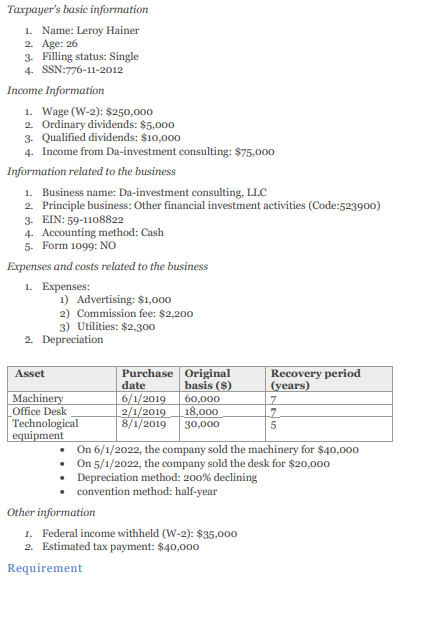

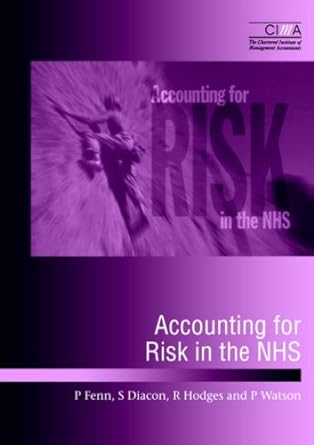

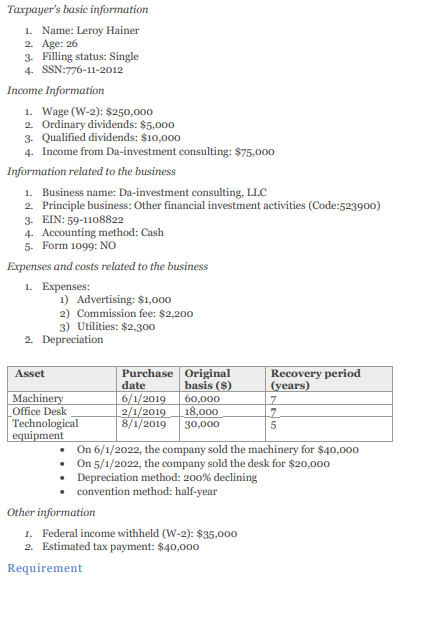

Taxpayer's basic information 1. Name: Leroy Hainer 2. Age: 26 3. Filling status: Single 4. SSN:776-11-2012 Income Information 1. Wage (W-2): $250,000 2. Ordinary dividends: $5,000 3. Qualified dividends: $10,000 4. Income from Da-investment consulting: $75,000 Information related to the business 1. Business name: Da-investment consulting, LLC 2. Principle business: Other financial investment activities (Code:523900) 3. EIN: 59-1108822 4. Accounting method: Cash 5. Form 1099: NO Expenses and costs related to the business 1. Expenses: 1) Advertising: $1,000 2) Commission fee: $2,200 3) Utilities: $2,300 2. Depreciation - On 6/1/2022, the company sold the machinery for $40,000 - On 5/1/2022, the company sold the desk for $20,000 - Depreciation method: 200\% declining - convention method: half-year Other information 1. Federal income withheld (W2):$35,000 2. Estimated tax payment: $40,000 Requirement 1. Prepare form 1040 for the taxpayer. You may need to use schedules 1,B,C, and D, forms 4562, 4797, and 8995 . 2. When preparing form 4562 , please use what related knowledge in Chapter 10 to calculate the cost recovery amount for related assets. Taxpayer's basic information 1. Name: Leroy Hainer 2. Age: 26 3. Filling status: Single 4. SSN:776-11-2012 Income Information 1. Wage (W-2): $250,000 2. Ordinary dividends: $5,000 3. Qualified dividends: $10,000 4. Income from Da-investment consulting: $75,000 Information related to the business 1. Business name: Da-investment consulting, LLC 2. Principle business: Other financial investment activities (Code:523900) 3. EIN: 59-1108822 4. Accounting method: Cash 5. Form 1099: NO Expenses and costs related to the business 1. Expenses: 1) Advertising: $1,000 2) Commission fee: $2,200 3) Utilities: $2,300 2. Depreciation - On 6/1/2022, the company sold the machinery for $40,000 - On 5/1/2022, the company sold the desk for $20,000 - Depreciation method: 200\% declining - convention method: half-year Other information 1. Federal income withheld (W2):$35,000 2. Estimated tax payment: $40,000 Requirement 1. Prepare form 1040 for the taxpayer. You may need to use schedules 1,B,C, and D, forms 4562, 4797, and 8995 . 2. When preparing form 4562 , please use what related knowledge in Chapter 10 to calculate the cost recovery amount for related assets