Answered step by step

Verified Expert Solution

Question

1 Approved Answer

taxation #1) (2 Marks) Mark Mayer earns only pension income in the year and filed his 2017 personal income tax return. His spouse Julie Mayer

taxation

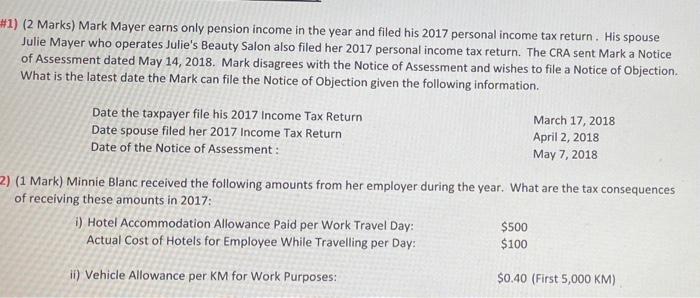

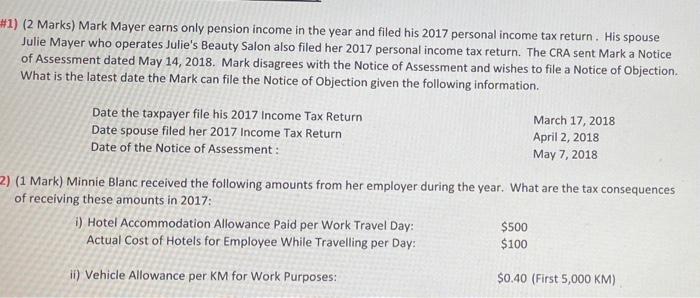

#1) (2 Marks) Mark Mayer earns only pension income in the year and filed his 2017 personal income tax return. His spouse Julie Mayer who operates Julie's Beauty Salon also filed her 2017 personal income tax return. The CRA sent Mark a Notice of Assessment dated May 14, 2018. Mark disagrees with the Notice of Assessment and wishes to file a Notice of Objection What is the latest date the Mark can file the Notice of Objection given the following information. Date the taxpayer file his 2017 Income Tax Return Date spouse filed her 2017 Income Tax Return Date of the Notice of Assessment: March 17, 2018 April 2, 2018 May 7, 2018 2) (1 mark) Minnie Blanc received the following amounts from her employer during the year. What are the tax consequences of receiving these amounts in 2017: i) Hotel Accommodation Allowance Paid per Work Travel Day: $500 Actual Cost of Hotels for Employee While Travelling per Day: $100 it) Vehicle Allowance per KM for Work Purposes: $0.40 (First 5,000 KM)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started