Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxation 3A (1) Please calculate/prepare the Taxable Income for Compute Golden Glow for the year ended 28 February 2023 NB: Ignore VAT Golden glow (Pty)

Taxation 3A (1)

Please calculate/prepare the Taxable Income for Compute Golden Glow for the year ended 28 February 2023 NB: Ignore VAT

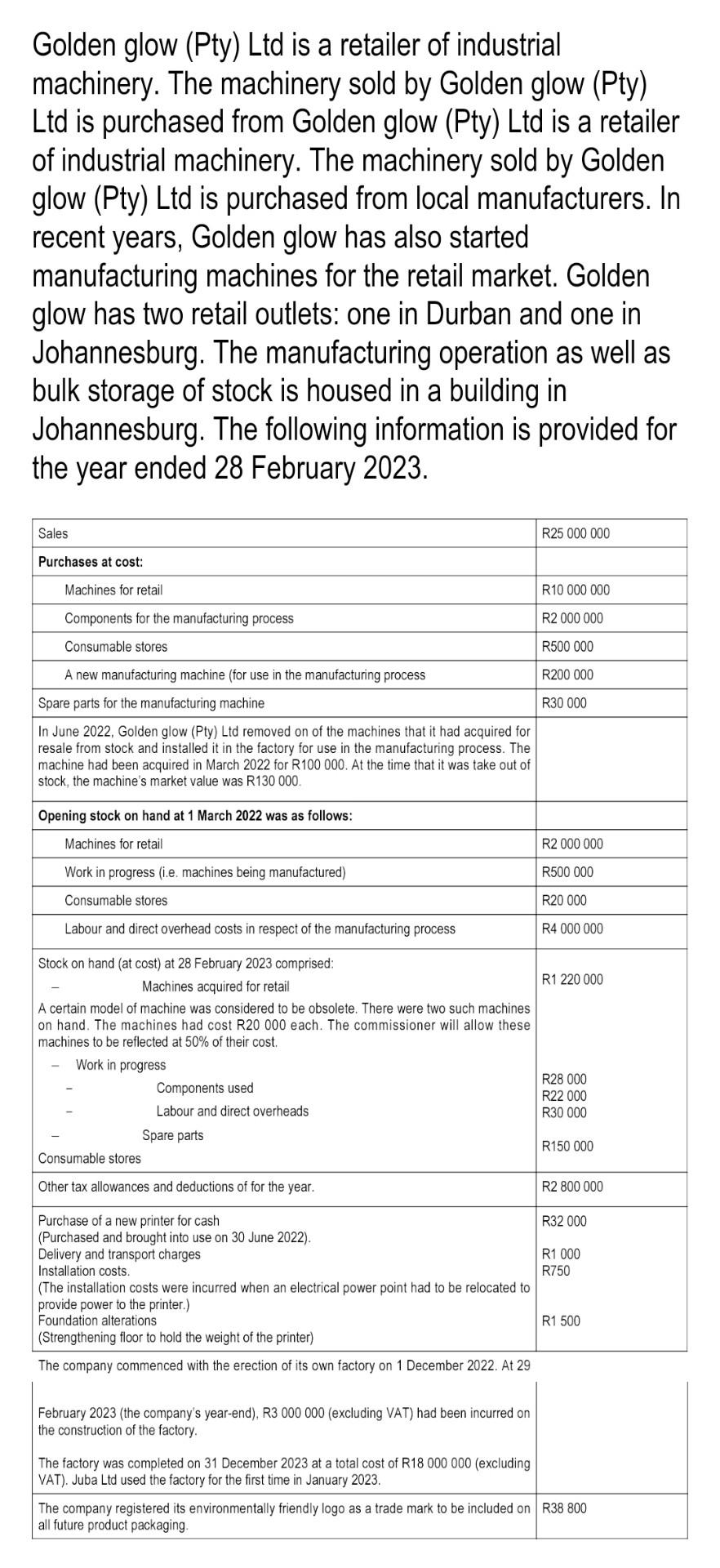

Golden glow (Pty) Ltd is a retailer of industrial machinery. The machinery sold by Golden glow (Pty) Ltd is purchased from Golden glow (Pty) Ltd is a retailer of industrial machinery. The machinery sold by Golden glow (Pty) Ltd is purchased from local manufacturers. In recent years, Golden glow has also started manufacturing machines for the retail market. Golden glow has two retail outlets: one in Durban and one in Johannesburg. The manufacturing operation as well as bulk storage of stock is housed in a building in Johannesburg. The following information is provided for the year ended 28 February 2023. Compute Golden glow (Pty) Ltd's taxable income for the year ended 28 February 2023 (30 Marks) NB: Ignore VAT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started