Answered step by step

Verified Expert Solution

Question

1 Approved Answer

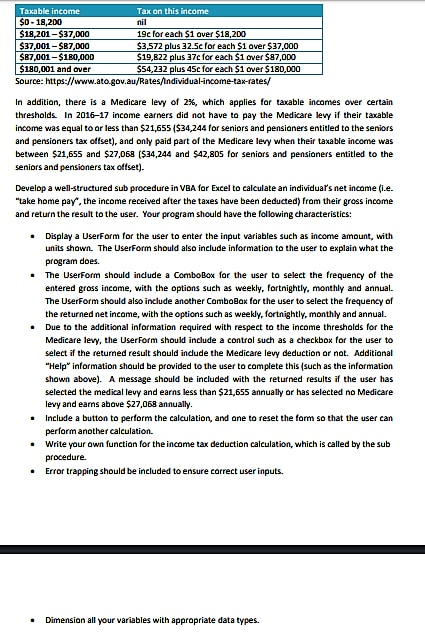

Taxable income S0-18,200 $18,201 $37,000 37,001-$87,000 Tax on this income nil 19c for each $1 aver $18,200 $3,572 plus 32.5cfor each $1 over $37,000 $19,822

Taxable income S0-18,200 $18,201 $37,000 37,001-$87,000 Tax on this income nil 19c for each $1 aver $18,200 $3,572 plus 32.5cfor each $1 over $37,000 $19,822 plus 37c for each $1 over $87,000 $54,232 plus 45c for each $1 over $180,D0O $B7,001-$1B0,000 $180,001 and over In addition, there is a Medicare levy of 2%, which applies for taxable incomes over certain thresholds In 2016-17 income earners did not have to pay the Medicare levy if their taxable income was equal to or less than $21,655 ($34,244 for seniors and pensianers entitied to the seniors and pensioners tax offset), and only paid part of the Medicare levy when their taxable income was between $21,655 and $27,068 S34,244 and $42,805 for seniors and pensioners entitled to the seniors and pensioners tax offset) Develop a well-structured sub procedure in VBA for Excel to calculate an individuals net income(ie "take home pay, the income received after the taxes have been deducted) fram their gross income and return the result to the user. Your program should have the fellowing characteristics: Display a UserForm for the user to enter the input variables such as income amount, with units shown The UserForm should also include information to the user to explain what the program does. . .The UserForm should indude a ComboBox for the user to select the frequency of the entered gross income, with the options such as weekly, fortnightly, monthly and annual. The UserForm should also include another ComboBax for the user to select the frequency of the returned net income, with the options such as weekly, fortnightly, monthly and annual. .Due to the additional information required with respect to the income thresholds for the Medicare levy, the UserForm should include a control such as a checkbox for the user to select if the returned result should indude the Medicare levy deduction or not. Additional "Help" information shauld be provided to the user to complete this (such as the information shown above). A message should be included with the returned results if the user has selected the medical levy and earns less than $21,655 annualy or has selected no Medicare levy and earns above $27,068 annually Include a button to perform the calculation, and one to reset the form so that the user can perform another calculation. Write your own functian for the income tax deduction calculation, which is called by the sub procedure. Error trapping should be included to ensure carrect user inputs. . Dimension all your variables with apprapriate data types. - Taxable income S0-18,200 $18,201 $37,000 37,001-$87,000 Tax on this income nil 19c for each $1 aver $18,200 $3,572 plus 32.5cfor each $1 over $37,000 $19,822 plus 37c for each $1 over $87,000 $54,232 plus 45c for each $1 over $180,D0O $B7,001-$1B0,000 $180,001 and over In addition, there is a Medicare levy of 2%, which applies for taxable incomes over certain thresholds In 2016-17 income earners did not have to pay the Medicare levy if their taxable income was equal to or less than $21,655 ($34,244 for seniors and pensianers entitied to the seniors and pensioners tax offset), and only paid part of the Medicare levy when their taxable income was between $21,655 and $27,068 S34,244 and $42,805 for seniors and pensioners entitled to the seniors and pensioners tax offset) Develop a well-structured sub procedure in VBA for Excel to calculate an individuals net income(ie "take home pay, the income received after the taxes have been deducted) fram their gross income and return the result to the user. Your program should have the fellowing characteristics: Display a UserForm for the user to enter the input variables such as income amount, with units shown The UserForm should also include information to the user to explain what the program does. . .The UserForm should indude a ComboBox for the user to select the frequency of the entered gross income, with the options such as weekly, fortnightly, monthly and annual. The UserForm should also include another ComboBax for the user to select the frequency of the returned net income, with the options such as weekly, fortnightly, monthly and annual. .Due to the additional information required with respect to the income thresholds for the Medicare levy, the UserForm should include a control such as a checkbox for the user to select if the returned result should indude the Medicare levy deduction or not. Additional "Help" information shauld be provided to the user to complete this (such as the information shown above). A message should be included with the returned results if the user has selected the medical levy and earns less than $21,655 annualy or has selected no Medicare levy and earns above $27,068 annually Include a button to perform the calculation, and one to reset the form so that the user can perform another calculation. Write your own functian for the income tax deduction calculation, which is called by the sub procedure. Error trapping should be included to ensure carrect user inputs. . Dimension all your variables with apprapriate data types

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started