Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TAXATION QUESTION ONE You are employed in the Tax department of a firm of Chartered Accountants. The tax manager has presented you with the following

TAXATION

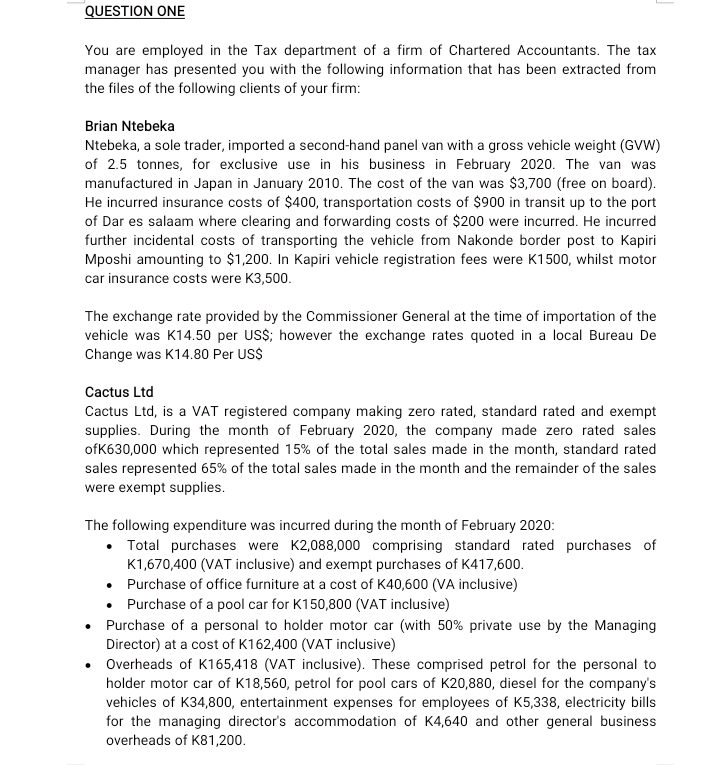

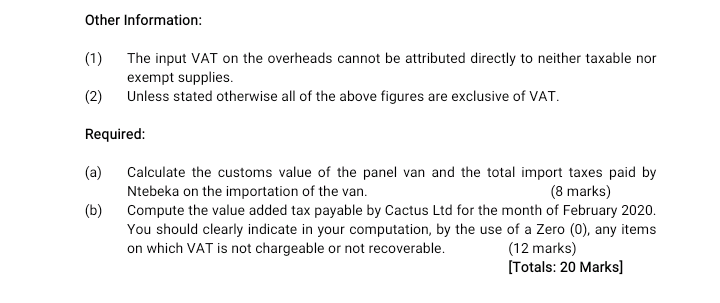

QUESTION ONE You are employed in the Tax department of a firm of Chartered Accountants. The tax manager has presented you with the following information that has been extracted from the files of the following clients of your firm: Brian Ntebeka Ntebeka, a sole trader, imported a second-hand panel van with a gross vehicle weight (GVW) of 2.5 tonnes, for exclusive use in his business in February 2020 . The van was manufactured in Japan in January 2010. The cost of the van was $3,700 (free on board). He incurred insurance costs of $400, transportation costs of $900 in transit up to the port of Dar es salaam where clearing and forwarding costs of $200 were incurred. He incurred further incidental costs of transporting the vehicle from Nakonde border post to Kapiri Mposhi amounting to $1,200. In Kapiri vehicle registration fees were K1500, whilst motor car insurance costs were K3,500. The exchange rate provided by the Commissioner General at the time of importation of the vehicle was K14.50 per US\$; however the exchange rates quoted in a local Bureau De Change was K14.80 Per USS Cactus Ltd Cactus Ltd, is a VAT registered company making zero rated, standard rated and exempt supplies. During the month of February 2020, the company made zero rated sales ofK 630,000 which represented 15% of the total sales made in the month, standard rated sales represented 65% of the total sales made in the month and the remainder of the sales were exempt supplies. The following expenditure was incurred during the month of February 2020: - Total purchases were K2,088,000 comprising standard rated purchases of K1,670,400 (VAT inclusive) and exempt purchases of K417,600. - Purchase of office furniture at a cost of K40,600 (VA inclusive) - Purchase of a pool car for K150,800 (VAT inclusive) - Purchase of a personal to holder motor car (with 50% private use by the Managing Director) at a cost of K162,400 (VAT inclusive) - Overheads of K165,418 (VAT inclusive). These comprised petrol for the personal to holder motor car of K18,560, petrol for pool cars of K20,880, diesel for the company's vehicles of K34,800, entertainment expenses for employees of K5,338, electricity bills for the managing director's accommodation of K4,640 and other general business overheads of K81,200. Other Information: (1) The input VAT on the overheads cannot be attributed directly to neither taxable nor exempt supplies. (2) Unless stated otherwise all of the above figures are exclusive of VAT. Required: (a) Calculate the customs value of the panel van and the total import taxes paid by Ntebeka on the importation of the van. (8 marks) (b) Compute the value added tax payable by Cactus Ltd for the month of February 2020. You should clearly indicate in your computation, by the use of a Zero (0), any items on which VAT is not chargeable or not recoverable. (12 marks) [Totals: 20 Marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started