Question

Taxes are costs, and, therefore, changes in tax rates can affect consumer prices, project lives, and the value of existing firms. Evaluate the change in

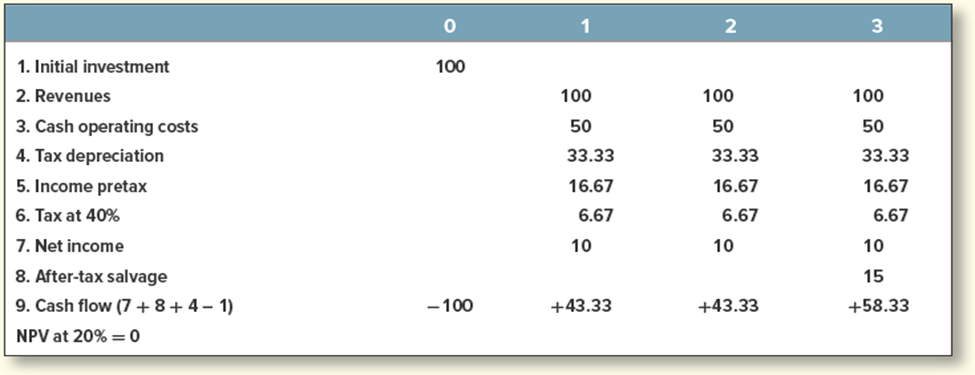

Taxes are costs, and, therefore, changes in tax rates can affect consumer prices, project lives, and the value of existing firms. Evaluate the change in taxation on the valuation of the following project:

1 2 3 1. Initial investment 2. Revenues 3. Cash operating costs 4. Tax depreciation 5. Income pretax 6. Tax at 40% 7. Net income 100 100 100 100 50 50 50 33.33 33.33 33.33 16.67 16.67 16.67 6.67 6.67 6.67 10 10 10 8. After-tax salvage 15 9. Cash flow (7+8+4-1) -100 +43.33 +43.33 +58.33 NPV at 20% = 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The change in taxation can indeed impact the valuation of the project Heres how the change in taxation can affect the projects valuation 1 Impact on C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Corporate Finance

Authors: Richard A. Brealey, Stewart C. Myers

7th edition

72869461, 72467665, 9780072467666, 978-0072869460

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App