taxation question

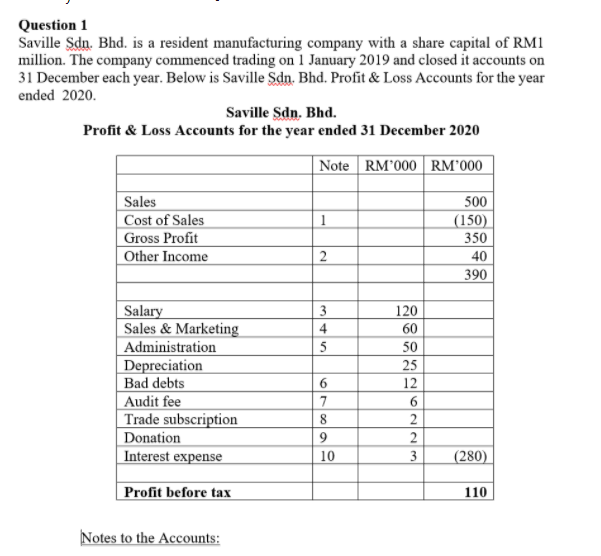

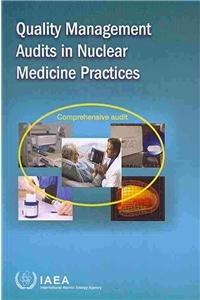

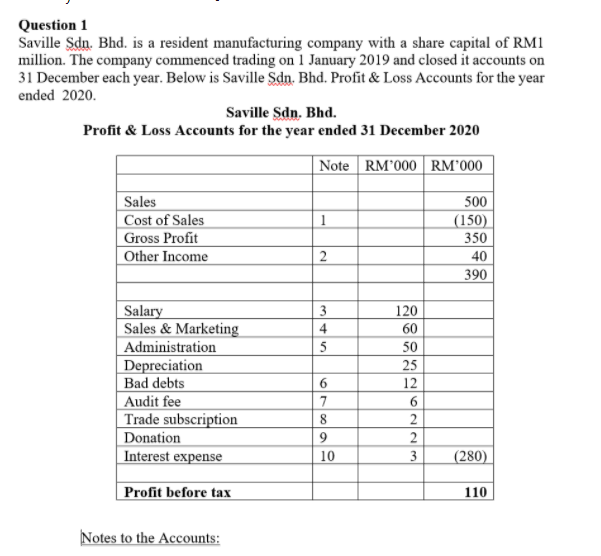

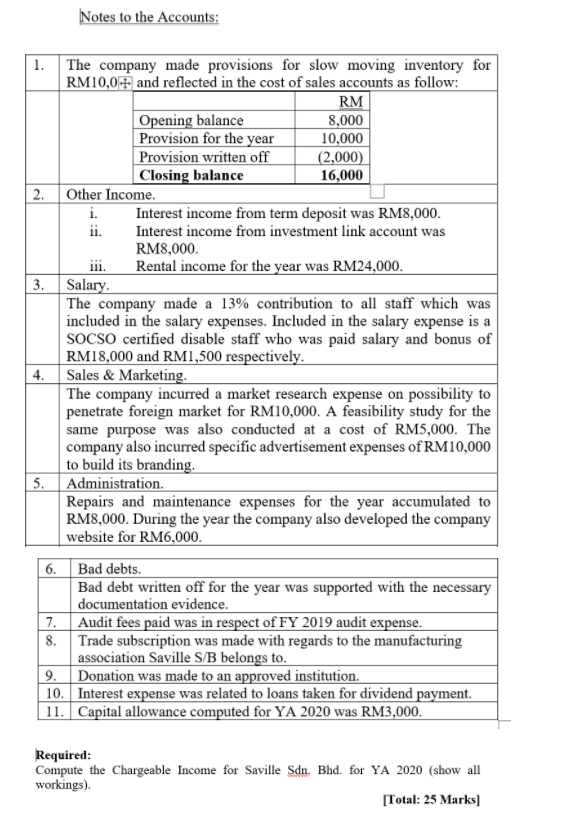

Question 1 Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RMI million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 1 Sales Cost of Sales Gross Profit Other Income 500 (150) 350 40 390 2 3 4 5 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense 6 7 8 120 60 50 25 12 6 2 2 3 10 (280) Profit before tax 110 Notes to the Accounts: Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0+ and reflected in the cost of sales accounts as follow: RM Opening balance 8,000 Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 2. Other Income i. Interest income from term deposit was RM8,000. ii. Interest income from investment link account was RM8,000. Rental income for the year was RM24,000. 3. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. 5. Administration Repairs and maintenance expenses for the year accumulated to RM8,000. During the year the company also developed the company website for RM6,000. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks) Question 1 Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RMI million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 1 Sales Cost of Sales Gross Profit Other Income 500 (150) 350 40 390 2 3 4 5 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense 6 7 8 120 60 50 25 12 6 2 2 3 10 (280) Profit before tax 110 Notes to the Accounts: Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0+ and reflected in the cost of sales accounts as follow: RM Opening balance 8,000 Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 2. Other Income i. Interest income from term deposit was RM8,000. ii. Interest income from investment link account was RM8,000. Rental income for the year was RM24,000. 3. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. 5. Administration Repairs and maintenance expenses for the year accumulated to RM8,000. During the year the company also developed the company website for RM6,000. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks)