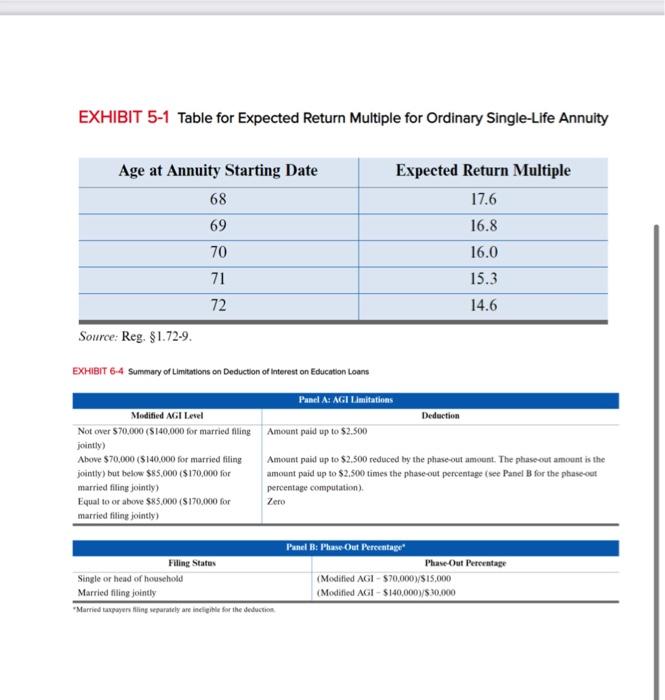

Taxpayer and Spouse are married couple who the fonty During the tax year. Taxpayer was self-employed and realed profit of $7.000 Spouse was on employee during the year. Through Speemployer. Both Spouse and Taxpayer were eligible to participate in an employer sponsored health insurance Spouse chose coverage through the employer's plan while Taxpayer chose to purchase their own Insurance that through a marketplace by paying $8.000 in premium. Determine then that payer and Spouse deductas For AG above the line deduction for Taxpayer's health insurance premium S8,300 $4150 OOOOO $7.000 None of the score 50 De EXHIBIT 5-1 Table for Expected Return Multiple for Ordinary Single-Life Annuity Age at Annuity Starting Date 68 69 70 71 72 Source: Reg. $1.72-9 Expected Return Multiple 17.6 16.8 16.0 15.3 14.6 EXHIBIT 6-4 Summary of Limitations on Deduction of interest on Education Loans Panel A: AGI Limitations Deduction Amount paid up to $2.500 Modified AGI Level Not over 570.000 (S140,000 for married fling jointly) Above $70,000 (S140,000 for married filing jointly) but below $85.000 ($170,000 for married filing jointly) Equal to or above $85.000 (5170.000 for married filing jointly) Amount paid up to $2.500 reduced by the phase-out amount. The pluse-out amount is the amount paid up to $2.500 times the phase-out percentage (see Panel B for the phase-out percentage computation) Zero Filing Status Single or head of household Married filing jointly "Married taxpayers filing separately are ineligible for the deduction Panel B: Phase Out Percentage Phase-Out Percentage (Modified AGI- $70,000)/S15,000 (Modified AGI - $140,000/530,000 Taxpayer and Spouse are married couple who the fonty During the tax year. Taxpayer was self-employed and realed profit of $7.000 Spouse was on employee during the year. Through Speemployer. Both Spouse and Taxpayer were eligible to participate in an employer sponsored health insurance Spouse chose coverage through the employer's plan while Taxpayer chose to purchase their own Insurance that through a marketplace by paying $8.000 in premium. Determine then that payer and Spouse deductas For AG above the line deduction for Taxpayer's health insurance premium S8,300 $4150 OOOOO $7.000 None of the score 50 De EXHIBIT 5-1 Table for Expected Return Multiple for Ordinary Single-Life Annuity Age at Annuity Starting Date 68 69 70 71 72 Source: Reg. $1.72-9 Expected Return Multiple 17.6 16.8 16.0 15.3 14.6 EXHIBIT 6-4 Summary of Limitations on Deduction of interest on Education Loans Panel A: AGI Limitations Deduction Amount paid up to $2.500 Modified AGI Level Not over 570.000 (S140,000 for married fling jointly) Above $70,000 (S140,000 for married filing jointly) but below $85.000 ($170,000 for married filing jointly) Equal to or above $85.000 (5170.000 for married filing jointly) Amount paid up to $2.500 reduced by the phase-out amount. The pluse-out amount is the amount paid up to $2.500 times the phase-out percentage (see Panel B for the phase-out percentage computation) Zero Filing Status Single or head of household Married filing jointly "Married taxpayers filing separately are ineligible for the deduction Panel B: Phase Out Percentage Phase-Out Percentage (Modified AGI- $70,000)/S15,000 (Modified AGI - $140,000/530,000