Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxpayers have incentives to minimize their taxes through legal means, which can include: (a) Forward- and backwards-shifting of the tax burden; (b) Changing the timing

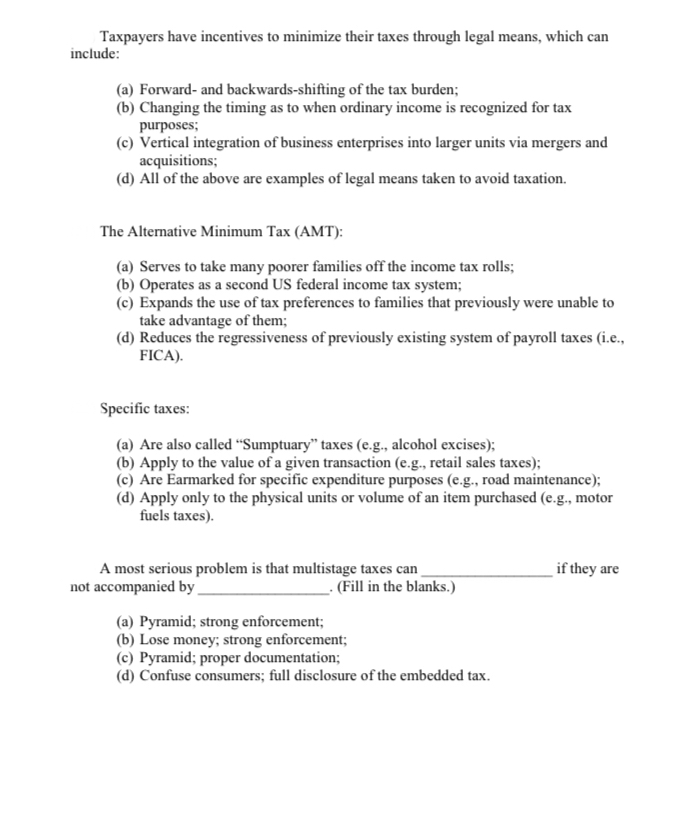

Taxpayers have incentives to minimize their taxes through legal means, which can include: (a) Forward- and backwards-shifting of the tax burden; (b) Changing the timing as to when ordinary income is recognized for tax purposes; (c) Vertical integration of business enterprises into larger units via mergers and acquisitions; (d) All of the above are examples of legal means taken to avoid taxation. The Alternative Minimum Tax (AMT): (a) Serves to take many poorer families off the income tax rolls; (b) Operates as a second US federal income tax system; (c) Expands the use of tax preferences to families that previously were unable to take advantage of them; (d) Reduces the regressiveness of previously existing system of payroll taxes (i.e., FICA). Specific taxes: (a) Are also called "Sumptuary" taxes (e.g., alcohol excises); (b) Apply to the value of a given transaction (e.g., retail sales taxes); (c) Are Earmarked for specific expenditure purposes (e.g., road maintenance); (d) Apply only to the physical units or volume of an item purchased (e.g., motor fuels taxes). A most serious problem is that multistage taxes can if they are not accompanied by . (Fill in the blanks.) (a) Pyramid; strong enforcement; (b) Lose money; strong enforcement; (c) Pyramid; proper documentation; (d) Confuse consumers; full disclosure of the embedded tax

Taxpayers have incentives to minimize their taxes through legal means, which can include: (a) Forward- and backwards-shifting of the tax burden; (b) Changing the timing as to when ordinary income is recognized for tax purposes; (c) Vertical integration of business enterprises into larger units via mergers and acquisitions; (d) All of the above are examples of legal means taken to avoid taxation. The Alternative Minimum Tax (AMT): (a) Serves to take many poorer families off the income tax rolls; (b) Operates as a second US federal income tax system; (c) Expands the use of tax preferences to families that previously were unable to take advantage of them; (d) Reduces the regressiveness of previously existing system of payroll taxes (i.e., FICA). Specific taxes: (a) Are also called "Sumptuary" taxes (e.g., alcohol excises); (b) Apply to the value of a given transaction (e.g., retail sales taxes); (c) Are Earmarked for specific expenditure purposes (e.g., road maintenance); (d) Apply only to the physical units or volume of an item purchased (e.g., motor fuels taxes). A most serious problem is that multistage taxes can if they are not accompanied by . (Fill in the blanks.) (a) Pyramid; strong enforcement; (b) Lose money; strong enforcement; (c) Pyramid; proper documentation; (d) Confuse consumers; full disclosure of the embedded tax Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started