Question

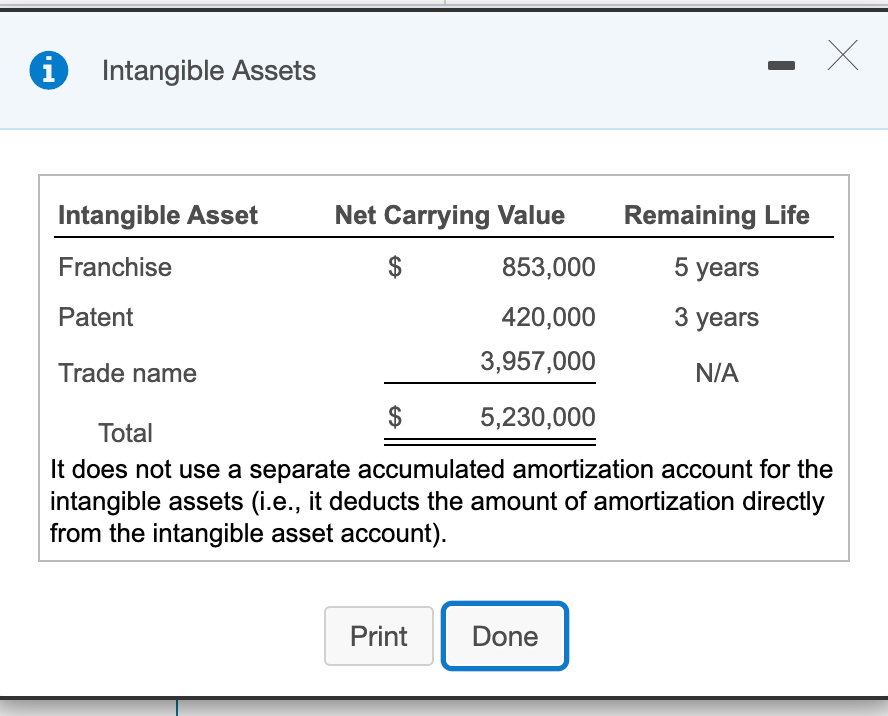

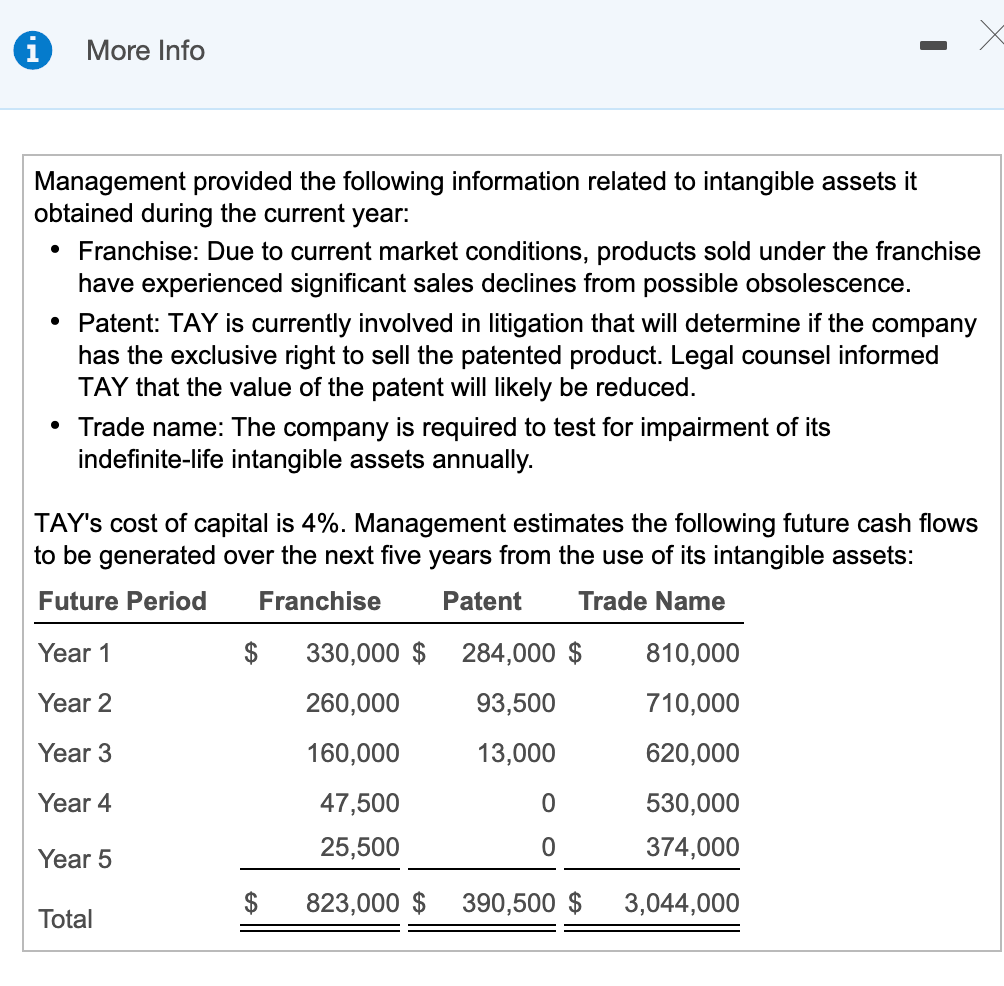

TAY Research Associates reports the following intangible assets on its December 31 balance sheet: Requirement a. Compute the impairment loss (if any) for each intangible

TAY Research Associates reports the following intangible assets on its December 31 balance sheet:

Requirement a. Compute the impairment loss (if any) for each intangible asset.

Conduct the impairment test indicated for each intangible asset at the end of the year. For each asset, select whether Step 1 of the test is required on the first line. If the test is not required, select "No" on the first line and leave all remaining cells blank in that column, including the "Impairment indicated" cell. (If the test is not required, leave all remaining cells in that column blank.)

Start with step 1.

| Step 1: | Franchise | Patent | Trade Name |

| Step 1 required? |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment indicated |

|

|

|

Now, complete step 2 of the impairment test for each intangible asset. Select whether step 2 of the test is required on the first line. (If the test is not required, leave all remaining cells in that column blank. However, if the test is required, but no impairment loss exists, then leave only the impairment loss input cell blank in that column. Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round intermediary calculations and your final answers to the nearest whole dollar.)

| Step 2: | Franchise | Patent | Trade name |

| Step 2 required |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment loss |

|

|

|

Requirement b. Prepare the journal entry necessary to record the impairment loss. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required, select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.)

First, record any impairment loss on franchise.

| Account | Date of impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Now, record any impairment loss on patent.

| Account | Date of impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Next, record any impairment loss on trade name.

| Account | Date of impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Requirement c. Assuming that

TAY

amortizes its finite-life intangible assets using the straight-line method, with no scrap value, prepare the journal entry to record the annual amortization for the first year subsequent to the impairment write-down. (Record debits first, then credits. Exclude explanations from any journal entries. Round intermediary calculations and your final answers to the nearest whole dollar.)

Record the entry for amortization expense for franchise.

| Account | Year after impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finally, record the entry for amortization expense for patent.

| Account | Year after impairment | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started