Answered step by step

Verified Expert Solution

Question

1 Approved Answer

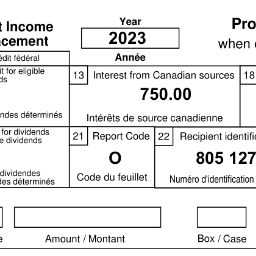

Taxpayer # 1 Name:Keith DoxSIN: 8 0 5 1 2 7 1 1 5 DOB:August 1 3 , 1 9 8 9 Marital status:MarriedAddress: 1

Taxpayer #Name:Keith DoxSIN:DOB:August Marital status:MarriedAddress: Page Place, Your City, YP XX X

Note: use a postal code applicable to your province YPPhone number:XXX

Note: use an area code applicable to your province YPEmail address:kdox@rogers.ca

Taxpayer #Name:Katie DoxSIN:DOB:March

Keith Dox lives with his wife, Katie. Katie's net and taxable income is $ Her income consists of one T and $ in tips. She has already filed her own return.

Keith and Katie sold their original home located at Bayfield Street, YourCity YP XX X for $ on March before moving into their new home a few blocks away at their current address. They had purchased the house on Bayfield Street together in ; they lived exclusively at that address and had not owned any other residential property during the time they owned that home. Neither Keith nor Katie changed employment last year; they moved simply because they liked the new house.

Keith has a Tangerine investment account which pays him interest. He never received an information slip but was able to total up the $ interest he received last year from Tangerine. Keith receives income each year on a Tslip from a trust that was set up by his father. Keith also has a Royal Bank savings account to which he contributes of the funds, and Katie contributes the remaining

In Keith inherited a bank account in the US with a balance of US$ from his uncle. At that time, the exchange rate was He neither contributed nor withdrew any amounts from this account. According to the bank statements, the account had a balance of US$ on January st and US$ on Decemberst The bank statements also show that the only credits on this account are for monthly interest payments. For the annual average exchange rate was Keith is not a US Citizen. He does not need to file a US return.

In late Keith bought shares of Metro Inc. Keith received four dividend payments in each payment being $ for a total of $ He did not receive a slip for this income, and Metro Inc. is a Canadian corporation that issues eligible dividends. Keith still has these shares and does not plan on selling them in the near future. He has a $ receipt for management fees anda $ receipt for investment counsel fees.

Keith always donates $ each summer to the Terry Fox Foundation, which is a charitable organization registered with the Canada Revenue Agency. Keith wants to claim his donation each year versus saving for a future year. This year, Keith made a $ political contribution to the federal Liberal Party of Canada, for which he has an official receipt.

Keiths T and other information slips are reproduced below. Last year Keith received a tax refund of $ including $ interest on the refund. He is hoping for a refund again this year.

Keith is a Canadian citizen and he wants to answer Yes to the Elections Canada question. He has signed up for My Account, and would like to register for online mail.

Keith lives within a Census Metropolitan Area in your province. YP Amount Montant

BoxCase Statement of Trust Income Allocat tat des revenus de fiducie rpar

int

Footnotes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started