Answered step by step

Verified Expert Solution

Question

1 Approved Answer

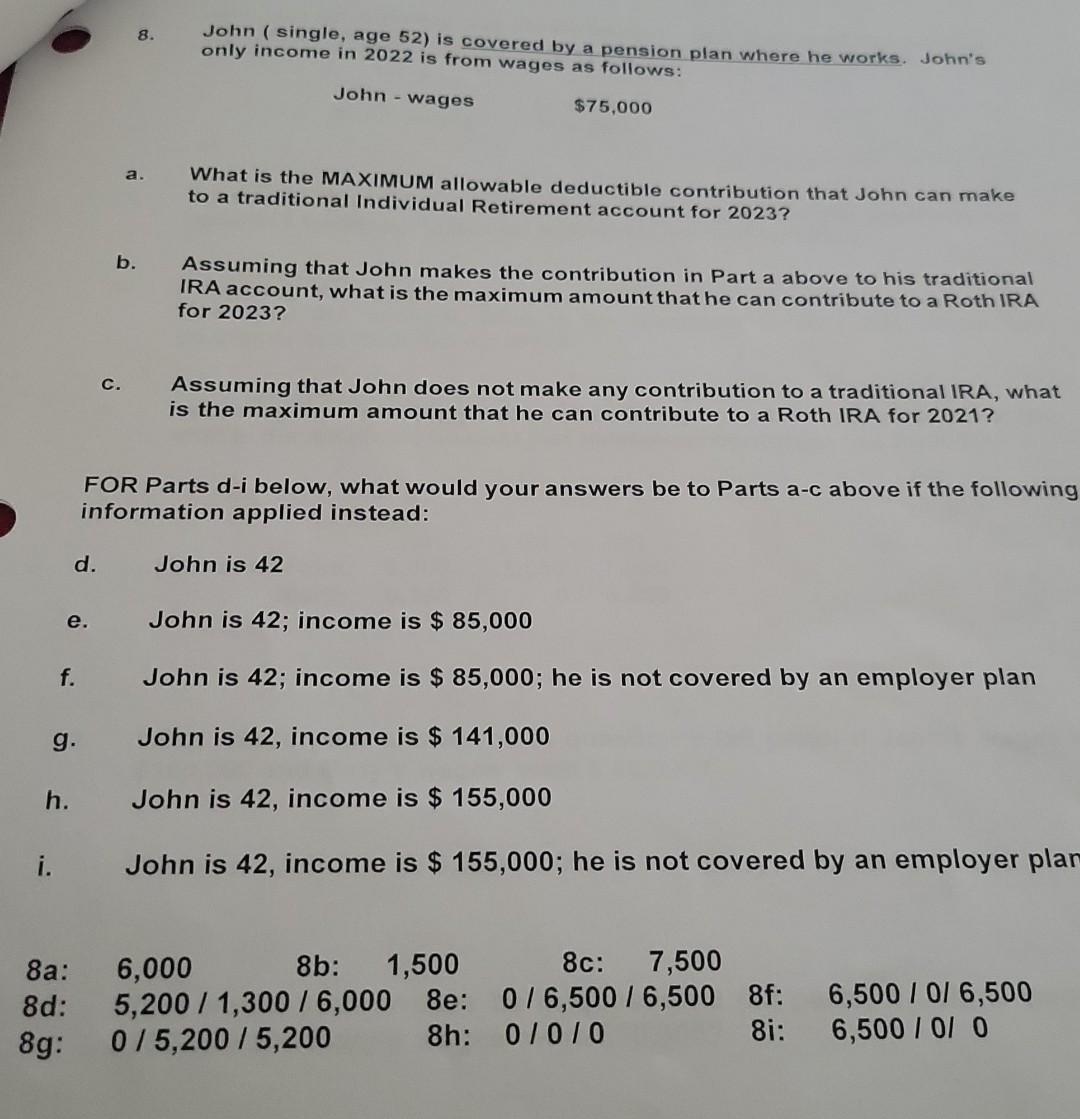

TAXATION 8. John ( single, age 52) is covered by a pension plan where he works. John's only income in 2022 is from wages as

TAXATION

8. John ( single, age 52) is covered by a pension plan where he works. John's only income in 2022 is from wages as follows: John - wages $75,000 a. What is the MAXIMUM allowable deductible contribution that John can make to a traditional Individual Retirement account for 2023 ? b. Assuming that John makes the contribution in Part a above to his traditional IRA account, what is the maximum amount that he can contribute to a Roth IRA for 2023 ? c. Assuming that John does not make any contribution to a traditional IRA, what is the maximum amount that he can contribute to a Roth IRA for 2021? FOR Parts d-i below, what would your answers be to Parts a-c above if the following information applied instead: d. John is 42 e. John is 42 ; income is $85,000 f. John is 42 ; income is $85,000; he is not covered by an employer plan g. John is 42 , income is $141,000 h. John is 42 , income is $155,000 John is 42 , income is $155,000; he is not covered by an employer plaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started