Answered step by step

Verified Expert Solution

Question

1 Approved Answer

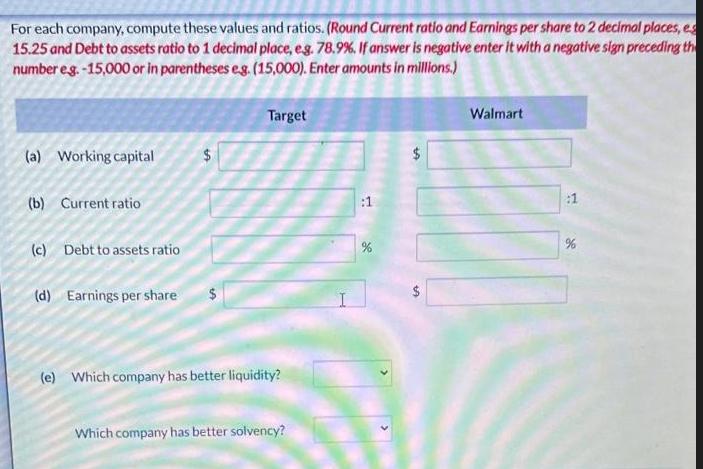

For each company, compute these values and ratios. (Round Current ratio and Earnings per share to 2 decimal places, es 15.25 and Debt to

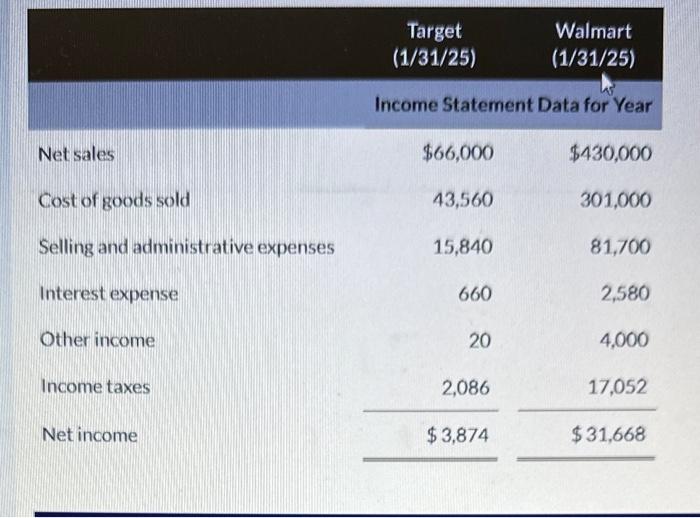

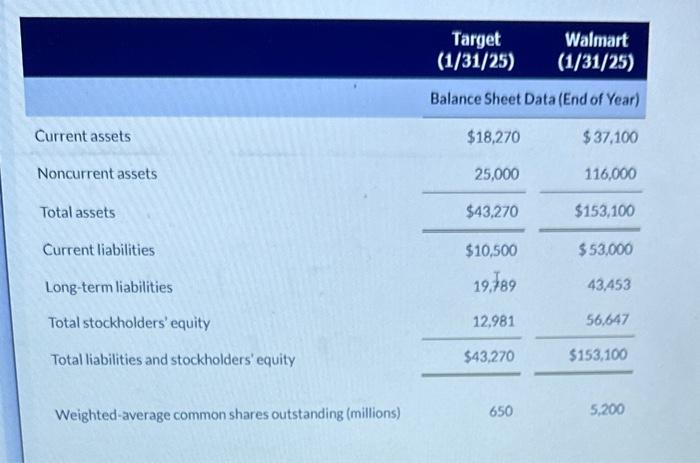

For each company, compute these values and ratios. (Round Current ratio and Earnings per share to 2 decimal places, es 15.25 and Debt to assets ratio to 1 decimal place, eg. 78.9%. If answer is negative enter it with a negative sign preceding the number eg. -15,000 or in parentheses e.g. (15,000). Enter amounts in millions.) (a) Working capital (b) Current ratio (c) Debt to assets ratio (d) Earnings per share $ Target (e) Which company has better liquidity? Which company has better solvency? :1 % $ Walmart :1 % Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income Income taxes Net income Walmart (1/31/25) Income Statement Data for Year Target (1/31/25) $66,000 43,560 15,840 660 20 2,086 $3,874 $430,000 301,000 81,700 2,580 4,000 17,052 $31,668 Current assets Noncurrent assets Total assets Current liabilities Long-term liabilities Total stockholders' equity Total liabilities and stockholders' equity Weighted average common shares outstanding (millions) Target (1/31/25) Walmart (1/31/25) Balance Sheet Data (End of Year) $18,270 $37,100 116,000 $153,100 $53,000 43,453 56,647 $153,100 25,000 $43,270 $10,500 19,789 12,981 $43,270 650 5,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started