Question

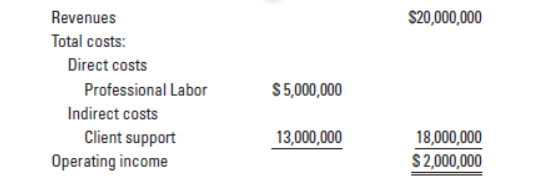

. Taylor & Associates, a consulting firm, has the following condensed budget for 2014: Taylor s a single direct-cost category (professional labor) and a single

. Taylor & Associates, a consulting firm, has the following condensed budget for 2014:

Taylor s a single direct-cost category (professional labor) and a single indirect-cost pool (client support). Indirect costs are allocated to jobs on the basis of professional labor costs.

a. Calculate the 2014 budgeted indirect-cost rate for Taylor & Associates.

b. The markup rate for pricing jobs is intended to produce operating income equal to 10% of revenues. Calculate the markup rate as a percentage of professional labor costs.

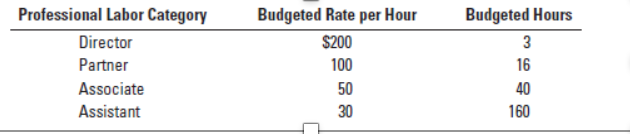

c. Taylor is bidding on a consulting job for Tasty Chicken, a fast food chain specializing in poultry meats. The budgeted breakdown of professional labor on the job is as follows:

Calculate the budgeted cost of the Tasty Chicken job. How much will Taylor bid for the job if it is to earn its target operating income of 10% of revenues?

$20,000,000 Revenues Total costs: Direct costs Professional Labor Indirect costs Client support Operating income $5,000,000 13,000,000 18,000,000 $ 2,000,000 Professional Labor Category Director Partner Associate Assistant Budgeted Rate per Hour $200 100 50 30 Budgeted Hours 3 16 40 160Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started