Taxation

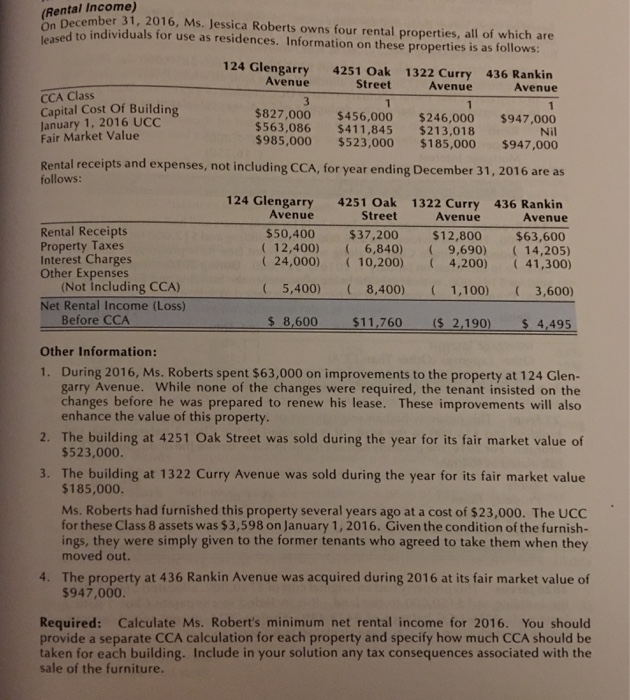

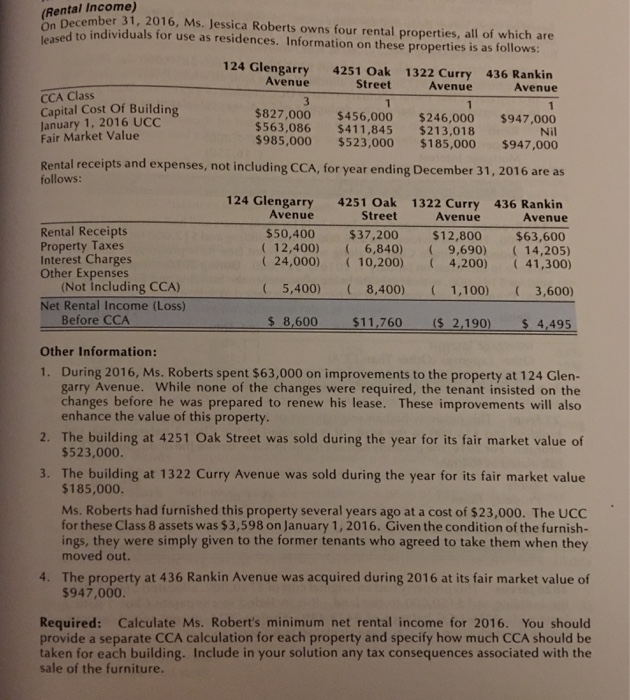

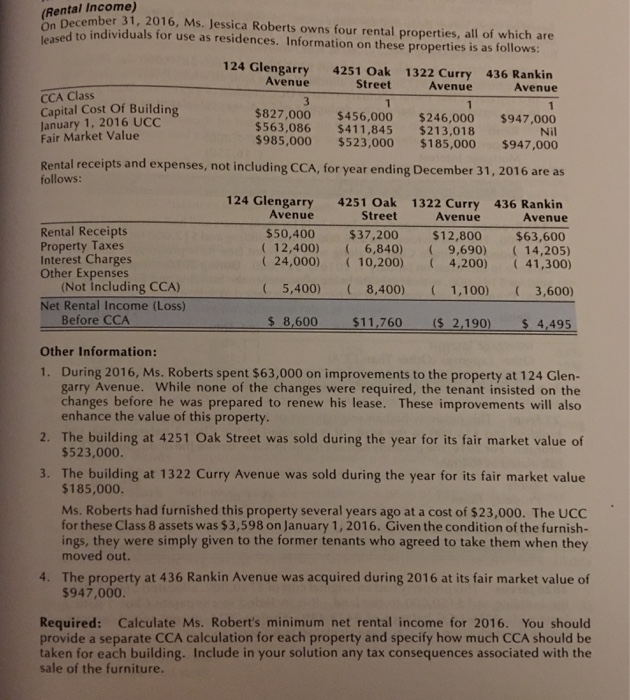

On December 31, 2016, Ms. Jessica Roberts owns four rental properties all of which are leased to individuals for use as residences. Information on these properties is as follows: During 2016, Ms. Roberts spent $63,000 on improvements to the property at 124 Glengarry Avenue. While none of the changes were required, the tenant insisted on the changes before he was prepared to renew his lease. These improvements will also enhance the value of this property. The building at 4251 Oak Street was sold during the year for its fair market value of $523,000. The building at 1322 Curry Avenue was sold during the year for its fair market value $185,000. Ms. Roberts had furnished this property several years ago at a cost of $23,000. The UCC for these Class 8 assets was $3, 598 on January 1, 2016. Given the condition of the furnishings, they were simply given to the former tenants who agreed to take them when they moved out. The property at 436 Rankin Avenue was acquired during 2016 at its fair market value of $947,000. Required: Calculate Ms. Roberts minimum net rental income for 2016. You should provide a separate CCA calculation for each property and specify how much CCA should be taken for each building. Include in your solution any tax consequences associated with the sale of the furniture. On December 31, 2016, Ms. Jessica Roberts owns four rental properties all of which are leased to individuals for use as residences. Information on these properties is as follows: During 2016, Ms. Roberts spent $63,000 on improvements to the property at 124 Glengarry Avenue. While none of the changes were required, the tenant insisted on the changes before he was prepared to renew his lease. These improvements will also enhance the value of this property. The building at 4251 Oak Street was sold during the year for its fair market value of $523,000. The building at 1322 Curry Avenue was sold during the year for its fair market value $185,000. Ms. Roberts had furnished this property several years ago at a cost of $23,000. The UCC for these Class 8 assets was $3, 598 on January 1, 2016. Given the condition of the furnishings, they were simply given to the former tenants who agreed to take them when they moved out. The property at 436 Rankin Avenue was acquired during 2016 at its fair market value of $947,000. Required: Calculate Ms. Roberts minimum net rental income for 2016. You should provide a separate CCA calculation for each property and specify how much CCA should be taken for each building. Include in your solution any tax consequences associated with the sale of the furniture