Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax witholding tables: In the appropriate steps of this problem, you will find prior period paycheck stubs and selected payroll data for Malone Company. Prepare

Tax witholding tables:

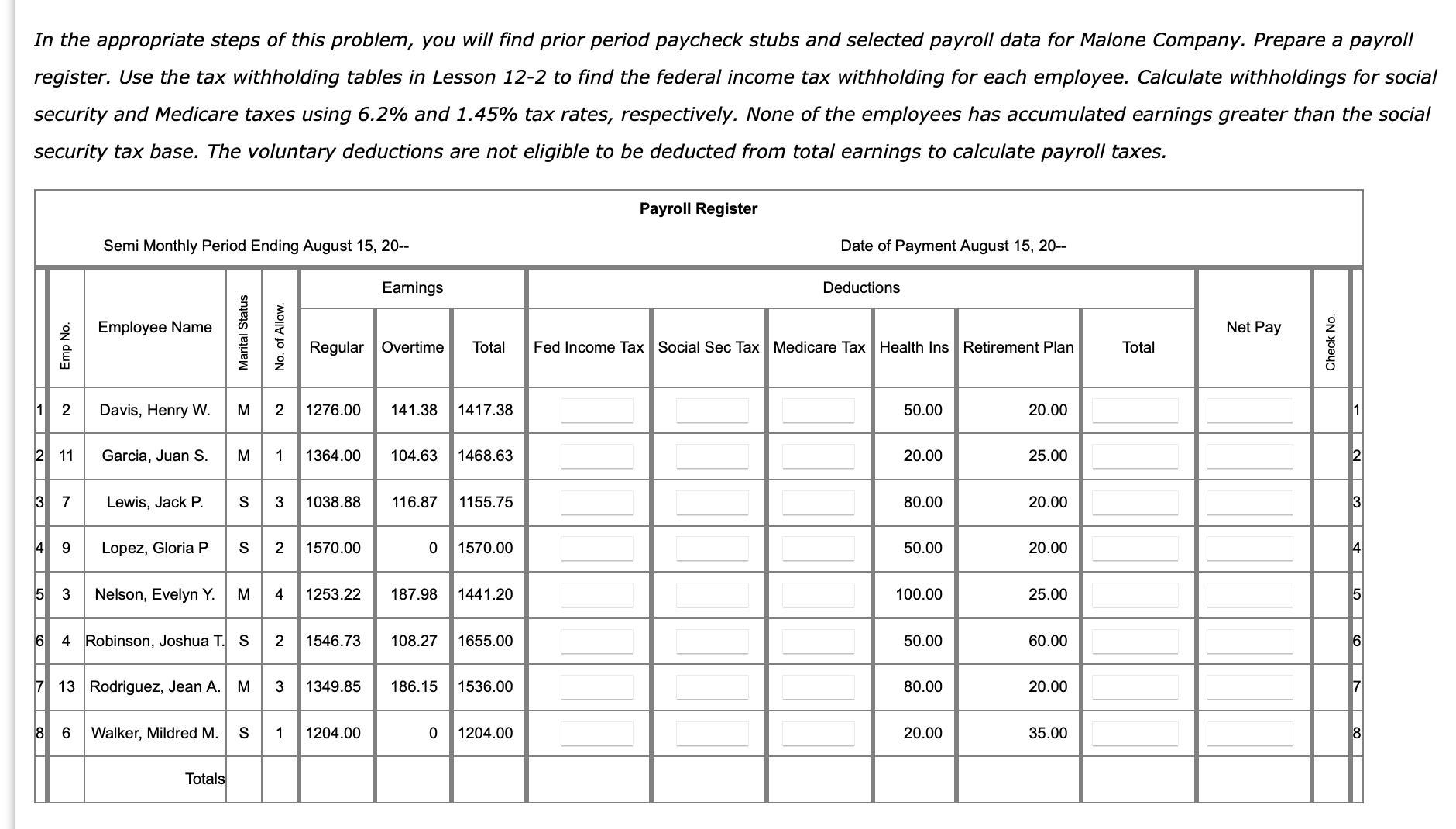

In the appropriate steps of this problem, you will find prior period paycheck stubs and selected payroll data for Malone Company. Prepare a payroll register. Use the tax withholding tables in Lesson 12-2 to find the federal income tax withholding for each employee. Calculate withholdings for soci security and Medicare taxes using 6.2% and 1.45\% tax rates, respectively. None of the employees has accumulated earnings greater than the security tax base. The voluntary deductions are not eligible to be deducted from total earnings to calculate payroll taxes. In the appropriate steps of this problem, you will find prior period paycheck stubs and selected payroll data for Malone Company. Prepare a payroll register. Use the tax withholding tables in Lesson 12-2 to find the federal income tax withholding for each employee. Calculate withholdings for soci security and Medicare taxes using 6.2% and 1.45\% tax rates, respectively. None of the employees has accumulated earnings greater than the security tax base. The voluntary deductions are not eligible to be deducted from total earnings to calculate payroll taxesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started