Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxes paid for a given income level Suppose that Kyoko is preparing to file her taxes. She is single and currently lives in Miami. Kyoko

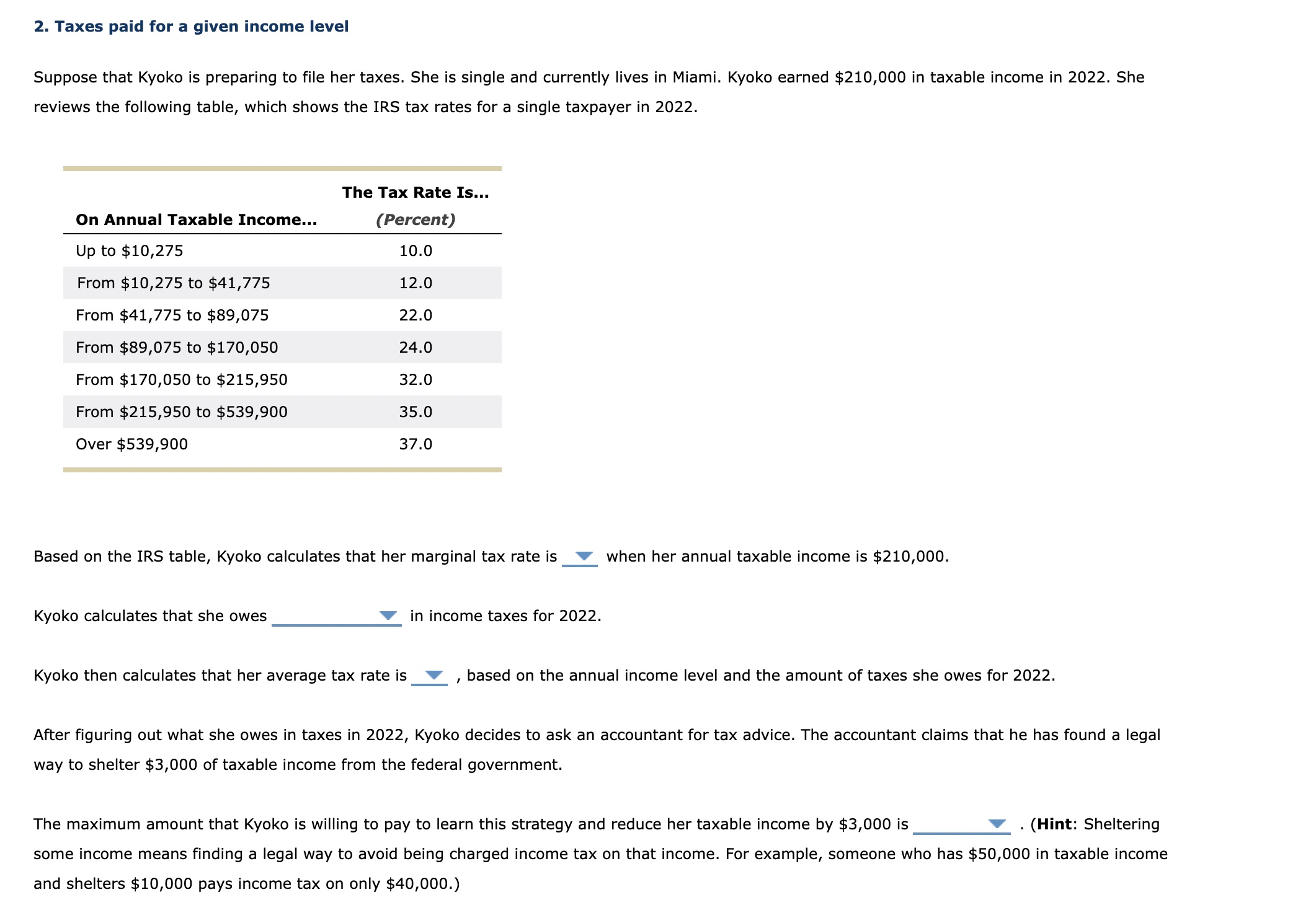

Taxes paid for a given income level

Suppose that Kyoko is preparing to file her taxes. She is single and currently lives in Miami. Kyoko earned $ in taxable income in She

reviews the following table, which shows the IRS tax rates for a single taxpayer in

Based on the IRS table, Kyoko calculates that her marginal tax rate is

when her annual taxable income is $

Kyoko calculates that she owes

in income taxes for

Kyoko then calculates that her average tax rate is

based on the annual income level and the amount of taxes she owes for

After figuring out what she owes in taxes in Kyoko decides to ask an accountant for tax advice. The accountant claims that he has found a legal

way to shelter $ of taxable income from the federal government.

The maximum amount that Kyoko is willing to pay to learn this strategy and reduce her taxable income by $ is

Hint: Sheltering

some income means finding a legal way to avoid being charged income tax on that income. For example, someone who has $ in taxable income

and shelters $ pays income tax on only $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started