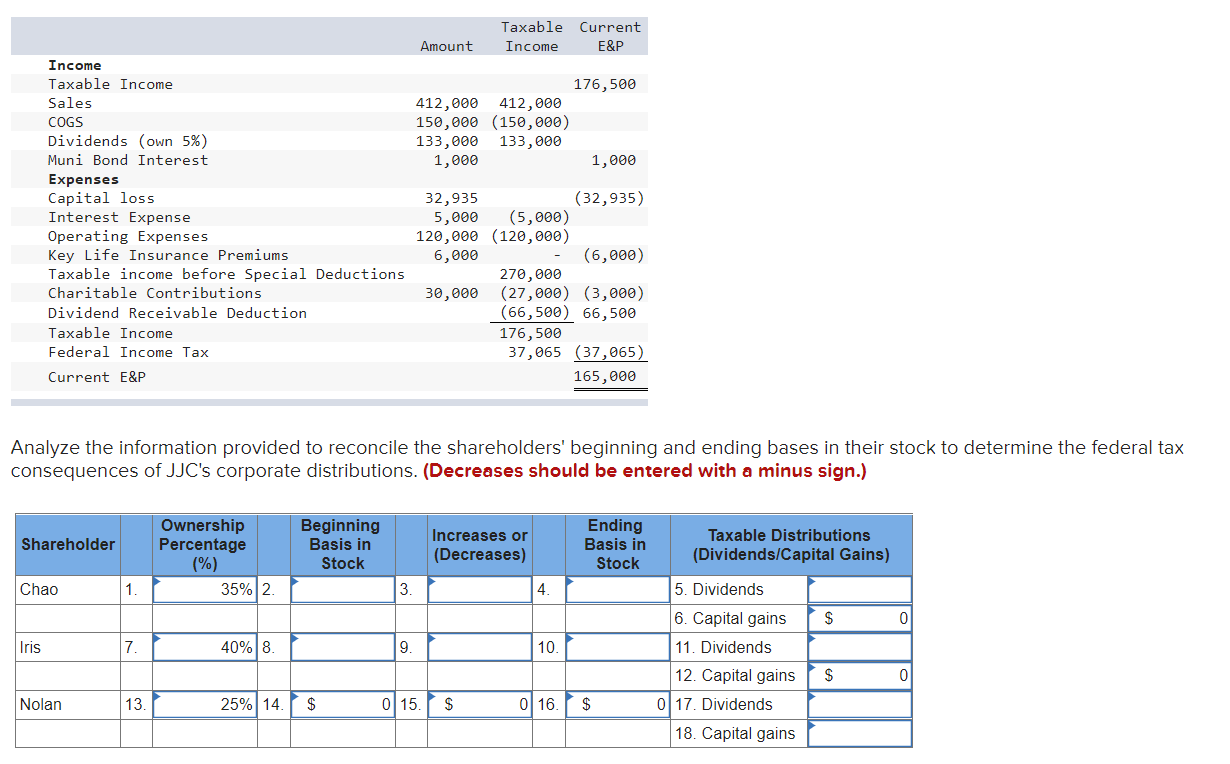

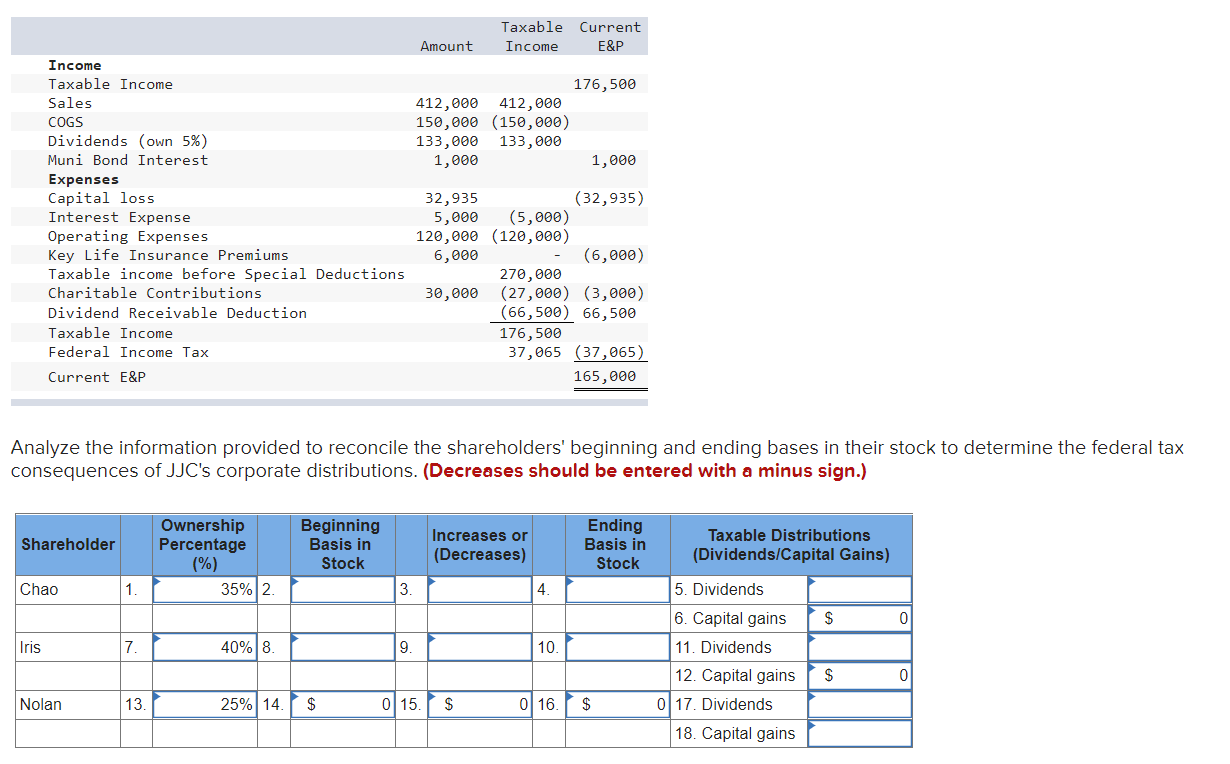

Taxable Income Current E&P Amount 176,500 412,000 412,000 150,000 (150,000) 133,000 133,000 1,000 1,000 Income Taxable Income Sales COGS Dividends (own 5%) Muni Bond Interest Expenses Capital loss Interest Expense Operating Expenses Key Life Insurance Premiums Taxable income before Special Deductions Charitable Contributions Dividend Receivable Deduction Taxable Income Federal Income Tax Current E&P 32,935 (32,935) 5,000 (5,000) 120,000 (120,000) 6,000 (6,000) 270,000 30,000 (27,000) (3,000) (66,500) 66,500 176,500 37,065 (37,065) 165,000 Analyze the information provided to reconcile the shareholders' beginning and ending bases in their stock to determine the federal tax consequences of JJC's corporate distributions. (Decreases should be entered with a minus sign.) Shareholder Ownership Percentage (%) 35% 2. Beginning Basis in Stock Increases or (Decreases) Ending Basis in Stock Taxable Distributions (Dividends/Capital Gains) Chao 1 3. 4. 5. Dividends 6. Capital gains $ 0 Iris 7. 40% 8. 9. 10. 11. Dividends $ 0 Nolan 13 25% 14. $ 015 $ 016 $ 12. Capital gains 0 17. Dividends 18. Capital gains Taxable Income Current E&P Amount 176,500 412,000 412,000 150,000 (150,000) 133,000 133,000 1,000 1,000 Income Taxable Income Sales COGS Dividends (own 5%) Muni Bond Interest Expenses Capital loss Interest Expense Operating Expenses Key Life Insurance Premiums Taxable income before Special Deductions Charitable Contributions Dividend Receivable Deduction Taxable Income Federal Income Tax Current E&P 32,935 (32,935) 5,000 (5,000) 120,000 (120,000) 6,000 (6,000) 270,000 30,000 (27,000) (3,000) (66,500) 66,500 176,500 37,065 (37,065) 165,000 Analyze the information provided to reconcile the shareholders' beginning and ending bases in their stock to determine the federal tax consequences of JJC's corporate distributions. (Decreases should be entered with a minus sign.) Shareholder Ownership Percentage (%) 35% 2. Beginning Basis in Stock Increases or (Decreases) Ending Basis in Stock Taxable Distributions (Dividends/Capital Gains) Chao 1 3. 4. 5. Dividends 6. Capital gains $ 0 Iris 7. 40% 8. 9. 10. 11. Dividends $ 0 Nolan 13 25% 14. $ 015 $ 016 $ 12. Capital gains 0 17. Dividends 18. Capital gains