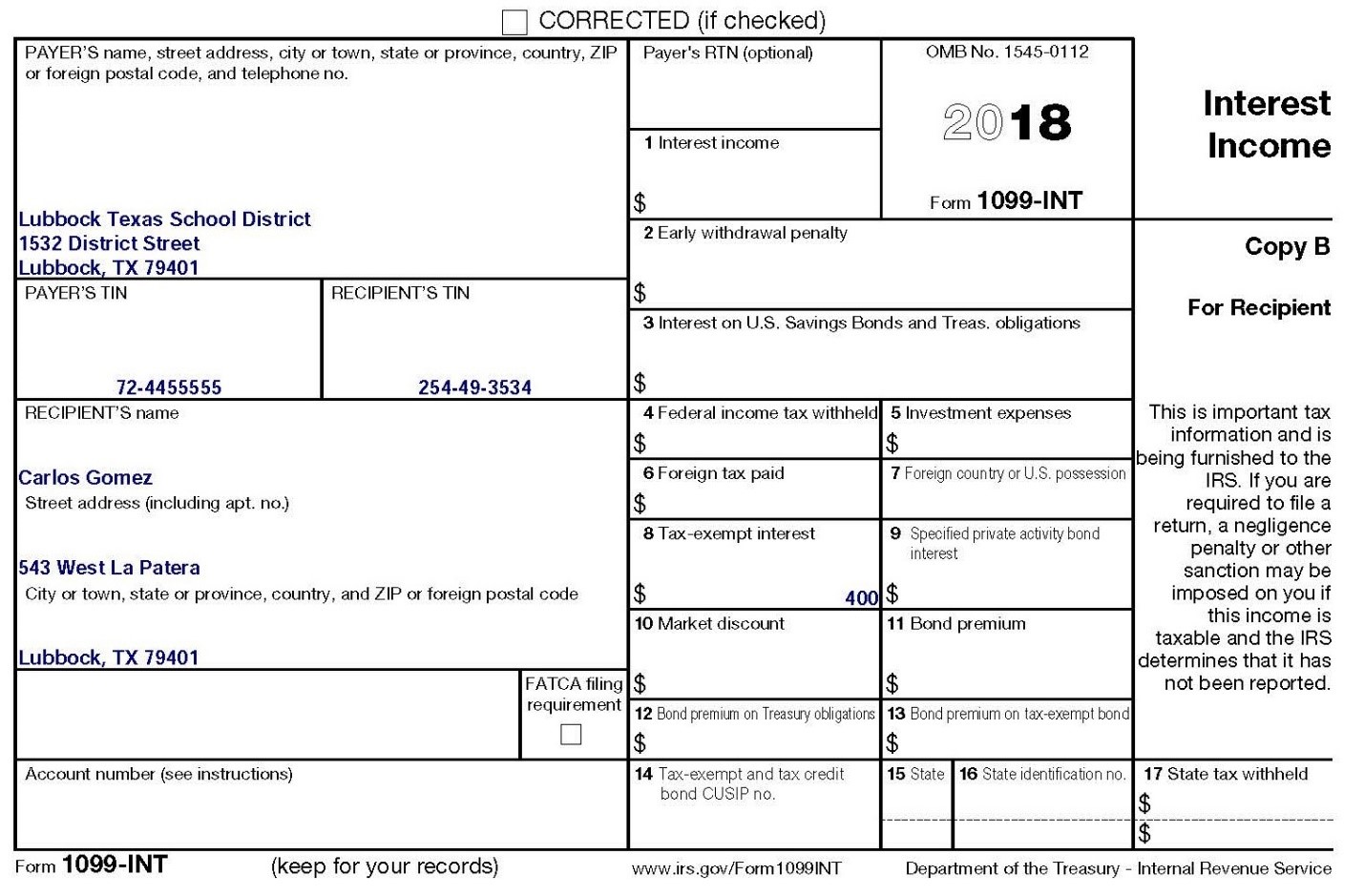

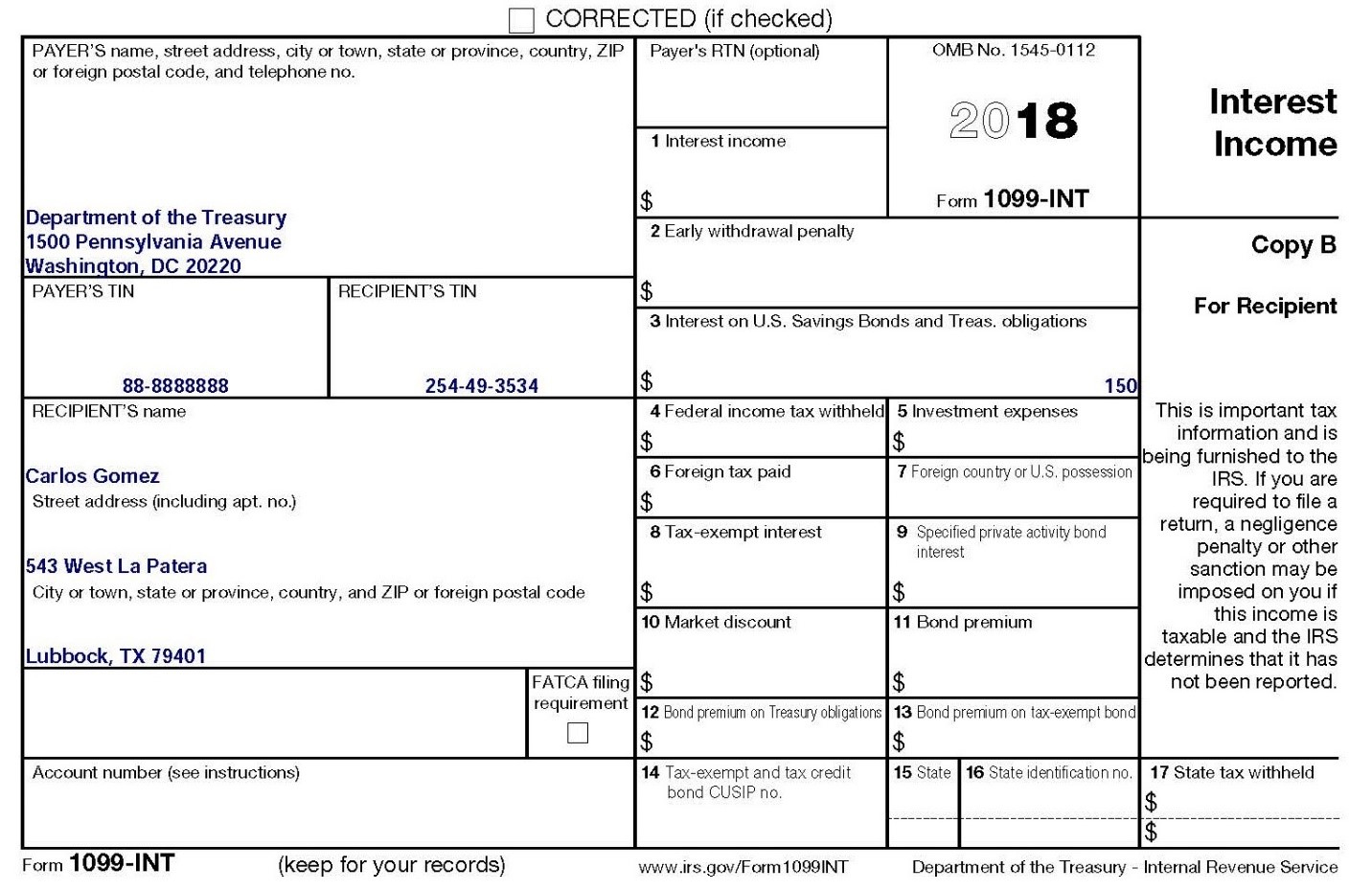

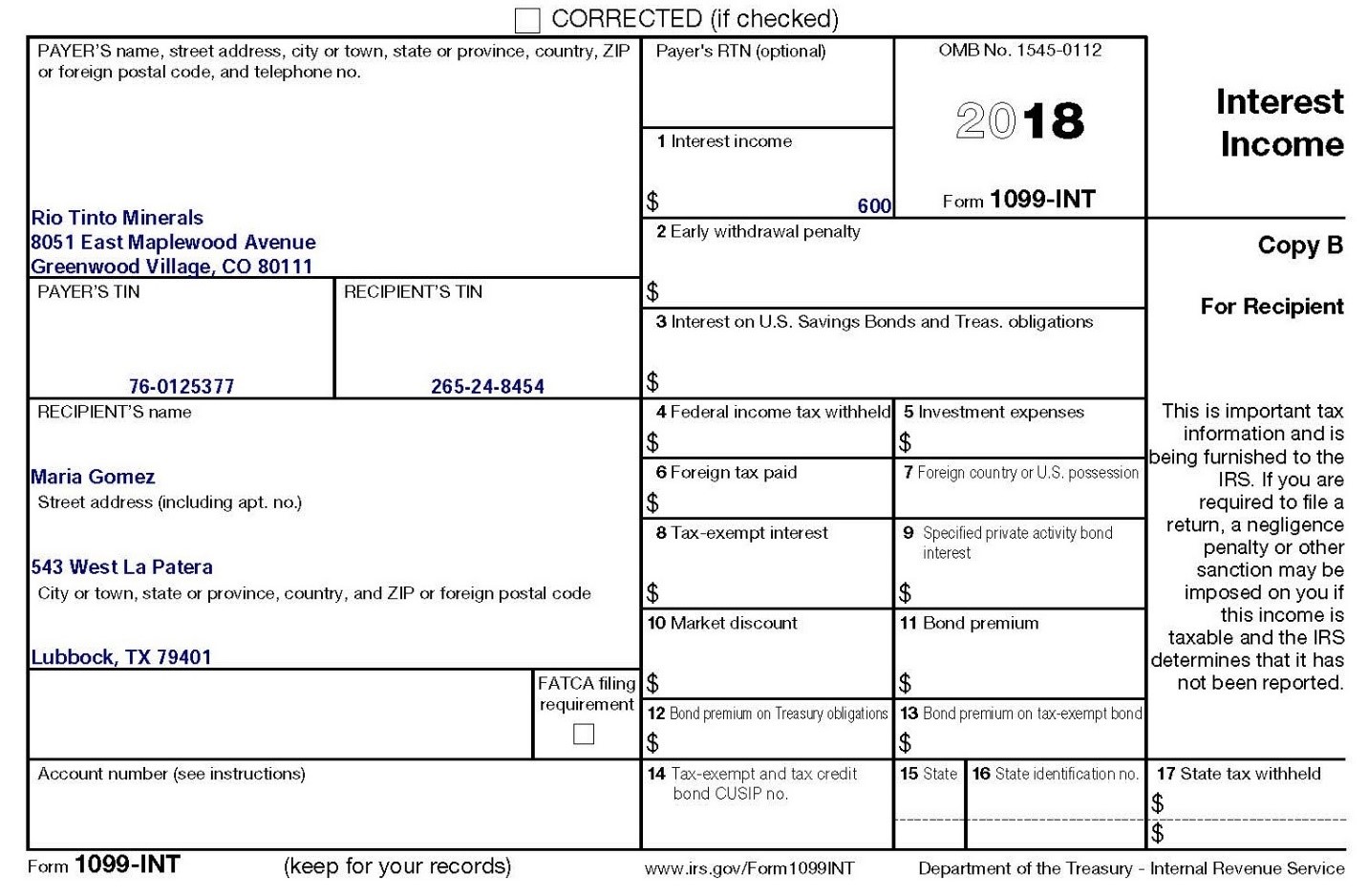

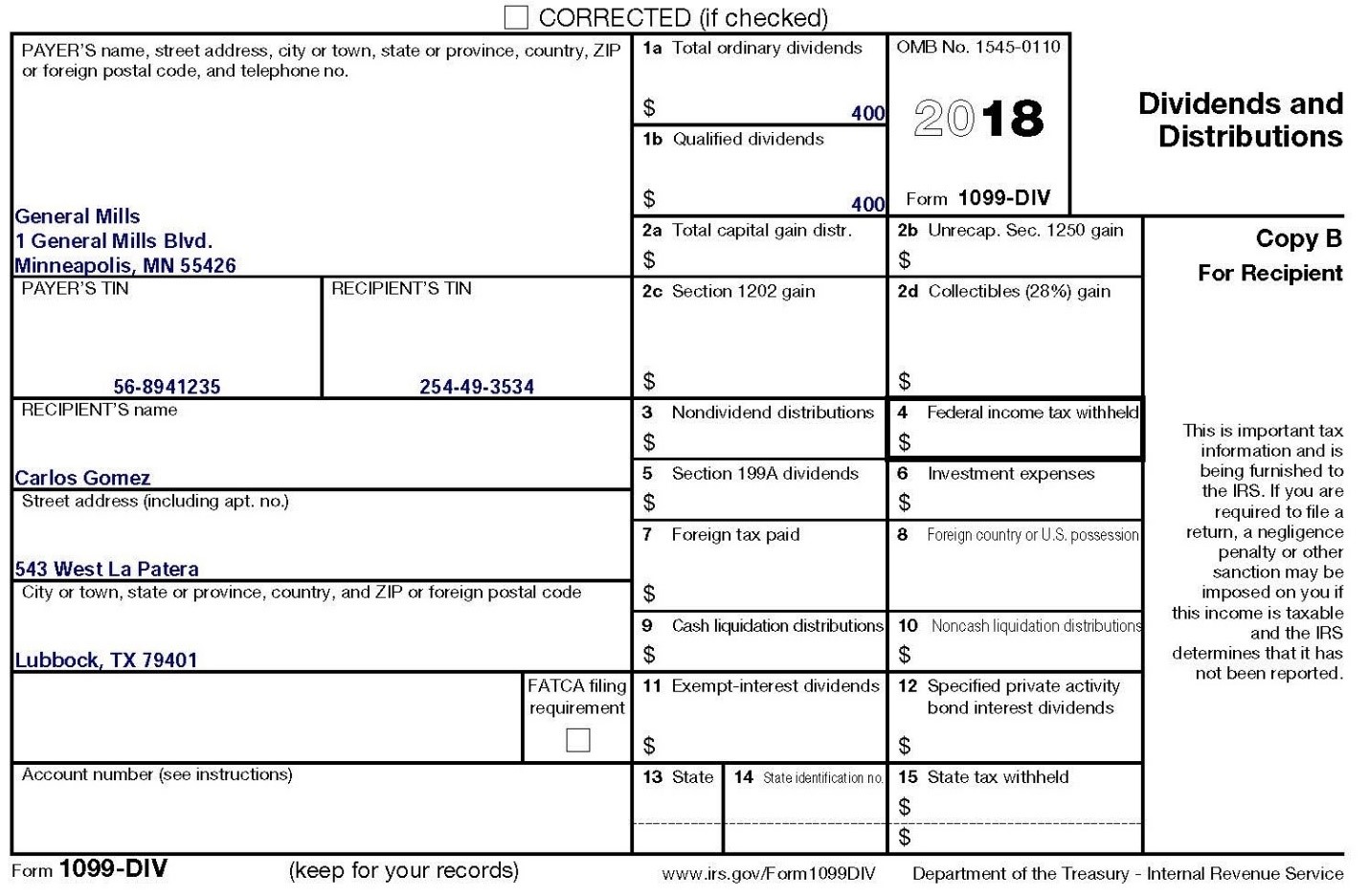

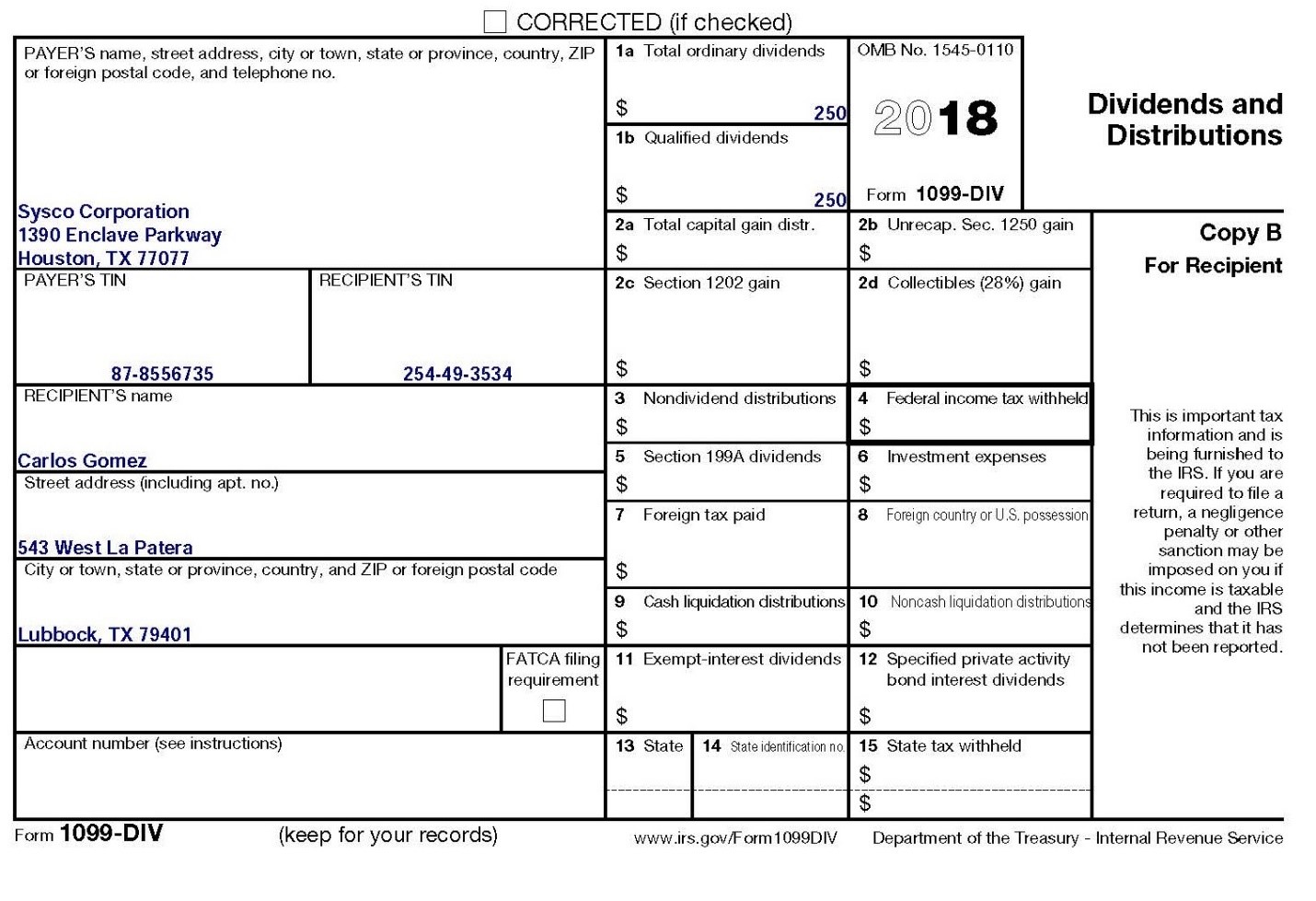

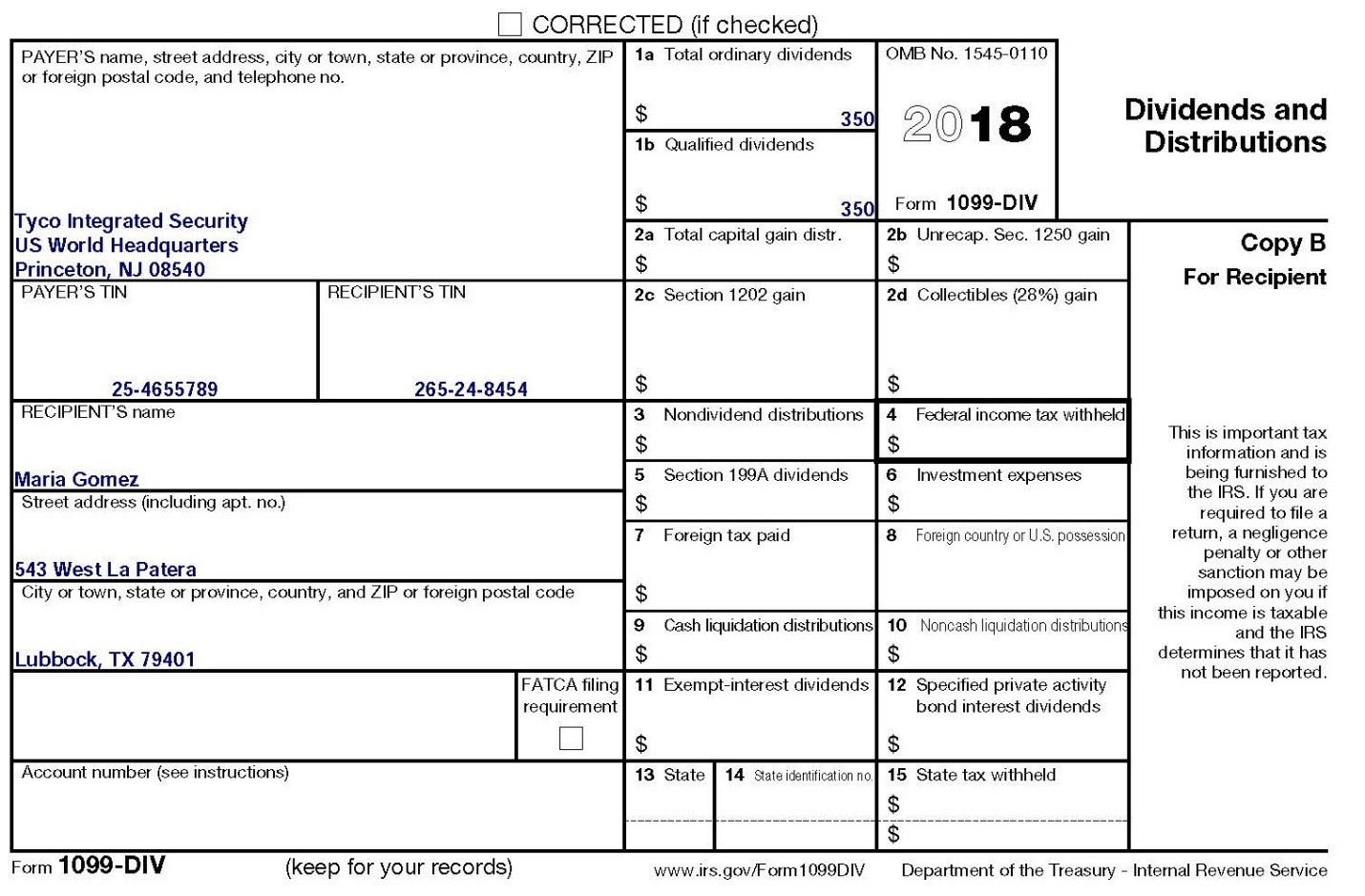

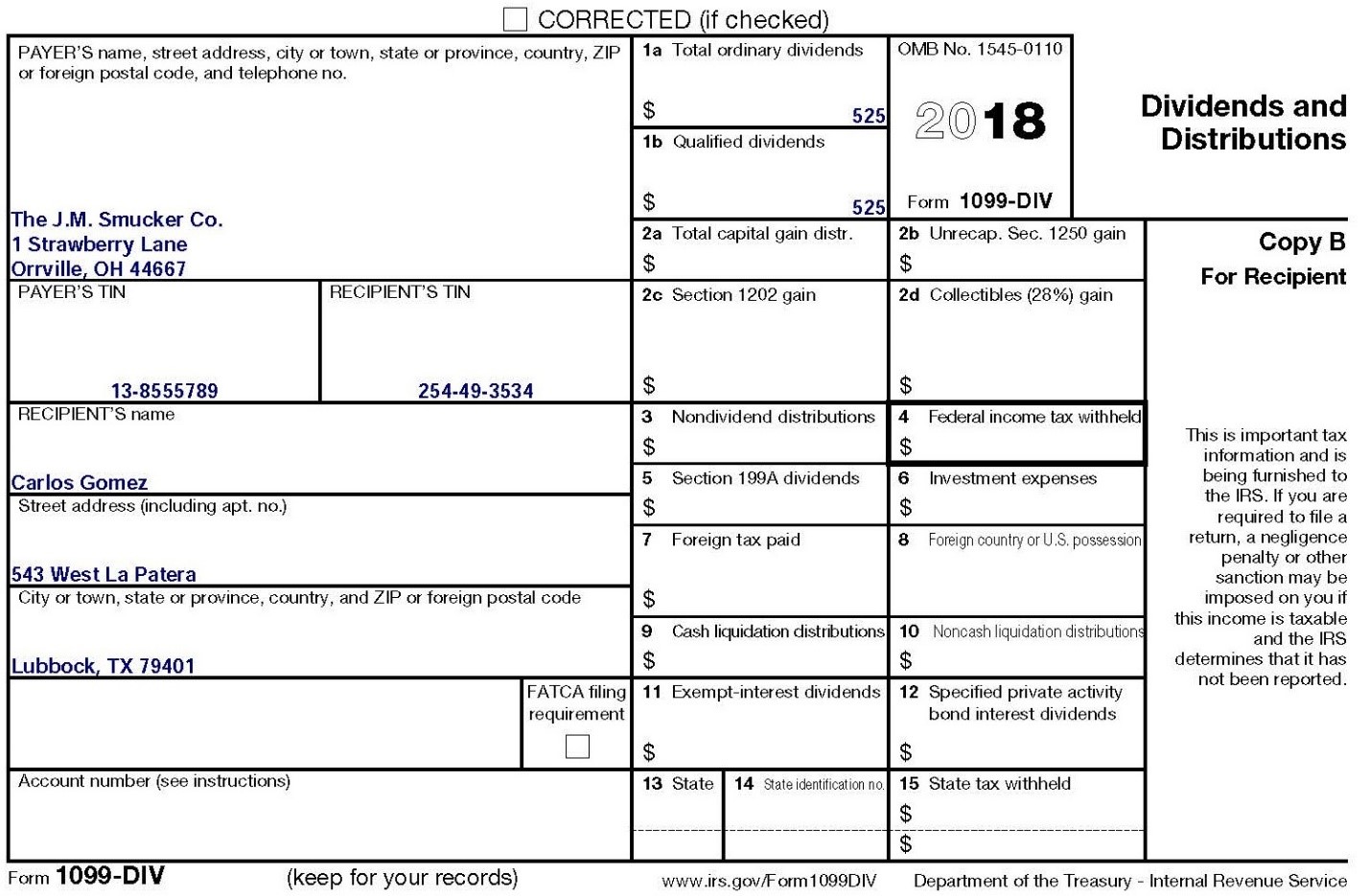

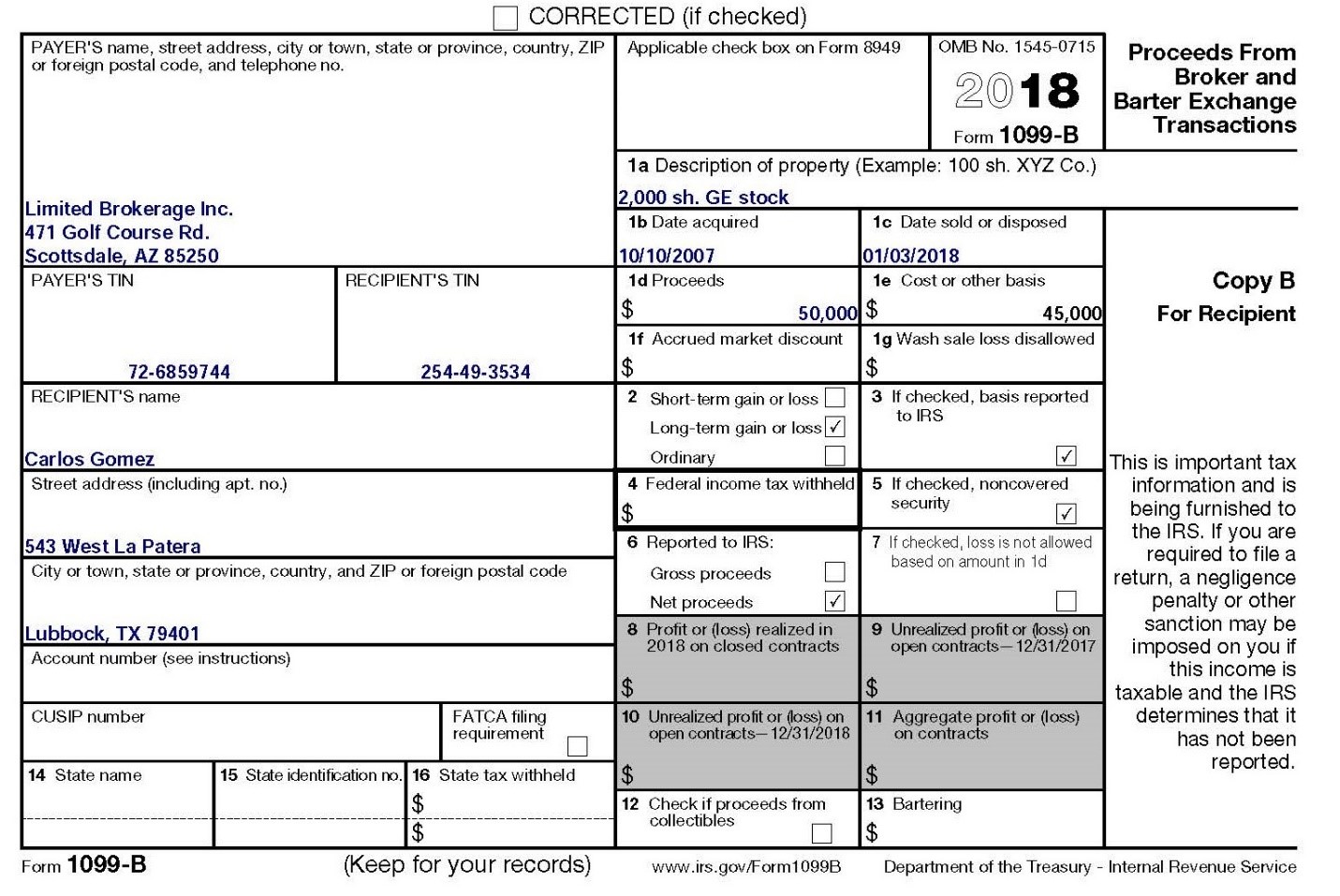

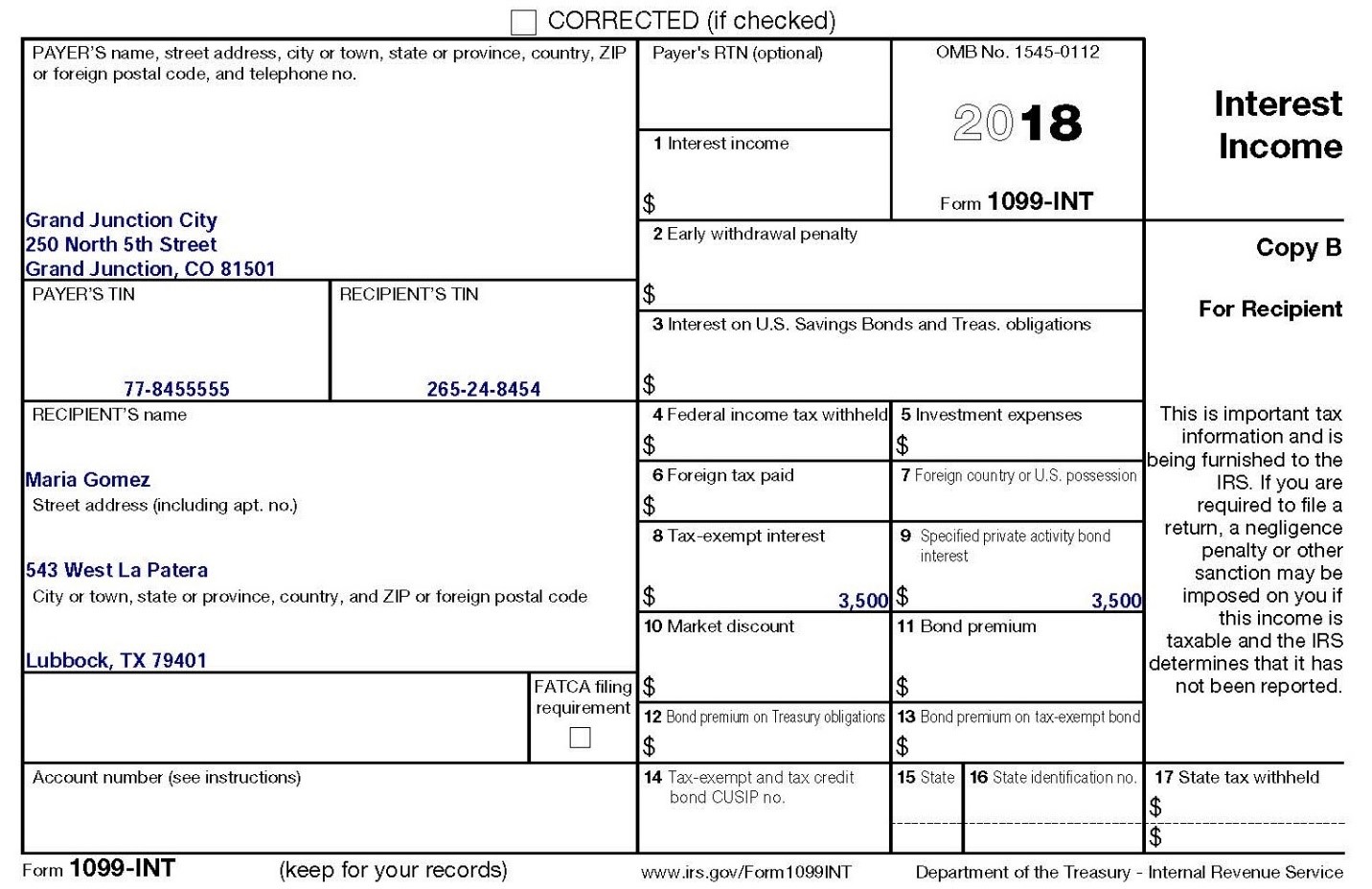

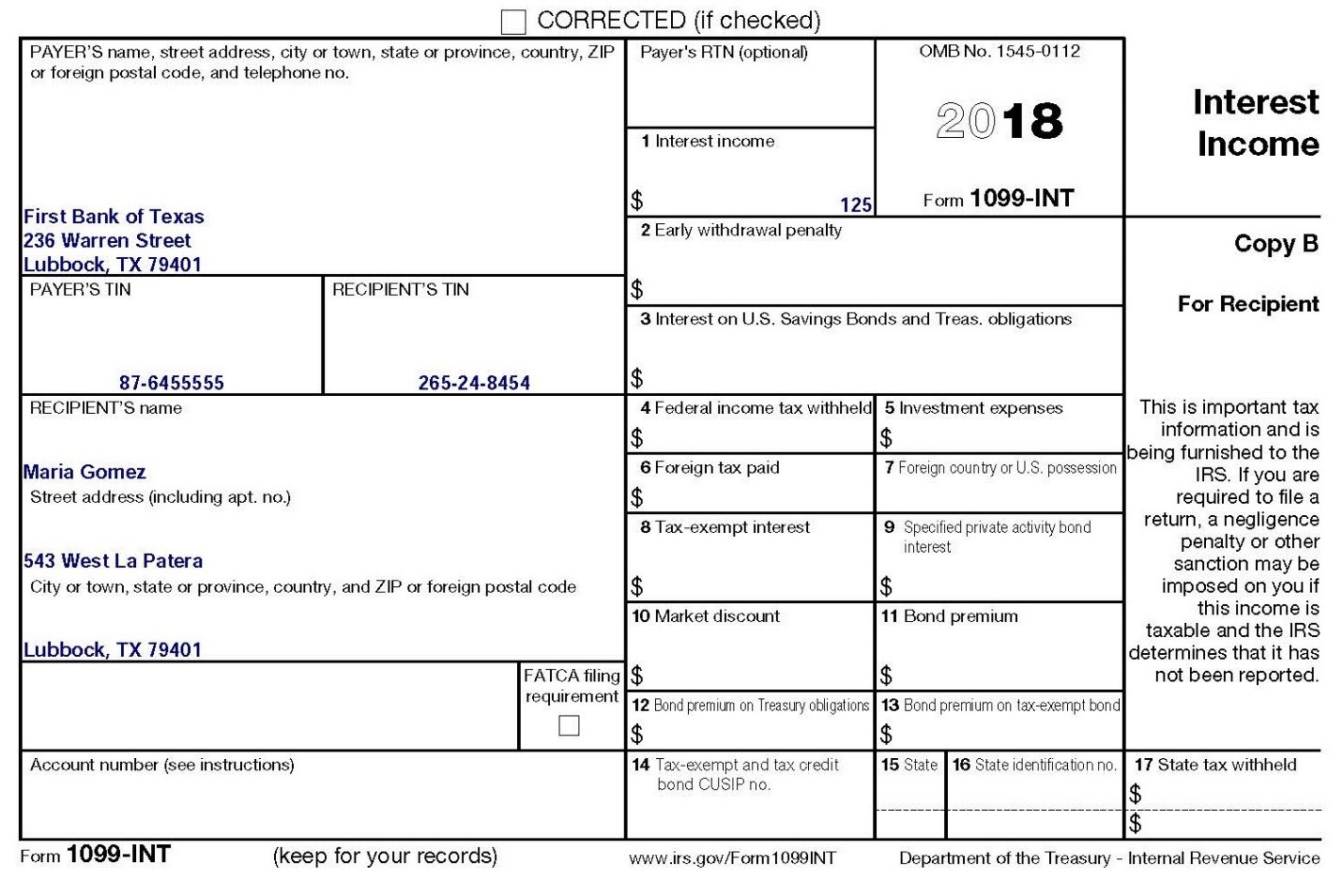

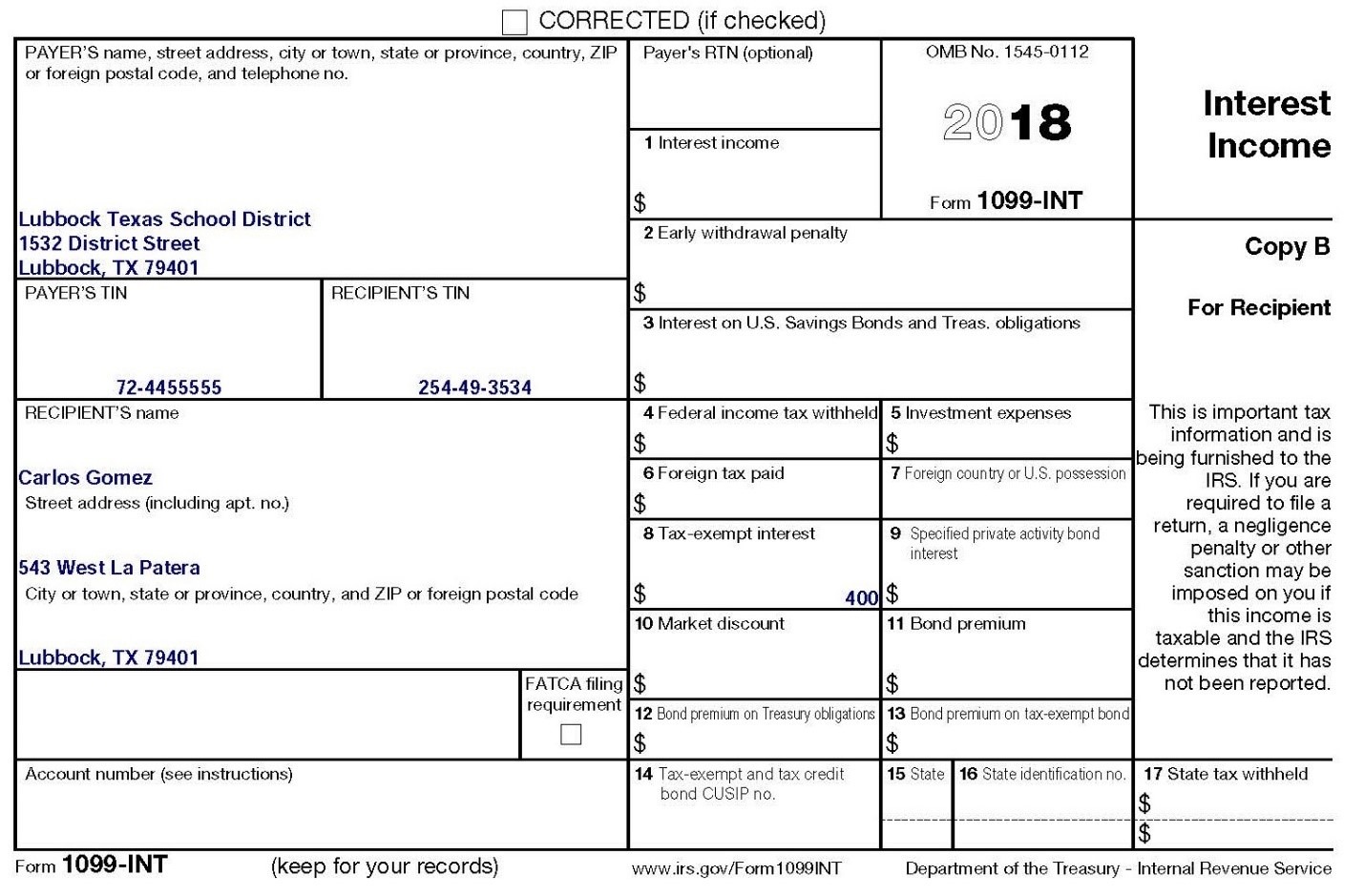

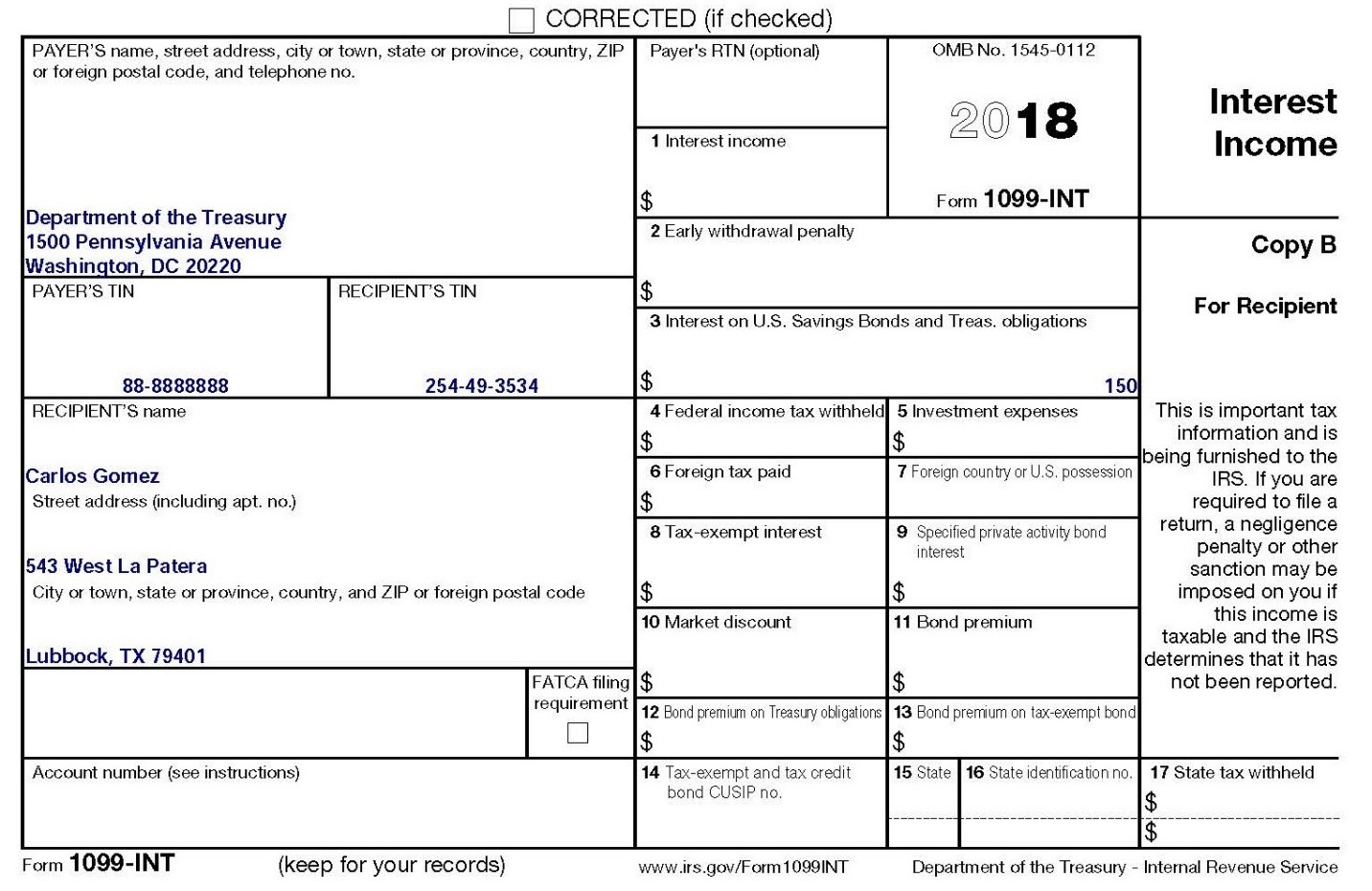

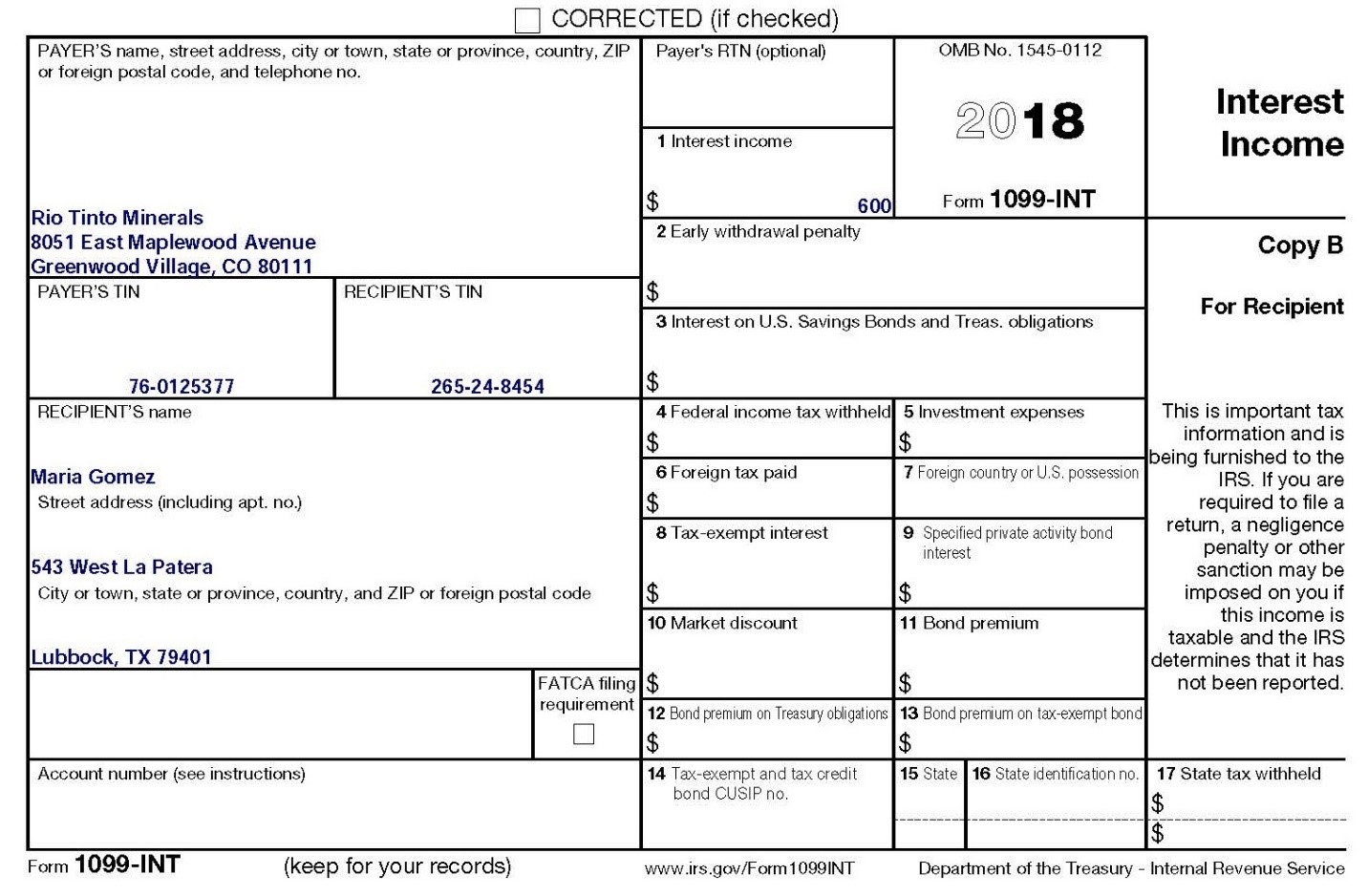

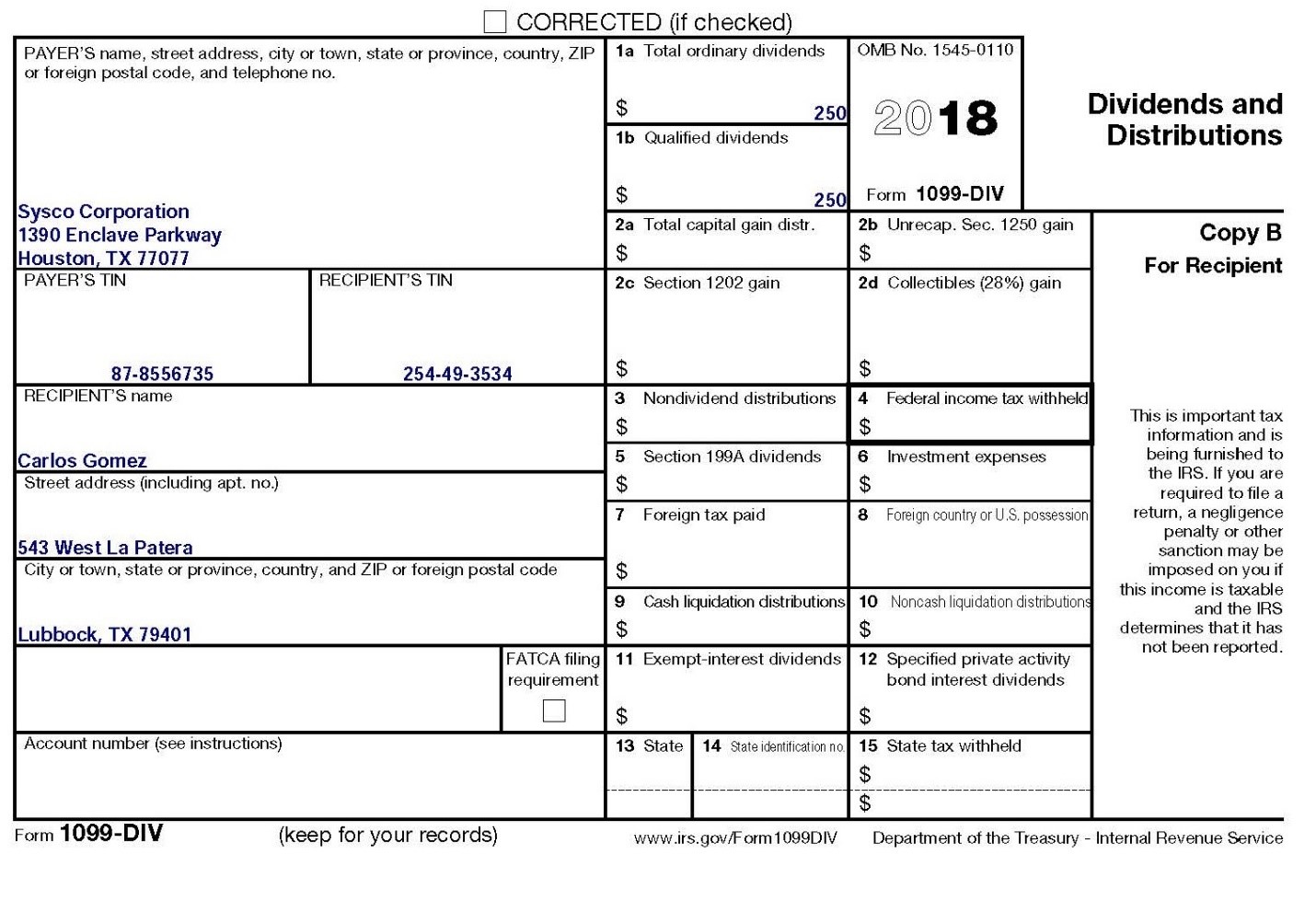

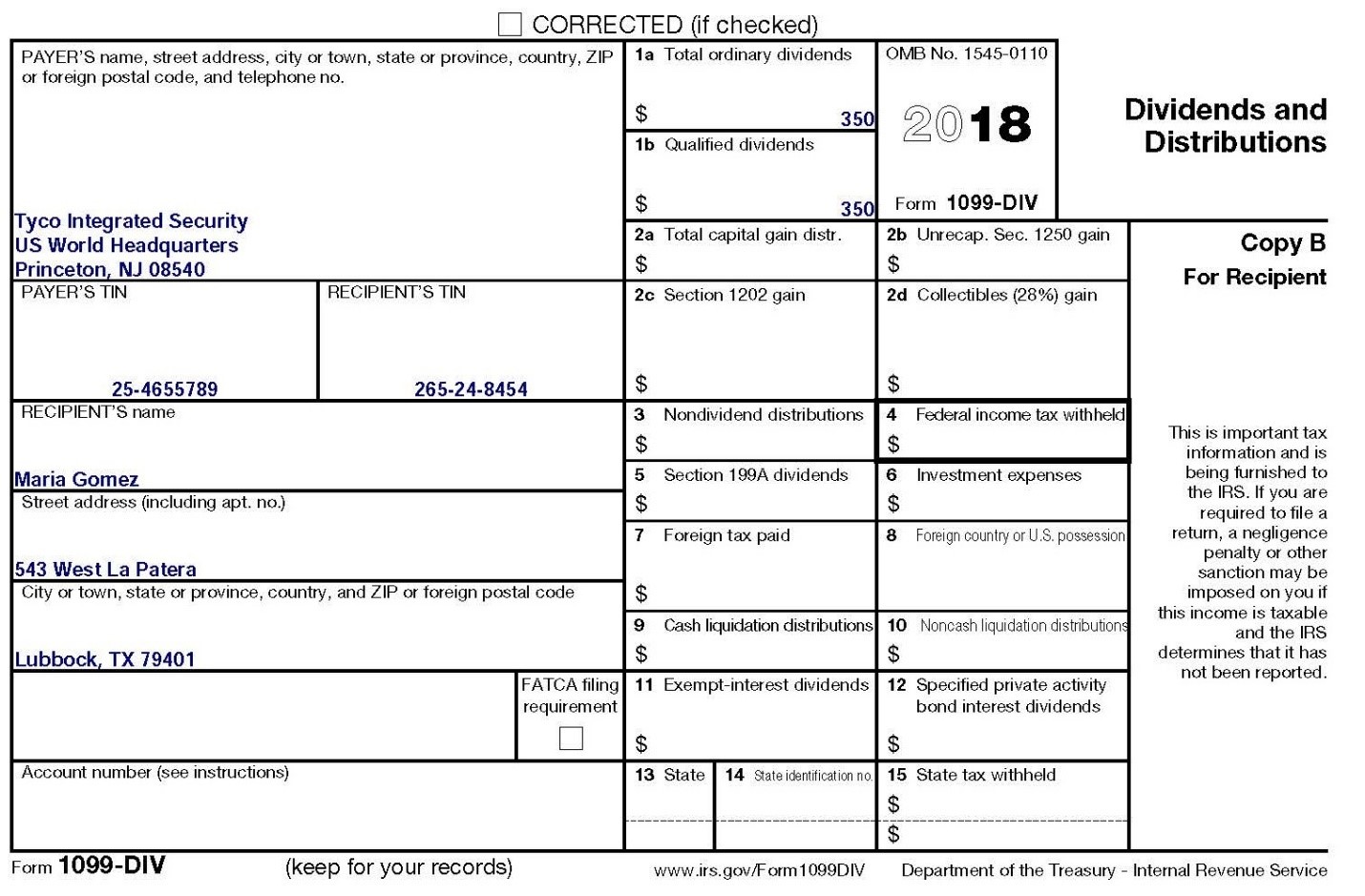

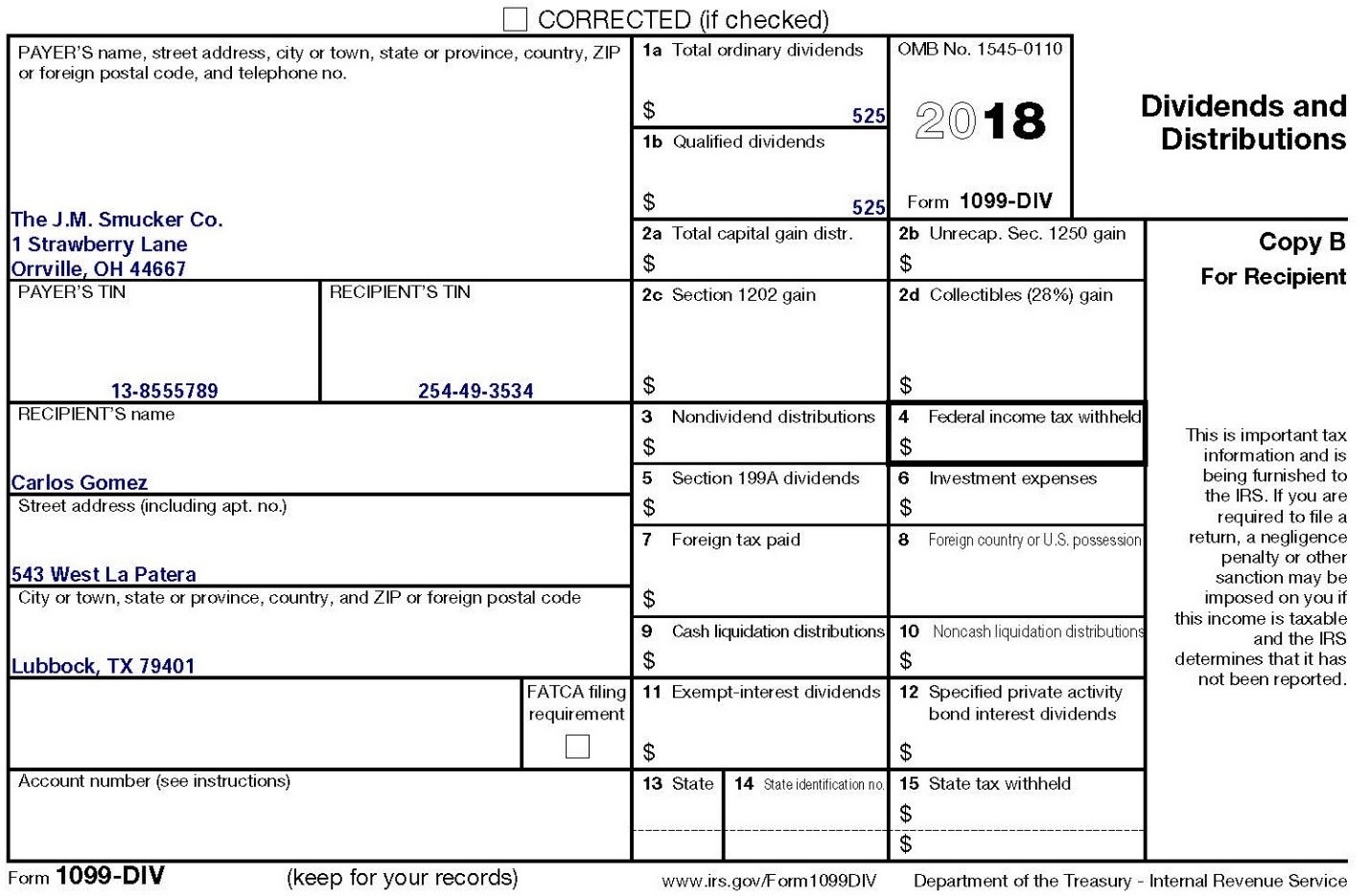

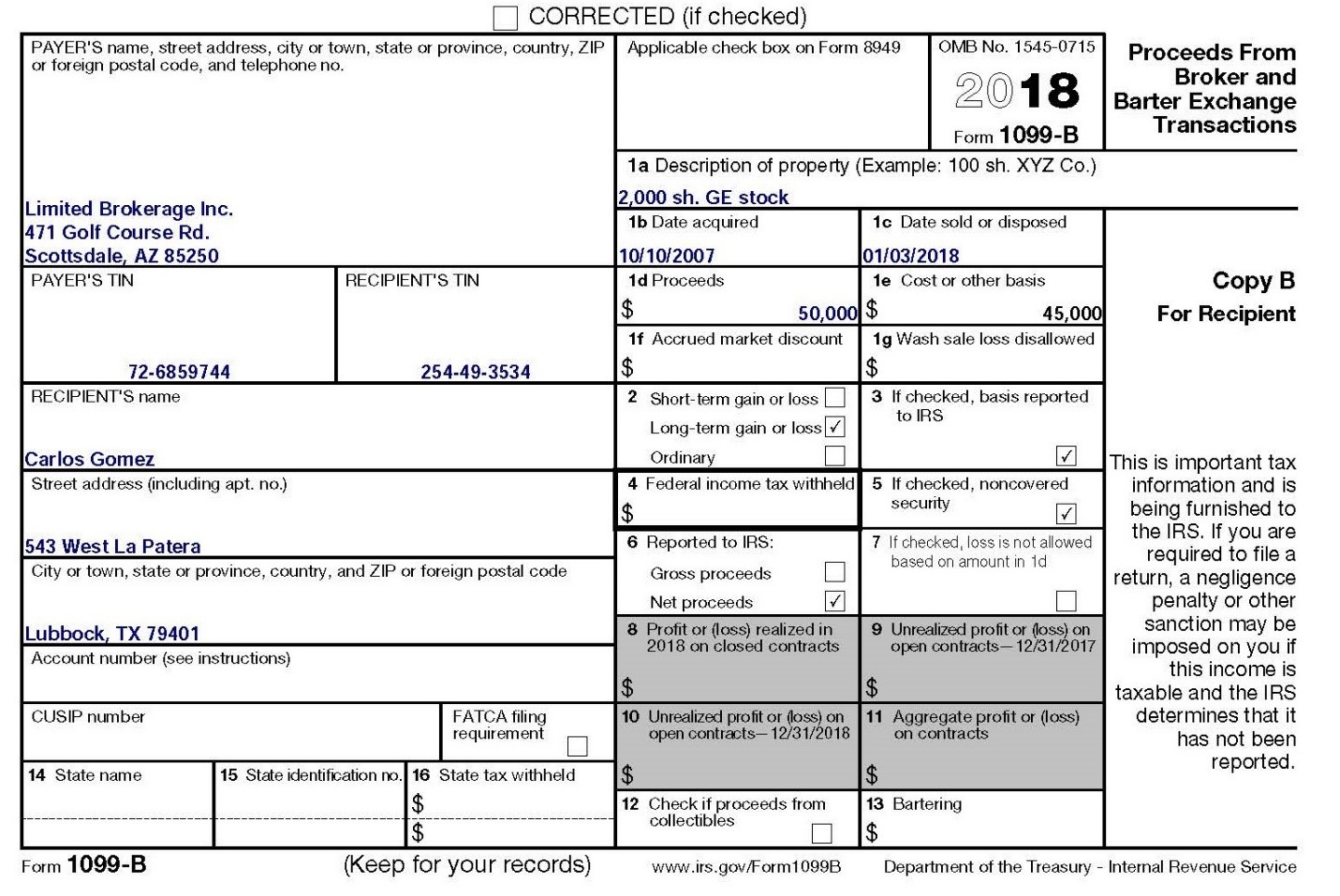

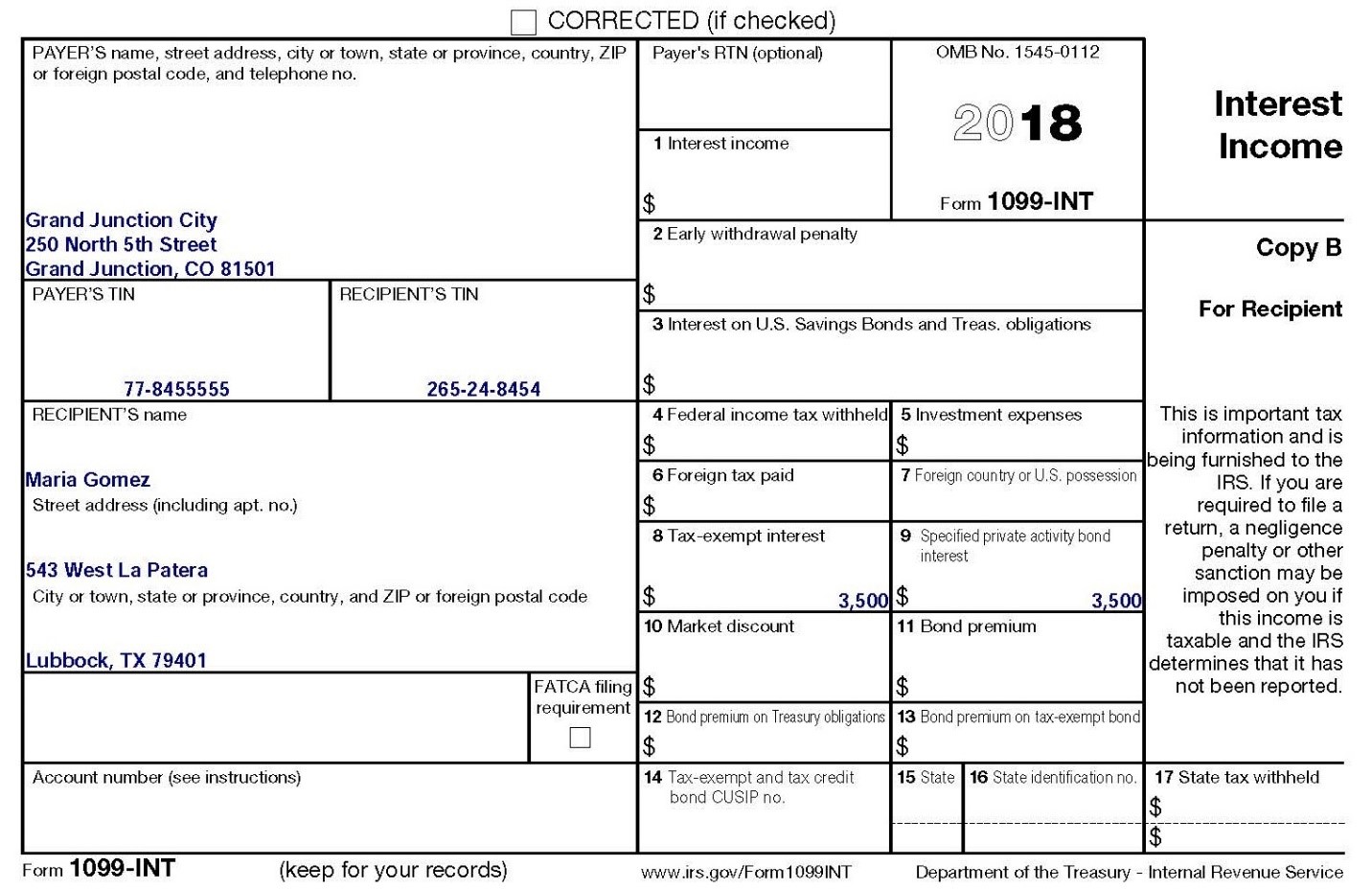

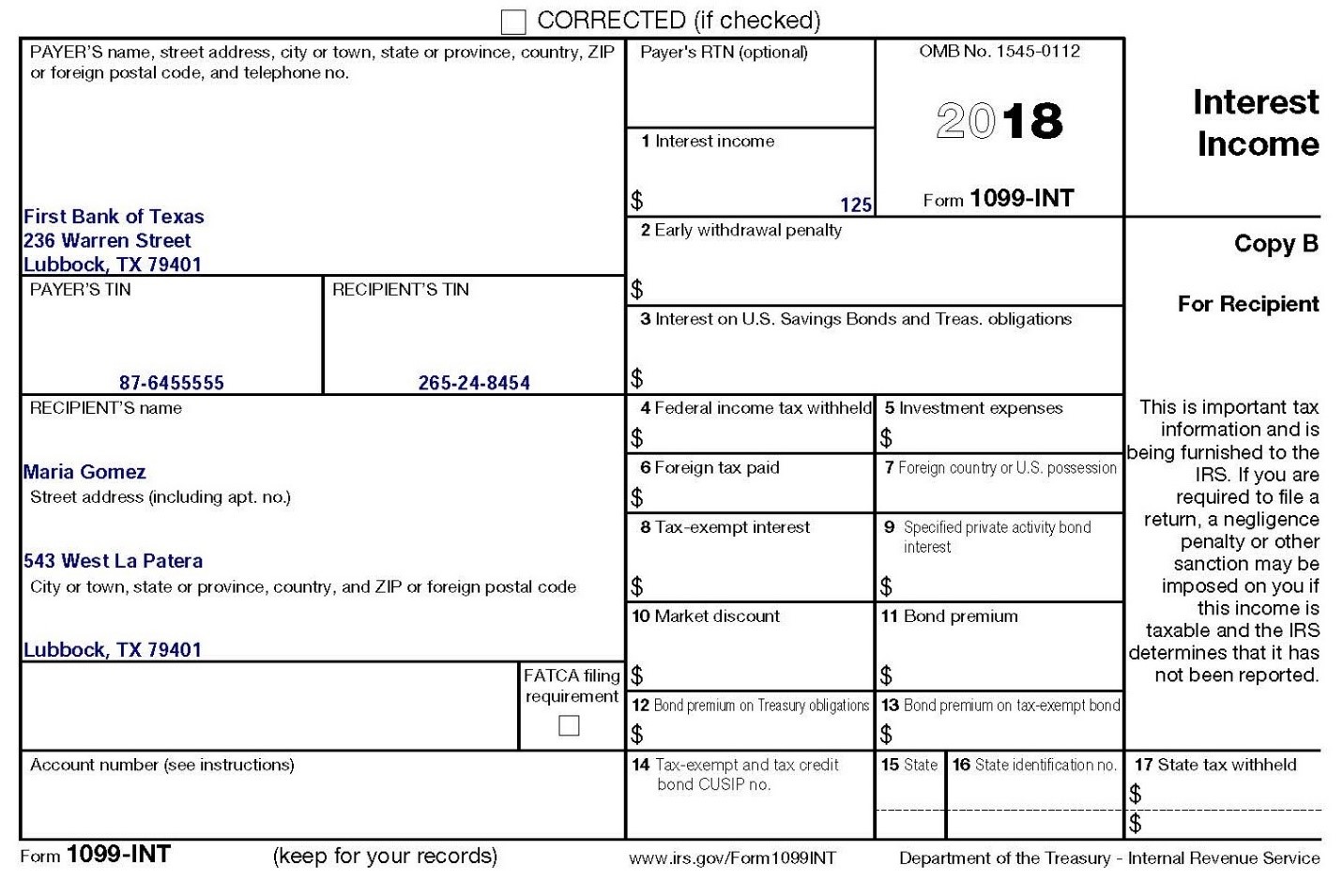

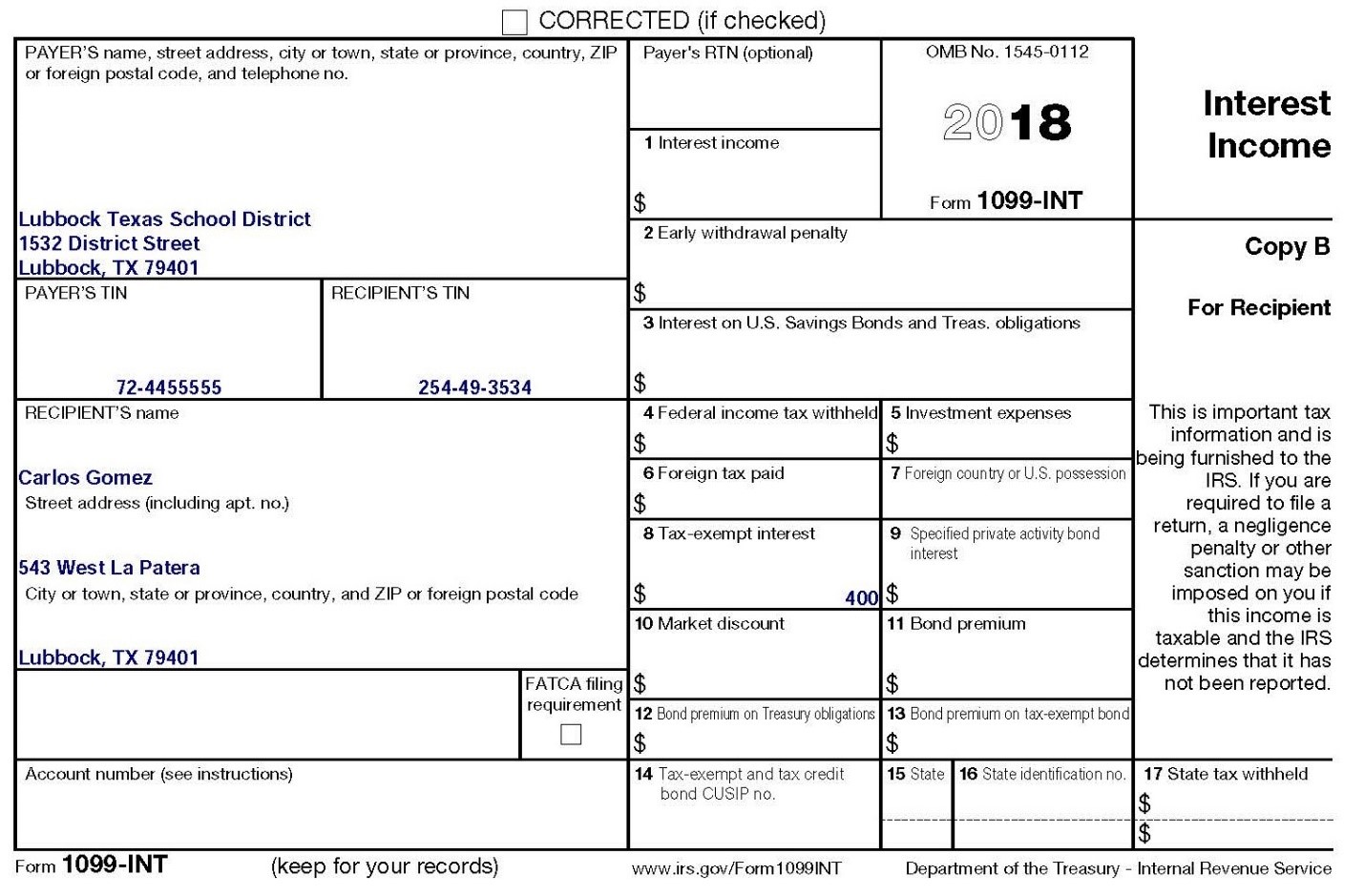

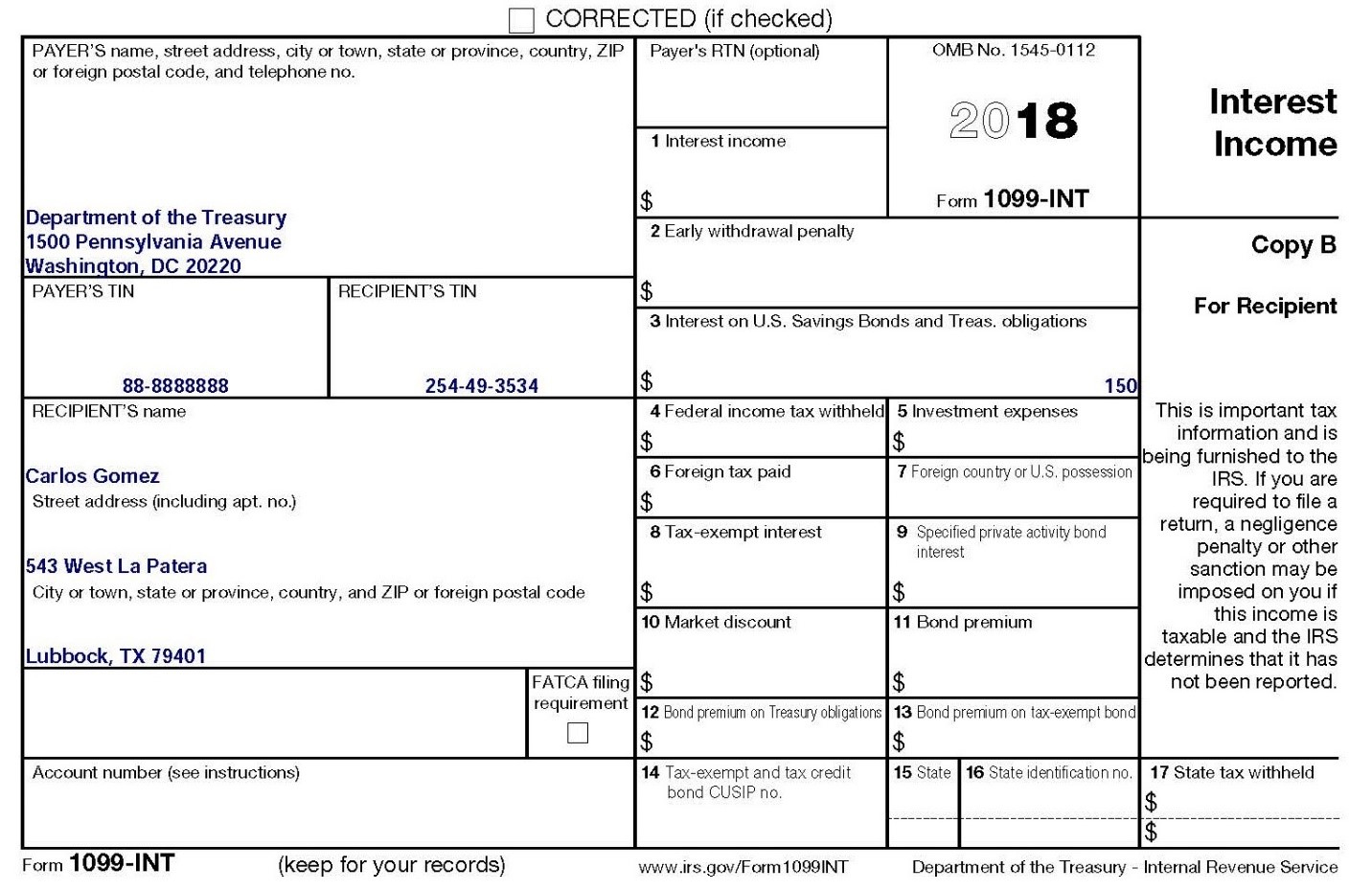

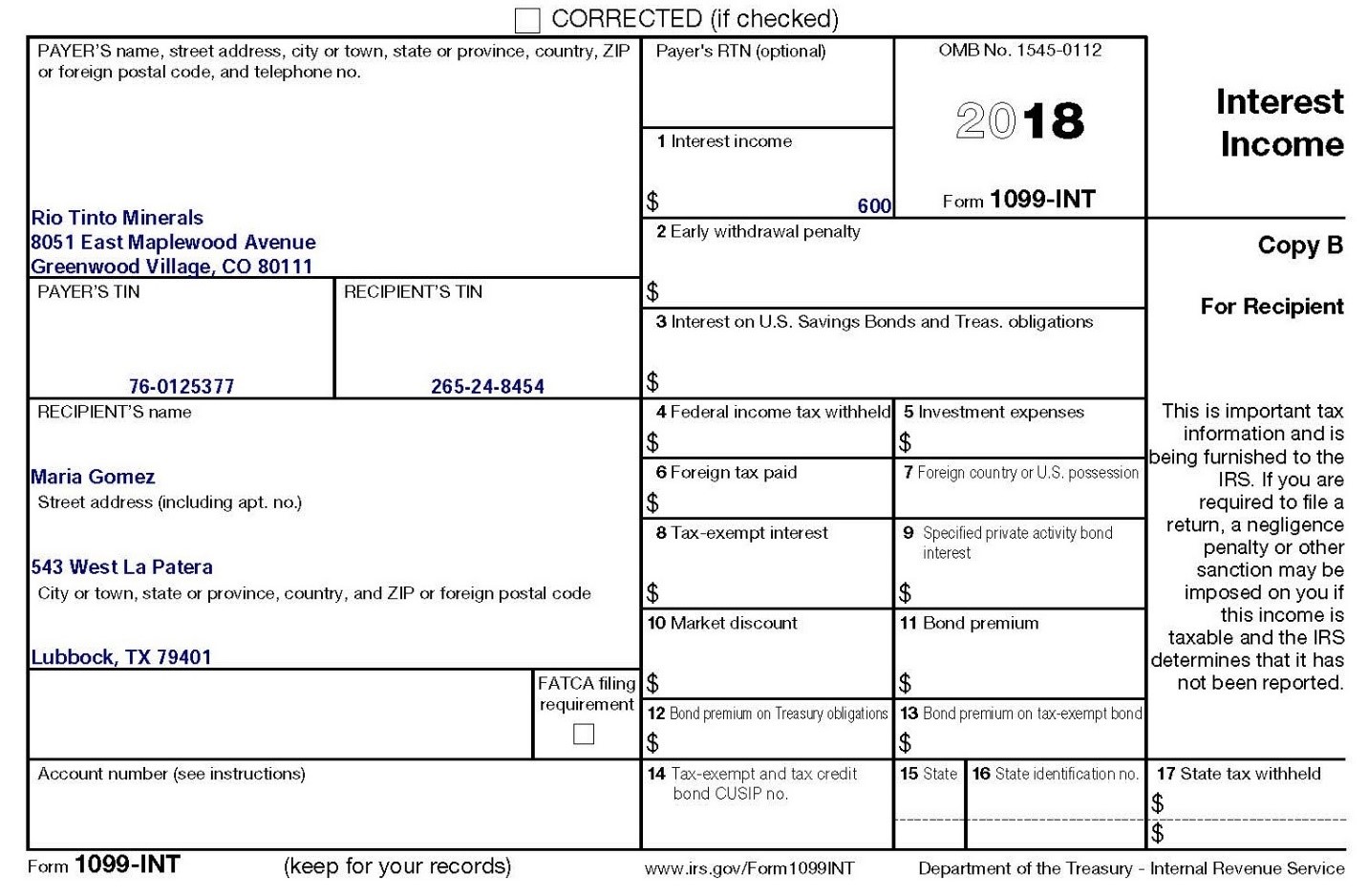

The Gomezes also received the following Forms 1099 for the year:

The Grand Junction City bond was issued in 2014.

The Lubbock Texas School District bond was issued in 2014.

The Gomezes did not own, control, or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year.

The Gomezes paid the following expenses during the year (in addition to the personal residence-related items listed above):

Dentist (unreimbursed by insurance)$500

Doctors (unreimbursed by insurance)$1,750

Prescriptions (unreimbursed by insurance)$425

Personal behicle property tax based upon value $ 1,950

Contribution to qualified charities$9,500

The Gomezes did not pay any state income taxes during the year.

Other Information

The Gomezes made timely federal estimated tax payments for 2018 as follows:

April 15, 2018$7,000

June 15, 2018$7,000

September 15, 2018$7,000

January 15, 2019$7,000

The Gomezes want to contribute to the Presidential Election Campaign Fund.The Gomezes would like to receive a refund (if any) of tax they may have overpaid for the year.Their preferred method of receiving the refund is by check.

22222 a Employee's social security number 254-49-3534 OMB No. 1545-0008 b Employer identification number (EIN) 99-9999999 1 Wages, tips, other compensation 2 Federal income tax withheld 25,650 4,500 c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld West Texas Engineering 25,650 1,590 7602 Buena Vista Blvd. 5 Medicare wages and tips 6 Medicare tax withheld Lubbock, TX 79401 25,650 372 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a a 20 0 Carlos Gomez 13 Statutory Retirement plar gard-party 12b 543 West La Patera X Lubbock, TX 79401 14 Other 120 C 12d 120 0 f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Department of the Treasury-Internal Revenue Service Form W-2 wage and Tax Statement 2018 Copy 1-For State, City, or Local Tax DepartmenCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1a Total ordinary dividends OMB No. 1545-0110 or foreign postal code, and telephone no. $ 400 Dividends and 1b Qualified dividends 2018 Distributions $ General Mills 400 Form 1099-DIV 1 General Mills Blvd. 2a Total capital gain distr 2b Unrecap. Sec. 1250 gain Minneapolis, MN 55426 $ $ Copy B PAYER'S TIN RECIPIENT'S TIN 2c Section 1202 gain 2d Collectibles (28%) gain For Recipient 56-8941235 254-49-3534 $ $ RECIPIENT'S name 3 Nondividend distributions 4 Federal income tax withheld $ This is important tax information and is Carlos Gomez 5 Section 199A dividends 6 Investment expenses being furnished to Street address (including apt. no.) the IRS. If you are required to file a 7 Foreign tax paid B Foreign country or U.S. possession return, a negligence 543 West La Patera penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ imposed on you if 9 Cash liquidation distributions| 10 Noncash liquidation distributions this income is taxable and the IRS Lubbock, TX 79401 $ determines that it has FATCA filing 11 Exempt-interest dividends | 12 Specified private activity not been reported. requirement bond interest dividends 0 $ $ Account number (see instructions) 13 State 14 State identification no. 15 State tax withheld Form 1099-DIV (keep for your records) www.irs.gov/Form 1099DIV Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP | 1a Total ordinary dividends OMB No. 1545-0110 or foreign postal code, and telephone no. $ 250 Dividends and 1b Qualified dividends 2018 Distributions $ 250 Form 1099-DIV Sysco Corporation 1390 Enclave Parkway 2a Total capital gain distr 2b Unrecap. Sec. 1250 gain Copy B Houston, TX 77077 $ $ RECIPIENT'S TIN 2c Section 1202 gain 2d Collectibles (28%) gain For Recipient PAYER'S TIN 87-8556735 254-49-3534 $ $ RECIPIENT'S name 3 Nondividend distributions 4 Federal income tax withheld $ This is important tax information and is Carlos Gomez 5 Section 199A dividends 6 Investment expenses being furnished to Street address (including apt. no.) $ the IRS. If you are required to file a 7 Foreign tax paid 8 Foreign country or U.S. possession return, a negligence penalty or other 543 West La Patera sanction may be City or town, state or province, country, and ZIP or foreign postal code $ imposed on you if Cash liquidation distributions | 10 Noncash liquidation distributions this income is taxable and the IRS Lubbock, TX 79401 $ determines that it has FATCA filing 11 Exempt-interest dividends 12 Specified private activity not been reported. requirement bond interest dividends $ $ Account number (see instructions) 13 State |14 State identification no. 15 State tax withheld $ Form 1099-DIV (keep for your records) www.irs.gov/Form 1099DIV Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1a Total ordinary dividends OMB No. 1545-0110 or foreign postal code, and telephone no. $ 350 2018 Dividends and 1b Qualified dividends Distributions $ Tyco Integrated Security 350 Form 1099-DIV US World Headquarters 2a Total capital gain distr 2b Unrecap. Sec. 1250 gain Copy B Princeton, NJ 08540 $ $ PAYER'S TIN RECIPIENT'S TIN 2c Section 1202 gain 2d Collectibles (28%) gain For Recipient 25-4655789 265-24-8454 $ $ RECIPIENT'S name 3 Nondividend distributions 4 Federal income tax withheld CA This is important tax information and is Maria Gomez 5 Section 199A dividends Investment expenses being furnished to Street address (including apt. no.) the IRS. If you are required to file a 7 Foreign tax paid 8 Foreign country or U.S. possession return, a negligence penalty or other 543 West La Patera sanction may be City or town, state or province, country, and ZIP or foreign postal code imposed on you if 9 Cash liquidation distributions| 10 Noncash liquidation distributions this income is taxable and the IRS Lubbock, TX 79401 $ determines that it has FATCA filing 11 Exempt-interest dividends 12 Specified private activity not been reported. requirement bond interest dividends 0 $ $ Account number (see instructions) 13 State 14 State identification no. 15 State tax withheld Form 1099-DIV (keep for your records) www.irs.gov/Form 1099DIV Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1a Total ordinary dividends OMB No. 1545-0110 or foreign postal code, and telephone no. $ 525 Dividends and 1b Qualified dividends 2018 Distributions $ 525 Form 1099-DIV The J.M. Smucker Co. 1 Strawberry Lane 2a Total capital gain distr 2b Unrecap. Sec. 1250 gain Copy B Orrville, OH 44667 $ $ PAYER'S TIN RECIPIENT'S TIN 2c Section 1202 gain 2d Collectibles (28%) gain For Recipient 13-8555789 254-49-3534 $ $ RECIPIENT'S name 3 Nondividend distributions 4 Federal income tax withheld $ This is important tax information and is Carlos Gomez 5 Section 199A dividends 6 Investment expenses being furnished to Street address (including apt. no.) A the IRS. If you are required to file a 7 Foreign tax paid B Foreign country or U.S. possession return, a negligence penalty or other 543 West La Patera sanction may be City or town, state or province, country, and ZIP or foreign postal code $ imposed on you if 9 Cash liquidation distributions | 10 Noncash liquidation distributions this income is taxable and the IRS Lubbock, TX 79401 CA $ determines that it has FATCA filing 11 Exempt-interest dividends 12 Specified private activity not been reported. requirement bond interest dividends 0 $ $ Account number (see instructions) 13 State 14 State identification no. 15 State tax withheld Form 1099-DIV keep for your records) www.irs.gov/Form 1099DIV Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Applicable check box on Form 8949 OMB No. 1545-0715 or foreign postal code, and telephone no. Proceeds From 2018 Broker and Barter Exchange Form 1099-B Transactions 1a Description of property (Example: 100 sh. XYZ Co.) Limited Brokerage Inc. 2,000 sh. GE stock 471 Golf Course Rd. 1b Date acquired 1c Date sold or disposed Scottsdale, AZ 85250 10/10/2007 01/03/2018 PAYER'S TIN RECIPIENT'S TIN 1d Proceeds le Cost or other basis Copy B $ 50,000 $ 45,000 For Recipient 1f Accrued market discount 1g Wash sale loss disallowed 72-6859744 254-49-3534 $ $ RECIPIENT'S name 2 Short-term gain or loss 3 If checked, basis reported Long-term gain or loss to IRS Carlos Gomez Ordinary This is important tax Street address (including apt. no.) 4 Federal income tax withheld _5 If checked, noncovered information and is $ security being furnished to 543 West La Patera 6 Reported to IRS: 7 If checked, loss is not allowed the IRS. If you are City or town, state or province, country, and ZIP or foreign postal code required to file a Gross proceeds based on amount in 1d return, a negligence Net proceeds penalty or other Lubbock, TX 79401 8 Profit or (loss) realized in 9 Unrealized profit or loss) on sanction may be Account number (see instructions) 2018 on closed contracts open contracts- 12/31/2017 imposed on you if $ $ this income is taxable and the IRS CUSIP number FATCA filing 10 Unrealized profit or (loss) on open contracts- 12/31/2018 11 Aggregate profit or (loss) determines that it requirement on contracts has not been 14 State name 15 State identification no. 16 State tax withheld $ $ reported. 12 Check if proceeds from 13 Bartering collectibles Form 1099-B (Keep for your records) www.irs.gov/Form1099B Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 Distributions From country, ZIP or foreign postal code, and phone no. Pensions, Annuities, $ 20,000 2018 Retirement or 2a Taxable amount Profit-Sharing Plans, IRAs, Insurance Contracts, etc. West Texas Engineering 20,000 Form 1099-R 7602 Buena Vista Blvd. Taxable amount Total Copy B Lubbock, TX 79401 not determined distribution Report this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain included 4 Federal income tax income on your in box 2a) withheld federal tax return. If this 12-3456781 254-49-3534 2,000 form shows federal income RECIPIENT'S name 5 Employee contributions/ 6 Net unrealized Designated Roth appreciation in tax withheld in contributions or employer's securities box 4, attach insurance premiums this copy to Carlos Gomez $ $ your return. Street address (including apt. no.) 7 Distribution IRA code(s) SEP/ 8 Other SIMPLE This information is 543 West La Patera $ % being furnished to City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions the IRS. Lubbock, TX 79401 distribution % I$ 10 Amount allocable to IRR 11 1st year of FATCA filing 14 State distribution requirement 12 State tax withheld 13 State/Payer's state no. within 5 years desig. Roth contrib $ Account number (see instructions) Date of 15 Local tax withheld 16 Name of locality 17 Local distribution payment Form 1099-R www.irs.gov/Form1099R Department of the Treasury - Internal Revenue ServiceI CORRECTED if Checked PAYER'S name, street address. city or town, state or province. country, ZIP 1 Rents OMB No. 15430115 or foreign postal code, and telephone no. $ 2 1 8 Miscellaneous 2 Royalties lnco me $ Form 1099-MISC 4 Federal income tax withheld Copy B For Recipient PAYEFI'S TIN RECIPIENTS TIN 5 Fishing boat proceeds a Medical and health care payments 123456781 265-24-8454 RECIPIENTS name 8 Substitute payments in lieu o' dividends or interest This is important tax information and is Maria Gomez being furnished to Street address (including apt. no.) the IRS. If you are required to le a return, a negligence penalty or other sanction may be imposed on you if this income is Lubbock TX 79401 taxable and the IFIS Account number (see instructions) FATCA ling 13 Excess golden parachute 14 Goes proceeds paid to an datermines that it requirement payments atlorney has "01 been D 15a Section 409A deferrals 15b Section 409A income 9 Payer made direct sales of .000 f 543 West La Patera Some: 1:23;\" \"sum City or town. state or province, country. and ZIP or foreign postal code (recipient) for resale p D $ $ $ Form 1099-MISC (Keep for your records) wwwjrs.grw/Form1099MlSC Department ofthe Treasury A Internal Revenue Service CORRECTED (if checked) RECIPIENT'S/LENDER'S name, street address, city or town, state or Caution: The amount shown may OMB No. 1545-0901 province, country, ZIP or foreign postal code, and telephone no. not be fully deductible by you. Limits based on the loan amount and the cost and value of the 2018 Mortgage secured property may apply. Also, you may only deduct interest to the Interest extent it was incurred by you, Statement actually paid by you, and not reimbursed by another person. First Bank of Texas Form 1098 236 Warren Street 1 Mortgage interest received from payer(s)/borrower(s)* Lubbock, TX 79401 $ Copy B 12,000 For Payer/ RECIPIENT'S/LENDER'S TIN PAYER'S/BORROWER'S TIN 2 Outstanding mortgage principal as of 1/1/2018 3 Mortgage origination date Borrower $ The information in boxes 4 Refund of overpaid 5 Mortgage insurance 1 through 9 is important 77-8455555 254-49-3534 interest premiums tax information and is PAYER'S/BORROWER'S name $ $ being fumished to the IRS. If you are required 6 Points paid on purchase of principal residence to file a return, a Carlos and Maria Gomez $ 3,000 negligence penalty or other sanction may be Street address (including apt. no.) 7 If address of property securing mortgage is the same imposed on you if the as PAYER'S/BORROWER'S address, the box is checked, or IRS determines that an the address or description is entered in box 8. underpayment of tax 543 West La Patera results because you City or town, state or province, country, and ZIP or foreign postal code 8 Address or description of property securing mortgage (see overstated a deduction instructions) for this mortgage interest Lubbock, TX 79401 or for these points, reported in boxes 1 and 9 Number of properties securing the 10 Other 6; or because you didn't mortgage report the refund of interest (box 4); or because you Account number (see instructions) claimed a nondeductible item. Form 1098 (Keep for your records) www.irs.gov/Form1098 Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) OMB No. 1545-0112 or foreign postal code, and telephone no. 2018 Interest 1 Interest income Income Grand Junction City $ Form 1099-INT 250 North 5th Street 2 Early withdrawal penalty Copy B Grand Junction, CO 81501 PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Treas. obligations For Recipient 77-8455555 265-24-8454 $ RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses This is important tax $ $ information and is 6 Foreign tax paid 7Foreign country or U.S. possession being furnished to the Maria Gomez IRS. If you are Street address (including apt. no.) $ required to file a 8 Tax-exempt interest 9 Specified private activity bond return, a negligence interest penalty or other 543 West La Patera sanction may be City or town, state or province, country, and ZIP or foreign postal code $ 3,500 $ 3,500 imposed on you if 10 Market discount 11 Bond premium this income is taxable and the IRS Lubbock, TX 79401 determines that it has FATCA filing | $ $ not been reported. requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond 0 $ $ Account number (see instructions) 14 Tax-exempt and tax credit 15 State | 16 State identification no. 17 State tax withheld bond CUSIP no. Form 1099-INT (keep for your records) www.irs.gov/Form 1099INT Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) OMB No. 1545-0112 or foreign postal code, and telephone no. 2018 Interest 1 Interest income Income First Bank of Texas $ 125 Form 1099-INT 236 Warren Street 2 Early withdrawal penalty Lubbock, TX 79401 Copy B PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Treas. obligations For Recipient 87-6455555 265-24-8454 $ RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses This is important tax $ $ information and is Maria Gomez 6 Foreign tax paid 7 Foreign country or U.S. possession being furnished to the IRS. If you are Street address (including apt. no.) $ required to file a 8 Tax-exempt interest 9 Specified private activity bond return, a negligence 543 West La Patera interest penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ $ imposed on you if 10 Market discount 11 Bond premium this income is taxable and the IRS Lubbock, TX 79401 determines that it has FATCA filing $ $ not been reported. requirement O 12 Bond premium on Treasury obligations | 13 Bond premium on tax-exempt bond $ $ Account number (see instructions) 14 Tax-exempt and tax credit 15 State | 16 State identification no. 17 State tax withheld bond CUSIP no. $ Form 1099-INT (keep for your records) www.irs.gov/Form 1099INT Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP | Payer's RTN (optional) OMB No. 1545-0112 or foreign postal code, and telephone no. Interest 1 Interest income 2018 Income Lubbock Texas School District $ Form 1099-INT 1532 District Street 2 Early withdrawal penalty Lubbock, TX 79401 Copy B PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Treas. obligations For Recipient 72-4455555 254-49-3534 $ RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses This is important tax $ $ information and is being furnished to the Carlos Gomez 6 Foreign tax paid 7 Foreign country or U.S. possession IRS. If you are Street address (including apt. no.) $ required to file a B Tax-exempt interest 9 Specified private activity bond return, a negligence interest penalty or other 543 West La Patera sanction may be City or town, state or province, country, and ZIP or foreign postal code $ 400 $ imposed on you if 10 Market discount 11 Bond premium this income is taxable and the IRS Lubbock, TX 79401 determines that it has FATCA filing | $ $ not been reported. requirement 12 Bond premium on Treasury obligations | 13 Bond premium on tax-exempt bond 0 $ Account number (see instructions) 14 Tax-exempt and tax credit 15 State | 16 State identification no. 17 State tax withheld bond CUSIP no. $ Form 1099-INT (keep for your records) www.irs.gov/Form 1099INT Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) OMB No. 1545-0112 or foreign postal code, and telephone no. 2018 Interest 1 Interest income Income $ Form 1099-INT Department of the Treasury 1500 Pennsylvania Avenue 2 Early withdrawal penalty Copy B Washington, DC 20220 PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Treas. obligations For Recipient 88-8888888 254-49-3534 $ 150 RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses This is important tax $ $ information and is being furnished to the Carlos Gomez 6 Foreign tax paid 7 Foreign country or U.S. possession IRS. If you are Street address (including apt. no.) $ required to file a 8 Tax-exempt interest 9 Specified private activity bond return, a negligence penalty or other 543 West La Patera interest sanction may be City or town, state or province, country, and ZIP or foreign postal code $ $ imposed on you if 10 Market discount 11 Bond premium this income is taxable and the IRS Lubbock, TX 79401 determines that it has FATCA filing |$ $ not been reported. requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond 0 $ $ Account number (see instructions) 14 Tax-exempt and tax credit 15 State |16 State identification no. 17 State tax withheld bond CUSIP no. $ Form 1099-INT (keep for your records) www.Irs.gov/Form 1099INT Department of the Treasury - Internal Revenue ServiceCORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) OMB No. 1545-0112 or foreign postal code, and telephone no. 2018 Interest 1 Interest income Income Rio Tinto Minerals $ 600 Form 1099-INT 8051 East Maplewood Avenue 2 Early withdrawal penalty Greenwood Village, CO 80111 Copy B PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Treas. obligations For Recipient 76-0125377 265-24-8454 $ RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses This is important tax $ $ information and is Maria Gomez 6 Foreign tax paid 7 Foreign country or U.S. possession being furnished to the IRS. If you are Street address (including apt. no.) $ required to file a 3 Tax-exempt interest 9 Specified private activity bond return, a negligence 543 West La Patera interest penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ $ imposed on you if 10 Market discount 11 Bond premium this income is taxable and the IRS Lubbock, TX 79401 determines that it has FATCA filing $ $ not been reported. requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond $ $ Account number (see instructions) 14 Tax-exempt and tax credit 15 State 16 State identification no. 17 State tax withheld bond CUSIP no. $ Form 1099-INT (keep for your records) www.irs.gov/Form 1099INT Department of the Treasury - Internal Revenue Service