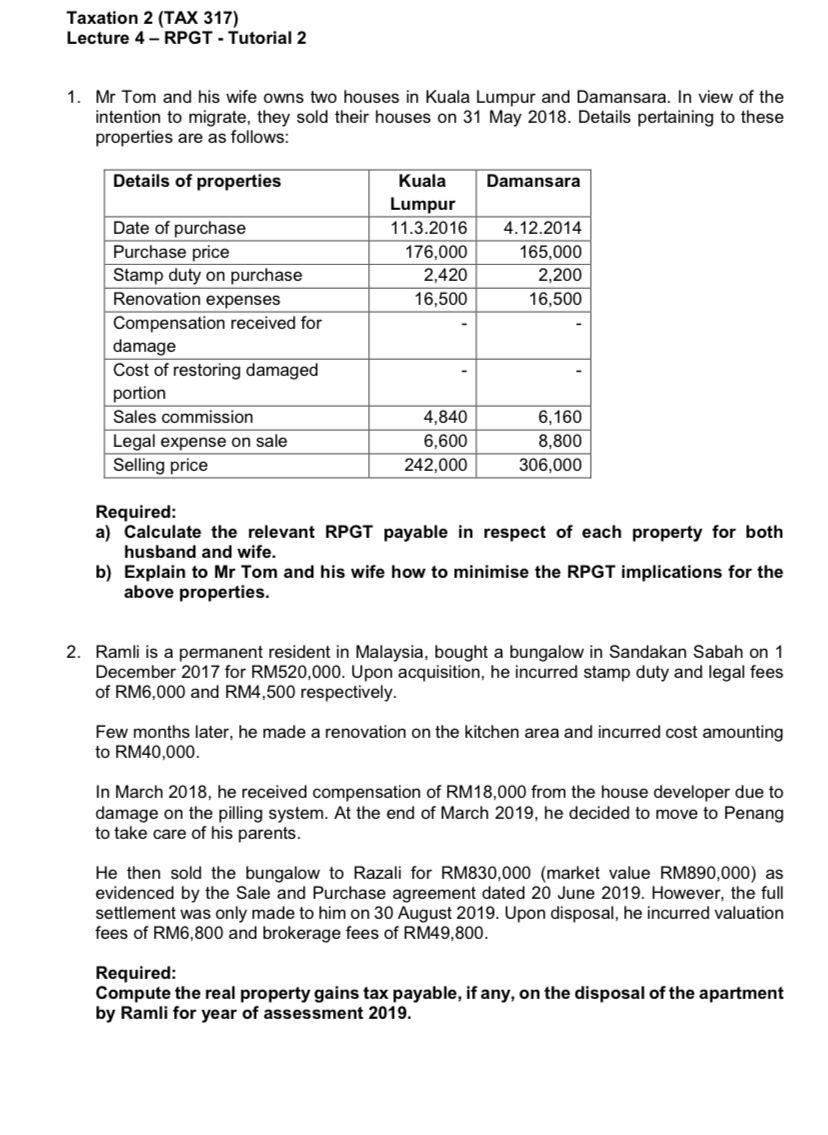

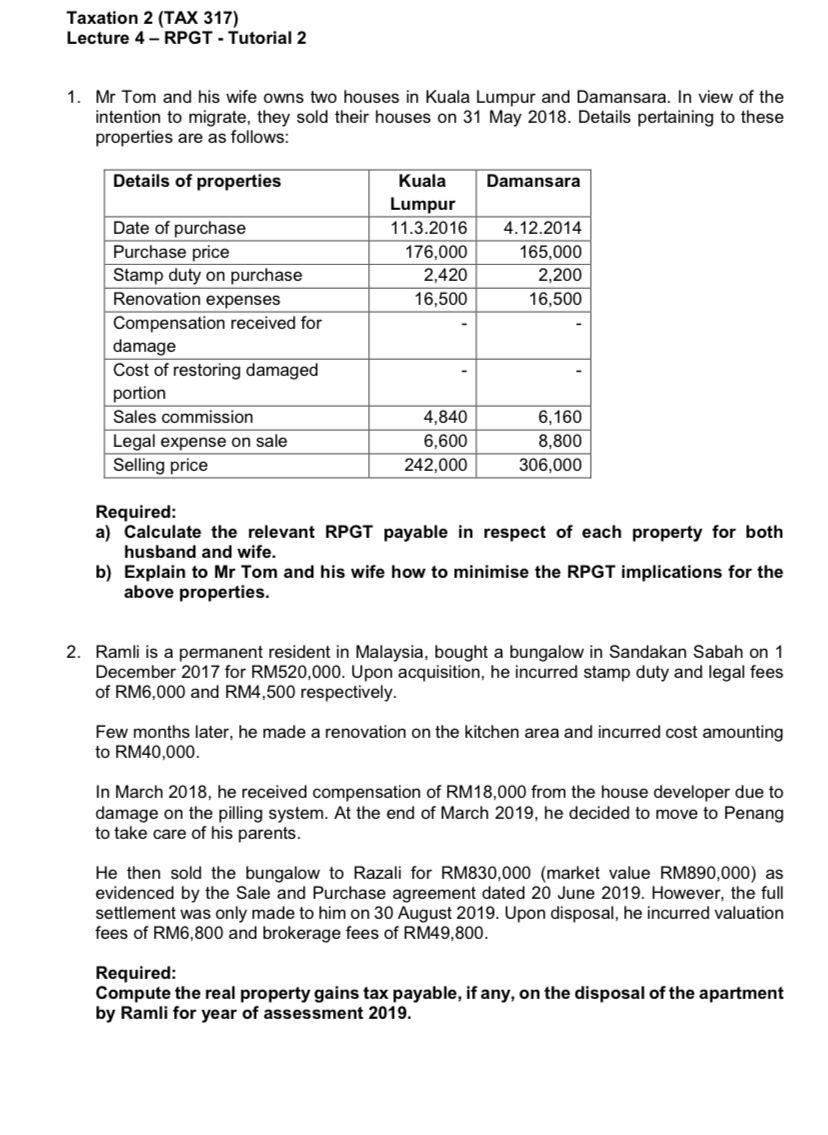

Taxation 2 (TAX 317) Lecture 4 - RPGT - Tutorial 2 1. Mr Tom and his wife owns two houses in Kuala Lumpur and Damansara. In view of the intention to migrate, they sold their houses on 31 May 2018. Details pertaining to these properties are as follows: Details of properties Damansara Kuala Lumpur 11.3.2016 176.000 2,420 16,500 4.12.2014 165,000 2,200 16,500 Date of purchase Purchase price Stamp duty on purchase Renovation expenses Compensation received for damage Cost of restoring damaged portion Sales commission Legal expense on sale Selling price 4,840 6,600 242,000 6,160 8,800 306,000 Required: a) Calculate the relevant RPGT payable in respect of each property for both husband and wife. b) Explain to Mr Tom and his wife how to minimise the RPGT implications for the above properties. 2. Ramli is a permanent resident in Malaysia, bought a bungalow in Sandakan Sabah on 1 December 2017 for RM520,000. Upon acquisition, he incurred stamp duty and legal fees of RM6,000 and RM4,500 respectively. Few months later, he made a renovation on the kitchen area and incurred cost amounting to RM40,000 In March 2018, he received compensation of RM18,000 from the house developer due to damage on the pilling system. At the end of March 2019, he decided to move to Penang to take care of his parents. He then sold the bungalow to Razali for RM830,000 (market value RM890,000) as evidenced by the Sale and Purchase agreement dated 20 June 2019. However, the full settlement was only made to him on 30 August 2019. Upon disposal, he incurred valuation fees of RM6,800 and brokerage fees of RM49,800. Required: Compute the real property gains tax payable, if any, on the disposal of the apartment by Ramli for year of assessment 2019. Taxation 2 (TAX 317) Lecture 4 - RPGT - Tutorial 2 1. Mr Tom and his wife owns two houses in Kuala Lumpur and Damansara. In view of the intention to migrate, they sold their houses on 31 May 2018. Details pertaining to these properties are as follows: Details of properties Damansara Kuala Lumpur 11.3.2016 176.000 2,420 16,500 4.12.2014 165,000 2,200 16,500 Date of purchase Purchase price Stamp duty on purchase Renovation expenses Compensation received for damage Cost of restoring damaged portion Sales commission Legal expense on sale Selling price 4,840 6,600 242,000 6,160 8,800 306,000 Required: a) Calculate the relevant RPGT payable in respect of each property for both husband and wife. b) Explain to Mr Tom and his wife how to minimise the RPGT implications for the above properties. 2. Ramli is a permanent resident in Malaysia, bought a bungalow in Sandakan Sabah on 1 December 2017 for RM520,000. Upon acquisition, he incurred stamp duty and legal fees of RM6,000 and RM4,500 respectively. Few months later, he made a renovation on the kitchen area and incurred cost amounting to RM40,000 In March 2018, he received compensation of RM18,000 from the house developer due to damage on the pilling system. At the end of March 2019, he decided to move to Penang to take care of his parents. He then sold the bungalow to Razali for RM830,000 (market value RM890,000) as evidenced by the Sale and Purchase agreement dated 20 June 2019. However, the full settlement was only made to him on 30 August 2019. Upon disposal, he incurred valuation fees of RM6,800 and brokerage fees of RM49,800. Required: Compute the real property gains tax payable, if any, on the disposal of the apartment by Ramli for year of assessment 2019