Answered step by step

Verified Expert Solution

Question

1 Approved Answer

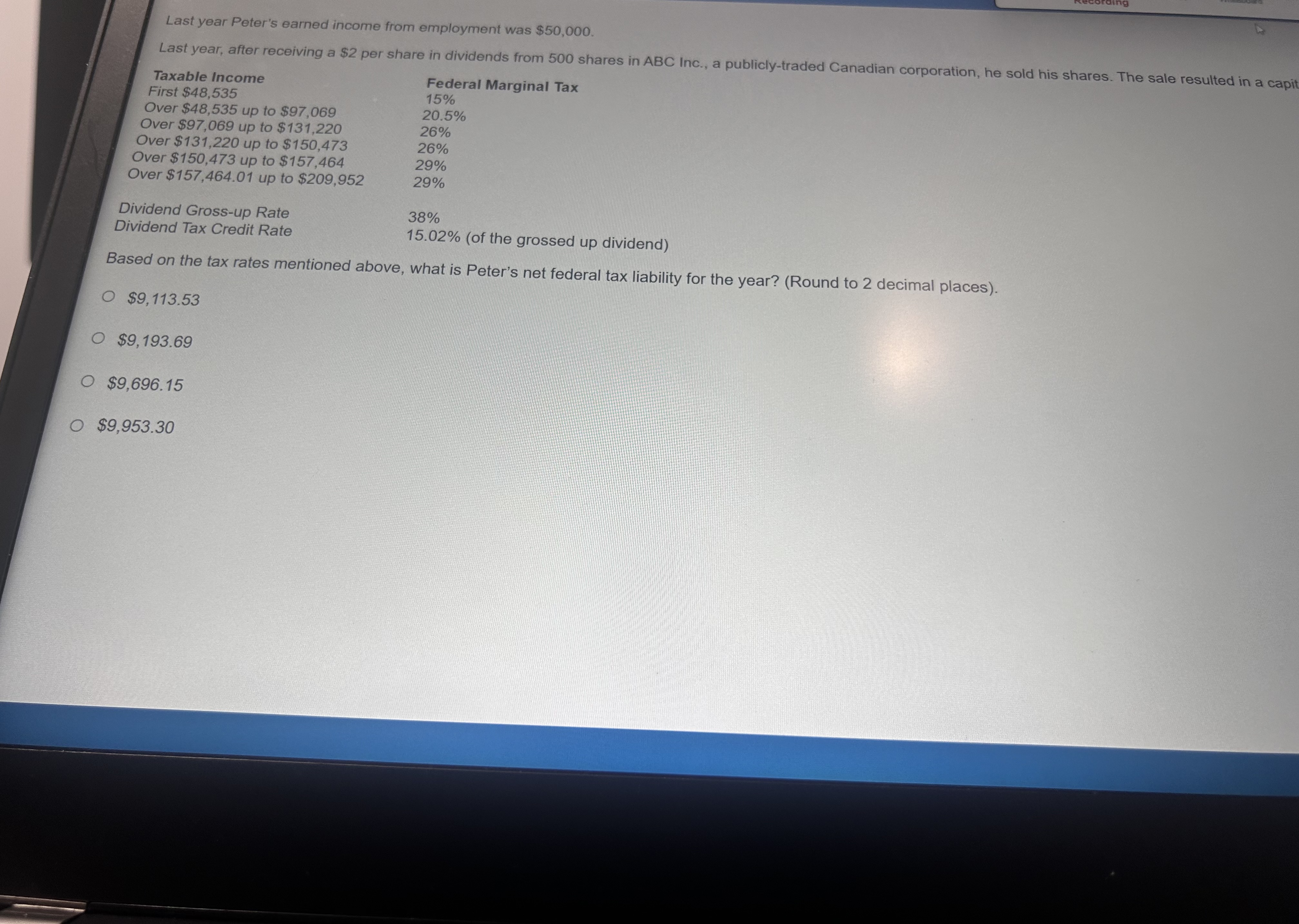

Taxable Income = Total IncomeLast year Peter's earned income from employment was $ 5 0 , 0 0 0 . Last year, after receiving a

Taxable Income Total IncomeLast year Peter's earned income from employment was $

Last year, after receiving a $ per share in dividends from shares in ABC Inc., a publiclytraded Canadian corporation, he sold his shares. The sale resulted in a capit

Taxable Income

First $

Over $ up to $

Over $ up to $

Over $ up to $

Over $ up to $

Over $ up to $

Dividend Grossup Rate

Dividend Tax Credit Rate

Federal Marginal Tax

of the grossed up dividend

Based on the tax rates mentioned above, what is Peter's net federal tax liability for the year? Round to decimal places

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started