Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxpayer T, a single individual, purchased real estate for $1,000,000 in Year 1 (Property P). T paid $700,000 cash and borrowed $300,000 (put a

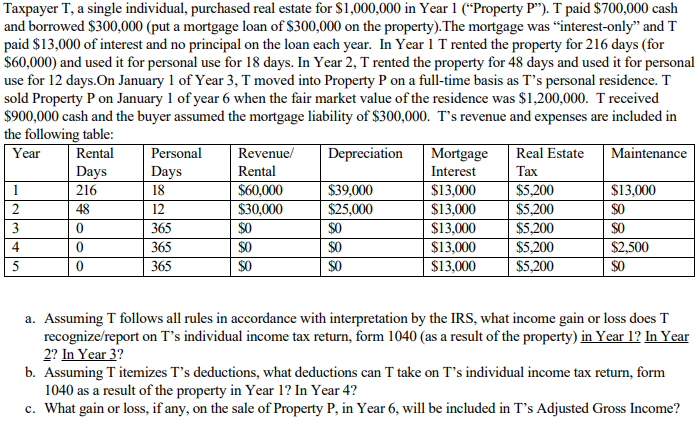

Taxpayer T, a single individual, purchased real estate for $1,000,000 in Year 1 ("Property P"). T paid $700,000 cash and borrowed $300,000 (put a mortgage loan of $300,000 on the property). The mortgage was "interest-only" and T paid $13,000 of interest and no principal on the loan each year. In Year 1 T rented the property for 216 days (for $60,000) and used it for personal use for 18 days. In Year 2, T rented the property for 48 days and used it for personal use for 12 days.On January 1 of Year 3, T moved into Property P on a full-time basis as T's personal residence. T sold Property P on January 1 of year 6 when the fair market value of the residence was $1,200,000. T received $900,000 cash and the buyer assumed the mortgage liability of $300,000. T's revenue and expenses are included in the following table: Year Rental Days Personal Days Revenue/ Depreciation Mortgage Real Estate Maintenance Rental Interest Tax 1 216 18 $60,000 $39,000 $13,000 $5,200 $13,000 2 48 12 $30,000 $25,000 $13,000 $5,200 $0 3 0 365 $0 $0 $13,000 $5,200 $0 4 0 365 $0 $0 $13,000 $5,200 $2,500 5 0 365 $0 $0 $13,000 $5,200 $0 a. Assuming T follows all rules in accordance with interpretation by the IRS, what income gain or loss does T recognize/report on T's individual income tax return, form 1040 (as a result of the property) in Year 1? In Year 2? In Year 3? b. Assuming T itemizes T's deductions, what deductions can T take on T's individual income tax return, form 1040 as a result of the property in Year 1? In Year 4? c. What gain or loss, if any, on the sale of Property P, in Year 6, will be included in T's Adjusted Gross Income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started