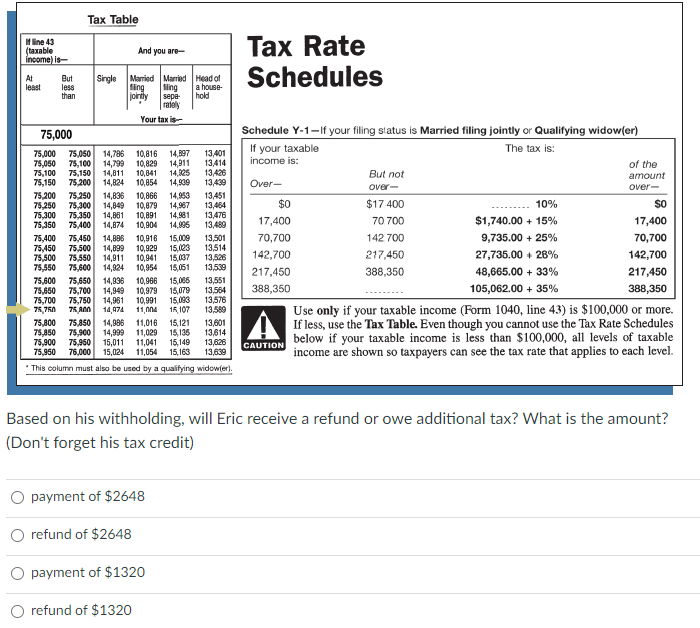

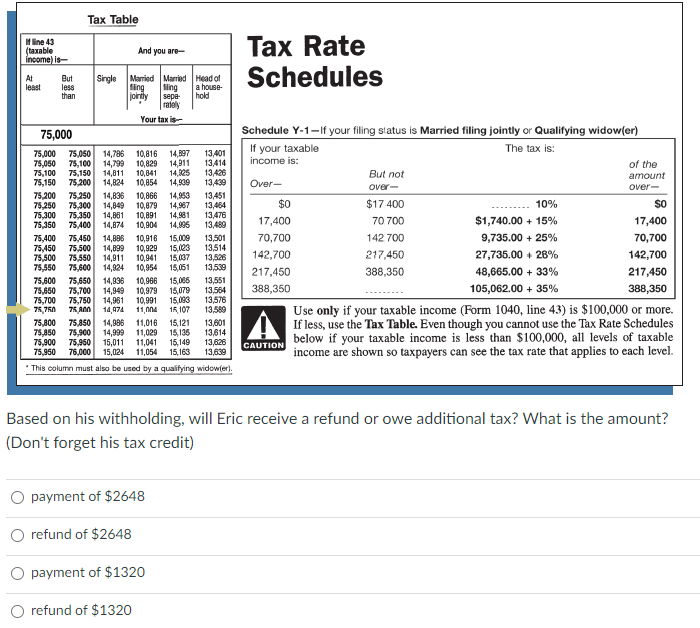

Tax Table line 43 (taxable income) is And you are Tax Rate Schedules jointly sepe At But Single Married Married Head of least less filing filing a house than hold rately Your taxis 75,000 75,000 75,050 14,786 10,816 14,897 13,401 75,050 75,100 14,799 10,829 14,911 13,414 75,100 75,150 14,811 10,841 14,125 13,426 75,150 75,200 14,824 10,854 14,900 13,439 75,200 75.250 14,836 10,866 13,451 75,250 75,300 14,849 10,879 14,967 13,464 75,300 75.350 14,881 10,891 14,981 13,476 75,350 75.400 14,874 10,904 14.995 13,480 75,400 75,450 14,896 10,916 15.009 13,501 75,450 75,500 14,899 10,929 15.023 13,514 75,500 75,550 14,911 10,941 15.007 13,526 75,550 75,600 14,924 10,954 15,051 13,599 75,600 75,650 14,836 10,966 15.066 13,551 75,650 75,700 14,949 10,979 15.079 13,564 75,700 75,750 14,981 10,991 15,093 13,576 76,760 75 RON 14,974 11, nu 15. 107 13,589 75.800 75,850 14,996 11,016 15, 121 13,601 75,850 75,900 14,999 11,029 15,136 13,614 75,900 75,950 15,011 11,041 15,149 13,826 75,950 76,000 15,024 11,054 15.163 13,639 This column must also be used by a qualifying widowier). Schedule Y-1-If your filing status is Married filing jointly or Qualifying widow(er) If your taxable The tax is: income is: of the But not amount Over- over- over- $0 $17 400 10% SO 17,400 70 700 $1,740.00 + 15% 17,400 70,700 142 700 9,735.00 + 25% 70,700 142,700 217,450 27,735.00 +28% 142,700 217,450 388,350 48,665.00 + 33% 217,450 388,350 105,062.00 + 35% 388,350 Use only if your taxable income (Form 1040, line 43) is $100,000 or more. If less, use the Tax Table. Even though you cannot use the Tax Rate Schedules below if your taxable income is less than $100,000, all levels of taxable income are shown so taxpayers can see the tax rate that applies to each level. CAUTION Based on his withholding, will Eric receive a refund or owe additional tax? What is the amount? (Don't forget his tax credit) payment of $2648 refund of $2648 O payment of $1320 refund of $1320 Tax Table line 43 (taxable income) is And you are Tax Rate Schedules jointly sepe At But Single Married Married Head of least less filing filing a house than hold rately Your taxis 75,000 75,000 75,050 14,786 10,816 14,897 13,401 75,050 75,100 14,799 10,829 14,911 13,414 75,100 75,150 14,811 10,841 14,125 13,426 75,150 75,200 14,824 10,854 14,900 13,439 75,200 75.250 14,836 10,866 13,451 75,250 75,300 14,849 10,879 14,967 13,464 75,300 75.350 14,881 10,891 14,981 13,476 75,350 75.400 14,874 10,904 14.995 13,480 75,400 75,450 14,896 10,916 15.009 13,501 75,450 75,500 14,899 10,929 15.023 13,514 75,500 75,550 14,911 10,941 15.007 13,526 75,550 75,600 14,924 10,954 15,051 13,599 75,600 75,650 14,836 10,966 15.066 13,551 75,650 75,700 14,949 10,979 15.079 13,564 75,700 75,750 14,981 10,991 15,093 13,576 76,760 75 RON 14,974 11, nu 15. 107 13,589 75.800 75,850 14,996 11,016 15, 121 13,601 75,850 75,900 14,999 11,029 15,136 13,614 75,900 75,950 15,011 11,041 15,149 13,826 75,950 76,000 15,024 11,054 15.163 13,639 This column must also be used by a qualifying widowier). Schedule Y-1-If your filing status is Married filing jointly or Qualifying widow(er) If your taxable The tax is: income is: of the But not amount Over- over- over- $0 $17 400 10% SO 17,400 70 700 $1,740.00 + 15% 17,400 70,700 142 700 9,735.00 + 25% 70,700 142,700 217,450 27,735.00 +28% 142,700 217,450 388,350 48,665.00 + 33% 217,450 388,350 105,062.00 + 35% 388,350 Use only if your taxable income (Form 1040, line 43) is $100,000 or more. If less, use the Tax Table. Even though you cannot use the Tax Rate Schedules below if your taxable income is less than $100,000, all levels of taxable income are shown so taxpayers can see the tax rate that applies to each level. CAUTION Based on his withholding, will Eric receive a refund or owe additional tax? What is the amount? (Don't forget his tax credit) payment of $2648 refund of $2648 O payment of $1320 refund of $1320