Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial statements of Amazon.com, Inc. are presented in Appendix D Click here to view Appendix D Financial statements of Wal-Mart Stores, Inc. are

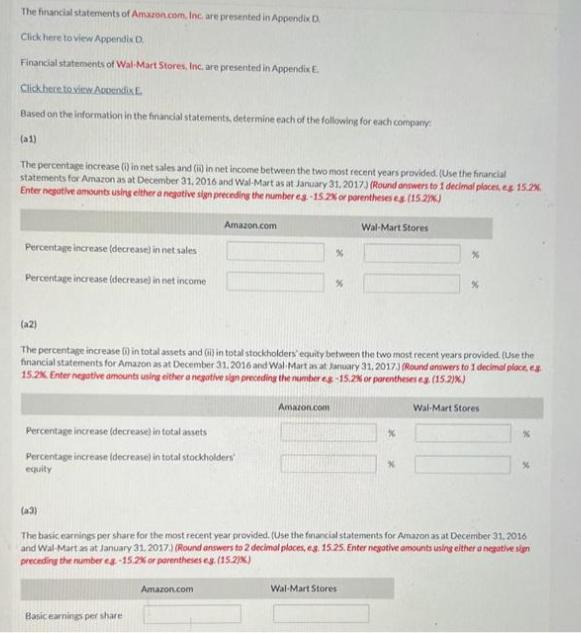

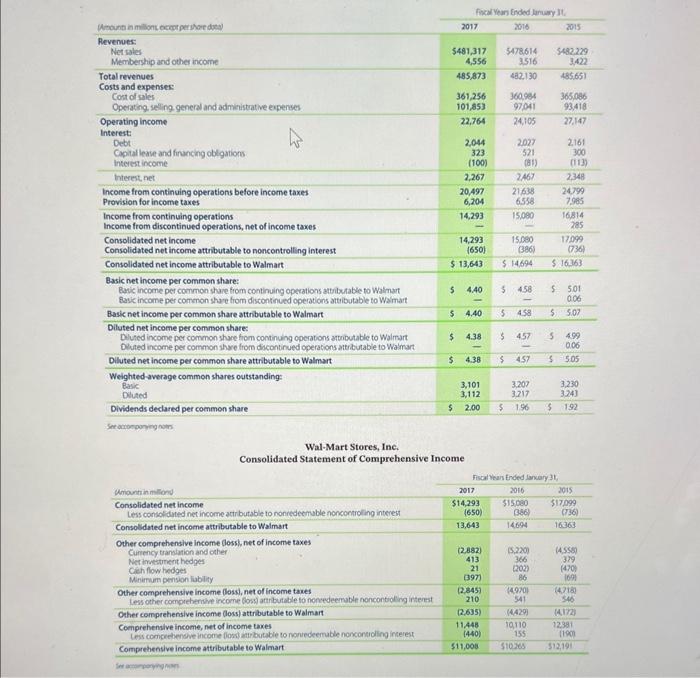

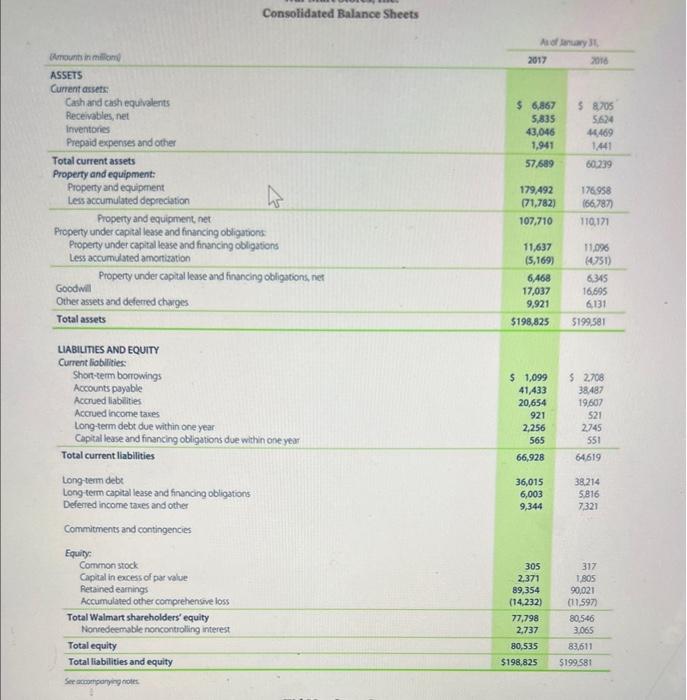

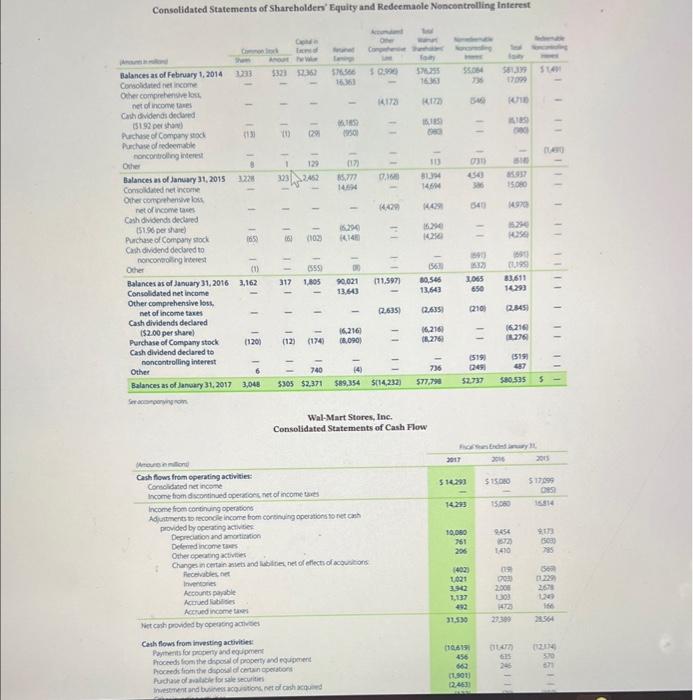

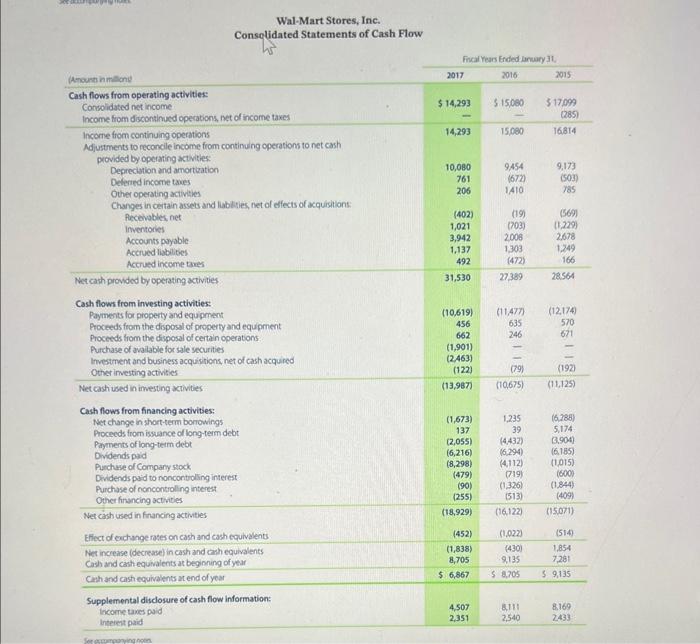

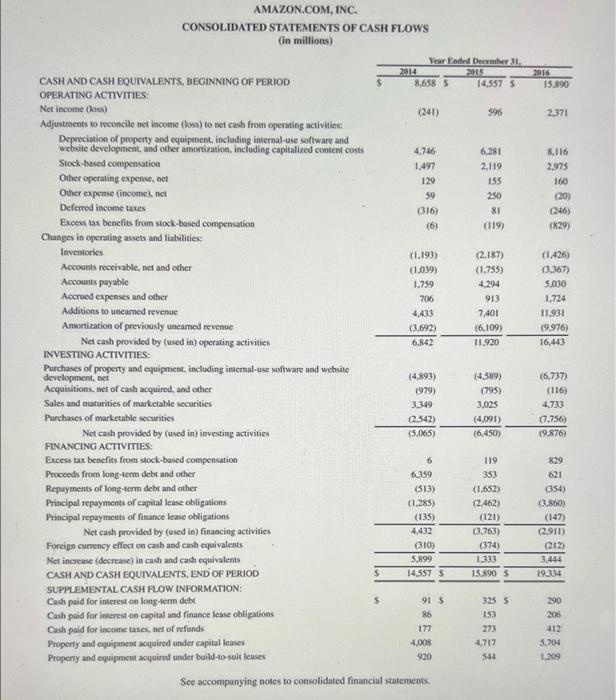

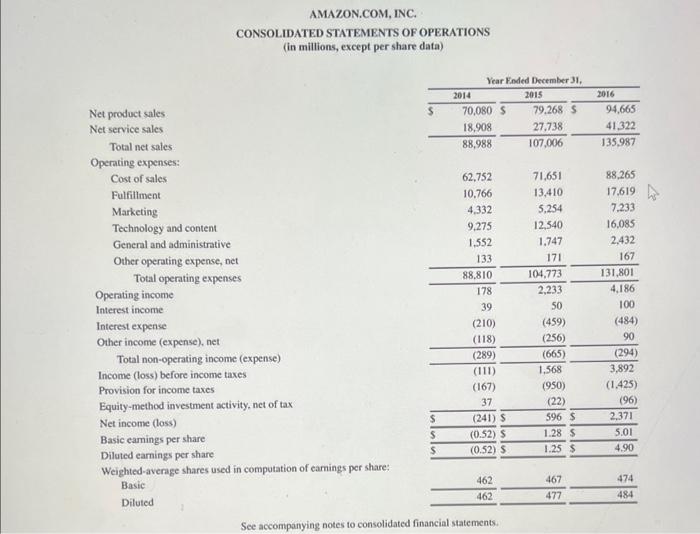

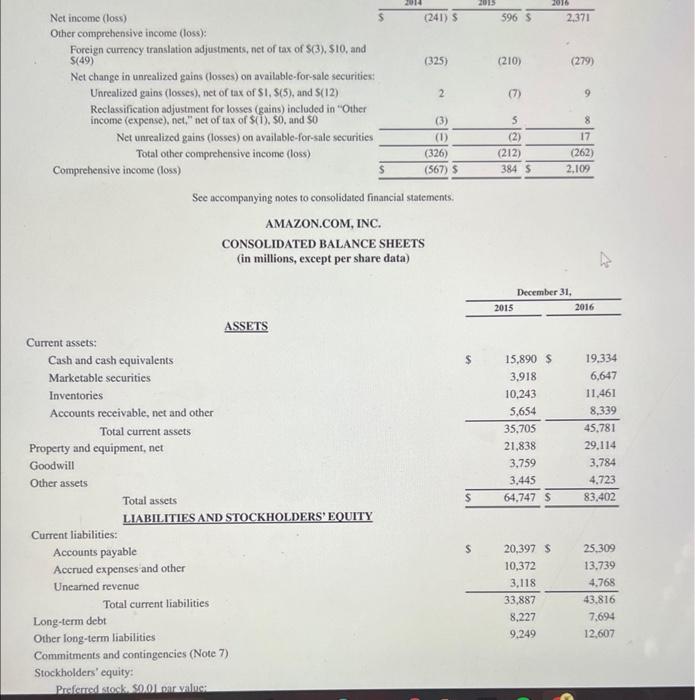

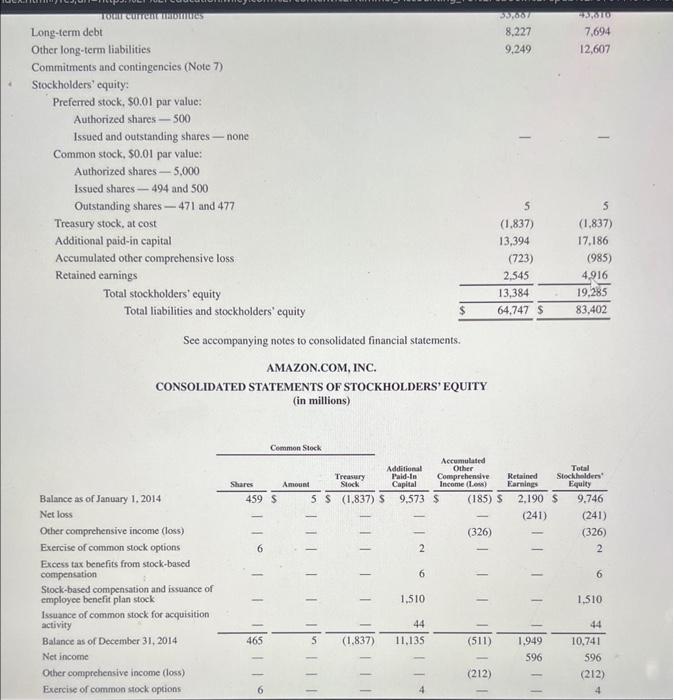

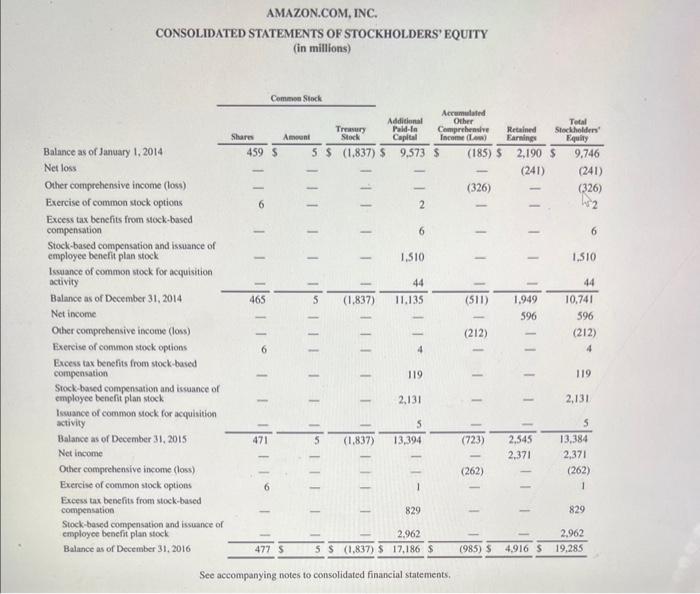

The financial statements of Amazon.com, Inc. are presented in Appendix D Click here to view Appendix D Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E Click here to view Appendix E. Based on the information in the financial statements, determine each of the following for each company: (a1) The percentage increase (i) in net sales and (ii) in net income between the two most recent years provided. (Use the financial statements for Amazonas at December 31, 2016 and Wal-Mart as at January 31, 2017) (Round answers to 1 decimal places, eg 15.2% Enter negative amounts using either a negative sign preceding the number eg.-15.2% or parentheses eg (15.2%) Wal-Mart Stores Percentage increase (decrease) in net sales Percentage increase (decrease) in net income Amazon.com Percentage increase (decrease) in total assets Percentage increase (decrease) in total stockholders equity Basic earnings per share (a2) The percentage increase () in total assets and (i) in total stockholders' equity between the two most recent years provided. (Use the financial statements for Amazon as at December 31, 2016 and Wal-Mart as at January 31, 2017.) (Round answers to 1 decimal place, es 15.2% Enter negative amounts using either a negative sign preceding the number eg-15.2% or parentheses eg (15.2)%) Amazon.com % Amazon.com % % (a3) The basic earnings per share for the most recent year provided. (Use the financial statements for Amazon as at December 31, 2016 and Wal-Mart as at January 31, 2017.) (Round answers to 2 decimal places, eg. 15.25. Enter negative amounts using either a negative sign preceding the number eg-15.2% or parentheses eg. (15.2%) Wal-Mart Stores Wal-Mart Stores (Amount in milions, except per shore dota Revenues: Net sales Membership and other income Total revenues Costs and expenses: Cost of sales Operating, selling general and administrative expenses Operating income Interest: Debt Capital lease and financing obligations Interest income Interest, net Income from continuing operations before income taxes Provision for income taxes Income from continuing operations Income from discontinued operations, net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart Basic net income per common share: Basic income per common share from continuing operations attributable to Walmart Basic income per common share from discontinued operations attributable to Walmart Basic net income per common share attributable to Walmart Diluted net income per common share: Diluted income per common share from continuing operations attributable to Walmart Diluted income per common share from discontinued operations attributable to Walmart Diluted net income per common share attributable to Walmart Weighted average common shares outstanding: Basic Diluted Dividends declared per common share See accompanying notes Amount in mind Consolidated net income Less consolidated net income attributable to nonredeemable noncontrolling interest Consolidated net income attributable to Walmart Other comprehensive income (loss), net of income taxes Currency translation and other Net investment hedges Cash flow hedges Minimum pension liability Other comprehensive income (loss), net of income taxes Less other comprehensive income Gloss) attributable to nonredeemable noncontrolling interest Other comprehensive income (loss) attributable to Walmart Comprehensive income, net of income taxes Less comprehensive income foss) attributable to nonredeemable noncontrolling interest Comprehensive income attributable to Walmart See accompanying no Fiscal Year Ended January 31, 2016 2017 $481,317 4,556 485,873 361,256 101,853 22,764 2,044 323 (100) $ 2,267 20,497 6,204 14,293 14,293 (650) $ 13,643 Wal-Mart Stores, Inc. Consolidated Statement of Comprehensive Income $4.40 4.38 3,101 3,112 $ 2.00 2017 $14,293 (650) $ 4.40 $ 4.58 $ 457 $ 4.38 $ 457 13,643 (2,882) 413 21 (397) (2845) 210 5478,614 3,516 482,130 (2,635) 11,448 (440) 360,984 97,041 24,105 $11,008 2,027 521 (81) 2467 21,638 6558 15,080 15.080 (386) $ 14,694 $ 4.58 3,207 3,217 $ 1.96 Fiscal Years Ended January 31, 2016 $15,000 (386) 14694 (5,220) 366 (202) 86 (4,970) 541 (4429) 10,110 155 $10.265 2015 $482,229 3,422 485,651 s 365,086 93,418 27,147 2,161 300 (113) 2,348 24,799 7,985 16,814 285 (736) $16.363 17,099 S 5.01 0.06 $ 5.07 4.99 0.06 $ 5.05 3,230 3,243 $192 2015 $17,099 (736) 16363 (4558) 379 (470) 1691 (4718) 546 (4172) 12,381 (190) $12,191 Amounts in milliom ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets Property and equipment: Property and equipment Less accumulated depreciation Property and equipment, net Property under capital lease and financing obligations: Property under capital lease and financing obligations Less accumulated amortization Goodwill Other assets and deferred charges Total assets Property under capital lease and financing obligations, net LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities Long-term debt Long-term capital lease and financing obligations Deferred income taxes and other Commitments and contingencies Equity: Consolidated Balance Sheets Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total Walmart shareholders' equity Nonredeemable noncontrolling interest Total equity Total liabilities and equity See accompanying notes As of January 31, 2017 $ 6,867 5,835 43,046 1,941 57/689 179,492 (71,782) 107,710 11,637 (5,169) 6,468 17,037 9,921 $198,825 $ 1,099 41,433 20,654 921 2,256 565 66,928 36,015 6,003 9,344 305 2,371 89,354 (14,232) 77,798 2,737 80,535 $198,825 2016 $ 8,705 5624 44,469 1,441 60,239 176.958 (66,787) 110,171 11,096 (4.751) 6,345 16,695 6,131 $199,581 $ 2,708 38,487 19,607 521 2745 551 64,619 38,214 5,816 7,321 317 1,805 90,021 (11,597) 80,546 3,065 83,611 $199.581 Consolidated Statements of Shareholders' Equity and Redeemaole Noncontrolling Interest Balances as of February 1, 2014 Consolidated net income Other comprehensive loss, net of income taxes Cash dividends declared (51.92 per shan) Purchase of Company stock Purchase of redeemable noncontrolling interest Other Balances as of January 31, Consolidated net income Other comprehensive loss net of income taxes Cash dividends declared (51.96 per share) Purchase of Company stock Cash dividend declared to noncontrolling interest 2015 ($2.00 per share) Purchase of Company stock Cash dividend declared to noncontrolling interest Commock Them 1233 (13) 3228 (65) Other (1) Balances as of January 31, 2016 3,162 Consolidated net income Other comprehensive loss, net of income taxes Cash dividends declared (120) Other Balances as of January 31, 2017 3,048 oning nom Op Ind Anout We $323 52362 (1) (29) Inventories Accounts payable Accrued abilities Accrued income taxes Net cash provided by operating activities 19 3232.462 I 1 317 129 I (102) (555) 1,805 (12) (174) 740 5305 $2,371 Amoure in million Cash flows from operating activities: Consolidated net income Income from discontinued operations net of income taxes Leveys $76,366 16361 MRS (950) (17) Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Poceeds from the disposal of certain operations Purchase of available for sale securities Investment and business acquisitions, net of cash acquired 85,777 14004 1 (6,290 (4140 18 1 (6,216) (8,090) 13 (4) $89,354 Income from continuing operations Adjustments to reconcile income from continuing operations to net cash provided by operating activities Depreciation and amortization Other Compen en forty $ 0,990) Deferred income taxes Other operating activities Changes in certain assets and liabilities, net of effects of acoustions Receivables, net 14,172 90,021 (11,597) 13,643 T 0.168 (4429) 14 311 (2,635) $76,255 16363 14122) 15,185) Wal-Mart Stores, Inc. Consolidated Statements of Cash Flow 113 81394 14694 (4429) 16290 (5630) 80,546 13,643 (2635) (6,216) (8.276) 736 $(14,232) $77,798 HOME $5.064 736 2017 4543 386 (2313 3,065 650 $14,293 14,293 541) (519) (249) $2,737 10,080 761 206 (1840) 16532) 1,021 3942 1,137 492 31,530 (210) (10,619) 456 662 $81,339 17099 (1,501) (2,463) (4718) 1185) 000 85.937 15,080 Fun Ended inry 31, 2016 (4970) 86290 14250 ww (195) 83,611 14293 (2,845) (6,216) (8,276) (519) 487 580,535 15,080 9,454 (672) 1,410 (09) 003) 2008 1303 14720 27309 $140 (11477) 635 246 $15.080 $17,099 085) (LAR) S 1 2013 1111 1 1 11 9173 (5030) 785 1569 (1229) 2678 166 28,564 (12134) 570 871 (Amount in milliond Cash flows from operating activities: Consolidated net income Income from discontinued operations, net of income taxes Wal-Mart Stores, Inc. Consolidated Statements of Cash Flow Income from continuing operations Adjustments to reconcile income from continuing operations to net cash provided by operating activities: Depreciation and amortization Deferred income taxes Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale securities Investment and business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Payments of long-term debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities Effect of exchange rates on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental disclosure of cash flow information: Income taxes paid Interest paid See accompanying no Fiscal Years Ended January 31, 2016 2017 $14,293 14,293 10,080 761 206 (402) 1,021 3,942 1,137 492 31,530 (10,619) 456 662 (1,901) (2,463) (122) (13,987) (1,673) 137 (2,055) (6,216) (8,298) (479) (90) (255) (18,929) (452) (1,838) 8,705 $ 6,867 4,507 2,351 $ 15,000 15,000 9,454 (672) 1410 (19) (703) 2,006 1,303 (472) 27,389 (11,477) 635 246 (79) (10,675) 1,235 39 (4432) (6,294) (4,112) (719) (1,326) (513) (16,122) (1,022) (430) 9,135 $ 8,705 8,111 2,540 2015 $17,099 (285) 16814 9,173 (503) 785 (569) (1,229) 2,678 1,249 166 28,564 (12,174) 570 671 (192) (11,125) (6,288) 5,174 (3,904) (6.185) (1,015) (600) (1,844) (409) (15,071) (514) 1,854 7,281 $ 9,135 8.169 2433 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net income (loss) Adjustments to reconcile net income (loss) to net cash from operating activities: Depreciation of property and equipment, including internal-use software and website development, and other amortization, including capitalized content costs Stock-based compensation Other operating expense, net Other expense (income), net Deferred income taxes Excess tax benefits from stock-based compensation Changes in operating assets and liabilities: Inventories Accounts receivable, net and other Accounts payable Accrued expenses and other Additions to unearned revenue Amortization of previously uneared revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES: Purchases of property and equipment, including internal-use software and website development, net Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Excess tax benefits from stock-based compensation Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of capital lease obligations Principal repayments of finance lease obligations Net cash provided by (used in) financing activities Foreign currency effect on cash and cash equivalents Net increase (decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for interest on capital and finance lease obligations Cash paid for income taxes, net of refunds Property and equipment acquired under capital leases Property and equipment acquired under build-to-suit leases S 2014 Year Ended December 31, 2015 14,557 S 8,658 S (241) 4,746 1,497 129 59 (316) (6) (1.193) (1,039) 1,759 706 4,433 (3,692) 6,842 (4,893) (979) 3.349 (2,542) (5,065) 6 6,359 (513) (1,285) (135) 4,432 (310) 5,899 14,557 S 91 S 86 177 4,008 920 See accompanying notes to consolidated financial statements. 596 6,281 2,119 155 250 81 (119) (2,187) (1.755) 4,294 913 7,401 (6,109) 11,920 (4,589) (795) 3,025 (4,091) (6,450) 119 353 (1.652) (2,462) (121) (3,763) (374) 1,333 15,890 S 325 $ 153 273 4,717 544 2016 15,890 2,371 8.116 2975 160 (20) (246) (829) (1426) (3,367) 5,030 1,724 11,931 (9.976) 16,443 (6,737) (116) 4,733 (7.756) (9,876) 829 621 (354) (3,860) (147) (2,911) (212) 3,444 19.334 290 206 412 5,704 1,209 Net product sales Net service sales Total net sales Operating expenses: Cost of sales Fulfillment Marketing Technology and content General and administrative Other operating expense, net AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Total operating expenses Operating income Interest income Interest expense Other income (expense), net Total non-operating income (expense) Income (loss) before income taxes Provision for income taxes Equity-method investment activity, net of tax Net income (loss) Basic earnings per share Diluted earnings per share Weighted average shares used in computation of earnings per share: Basic Diluted $ S $ 2014 Year Ended December 31, 70,080 S 18,908 88,988 62,752 10,766 4,332 9,275 1,552 133 88,810 178 39 (210) (118) (289) (111) (167) 37 (241) S (0.52) S (0.52) S 462 462 See accompanying notes to consolidated financial statements. 2015 79,268 S 27,738 107,006 71,651 13,410 5,254 12,540 1.747 171 104,773 2,233 50 (459) (256) (665) 1,568 (950) (22) 596 S 1.28 S 1.25 $ 467 477 2016 94,665 41,322 135,987 88,265 17,619 7.233 16,085 2,432 167 131,801 4,186 100 (484) 90 (294) 3,892 (1.425) (96) 2,371 5.01 4.90 474 484 Net income (loss) Other comprehensive income (loss): Foreign currency translation adjustments, net of tax of $(3), $10, and $(49) Net change in unrealized gains (losses) on available-for-sale securities: Unrealized gains (losses), net of tax of S1, S(5), and S(12) Reclassification adjustment for losses (gains) included in "Other income (expense), net," net of tax of S(1), $0, and 50 Net unrealized gains (losses) on available-for-sale securities Total other comprehensive income (loss) Comprehensive income (loss) Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Goodwill Other assets Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Total current liabilities Long-term debt Other long-term liabilities (326) (567) S See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) ASSETS Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock. $0.01 par value: (241) S (325) 2 (3) (1) 2015 596 S (210) (7) 5 (2) (212) 384 S 2015 2016 15,890 $ 3,918 10,243 5,654 35,705 21,838 3,759 3,445 64,747 S December 31, 20,397 S 10,372 3,118 33,887 8,227 9,249 2,371 (279) 17 (262) 2,109 2016 19.334 6,647 11,461 8,339 45,781 29,114 3,784 4,723 83,402 25,309 13,739 4,768 43,816 7,694 12,607 Total current montes Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares-500 Issued and outstanding shares-none Common stock, $0.01 par value: Authorized shares-5,000 Issued shares-494 and 500 Outstanding shares-471 and 477 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) Balance as of January 1, 2014 Net loss Other comprehensive income (loss) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and issuance of employee benefit plan stock Issuance of common stock for acquisition activity Balance as of December 31, 2014 Net income Other comprehensive income (loss) Exercise of common stock options Shares 459 $ 1 1 Common Stock 465 Treasury Stock Additional Paid-In Capital 5S (1.837) $ 9,573 S Amount | || | || 1 2 6 1,510 44 (1,837) 11,135 (326) Accumulated Other Comprehensive Retained Income (Loss) Earnings (185) S 2,190 S (241) || (511) 33,687 8,227 9,249 (212) 5 (1,837) 13,394 (723) 2,545 13,384 64,747 S 1 1,949 596 - 43,810 7,694 12,607 5 (1,837) 17,186 (985) 4,916 19,285 83,402 Total Stockholders Equity 9,746 (241) (326) 2 6 1,510 44 10,741 596 (212) CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) Balance as of January 1, 2014 Net loss Other comprehensive income (loss) Exercise of common stock options Excess tax benefits from stock-based ompensation Stock-based compensation and issuance of employee benefit plan stock Issuance of common stock for acquisition activity Balance as of December 31, 2014 Net income Other comprehensive income (loss) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and issuance of employee benefit plan stock Issuance of common stock for acquisition activity Balance as of December 31, 2015 Net income Other comprehensive income (loss) Exercise of common stock options Excess tax benefits from stock-based compensation Shares Stock-based compensation and issuance of employee benefit plan stock Balance as of December 31, 2016 110 AMAZON.COM, INC. 459 S 11121111 465 Common Stock 1E11 Amount 477 S Treasury Stock 5$ (1.837) S I ul II Accumulated Other Comprehensive Retained Income (Low) Earnings 9.573 $ (185) $ 2,190 $ (241) Additional Paid-In Capital (1,837) 1,510 44 5 (1,837) 11.135 2 6 4 119 2,131 5 13,394 11 829 2.962 5$ (1,837) $ 17,186 $ See accompanying notes to consolidated financial statements. 1 (326) 11 (511) (212) 1 (723) (262) (985) $ 1,949 596 I 1 2,545 2,371 Total Stockholders Equity 9,746 (241) (326) 1,510 44 10,741 596 (212) 4 119 2,131 5 13,384 2,371 6 (262) 1 829 2,962 4,916 $ 19,285

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear step by step mannerStep 1 Answer Inventory t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started