Answered step by step

Verified Expert Solution

Question

1 Approved Answer

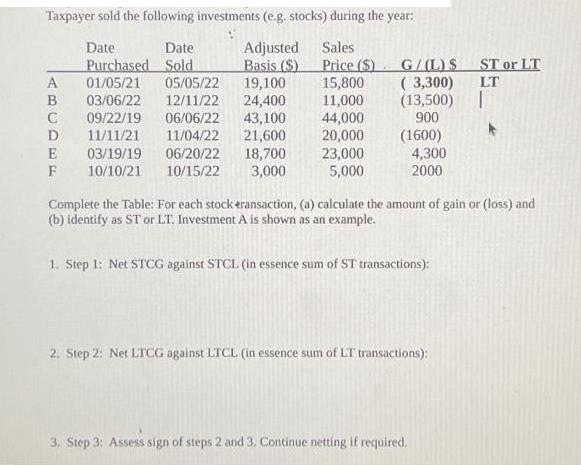

Taxpayer sold the following investments (e.g. stocks) during the year: Date Purchased Adjusted Sales Basis ($) Price ($) A 01/05/21 05/05/22 15,800 B 03/06/22

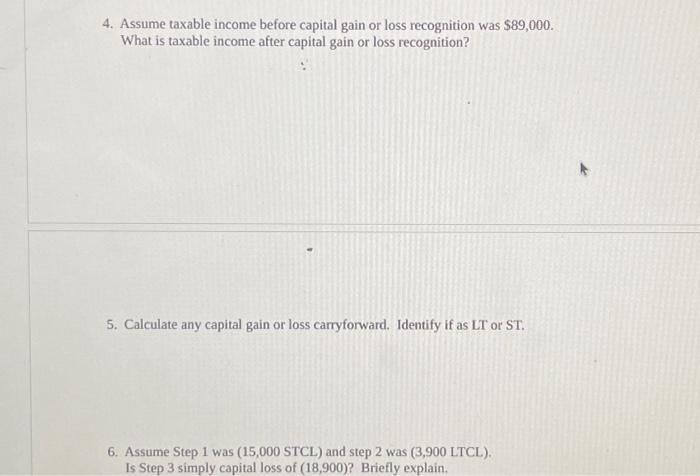

Taxpayer sold the following investments (e.g. stocks) during the year: Date Purchased Adjusted Sales Basis ($) Price ($) A 01/05/21 05/05/22 15,800 B 03/06/22 12/11/22 11,000 C 09/22/19 06/06/22 44,000 D 11/11/21 11/04/22 20,000 E 03/19/19 06/20/22 23,000 F 5,000 Date Sold 19,100 24,400 43,100 21,600 18,700 10/10/21 10/15/22 3,000 G/(L) S (3,300) (13,500) 900 (1600) 4,300 2000 1. Step 1: Net STCG against STCL (in essence sum of ST transactions): Complete the Table: For each stock transaction, (a) calculate the amount of gain or (loss) and (b) identify as ST or LT. Investment A is shown as an example. 2. Step 2: Net LTCG against LTCL (in essence sum of LT transactions): ST or LT LT 3. Step 3: Assess sign of steps 2 and 3. Continue netting if required. I 4. Assume taxable income before capital gain or loss recognition was $89,000. What is taxable income after capital gain or loss recognition? 5. Calculate any capital gain or loss carryforward. Identify if as LT or ST. 6. Assume Step 1 was (15,000 STCL) and step 2 was (3,900 LTCL). Is Step 3 simply capital loss of (18,900)? Briefly explain.

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Net STCG compared to STCL or the total of all ST transactions We must total the STCG and STCL ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started