taxation

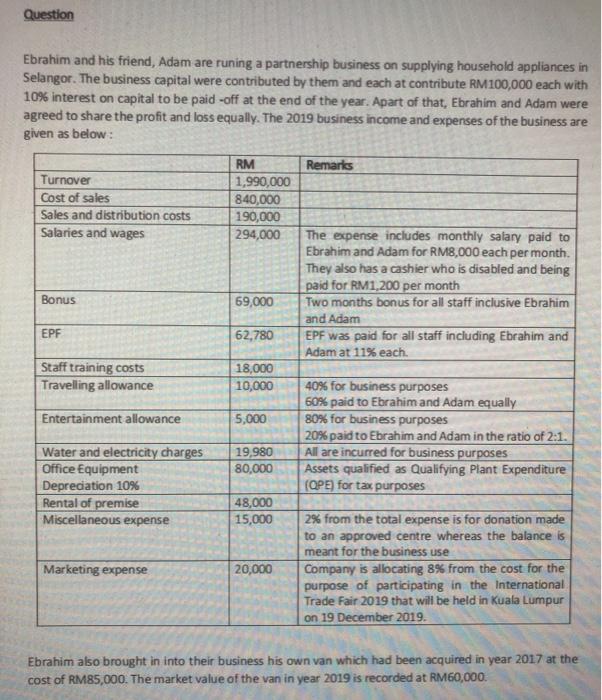

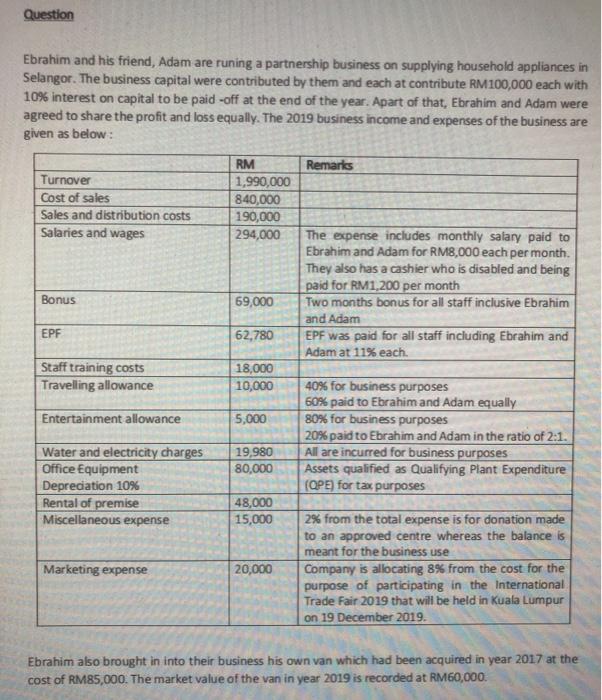

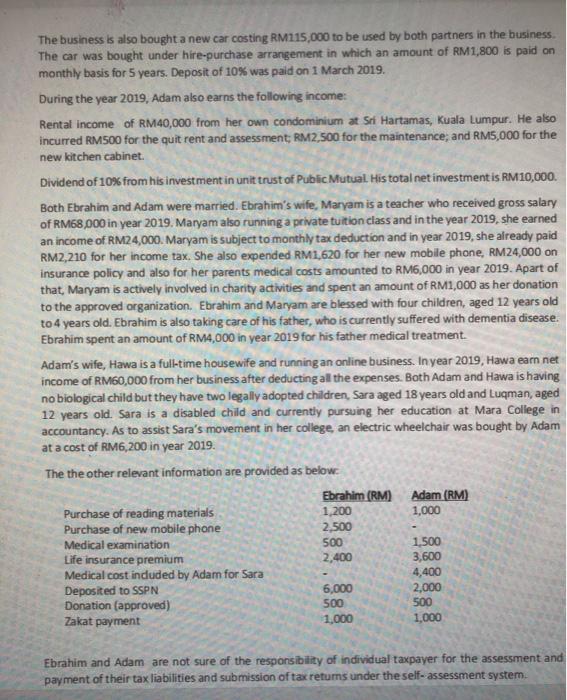

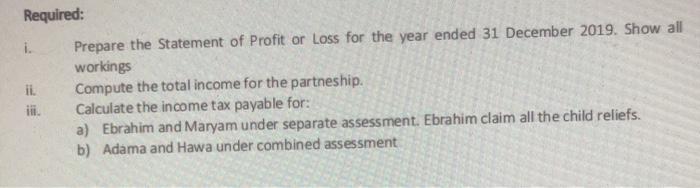

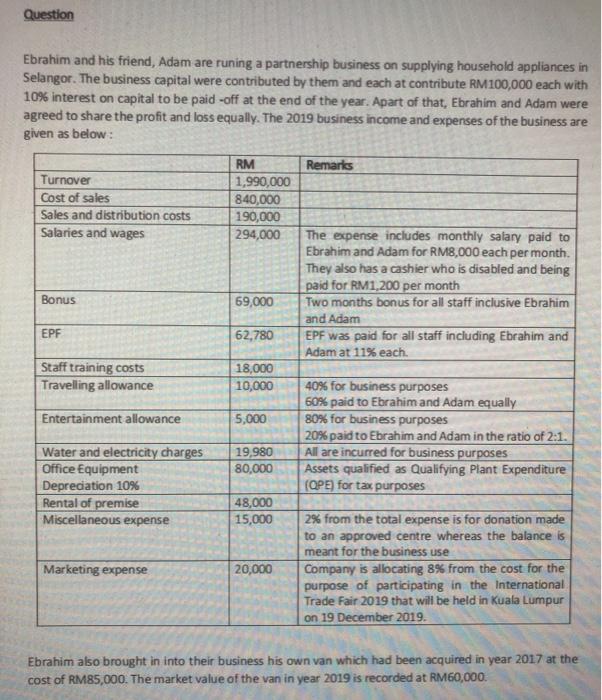

Question Ebrahim and his friend, Adam are runing a partnership business on supplying household appliances in Selangor. The business capital were contributed by them and each at contribute RM100,000 each with 10% interest on capital to be paid -off at the end of the year. Apart of that, Ebrahim and Adam were agreed to share the profit and loss equally. The 2019 business income and expenses of the business are given as below: RM Remarks Turnover 1,990,000 Cost of sales 840,000 Sales and distribution costs 190,000 Salaries and wages 294,000 The expense includes monthly salary paid to Ebrahim and Adam for RM8,000 each per month. They also has a cashier who is disabled and being paid for RM1,200 per month Bonus 69,000 Two months bonus for all staff inclusive Ebrahim and Adam EPF 62,780 EPF was paid for all staff including Ebrahim and Adam at 11% each. Staff training costs 18,000 Travelling allowance 10,000 40% for business purposes 60% paid to Ebrahim and Adam equally Entertainment allowance 5,000 80% for business purposes 20% paid to Ebrahim and Adam in the ratio of 2:1. Water and electricity charges 19,980 All are incurred for business purposes Office Equipment 80,000 Assets qualified as Qualifying Plant Expenditure Depreciation 10% (OPE) for tax purposes Rental of premise 48,000 Miscellaneous expense 15,000 2% from the total expense is for donation made to an approved centre whereas the balance is meant for the business use Marketing expense 20,000 Company is allocating 8% from the cost for the purpose of participating in the International Trade Fair 2019 that will be held in Kuala Lumpur on 19 December 2019 Ebrahim also brought in into their business his own van which had been acquired in year 2017 at the cost of RM85,000. The market value of the van in year 2019 is recorded at RM60,000. The business is also bought a new car costing RM115,000 to be used by both partners in the business The car was bought under hire-purchase arrangement in which an amount of RM1,800 is paid on monthly basis for 5 years. Deposit of 10% was paid on 1 March 2019, During the year 2019, Adam also earns the following income: Rental income of RM40,000 from her own condominium at Sri Hartamas, Kuala Lumpur. He also incurred RM500 for the quit rent and assessment: RM2,500 for the maintenance; and RM5,000 for the new kitchen cabinet. Dividend of 10% from his investment in unit trust of Public Mutual His total net investment is RM10,000. Both Ebrahim and Adam were married. Ebrahim's wife, Maryam is a teacher who received gross salary of RM68,000 in year 2019. Maryam also running a private tuition class and in the year 2019, she earned an income of RM24,000. Maryam is subject to monthly tax deduction and in year 2019, she already paid RM2,210 for her income tax. She also expended RM1,620 for her new mobile phone, RM24,000 on insurance policy and also for her parents medical costs amounted to RM6,000 in year 2019. Apart of that, Maryam is actively involved in charity activities and spent an amount of RM1,000 as her donation to the approved organization. Ebrahim and Maryam are blessed with four children, aged 12 years old to 4 years old. Ebrahim is also taking care of his father, who is currently suffered with dementia disease. Ebrahim spent an amount of RM4,000 in year 2019 for his father medical treatment Adam's wife, Hawa is a full-time housewife and running an online business. In year 2019, Hawa earn net income of RM60,000 from her business after deducting all the expenses. Both Adam and Hawa is having no biological child but they have two legally adopted children, Sara aged 18 years old and Luqman, aged 12 years old. Sara is a disabled child and currently pursuing her education at Mara College in accountancy. As to assist Sara's movement in her college, an electric wheelchair was bought by Adam at a cost of RM6,200 in year 2019. The the other relevant information are provided as below: Ebrahim (RM) Adam (RM) Purchase of reading materials 1,200 1,000 Purchase of new mobile phone 2.500 Medical examination 500 1,500 Life insurance premium 2,400 3,600 Medical cost induded by Adam for Sara 4,400 Deposited to SSPN 6,000 2,000 Donation (approved) 500 500 Zakat payment 1,000 1,000 Ebrahim and Adam are not sure of the responsibility of individual taxpayer for the assessment and payment of their tax liabilities and submission of tax returns under the self-assessment system Required: i. Prepare the Statement of Profit or loss for the year ended 31 December 2019. Show all workings ii. Compute the total income for the partneship. Calculate the income tax payable for: a) Ebrahim and Maryam under separate assessment. Ebrahim claim all the child reliefs. b) Adama and Hawa under combined assessment Question Ebrahim and his friend, Adam are runing a partnership business on supplying household appliances in Selangor. The business capital were contributed by them and each at contribute RM100,000 each with 10% interest on capital to be paid -off at the end of the year. Apart of that, Ebrahim and Adam were agreed to share the profit and loss equally. The 2019 business income and expenses of the business are given as below: RM Remarks Turnover 1,990,000 Cost of sales 840,000 Sales and distribution costs 190,000 Salaries and wages 294,000 The expense includes monthly salary paid to Ebrahim and Adam for RM8,000 each per month. They also has a cashier who is disabled and being paid for RM1,200 per month Bonus 69,000 Two months bonus for all staff inclusive Ebrahim and Adam EPF 62,780 EPF was paid for all staff including Ebrahim and Adam at 11% each. Staff training costs 18,000 Travelling allowance 10,000 40% for business purposes 60% paid to Ebrahim and Adam equally Entertainment allowance 5,000 80% for business purposes 20% paid to Ebrahim and Adam in the ratio of 2:1. Water and electricity charges 19,980 All are incurred for business purposes Office Equipment 80,000 Assets qualified as Qualifying Plant Expenditure Depreciation 10% (OPE) for tax purposes Rental of premise 48,000 Miscellaneous expense 15,000 2% from the total expense is for donation made to an approved centre whereas the balance is meant for the business use Marketing expense 20,000 Company is allocating 8% from the cost for the purpose of participating in the International Trade Fair 2019 that will be held in Kuala Lumpur on 19 December 2019 Ebrahim also brought in into their business his own van which had been acquired in year 2017 at the cost of RM85,000. The market value of the van in year 2019 is recorded at RM60,000. The business is also bought a new car costing RM115,000 to be used by both partners in the business The car was bought under hire-purchase arrangement in which an amount of RM1,800 is paid on monthly basis for 5 years. Deposit of 10% was paid on 1 March 2019, During the year 2019, Adam also earns the following income: Rental income of RM40,000 from her own condominium at Sri Hartamas, Kuala Lumpur. He also incurred RM500 for the quit rent and assessment: RM2,500 for the maintenance; and RM5,000 for the new kitchen cabinet. Dividend of 10% from his investment in unit trust of Public Mutual His total net investment is RM10,000. Both Ebrahim and Adam were married. Ebrahim's wife, Maryam is a teacher who received gross salary of RM68,000 in year 2019. Maryam also running a private tuition class and in the year 2019, she earned an income of RM24,000. Maryam is subject to monthly tax deduction and in year 2019, she already paid RM2,210 for her income tax. She also expended RM1,620 for her new mobile phone, RM24,000 on insurance policy and also for her parents medical costs amounted to RM6,000 in year 2019. Apart of that, Maryam is actively involved in charity activities and spent an amount of RM1,000 as her donation to the approved organization. Ebrahim and Maryam are blessed with four children, aged 12 years old to 4 years old. Ebrahim is also taking care of his father, who is currently suffered with dementia disease. Ebrahim spent an amount of RM4,000 in year 2019 for his father medical treatment Adam's wife, Hawa is a full-time housewife and running an online business. In year 2019, Hawa earn net income of RM60,000 from her business after deducting all the expenses. Both Adam and Hawa is having no biological child but they have two legally adopted children, Sara aged 18 years old and Luqman, aged 12 years old. Sara is a disabled child and currently pursuing her education at Mara College in accountancy. As to assist Sara's movement in her college, an electric wheelchair was bought by Adam at a cost of RM6,200 in year 2019. The the other relevant information are provided as below: Ebrahim (RM) Adam (RM) Purchase of reading materials 1,200 1,000 Purchase of new mobile phone 2.500 Medical examination 500 1,500 Life insurance premium 2,400 3,600 Medical cost induded by Adam for Sara 4,400 Deposited to SSPN 6,000 2,000 Donation (approved) 500 500 Zakat payment 1,000 1,000 Ebrahim and Adam are not sure of the responsibility of individual taxpayer for the assessment and payment of their tax liabilities and submission of tax returns under the self-assessment system Required: i. Prepare the Statement of Profit or loss for the year ended 31 December 2019. Show all workings ii. Compute the total income for the partneship. Calculate the income tax payable for: a) Ebrahim and Maryam under separate assessment. Ebrahim claim all the child reliefs. b) Adama and Hawa under combined assessment