taxation question

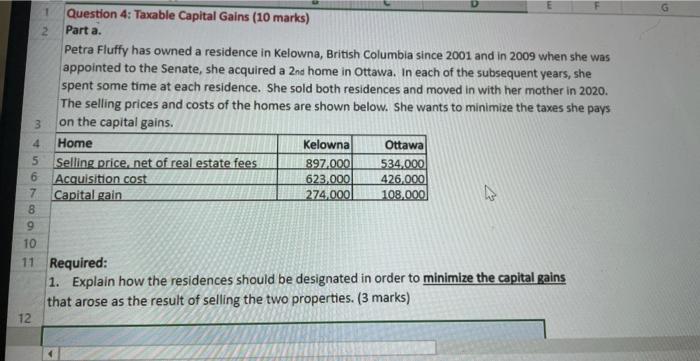

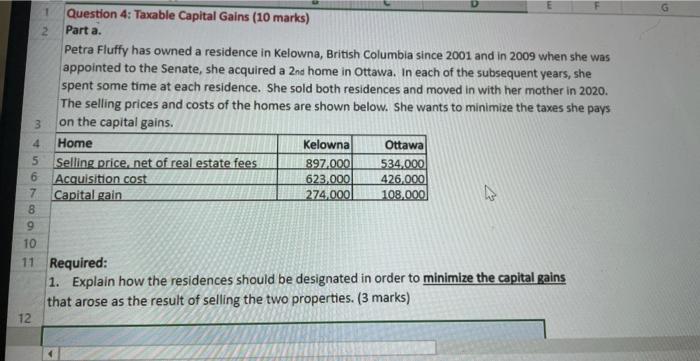

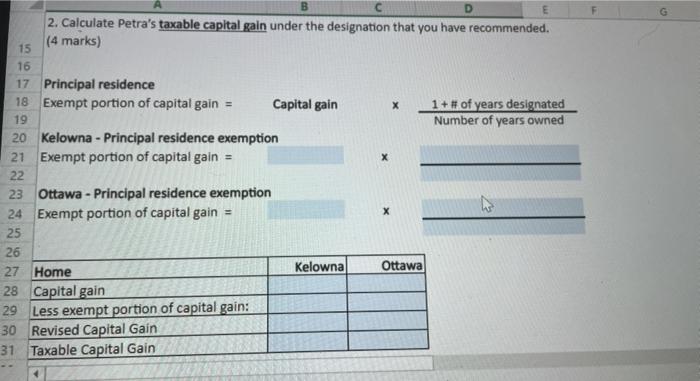

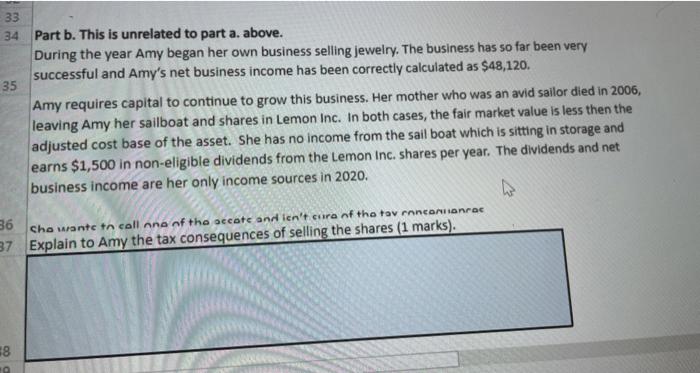

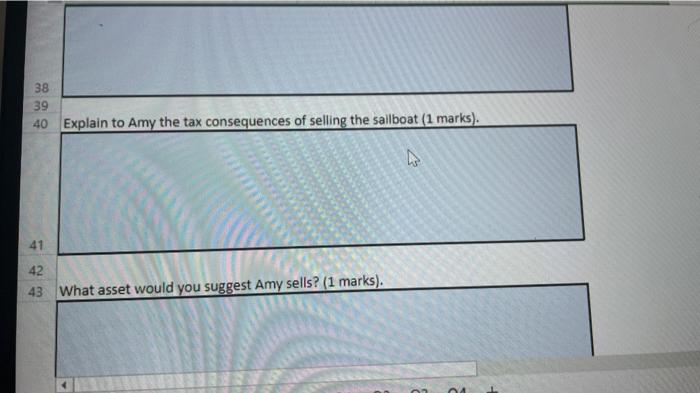

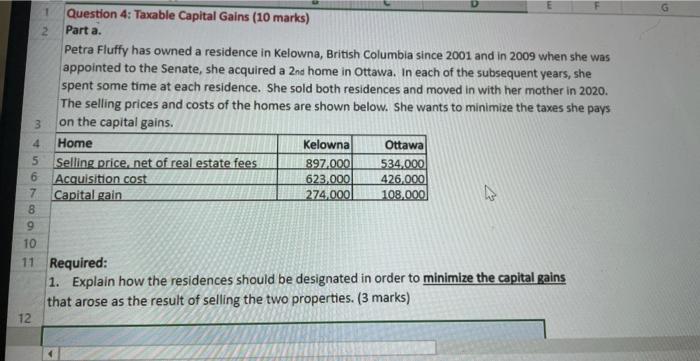

1 Question 4: Taxable Capital Gains (10 marks) Part a. Petra Fluffy has owned a residence in Kelowna, British Columbia since 2001 and in 2009 when she was appointed to the Senate, she acquired a 2nd home in Ottawa. In each of the subsequent years, she spent some time at each residence. She sold both residences and moved in with her mother in 2020. The selling prices and costs of the homes are shown below. She wants to minimize the taxes she pays 3 on the capital gains. 4 Home Kelowna Ottawa 5 Selling price, net of real estate fees 897.000 534,000 6 Acquisition cost 623,000 426.000 7 Capital gain 274,000 108,000 8 9 10 11 Required: 1. Explain how the residences should be designated in order to minimize the capital gains that arose as the result of selling the two properties. (3 marks) 12 X D 2. Calculate Petra's taxable capital gain under the designation that you have recommended. 15 (4 marks) 16 17 Principal residence 18 Exempt portion of capital gain = Capital gain 1+ # of years designated 19 Number of years owned 20 Kelowna - Principal residence exemption 21 Exempt portion of capital gain = 22 23 Ottawa - Principal residence exemption 24 Exempt portion of capital gain = 25 26 27 Home Kelowna Ottawa 28 Capital gain 29 Less exempt portion of capital gain: 30 Revised Capital Gain 31 Taxable Capital Gain 33 34 Part b. This is unrelated to part a. above. During the year Amy began her own business selling jewelry. The business has so far been very successful and Amy's net business income has been correctly calculated as $48,120. 35 Amy requires capital to continue to grow this business. Her mother who was an avid sailor died in 2006, leaving Amy her sailboat and shares in Lemon Inc. In both cases, the fair market value is less then the adjusted cost base of the asset. She has no income from the sail boat which is sitting in storage and earns $1,500 in non-eligible dividends from the Lemon Inc. shares per year. The dividends and net business income are her only income sources in 2020. 36 she wants to call one of the accate and ion't cura nf the tav ronconitanec 37 Explain to Amy the tax consequences of selling the shares (1 marks). 38 . 38 39 40 Explain to Amy the tax consequences of selling the sailboat (1 marks). 7 41 42 43 What asset would you suggest Amy sells? (1 marks). 1 Question 4: Taxable Capital Gains (10 marks) Part a. Petra Fluffy has owned a residence in Kelowna, British Columbia since 2001 and in 2009 when she was appointed to the Senate, she acquired a 2nd home in Ottawa. In each of the subsequent years, she spent some time at each residence. She sold both residences and moved in with her mother in 2020. The selling prices and costs of the homes are shown below. She wants to minimize the taxes she pays 3 on the capital gains. 4 Home Kelowna Ottawa 5 Selling price, net of real estate fees 897.000 534,000 6 Acquisition cost 623,000 426.000 7 Capital gain 274,000 108,000 8 9 10 11 Required: 1. Explain how the residences should be designated in order to minimize the capital gains that arose as the result of selling the two properties. (3 marks) 12 X D 2. Calculate Petra's taxable capital gain under the designation that you have recommended. 15 (4 marks) 16 17 Principal residence 18 Exempt portion of capital gain = Capital gain 1+ # of years designated 19 Number of years owned 20 Kelowna - Principal residence exemption 21 Exempt portion of capital gain = 22 23 Ottawa - Principal residence exemption 24 Exempt portion of capital gain = 25 26 27 Home Kelowna Ottawa 28 Capital gain 29 Less exempt portion of capital gain: 30 Revised Capital Gain 31 Taxable Capital Gain 33 34 Part b. This is unrelated to part a. above. During the year Amy began her own business selling jewelry. The business has so far been very successful and Amy's net business income has been correctly calculated as $48,120. 35 Amy requires capital to continue to grow this business. Her mother who was an avid sailor died in 2006, leaving Amy her sailboat and shares in Lemon Inc. In both cases, the fair market value is less then the adjusted cost base of the asset. She has no income from the sail boat which is sitting in storage and earns $1,500 in non-eligible dividends from the Lemon Inc. shares per year. The dividends and net business income are her only income sources in 2020. 36 she wants to call one of the accate and ion't cura nf the tav ronconitanec 37 Explain to Amy the tax consequences of selling the shares (1 marks). 38 . 38 39 40 Explain to Amy the tax consequences of selling the sailboat (1 marks). 7 41 42 43 What asset would you suggest Amy sells? (1 marks)