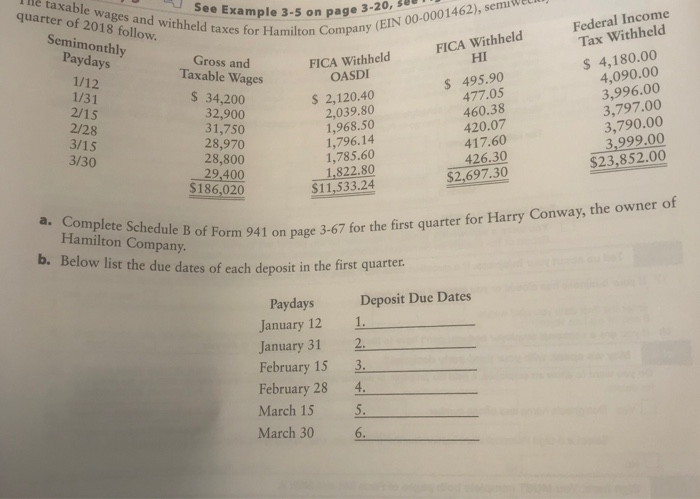

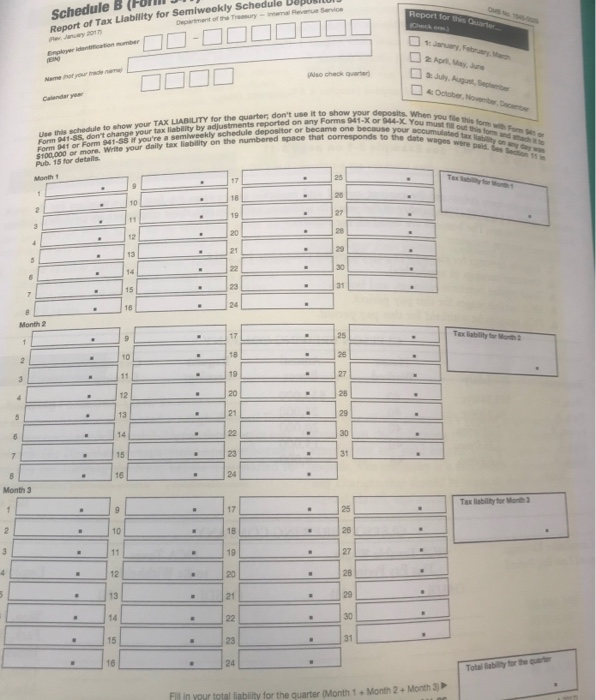

taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiW quarter of 2018 follow. See Example 3-5 on page 3-20, Federal Income Tax Withheld Semimonthly Paydays FICA Withheld HI Gross and Taxable Wages FICA Withheld OASDI $ 4,180.00 4,090.00 3,996.00 3,797.00 3,790.00 3,999.00 $23,852.00 1/12 1/31 2/15 S 495.90 477.05 $ 34,200 32,900 31,750 28,970 28,800 29,400 $186,020 $ 2,120.40 2,039.80 1,968.50 1,796.14 1,785.60 1,822.80 $11,533.24 460.38 420.07 417.60 2/28 3/15 3/30 426.30 $2,697.30 Complete Schedule B of Form 941 on page 3-67 for the first quarter for Harry Conway, the owner of a. Hamilton Company. b. Below list the due dates of each deposit in the first quarter. Deposit Due Dates Paydays January 12 January 31 February 15 February 28 1. 2. 3. 4 March 15 5. March 30 6. Schedule B Report of Tax Liability for Semiweekly Schedule D OMS No 50 Report for this Quarter Depertment of the Treasury-imal Revenue Sevice Check one) 1: January, February March Pe January 2017 Enolyer identfication number 2 April, May, June a July, August, September (Also check quarter Neme hor your tradnm October. November, Decemb Celendar year Use this schedule to show your TAX LIABIUITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or n't change your tax liatey b adlustments reported on any Forms 941-X or 944-X You must fil out this fom and ach to $100.000 or more. Write your daily tay lighillitY on the numbered space that corresponds to the date wages were paid. Sen Section 11 n Form 941 or Form 941-SS If you're a semiweekly schedule depositor or became one because your aocumulated tax bty on a Form 941-8S day was Pub. 15 for details. Tex bty for Month Month 1 25 17 26 16 10 27 19 1 3 28 20 12 29 13 22 30 14 31 23 15 24 16 Month 2 Tax liability for Month 2 25 17 1 26 18 10 27 19 11 3 20 28 10 21 29 13 5 22 30 14 6 23 31 15 7 24 16 Month 3 Tax liability for Month 3 25 17 2 18 28 10 27 3 11 19 4 28 20 21 29 13 30 14 22 31 15 23 24 16 Total lability for the quarter Fill in your total liability for the quarter (Month 1+ Month 2+ Month 3) e 12 taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiW quarter of 2018 follow. See Example 3-5 on page 3-20, Federal Income Tax Withheld Semimonthly Paydays FICA Withheld HI Gross and Taxable Wages FICA Withheld OASDI $ 4,180.00 4,090.00 3,996.00 3,797.00 3,790.00 3,999.00 $23,852.00 1/12 1/31 2/15 S 495.90 477.05 $ 34,200 32,900 31,750 28,970 28,800 29,400 $186,020 $ 2,120.40 2,039.80 1,968.50 1,796.14 1,785.60 1,822.80 $11,533.24 460.38 420.07 417.60 2/28 3/15 3/30 426.30 $2,697.30 Complete Schedule B of Form 941 on page 3-67 for the first quarter for Harry Conway, the owner of a. Hamilton Company. b. Below list the due dates of each deposit in the first quarter. Deposit Due Dates Paydays January 12 January 31 February 15 February 28 1. 2. 3. 4 March 15 5. March 30 6. Schedule B Report of Tax Liability for Semiweekly Schedule D OMS No 50 Report for this Quarter Depertment of the Treasury-imal Revenue Sevice Check one) 1: January, February March Pe January 2017 Enolyer identfication number 2 April, May, June a July, August, September (Also check quarter Neme hor your tradnm October. November, Decemb Celendar year Use this schedule to show your TAX LIABIUITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or n't change your tax liatey b adlustments reported on any Forms 941-X or 944-X You must fil out this fom and ach to $100.000 or more. Write your daily tay lighillitY on the numbered space that corresponds to the date wages were paid. Sen Section 11 n Form 941 or Form 941-SS If you're a semiweekly schedule depositor or became one because your aocumulated tax bty on a Form 941-8S day was Pub. 15 for details. Tex bty for Month Month 1 25 17 26 16 10 27 19 1 3 28 20 12 29 13 22 30 14 31 23 15 24 16 Month 2 Tax liability for Month 2 25 17 1 26 18 10 27 19 11 3 20 28 10 21 29 13 5 22 30 14 6 23 31 15 7 24 16 Month 3 Tax liability for Month 3 25 17 2 18 28 10 27 3 11 19 4 28 20 21 29 13 30 14 22 31 15 23 24 16 Total lability for the quarter Fill in your total liability for the quarter (Month 1+ Month 2+ Month 3) e 12