Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tax3247 my module is income taxation Question 1. Franko Mtobi is 52 years old. He is a livestock farmer, Three years ago, Franco Mtobi purchased

tax3247

my module is income taxation

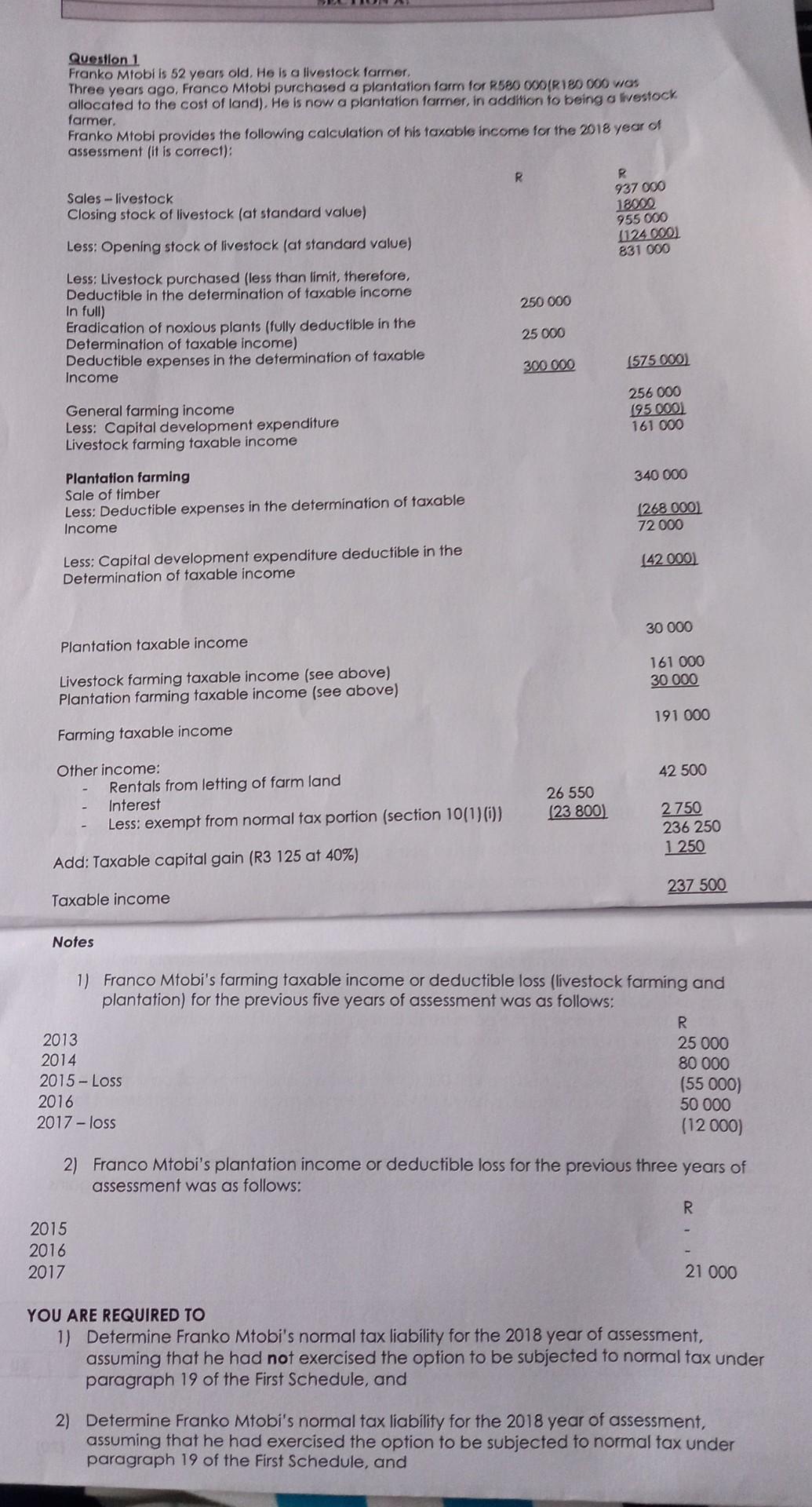

Question 1. Franko Mtobi is 52 years old. He is a livestock farmer, Three years ago, Franco Mtobi purchased a plantation form for R580 000(R180 000 was allocated to the cost of land). He is now a plantation farmer, in addition to being a livestock farmer. Franko Mtobi provides the following calculation of his taxable income for the 2018 year of assessment (it is correct): R R Sales-livestock Closing stock of livestock (at standard value) 937 000 18000 955 000 (124.0001 831 000 Less: Opening stock of livestock (at standard value) Less: Livestock purchased (less than limit, therefore, Deductible in the determination of taxable income In full) 250 000 Eradication of noxious plants (fully deductible in the Determination of taxable income) 25 000 Deductible expenses in the determination of taxable Income 300 000 (575 000) General farming income 256 000 (95 000) 161 000 Less: Capital development expenditure Livestock farming taxable income Plantation farming 340 000 Sale of timber Less: Deductible expenses in the determination of taxable Income (268 000) 72 000 Less: Capital development expenditure deductible in the Determination of taxable income (42 000) 30 000 Plantation taxable income Livestock farming taxable income (see above) Plantation farming taxable income (see above) 161 000 30 000 191 000 Farming taxable income Other income: 42 500 Rentals from letting of farm land 26 550 Interest Less: exempt from normal tax portion (section 10(1)(i)) (23 800) 2750 236 250 1 250 Add: Taxable capital gain (R3 125 at 40%) Taxable income 237 500 Notes 1) Franco Mtobi's farming taxable income or deductible loss (livestock farming and plantation) for the previous five years of assessment was as follows: R 2013 2014 25 000 80 000 2015-Loss 2016 (55 000) 50 000 (12 000) 2017-loss 2) Franco Mtobi's plantation income or deductible loss for the previous three years of assessment was as follows: R 2015 2016 2017 21 000 YOU ARE REQUIRED TO 1) Determine Franko Mtobi's normal tax liability for the 2018 year of assessment, assuming that he had not exercised the option to be subjected to normal tax under paragraph 19 of the First Schedule, and 2) Determine Franko Mtobi's normal tax liability for the 2018 year of assessment, assuming that he had exercised the option to be subjected to normal tax under paragraph 19 of the First Schedule, andStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started