Answered step by step

Verified Expert Solution

Question

1 Approved Answer

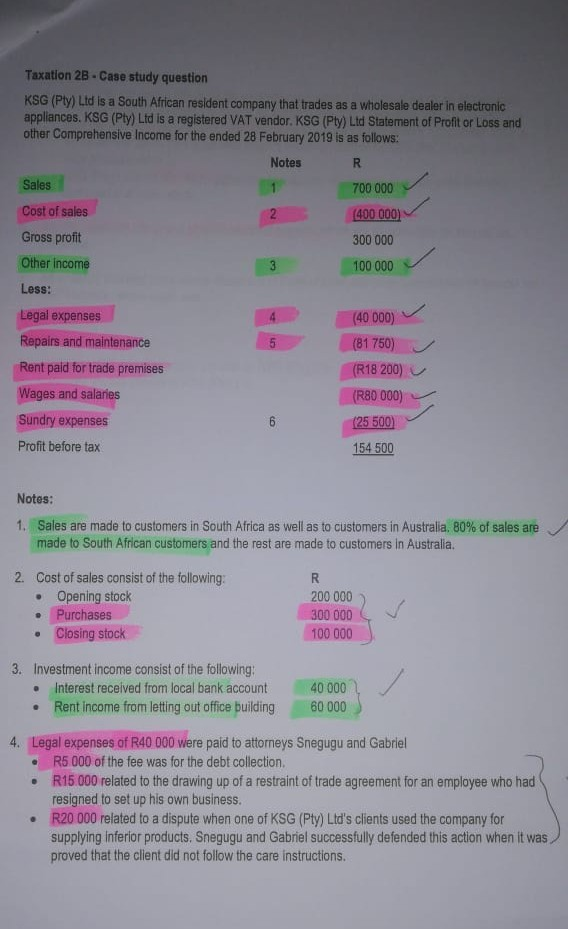

Taxation 2B - Case study question KSG (Ply) Ltd is a South African resident company that trades as a wholesale dealer in electronic appliances, KSG

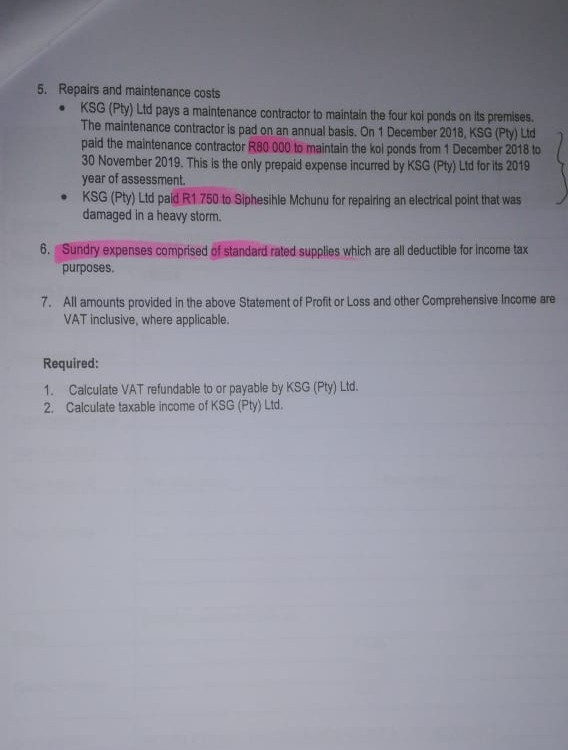

Taxation 2B - Case study question KSG (Ply) Ltd is a South African resident company that trades as a wholesale dealer in electronic appliances, KSG (Ply) Ltd is a registered VAT vendor. KSG (Ply) Ltd Statement of Profit or Loss and other Comprehensive Income for the ended 28 February 2019 is as follows: Notes R Sales 700 000 Cost of sales (400 000) 300 000 Gross profit Other income 100 000 5 Less: Legal expenses Repairs and maintenance Rent paid for trade premises Wages and salaries Sundry expenses Profit before tax (40 000) (81 750) (R18 200) (R80 000) (25 500) 154 500 6 6 Notes: 1. Sales are made to customers in South Africa as well as to customers in Australia. 80% of sales are made to South African customers and the rest are made to customers in Australia. 2. Cost of sales consist of the following: R Opening stock 200 000 Purchases 300 000 Closing stock 100 000 3. Investment income consist of the following: Interest received from local bank account Rent income from letting out office building 40 000 60 000 . 4. Legal expenses of R40 000 were paid to attorneys Snegugu and Gabriel R5 000 of the fee was for the debt collection R15.000 related to the drawing up of a restraint of trade agreement for an employee who had resigned to set up his own business. R20 000 related to a dispute when one of KSG (Pty) Ltd's clients used the company for supplying Inferior products, Snegugu and Gabriel successfully defended this action when it was proved that the client did not follow the care instructions. 5. Repairs and maintenance costs KSG (Pty) Ltd pays a maintenance contractor to maintain the four kol pands on its premises. The maintenance contractor is pad on an annual basis. On 1 December 2018, KSG (Pty) Ltd paid the maintenance contractor R80 000 to maintain the kol ponds from 1 December 2018 to 30 November 2019. This is the only prepaid expense incurred by KSG (Pty) Ltd for its 2018 year of assessment KSG (Pty) Ltd pald R1 750 to Siphesihle Mchunu for repairing an electrical point that was damaged in a heavy storm. 6. Sundry expenses comprised of standard rated supplies which are all deductible for income tax purposes. 7. All amounts provided in the above Statement of Profit or Loss and other Comprehensive Income are VAT inclusive, where applicable. Required: 1. Calculate VAT refundable to or payable by KSG (Pty) Ltd. 2. Calculate taxable income of KSG (Pty) Ltd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started