Answered step by step

Verified Expert Solution

Question

1 Approved Answer

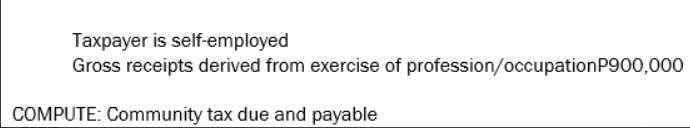

Taxpayer is self-employed Gross receipts derived from exercise of profession/occupation P900,000 COMPUTE: Community tax due and payable GIVEN data for a real property: Value

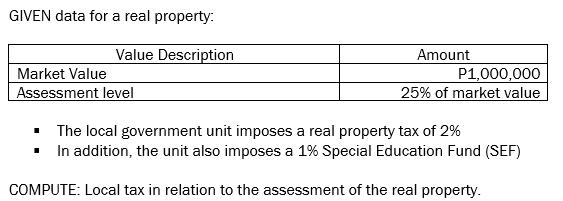

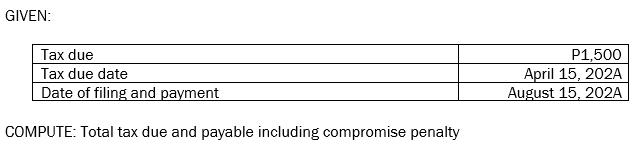

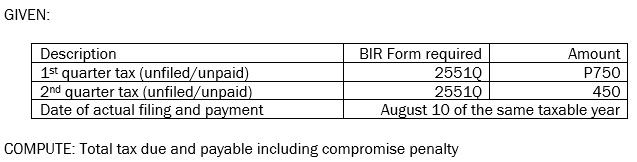

Taxpayer is self-employed Gross receipts derived from exercise of profession/occupation P900,000 COMPUTE: Community tax due and payable GIVEN data for a real property: Value Description Market Value Assessment level Amount P1,000,000 25% of market value The local government unit imposes a real property tax of 2% In addition, the unit also imposes a 1 % Special Education Fund (SEF) COMPUTE: Local tax in relation to the assessment of the real property. GIVEN: Tax due Tax due date Date of filing and payment COMPUTE: Total tax due and payable including compromise penalty P1,500 April 15, 202A August 15, 202A GIVEN: BIR Form required 25510 Amount P750 25510 450 August 10 of the same taxable year Description 1st quarter tax (unfiled/unpaid) 2nd quarter tax (unfiled/unpaid) Date of actual filing and payment COMPUTE: Total tax due and payable including compromise penalty

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are the computations for the questions 1 Community tax due and payable Gross receipts from prof...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started